Bitcoin halvings through history

The Bitcoin halving is now just weeks away. It’s an event that’s eagerly awaited by the community and has been since it first took place in 2012.

It was a brave new world back then. Nobody was quite sure what to expect, and speculation (and imaginations) ran wild. The cryptocurrency space today is more mature, but the impact of the halving is really no more predictable than it ever was, and the excitement is even higher.

We’ve had a look back through the archives at the events surrounding past halvings and what the community had to say then. Will it follow a similar pattern this time? What impact will it have on price? What can we learn from the past? Will the parties have matured with the market, or will we see new levels of depravity?

2012

The first Bitcoin halving was a big deal, eagerly talked about for months in advance.

Less than 2 months to block reward halving. The biggest event in Bitcoin history thus far. What are your thoughts? #bitcoin

— Bittiraha.fi (@Bittirahafi) October 4, 2012

For the next week I will be blaring “the final countdown” by Europe, to help notify everyone that the reward halving is nigh. #bitcoin

— BitCrate (@BitCrate) November 23, 2012

It was also a complete unknown. There was even discussion around whether it should, indeed would, take place at all. Would Satoshi change the protocol? Was Satoshi’s monetary policy of reducing block rewards by 50% every 210,000 blocks really the best way to keep inflation under control or would it signal the beginning of the end for Bitcoin? What would it mean for the future stability of the network and mining operations?

@neiltyson @ari_alise I’m more concerned with Bitcoin’s yield halving in three days…

— Terry Smith (@Prognosticus) November 25, 2012

There were a lot of questions around price, too. It was assumed by many that the laws of supply and demand would kick in, but with nothing to compare it to, this really felt like a make or break moment.

Most people feel the halving of the #bitcoin mining reward to 25 will cause the price to rise, but nobody knows when or on what curve.

— Joe Cascio (@JoeCascio) November 26, 2012

Can Block Reward Halving Still Increase #Bitcoin Value? – http://t.co/WlMCexKn

— David Perry (@KJ6CCZ) November 25, 2012

Bitcoin’s first halving finally took place on 28 November, 2012 at 15:24:38 UTC, reducing the rewards given to miners from 50 Bitcoin to 25 Bitcoin. The solution to block 210000 was found and broadcast by Slush’s mining pool, with a miner named laughingbear credited as responsible. The block was solved by a Radeon HD 5800[4] after mining for less than a week.

Today it’s the first #Bitcoin halving day!

— Mattia Baldani (@mattibal) November 28, 2012

Bitcoin Block Reward Halving Successful http://t.co/uvJ66Yj4

— The Daily Rustle (@dailyrustle) November 28, 2012

On the halving date itself, there were unofficial parties thrown across the world – from Las Vegas, to Macau.

Though not everyone was happy about it.

Hope you all had a happy #BTC #Bitcoin halving day! Working just as hard for half the reward… ouch.

— creditcrunch.co.uk (@creditcrunch_uk) November 29, 2012

Miners didn’t see the expected leap in difficulty levels, though this changed in the coming weeks. The hashrate of the network fell from 27.61 THash/s to 19.98 THash/s. However, the hashrate then rose steadily up to 60 THash/s about six months later.

So much for the idea that all the GPU miners shutting down post-halving would result in lower difficulty. #Bitcoin http://t.co/rWOhifdJ

— Bitcoin Money (@BitcoinMoney) November 29, 2012

While some decided to up-sticks and put their GPU to work on altcoins (of which there were distinctly fewer back in those days).

Biggest noticeable difference since halving? Amount of GPU hashing moved to altcoins. Up 15% for LTC: http://t.co/aU7Pltsy #Bitcoin

— Bitcoin Money (@BitcoinMoney) November 29, 2012

In terms of price, prior to the event, Bitcoin had previously hit an all-time price high of approximately $32 on 8 June, 2011, before falling to $11 in the run up. On the day itself, Bitcoin saw a sharp rise in price up to a high of $12.76, with the entire day’s price action spanning approximately 6.47%. It then remained relatively quiet in the days immediately after.

Is anyone else surprised that Bitcoin’s value hasn’t gone up after the halving? http://t.co/NRydnamz #bitcoin

— BTCtweetzer (@BTCtweetzer) November 29, 2012

These were still very early days in Bitcoin’s young life, however. Adoption was lower, there were very few crypto media outlets, and much of the discussion was restricted to niche forums such as Reddit and BitcoinTalks. This likely led to the event having a less speculative effect.

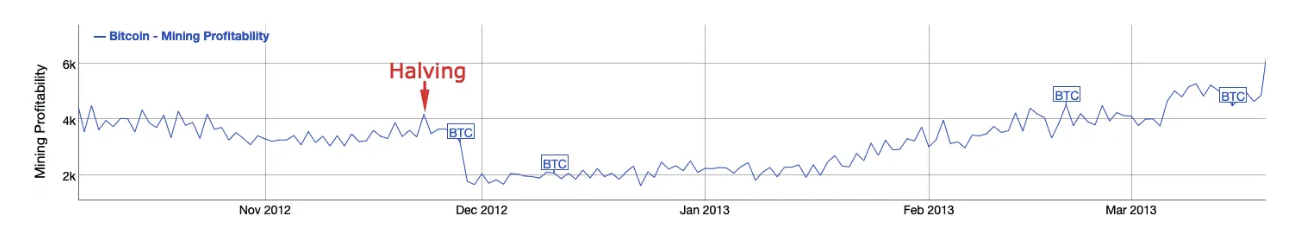

This meant it took longer than many might have thought for the halving to be priced in. Mining profitability plummeted following halving, but managed to recover within four months as the cost of ASICs decreased and the price of Bitcoin went up.

Bitcoin didn’t actually manage to decisively break through its previous high of $32 until 28 February, 2013, several months after its first halving. It then peaked above $1,000 in late 2013, before crashing back down following the collapse of the leading exchange at the time, Mt. Gox. This led to an extended period of decline and stabilisation, though the price held above the previous era’s peak so you could still consider the movement bullish from a long-term perspective.

2016

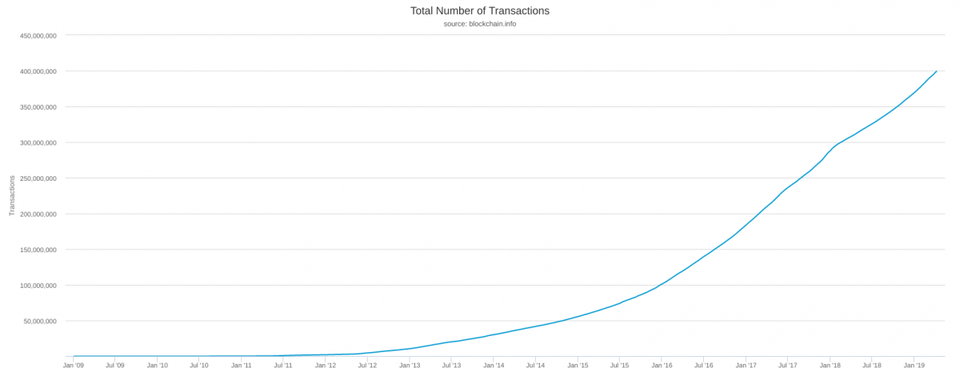

It was a different world for Bitcoin in 2016. There was more attention in the mainstream press, crypto-specific publications such as Coindesk had joined the fray, crypto influencers were a thing, and retail adoption had taken off.

People were also more educated about how Bitcoin worked and had a better idea of what to expect from the halving. There was less fear of the unknown and speculation that it would be Bitcoin’s doom was less – although it hadn’t disappeared completely. Though the community in general hadn’t necessarily matured at the same speed the market had.

The Bitcoin halving jokes are beginning… https://t.co/Htg3AJpwrv

— Digital Currency Group (@DCGco) July 9, 2016

The 420,000th block was eventually found on 9 July 2016 by F2Pool, reducing the rewards miners earned from 25 Bitcoin to 12.5.

Again, there were parties across the world to celebrate.

The world first Bitcoin enabled party Sushi chef, Kurosawa debuted in our Tokyo Bitcoin Halving event, Wow! pic.twitter.com/0X7BOd8YLn

— $kenshishido? (@kenshishido) July 14, 2016

1h before #bitcoin #halving in #Paris pic.twitter.com/x5PPDBlcG0

— Albin Cauderlier (@AlbinCAUDERLIER) July 9, 2016

.@BOBmeetupCHI #Bitcoin Halving Party! Thanks to all 50+ people who came out tonight to celebrate! pic.twitter.com/9Pv0Q4VJnt

— Pamela Morgan (@pamelawjd) July 13, 2016

The halving was good news for miners, who saw mining rewards rise. Immediately after the event, the hashrate fell slightly from 1.56 EHash/s to 1.40 EHash/s. However, it eventually improved to 3.85 EHash/s after seven months.

1/ #Bitcoin miners making more ? now than they were b4 July 2016 halving. The power of a rising price & txn fees ? https://t.co/vwHEMndgf2 pic.twitter.com/eHZq8g0sHO

— Chris Burniske (@cburniske) May 9, 2017

In terms of price, Bitcoin was selling for $576 on 9 June. It reached a high on the day of the halving of $664, with buyers accumulating Bitcoin in anticipation.

Bitcoin Halving Barely Registers on Price Chart https://t.co/OZLp1zEf3s #blockchain

— Coding Value (@Codingvalue) July 10, 2016

This was followed by a retracement during the weeks leading up to its second halving. The days after Bitcoin’s second halving were reasonably calm, until a tumble took the asset down to $466.20 by 2 August, 2016. Bitcoin did not break back above its 9 July halving day high until 27 October, 2016. The price then picked up the pace and went up to $2,526 precisely a year later on July 9, 2017 – a 288.60% increase in valuation. Bitcoin ultimately reached a high of almost $20,000 in December 2017. Since then, the digital asset has not revisited those price highs.

This increase in price was still not as substantial as the 2012-halving, likely because anticipation of the halving was greater and any expected price action was already factored in.

It was approximately this amount of time after the first halving that the Bitcoin price began a run up before going balistic

— Alistair Milne (@alistairmilne) October 22, 2016

People haven’t realized the effect that the bitcoin rewards halving will have on price. This is just the beginning… @VinnyLingham is right

— Alex Fortin (@realAlexFortin) December 2, 2016

Will this halving live up to expectations? Is the halving already priced in? Will the alts benefit?

People have certainly been looking forward to it for a while now…

More importantly: ~169 weeks until the next Bitcoin halving

— Alistair Milne (@alistairmilne) March 25, 2017

Only 1,123 days until the next bitcoin halving

— Barry Silbert (@barrysilbert) May 26, 2017

Are you excited? Planning any halving parties? Let us know on Twitter!

Keep reading…

Top crypto trends to watch out for in 2020

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press