Luno’s market analysis: Is low volatility here to stay? ?

Welcome to this week’s retrospective of the latest goings-on in the crypto markets, featuring an overview of price movements, a look at the fundamentals, and the impact of other major events over the last week. The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

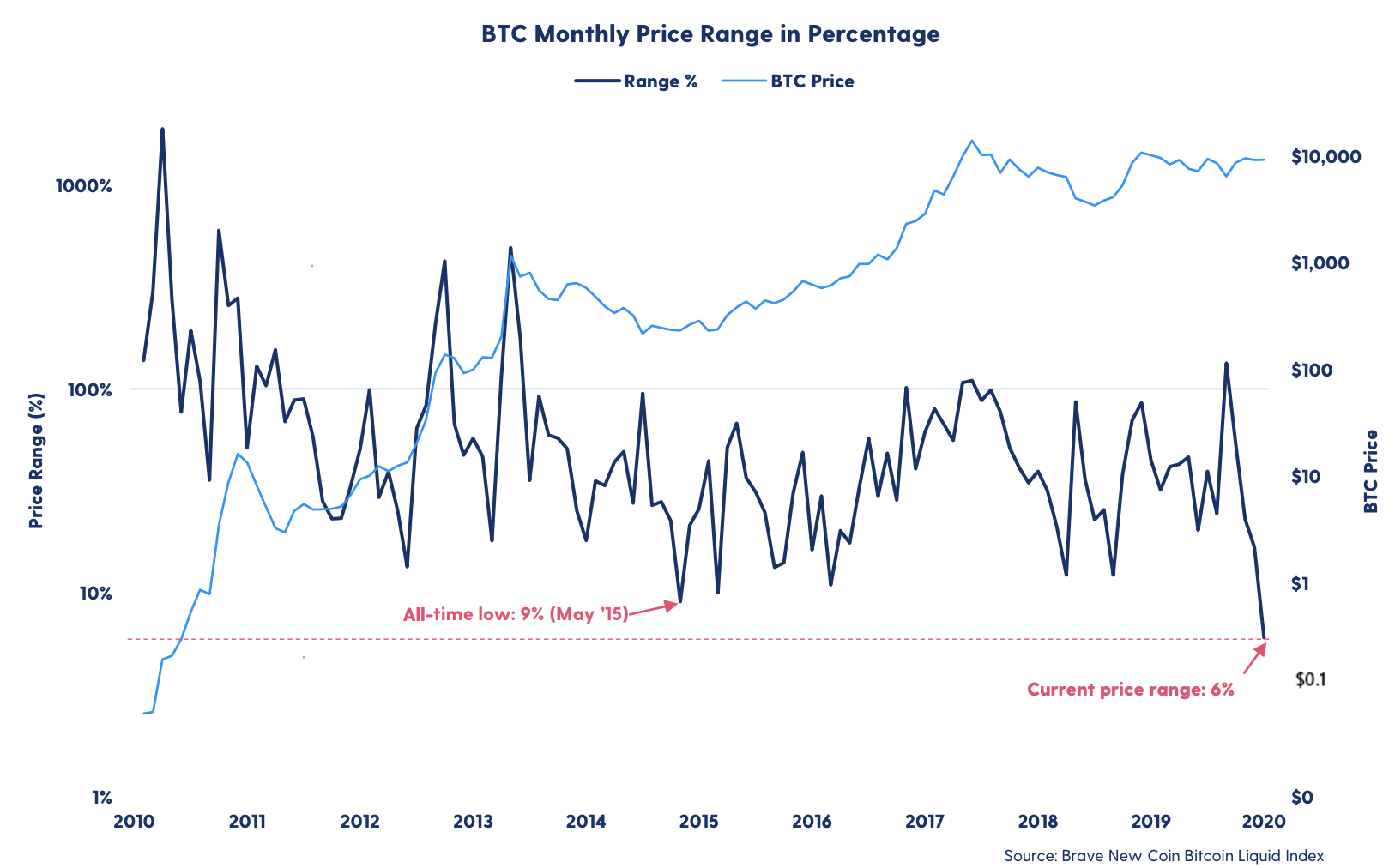

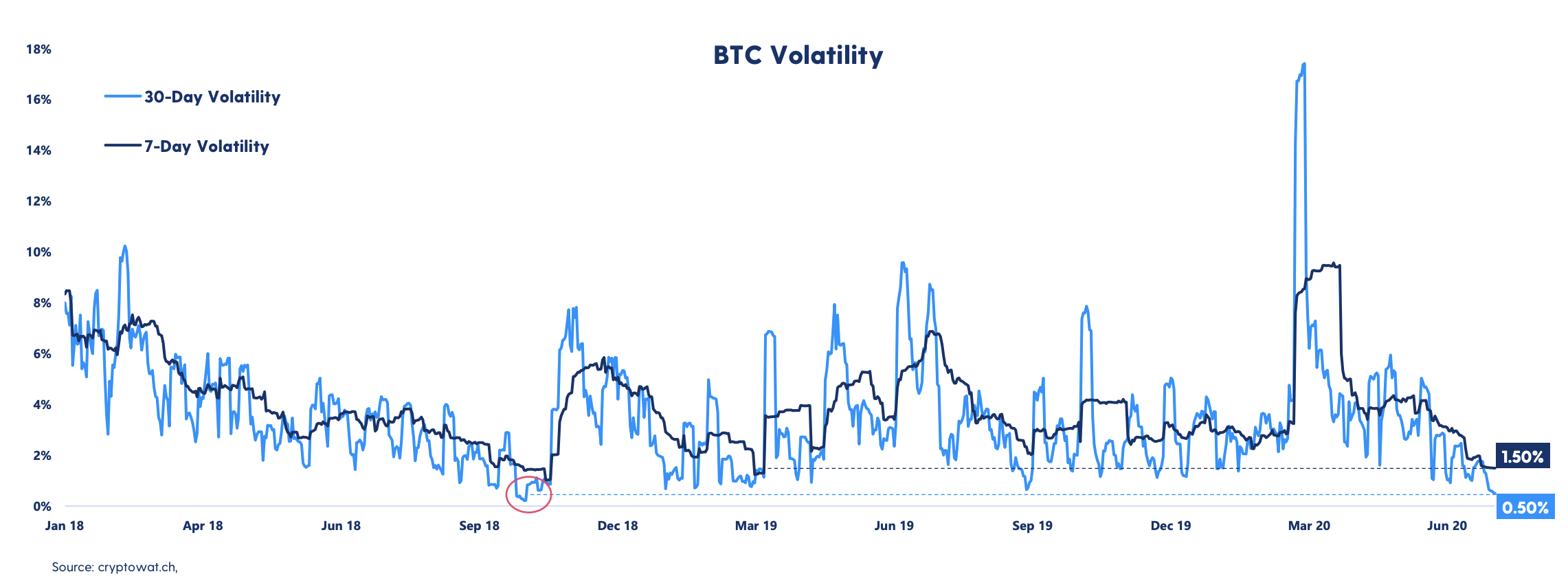

It’s now over a month since we started talking about low volatility and that a large move was imminent for Bitcoin. This has not yet happened, and we’re still waiting for the next big move. In fact, Bitcoin’s price range so far in July is actually the tightest in its history, having remained within a 6% range of between $9,470 and $8,930 for the duration. The tightest price range historically was seen in May 2015, when the price traded within a 9% range.

These tight ranges have historically been followed by large price movements, and it’s not unlikely that we’re getting close to some big movements relatively soon.

On the upside, the small price spike on Tuesday morning might herald the start of a short-term trend shift. The price broke up from a downwards trendline, after printing lower highs over the past weeks.

Price analysis

Bitcoin has been in a downwards trend since the beginning of June, forming lower highs each week. On Tuesday morning, Bitcoin broke up from the trend line, possibly indicating more upside for the leading cryptocurrency. However, we’ve got to remember that trend lines are subjective. A higher high would be an even stronger indication of more upside for Bitcoin, and the monthly high around $9,470 is the next level to look for.

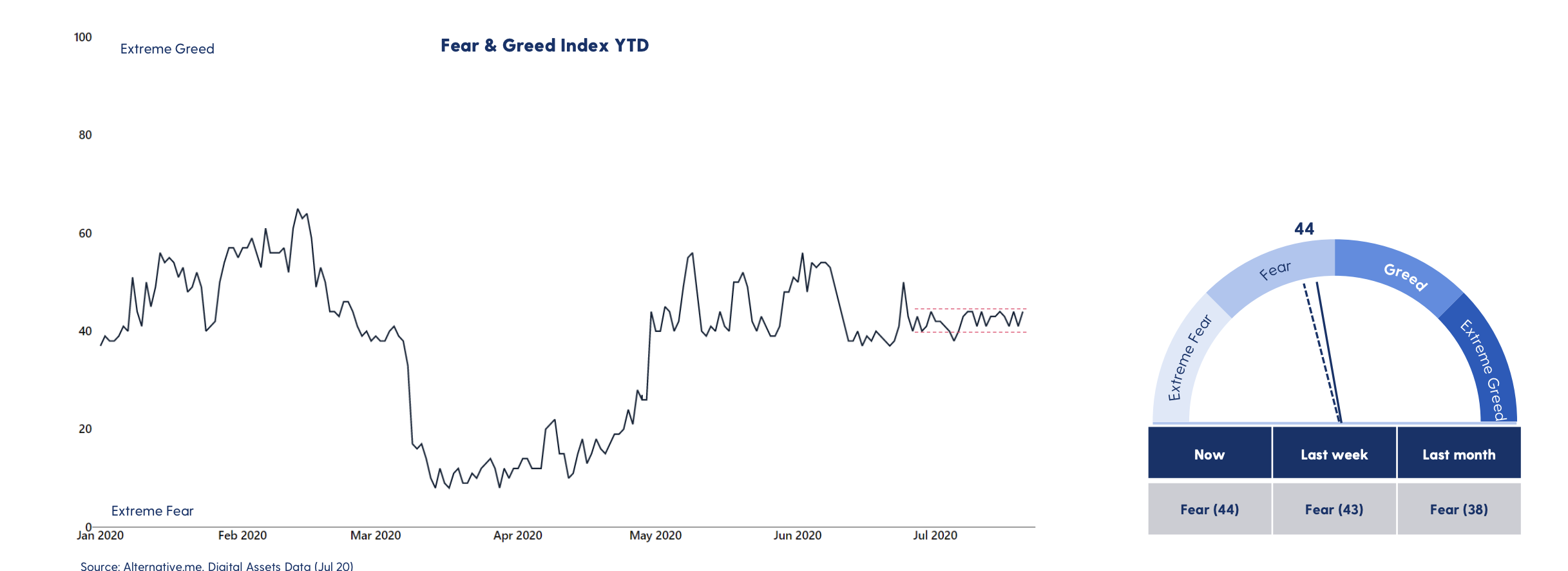

Bitcoin price flat = Market sentiment flat

Market sentiment has stayed virtually unchanged over the last week. More volatility will be needed to change the sentiment in either direction. With Bitcoin ranging in the lower $9,000 area, the market sentiment has been ranging in the lower 40 area for almost four weeks now.

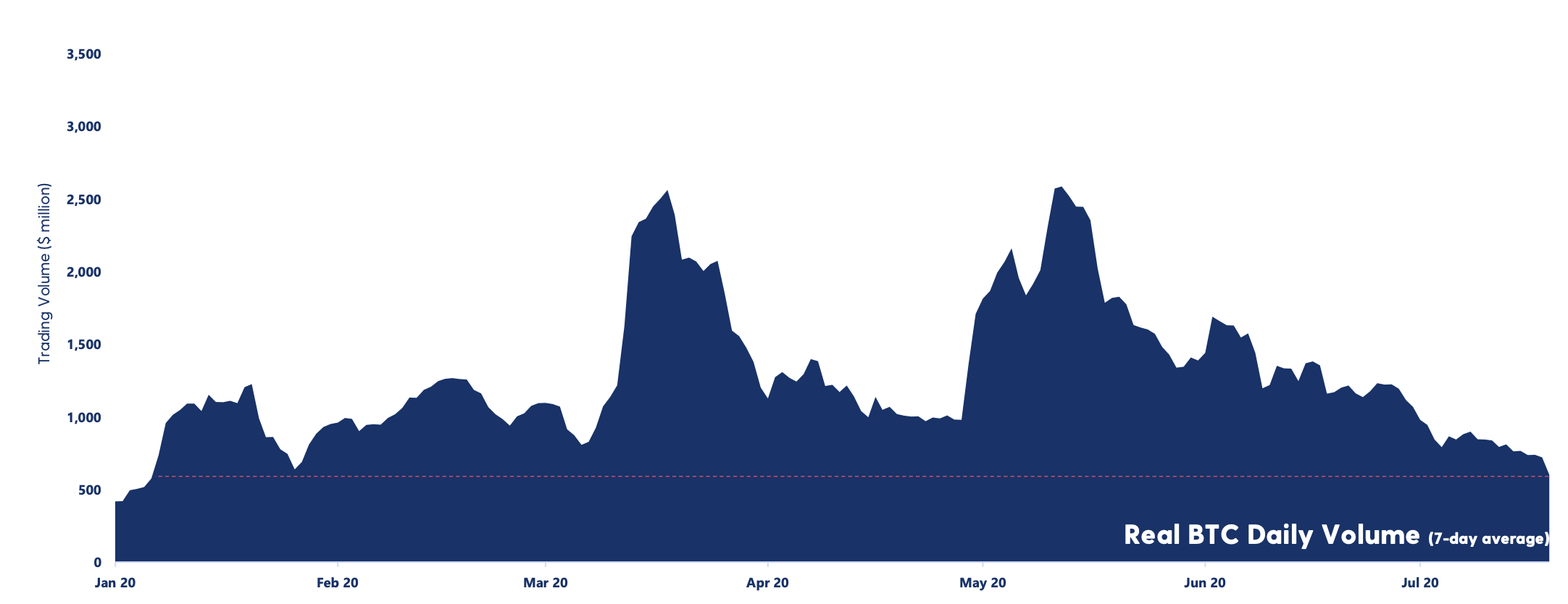

Bitcoin volume approaching yearly low

The 7-day average real trading volume fell further this week. The volume is now approaching the lowest so far in 2020, drifting down to the levels from early January.

Lowest 7-day volatility since October 2018

While it looked like the volatility was about to increase last week, that certainly did not happen. The 7-day volatility is now down to levels not seen since October 2018. Back then, the Bitcoin price crashed down 50% from $6,000 to $3,000 when the volatility came back. Which direction will the price move this time?

Keep reading…

Luno’s market analysis – Week 28

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press