Crypto Economic Calendar: Rates, inflation and other announcements

What a month it’s been. The spot Bitcoin ETFs were approved in the US, crypto rallies were followed by as many market sell-offs, and inflation reared its head again just as central bankers appeared to be loosening their grip.

What will investors be keeping an eye on in February? Let’s take a look.

? January recap

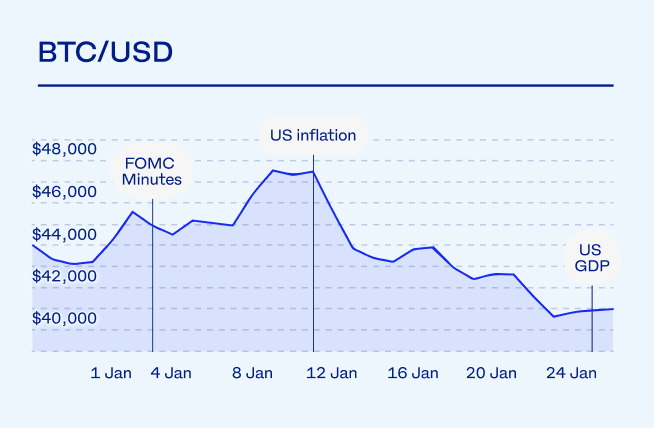

In the days following the approval of spot ETFs on 10 January, Bitcoin’s price hit a 21-month high, peaking at around $48,000 on some exchanges. This was quickly followed by a sell-off that saw the $40,000 level repeatedly tested before eventually relenting. Bitcoin dipped to a new low for the year around $38,000, though soon climbed back again to $40k.

There were also significant price increases for the likes of Solana, with many analysts proclaiming the beginning of a so-called altcoin season. However, these were also followed by significant sell-offs that coincided with Bitcoin’s price slip.

Around the same time that Bitcoin’s price was tagging multi-year highs, the US Labor Department shared that the Consumer Price Index (CPI) went up by 3.4% compared to last year in December. That’s a bit more than the 3.1% increase in November and higher than the 3.2% expected by economists. This pours cold water on the assumptions by many experts that the Fed could start trimming rates as early as March this year. Britain’s annual CPI rate also picked up for the first time in 10 months, reaching 4.0%, up from November’s 3.9%.

The interest rate narrative was overshadowed by news of spot Bitcoin ETF approvals in January, a development that analysts say was also among the main drivers of crypto market sentiment in the last few months. It’s still early days, though, as there are a few market dynamics playing out before the true impact of these institutional investment products become clear.

What’s on in February?

What? US ISM Services Purchasing Managers’ Index (PMI)

? When? Thursday, 1 February

Relevance? The US ISM Services PMI measures the health of the American services sector, which includes industries like healthcare, retail, and hospitality. Investors pay close attention to these numbers because the services sector makes up a significant portion of the US economy.

What? US unemployment rate and non-farm payrolls

? When? Friday, 2 February

Relevance? US unemployment numbers serve as a critical indicator of the overall health of the US economy. In the context of inflation, rising unemployment is a sign of a cooling economy, which could indicate that high interest rates are working as intended.

What? US inflation rate numbers

? When? Tuesday, 13 February

Relevance? The inflation rate in the US will decide the Fed’s plans with interest rates. Higher-than-expected inflation numbers may call for further rate hikes, while signs of inflation slowing may lead to a pause or even a decrease in interest rates.

What? GB inflation rate numbers

? When? Wednesday, 14 February

Relevance? Similar to the US, the inflation rate in the UK will decide the Bank of England’s plans with interest rates. Higher than expected inflation numbers may call for further rate hikes, while signs of inflation slowing may lead to a pause or even a decrease in interest rates.

What: FOMC minutes

? When: Wednesday, 21 February

Relevance: The release of Federal Open Market Committee (FOMC) minutes often influences markets by providing insights into the Federal Reserve’s policy discussions.

*This information should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary for information purposes only and is not investment advice or recommendation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press