Crypto in 2019: A review

Into 2020 we go, but let’s never forget 2019. It’s been a great year for crypto, leaping its way down the path to mass adoption. The events of the last year suggest that crypto’s potential is now being realised and it’s beginning to be embraced by the mainstream. Countries are implementing sophisticated regulatory regimes, major retailers and financial institutions are making their moves (with some faring better than others), and new use-cases are emerging.

We’ve cast our eye back over 2019’s biggest stories, headlines, and announcements.

Regulatory recap

If use cases are the key to mass adoption, regulations are the hinges that allow the door to open. In 2019, more and more countries pushed for clear, comprehensive regulation on cryptocurrencies. This is great news as governments, regulators, and the industry need to work together in harmony for crypto’s success to prevail.

Here’s a brief regulatory news snapshot.

Malaysia

In January, the Malaysian government passed a legislative order prescribing all “digital currency” and “digital tokens” as securities. Soon after, the Securities Commission released its legislative framework for crypto exchanges, bringing them within the existing Guidelines for Recognised Market Operators and ultimately giving conditional approval to three exchanges.

We were proud to be the first cryptocurrency exchange to receive full approval, allowing us to re-launch our full operations in the Malaysian market.

Singapore

In Singapore, the Payment Services Act earlier was introduced earlier this year. The means cryptocurrency dealing or exchange services will be supervised by the Monetary Authority of Singapore (MAS) from late January 2020.

China

The Chinese government blew hot and cold on crypto in 2019. One minute, they’d show signs of warming up to crypto and blockchain activities. The next, they’d distance themselves again. The signs are good, though. State censors are loosening up on promotional ads and state newspapers are publishing positive articles for the first time. However, the country has a historically restrictive cryptocurrency outlook, so we’ll be keeping a close eye on regulatory movements in the market in 2020.

United Kingdom

In the United Kingdom, the FCA confirmed that it will supervise the anti-money laundering and counter terrorist financing compliance of crypto asset businesses from January 2020. A UK Jurisdiction Taskforce also released a landmark statement seeking to address legal uncertainty by recognising crypto-assets as tradable property and smart contracts as enforceable agreements under English law. Earlier in the year, HMRC released a policy paper explaining how it will tax transactions involving cryptocurrency.

European Union

The 5AMLD (Fifth Anti-Money Laundering Directive) brings cryptocurrency service providers within the remit of European Union AML/CFT regulation and is set to be transposed into national laws across the EU by January 2020. The directive obliges crypto companies in the region to, among other things, register with the relevant regulator, carry out customer due diligence, and submit suspicious activity reports.

In Germany, legislation was passed by parliament making the custody of crypto assets a financial service subject to BaFin supervision. The legislation is effective from 1 Jan 2020 and was passed as an amendment to the fourth EU Money Laundering Directive. The original bill didn’t set out to allow banks to act as crypto custodians and initially specified they were to rely on third-party custodians, a change that has garnered significant praise for its forward-thinking nature.

Mainstream adoption and use cases galore

If crypto is going to realise its potential, people actually need to use it. Fortunately, there was plenty of that going on in 2019.

More retailers accepting crypto

There was a flurry of retailers who started accepting cryptocurrency payments in 2019.

A new partnership between point-of-sale technology provider Global POS, the EasyWallet application, and payments platform Easy2Play was announced in September, enabling consumers to pay in Bitcoin at more than 25,000 sales points at around 30 major retailers in France. These include sportswear giant Decathlon, Foot Locker, and Maisons Du Monde, among others.

There was also good news from global apparel retailer H&M. The clothing giant announced that they’ll accept cryptocurrencies as a form of payment for their distributors.

Banking enters the frey

Institutional involvement in crypto picked up rapidly in 2019. Multinational banking giant Banco Santander, for one, announced that it has launched the first end-to-end blockchain bond on the public Ethereum blockchain. The bank issued the bond directly onto the blockchain, where it will remain, while one of the Group’s units purchased the bond at market price, with no outside investors involved. The move opens the door to a potential secondary market for mainstream security tokens in the future.

US-based financial behemoth Wells Fargo also announced that they are developing a USD-pegged stablecoin that will run on the firm’s first blockchain platform, built on Corda Enterprise, the paid-for enterprise version of R3’s blockchain technology. In June 2019, J.P. Morgan also announced the launch of JPM Coin, an internal digital currency for institutional investors to transfer money in a more efficient manner. The stablecoin is backed by the US Dollar.

Supply chain and blockchain: a match made in heaven?

There have long been conversations around the use of blockchain technology in supply chains. After years of research and development, these conversations are moving into practise.

Nestlé this year announced a program to introduce baby formulas onto the blockchain. The aim is to provide customers with transparent information for certain infant milk ranges “from dairy to shelf”.

Sportswear giants including Nike and New Balance also announced new programs to use blockchain technology. They are bidding to combat counterfeiters and ensure indelible ownership of unique or custom-created items.

Non-fungible tokens (NFTs) in gaming

2019 saw an increase in the emergence of non-fungible tokens (NFTs) in the gaming world. They’ve been heralded as a more efficient way of tracking and issuing ownership of in-game collectables (remember CryptoKitties?). Read why we think decentralised gaming could ease and accelerate mainstream cryptocurrency adoption.

The founders of Gemini crypto exchange, Tyler and Cameron Winklevoss announced their company’s first ever acquisition in November. The company is Nifty Gateway, a startup that enables customers to buy and manage non-fungible tokens (NTFs).

The future is bright

Recent research shows millennials rate Bitcoin over more traditional stocks like Netflix and Disney. And the future looks bright, with educational resources increasing rapidly. For the first time ever Bitcoin is set to feature in a national curriculum, with France introducing it this year. Will other countries follow their lead in 2020?

Libra lifts off

Arguably the biggest news of the year was the formal announcement of Facebook’s Libra project in June. Libra is a new cryptocurrency that you can buy or cash out online or at local exchange points like grocery stores. You can also spend it using third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp or Messenger. With Facebook’s huge user base, to say the announcement caused ripples is an understatement.

In October, 21 organisations officially signed the Libra Association charter. They also selected its board of directors and formalised the consortium’s executive team. Calibra CEO and former Facebook blockchain lead David Marcus will take a seat on the five-person board of directors. He’s joined by Katie Haun, a general partner with Andreessen Horowitz; Wences Cesares, CEO of Xapo; Patrick Ellis, general counsel at PayU; and Matthew Davie, chief strategy officer of Kiva. Bertrand Perez, Dante Disparte and Kurt Hemecker – all former PayPal employees – will take leadership roles in the association’s executive team.

The 21 members of the association are: Calibra, Coinbase, Xapo, Anchorage, Bison Trails, Creative Destruction Lab, Andreessen Horowitz, Thrive Capital, Ribbit Capital, Union Square Ventures, Breakthrough Initiatives, Illiad, Vodafone, Farfetch, Uber, Lyft, Kiva, Mercy Corps, Women’s World Banking, Spotify, and PayU.

A number of US officials did, however, express criticism over the lack of clear regulatory procedures. This led to the US House Committee on Financial Services Democrats requesting Libra halt all developments citing concerns around national security and monetary policy, to name a few. The French finance minister Bruno Le Maire also stated the nation won’t allow the development of the Libra cryptocurrency in Europe as it poses a threat to the monetary sovereignty of nations.

However, development is continuing and signs are positive for the future.

Whale watch

The whales. Bitcoin’s most majestic animals. In 2019, they moved huge sums for minuscule fees and showcased to the world one of the key benefits of crypto – immediate cross-border transactions for a fraction of the price.

Let’s take a look at some of the biggest and boldest.

• May: Infamous Bitcoin whale, “Loaded” moved $211.9 million for just $3.93 in fees.

• July: Unknown Bitcoin holder moved 49,755.64 BTC ($468.5 million) in a single transaction for $374.98 in fees.

? ? ? ? ? ? ? ? ? ? 49,756 #BTC (468,491,827 USD) transferred from unknown wallet to unknown wallet

— Whale Alert (@whale_alert) July 29, 2019

• October: Previously unknown Bitcoin whale, which turned out to be European exchange Bitstamp, moved 107,848 BTC ($900 million).

• November: An unknown Bitcoin whale moved 44,000 BTC ($310 million) for just $0.32.

? ? ? ? ? ? ? ? ? ? 44,000 #BTC (310,280,282 USD) transferred from unknown wallet to unknown wallet

— Whale Alert (@whale_alert) November 24, 2019

• December: An unknown Bitcoin whale moved 57,577 BTC ($415 million) for only $5.

? ? ? ? ? ? ? ? ? ? 57,577 #BTC (414,977,399 USD) transferred from unknown wallet to unknown wallet

— Whale Alert (@whale_alert) December 4, 2019

The digital currency race

The great digital currency race is upon us! A myriad of countries across the globe are either looking into or diving head-first towards creating and implementing CBDC (central bank digital currencies). Here’s a list of some of the most prominent that launched in 2019 or will launch in 2020:

Bahamas: Residents of the island Exuma can now enroll in the Central Bank of The Bahamas’ “Project Sand Dollar”.

Bahamas: Residents of the island Exuma can now enroll in the Central Bank of The Bahamas’ “Project Sand Dollar”.

China: The People’s Bank of China is reportedly preparing to launch pilots for its Digital Currency Electronic Payment (DCEP) project, which features fully digital yuan. The two cities to pilot the CBDC are Shenzhen and Suzhou, and the first pilot it set to begin at the end of 2019 with the other following in the later part of 2020.

France: The Bank of France announced plans to start pilot testing a CBDC in early 2020.

Iran: Following US trade restrictions, Iran announced in June that it will issue its own cryptocurrency, to be pegged to the national fiat currency, the Rial. However, trading restrictions on the use of digital currencies still persist within the country.

Saudi Arabia and the United Arab Emirates: The central banks of these two gulf nations announced plans to jointly issue a digital currency named “Aber” for interbank money transfers.

Thailand: At the end of 2018/beginning of 2019, the Bank of Thailand tested a wholesale CBDC targeted at financial institutions. Eight big banks took part in the pilot, and while the results were positive, they showed more work needed to be done in order for the CBDC to be successful.

Turkey: A pilot test for a digital Lira is expected to be completed before the end of 2020.

The weird and the wonderful

Moving from planet Earth to outer space, one of the latest Bitcoin novelties amongst the Bitcoin technical community is to pay a couple of cents in Bitcoin to have a message sent into space. It’s the cosmic version of a message in a bottle. Crypto company, Blockstream, heads up this eccentric project. If that’s not enough, the launch of spacebit.live has given users another easy way to pay a small fee to send a message via satellites across the world.

And, in a galaxy not so far away, developers at SpaceChain sent a crypto wallet into space aboard a Falcon 9 rocket. The launch marks the first step in building a completely decentralised blockchain infrastructure above Earth.

Meanwhile, in the entertainment world, crypto failed to disappoint. Crypto popstar, Lil Bubble kept us dancing this year with a series of unique Bitcoin-related renditions of popular songs. This was the one that kicked it all off.

Grayscale Investment launched its one-of-a-kind campaign, titled #DropGold. Grayscale, one of the largest digital currency asset managers set out to challenge investors to reconsider their traditional beliefs around gold investing, and to embrace Bitcoin as a superior alternative.

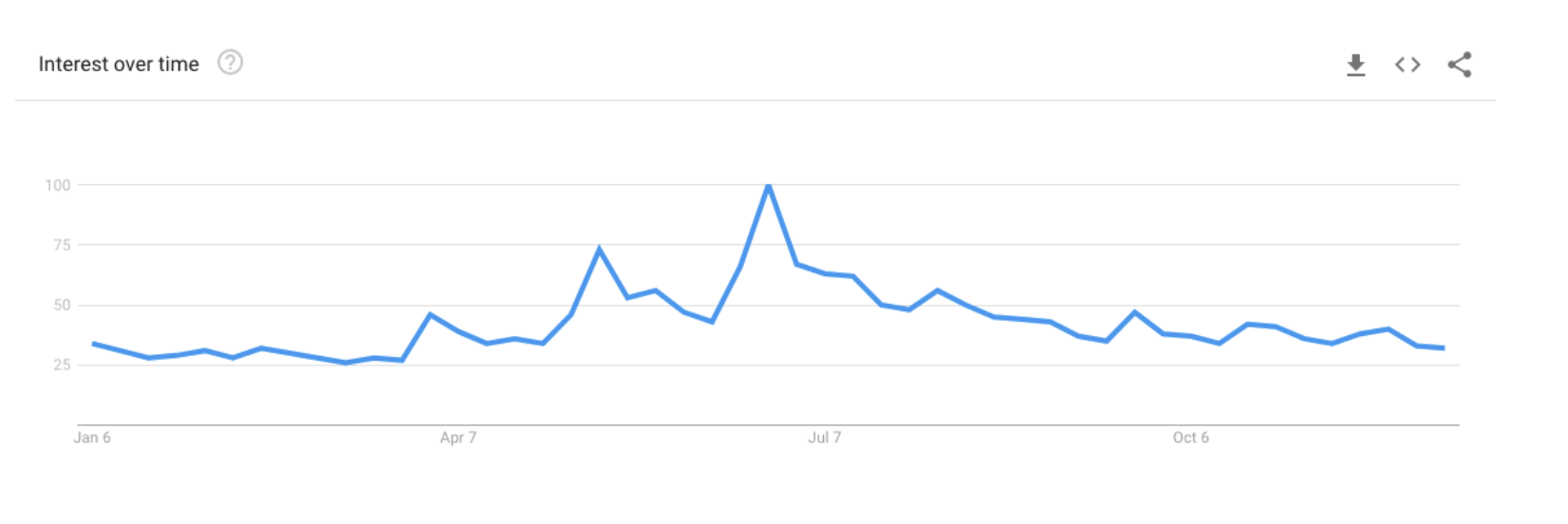

Whether or not the campaign was successful in its efforts is one story, but it’s clear more and more mainstream players have Bitcoin on their minds. Take a look at the increase in interest looking at “Bitcoin” as a search term this year.

(Source: Google Trends – Bitcoin search term interest worldwide throughout 2019)

Mining moves

The halving is arguably the event of 2020 for miners, but there was plenty in 2019 to keep miners on their toes.

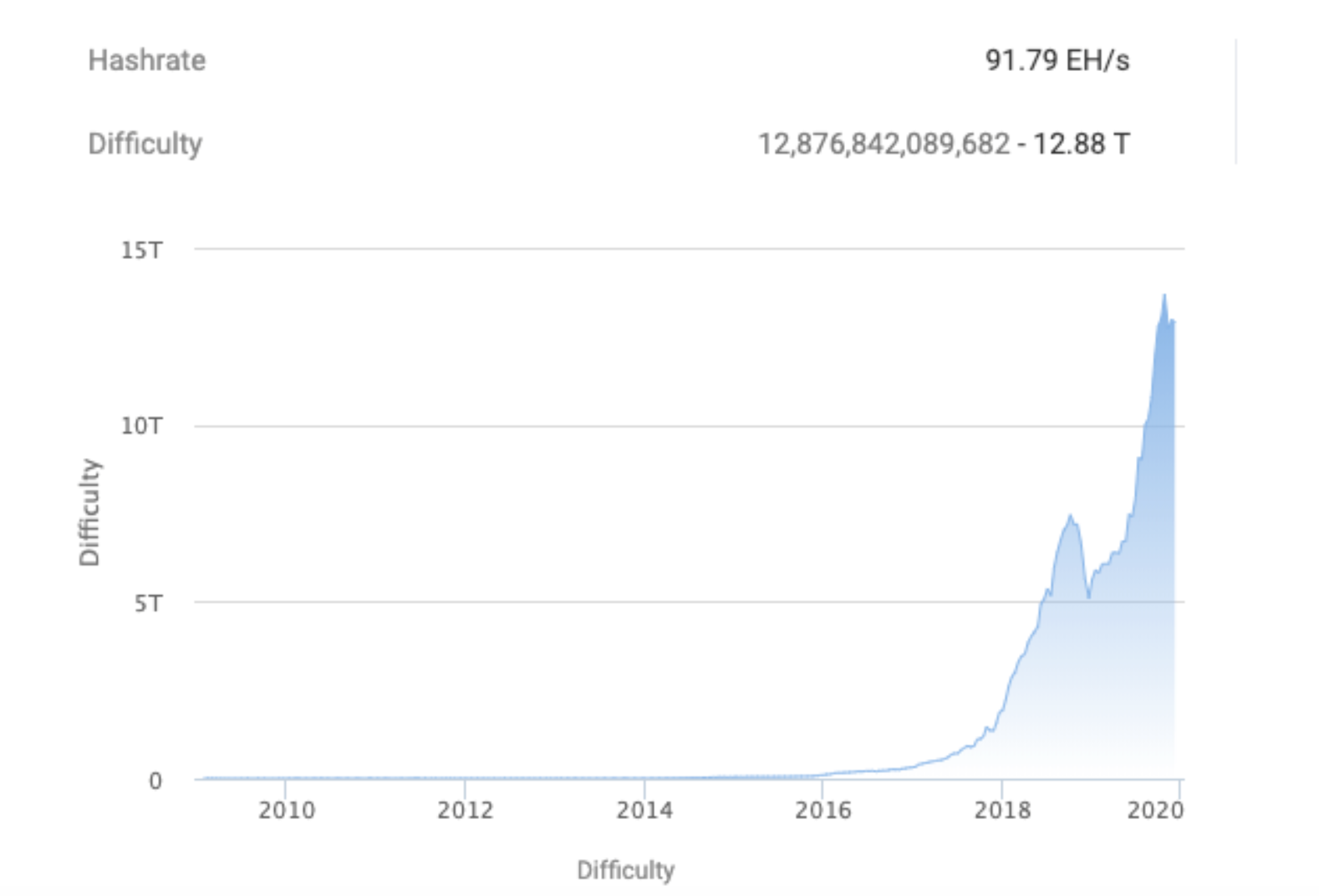

Mining difficulty on the rise ahead of halving

There was a significant increase in Bitcoin mining difficulty throughout 2019. Mining difficulty is a measure of how hard it is to compete for mining rewards. A higher difficulty means competition for block rewards is higher, lower difficulty incentivise more participation. This brings balance to the network, keeping block times at an average of 10 minutes. In December 2018, it was 5.1 trillion. By October 2019, it had more than doubled to an all-time high of 13.7 trillion, suggesting an increasingly competitive network.

In addition to this, the hash rate was also busy hitting all-time highs, reaching 114 quintillion hashes per second in October 2018.

To understand more about mining difficulty and the hash rate, and their importance to the Bitcoin industry, check out our blog.

Still greener than gold

There have been many spurious claims made about Bitcoin over the years, with sceptics looking to throw mud wherever possible. Perhaps the most prominent is the accusation that Bitcoin mining creates emissions that are harmful to the environment. But is Bitcoin mining really as dangerous for the environment as some may have you believe?

Research released this year suggested otherwise, with Bitcoin dubbed ‘greener than gold’ in a recent CoinShares study. The study found that the Bitcoin network gets 74.4% of its electricity from renewable sources, making it more “renewables-driven than almost every large-scale industry in the world.”

Be careful where you mine…

On a lighter note, there were also a couple of belly-laugh inducing mining blunders. TLDR; don’t mine Bitcoin at your place of work or at a government organisation. You’ll probably get caught and it probably won’t be worth it.

A celebrity of sorts in the mining sphere this year was Russian nuclear scientist, Denis Baykov. The state fined Baykov 450,000 rubles (£6,000) for illegally mining Bitcoin at a top secret facility in Russia, according to local reports. He was part of a trio that put the Sarov institute’s super powerful computers to work on their side hustle.

The supercomputer used by the scientists has one petaflop of processing power. This means it is capable of conducting up to 1,000 trillion operations per second. The perfect tool.

Bitcoin ‘best investment of the decade’

What was the “best investment of the decade”? Yep – you guessed it: Bitcoin. There may not have been a formal awards ceremony, but according to a report by Bank of America Securities, “if you invested $1 in bitcoin at the start of the decade, it would now be worth more than $90,000.” That’s a gain of 8,999,990%.

It was a different story for gold, which was trading for $1,113 per Troy ounce at the start of 2010. As of today, gold has reached a high of $1,542 per ounce – decent gains of 38%. In 2019, BTC has gained 96% compared to gold’s 10.8% increase.

All without a centralized marketing fund, no salespeople, no roadshow people pitching sovereign wealth funds or family offices and no fundraise or premine.

— Bruce Fenton (@brucefenton) December 4, 2019

Entering the roaring ‘20s

Have a happy and prosperous new year everyone! What was your highlight of 2019? Let us know on Twitter. What’s in store for 2020? Get ready for a fruitful year ahead with our top crypto trends for 2020.

To the moon ?

Keep reading…

Blockchain is most in-demand tech skill, says LinkedIn

What crypto Twitter had to say in 2019

Top crypto trends to watch out for in 2020

Bitcoin futures are growing in popularity, but what are they?

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press