Daily market update: Bitcoin hits heavy resistance at $20,000

Bitcoin saw another all-time high yesterday, before seeing a sharp retrace after almost hitting $20,000. Bulls are going to have their work cut out for them if they’re to surpass that huge landmark. Will they manage it?

As always, here’s your daily market update to help you on your way. If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 09.30am GMT.

Bitcoin price

We closed yesterday, 1 December, 2020, at a price of $18,803.00 – down from $19,625.84 the day before.

The daily high yesterday was $19,845.98. That was higher than the day before and an all-time high according to a number of sources. You can find out why they vary here. The daily low, meanwhile, was $18,321.92. This time last year, the price of bitcoin closed the day at $7,424.29 and in 2018 it was $4,214.67.

We’re 6.4% below bitcoin‘s all-time high on CoinMarketCap of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.6% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $49,633,658,712, up from $47,728,480,399 the day before. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $348,976,597,318, down from $364,229,729,426, the day before. To put that into context, Johnson & Johnson’s market cap is $388 billion.

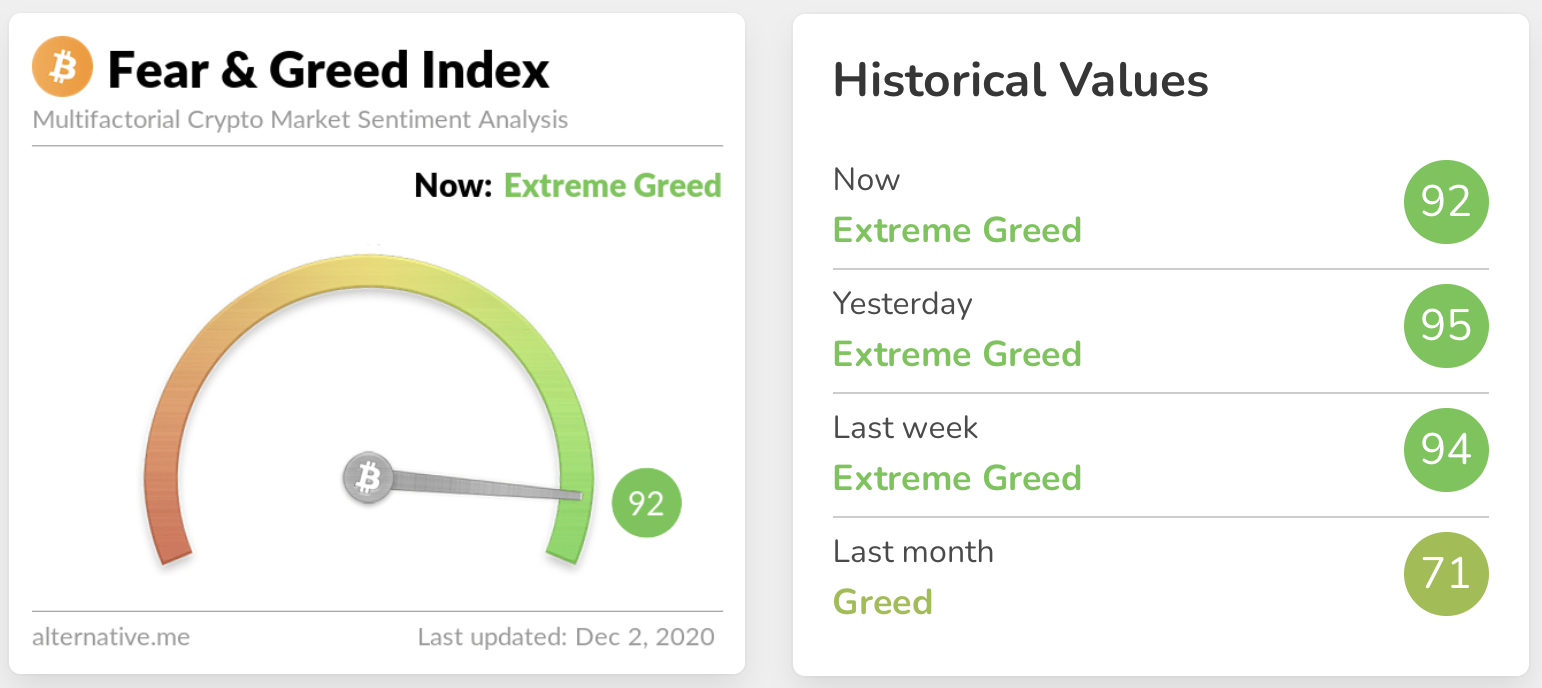

Fear and Greed Index

Sentiment remains in Extreme Greed at 92. The index spent the entirety of November above 70 and December doesn’t look like it’s going to be any different. In fact, with the likes of The New York Times and The Guardian reporting new all-time highs, and retail customers still largely quiet, it could be that we see a new record high before the year is out. Equally though, it’s important to note that the index doesn’t stay this high very often and a correction could be on the cards.

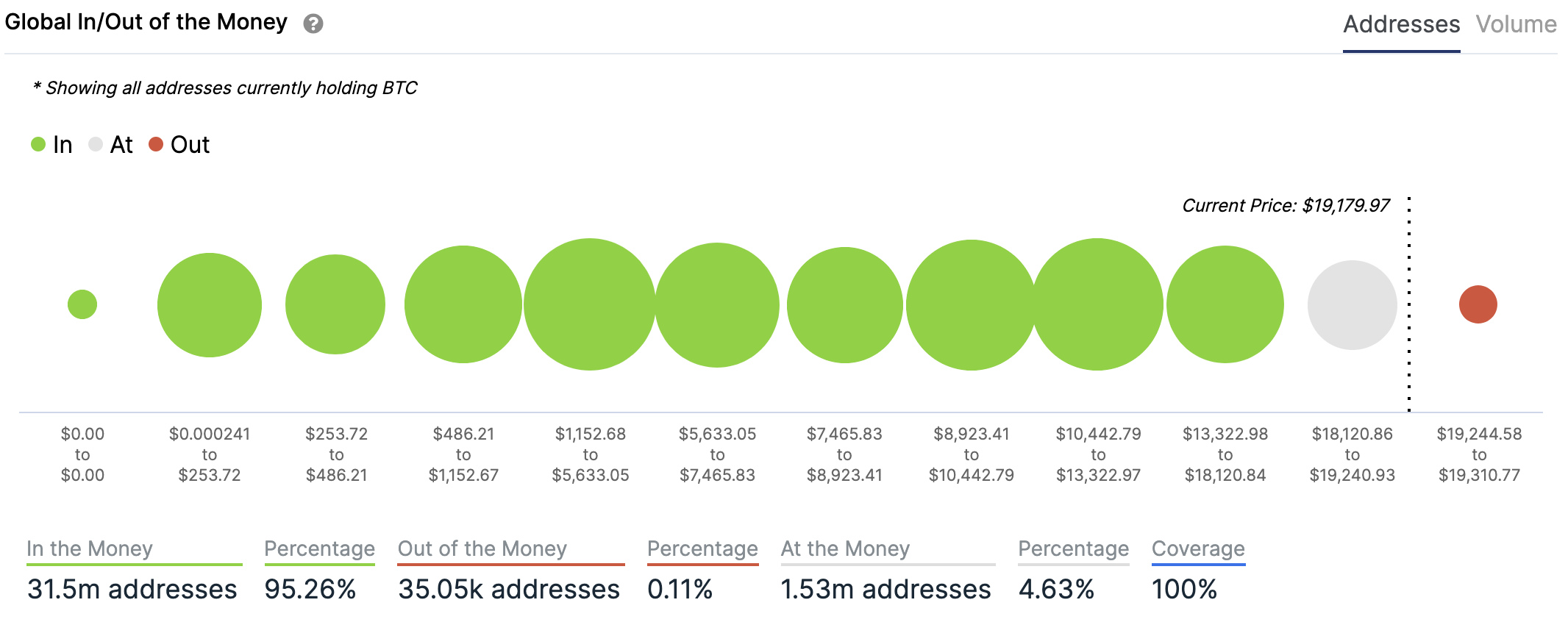

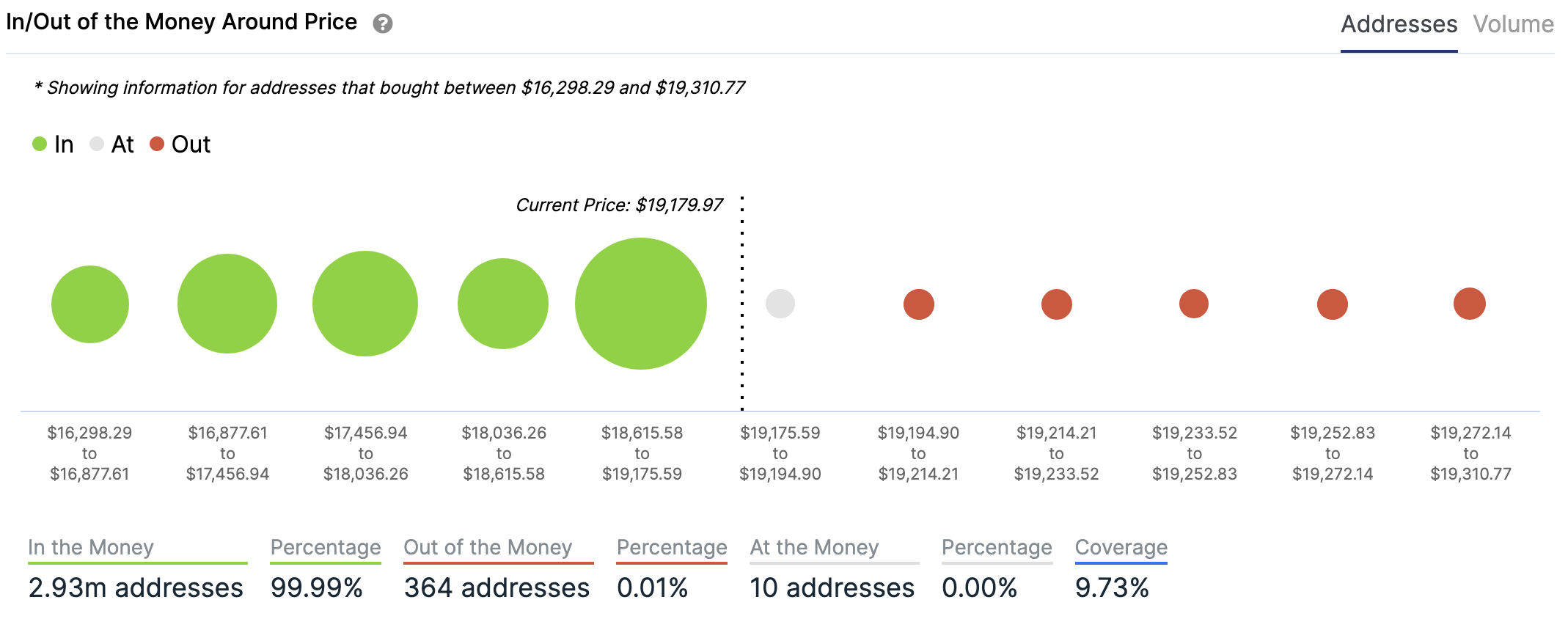

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Charts provided by IntoTheBlock.com

Volatility

Annualised price volatility using 365 days.

Charts provided by IntoTheBlock.com

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 63.40. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 64.15. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

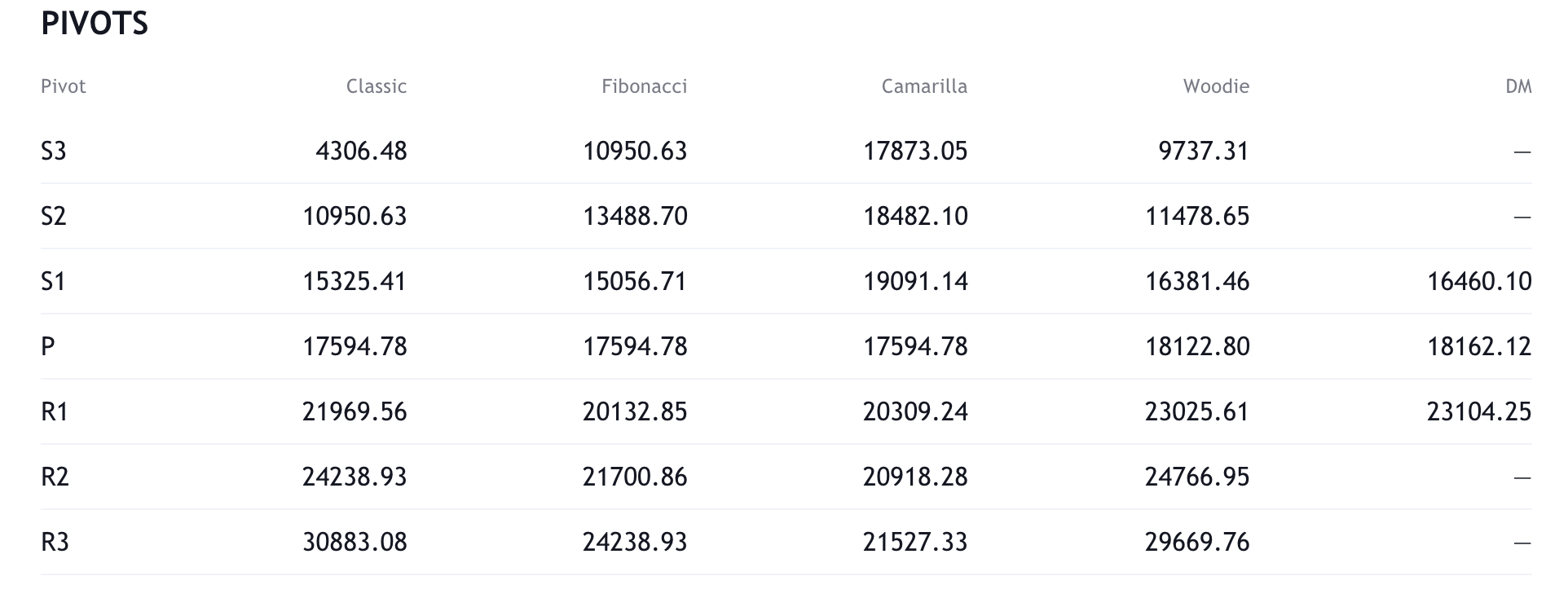

Resistance and support

What they said yesterday…

When I wrote the book that became The Social Network, I knew I was writing about something that was going to change the world. I felt the same way when I wrote Bitcoin Billionaires.

— Ben Mezrich (@benmezrich) December 1, 2020

The CEO of the world’s largest asset manager, @blackrock, has said bitcoin has “caught the attention of many” and could evolve into a global market asset.

Report via @sebsinclair1989https://t.co/LQEiYgpVI0

— CoinDesk (@CoinDesk) December 2, 2020

We converted our entire reserves to #Bitcoin in Aug 2020 and since then we’ve been ridiculed and called irresponsible fools by people in our community.

Our reserves in $ terms doubled since then

Here is why we will continue to buy #Bitcoin foreverTime for a thread ??????

— Tahinis Restaurants (@TheRealTahinis) December 1, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press