Crypto in 2020: The year so far

In December 2019, we dusted off the Luno crystal ball and took our annual look at what the next year had in store. Needless to say, there were a couple of things we missed (pandemics, for instance). But we’re big enough to admit that we’re not completely clairvoyant (though we can see the future of finance…).

Amidst the mayhem of the last six months though, there were a few things we got right. We’ve taken a look at what’s happened in the crypto space so far this year, and how much things have worked out the way we thought they would.

The Bitcoin Halving to send demand soaring? TOO SOON TO TELL

The Bitcoin halving is a major source of excitement in the crypto community, historically driving significant price action. This year was no exception, despite social distancing laws prohibiting some of the more dramatic celebrations we’ve seen previously. People did still manage to get virtual parties going though.

2020 Bitcoin Halvening Party #LIVE (Bitcoin Halving) https://t.co/n7f5TfAXyB

— Mad Bitcoins (@MadBitcoins) May 11, 2020

This year’s halving saw Bitcoin block rewards fall from 12.5 to 6.25 Bitcoin. The last Bitcoin halving in July 2016 saw them fall from 25 Bitcoin to 12.5. This preceded Bitcoin’s epic 2017 bull run, which briefly took the price as high as $20,000.

However, as we noted in December, this is no guarantee of another bull run. The space has matured significantly since 2016, with the traditional financial industry and some of the world’s biggest technology companies taking an interest in Bitcoin. Add to that the uncertain market conditions caused by COVID-19, and it’s extremely hard to compare this halving to previous instances.

Of course, none of this is to say the price won’t eventually rise as a result of the halving. The last halving took over a year and a half to bear fruit. So although there hasn’t been the immediate bull run some might have anticipated, it’s still far too early to tell whether we’ll see a repeat of the price action we’ve seen in the past.

Retail adoption on the rise? ON COURSE

“A charge long-levelled against Bitcoin and other cryptocurrencies is the lack of opportunity to actually use them. Throughout 2019, we saw this change rapidly, with new startups such as Flexa introducing slick crypto-payments platforms for retailers.”

The decision by major economies around the world to lock down has obviously had a hugely detrimental impact on bricks-and-mortar retailers. In our 2020 predictions, we noted that Starbucks would be accepting crypto this year after trialling Bakkt’s new consumer app to allow you to buy coffee with Bitcoin. And the coffee giant did indeed start testing it back in March. However, they then had to temporarily close many outlets, which has likely hampered testing somewhat. Even as bricks-and-mortar retailers re-open, those who were perhaps considering making the move to accept crypto will likely have bigger things to worry about.

There is another side to the coin, though. Fears around the spread of COVID-19 through paper money has caused a number of shops to stop accepting it as a form of payment. This could well open the doors to money that is exclusively digital – perhaps, even, money that’s not only digital but also cryptographically secure. Sound familiar?

Perhaps the most bullish thing to happen this year for retailers, though, is PayPal potentially entering the crypto space. This rumour appeared in CoinDesk in June and it actually seems to have legs. Currently, you can only use PayPal to withdraw funds from certain exchanges. A ‘well-placed industry source’ told CoinDesk: “My understanding is that they are going to allow buys and sells of crypto directly from PayPal and Venmo. They are going to have some sort of a built-in wallet functionality so you can store it there.” Factor in that the payment giant has also put up a job ad for a crypto specialist and you could even classify this speculation under ‘actually might happen.’

If it were to happen, arguably the most interesting part of it would be seeing how it aligns with PayPal’s pre-existing relationships with various physical and online retailers. Given that a massive swathe of online retailers already have at least a degree of integration with PayPal, will the firm begin to offer payment directly with crypto? This would be huge and would make it significantly easier for online retailers in particular to accept crypto.

Asia warming up to crypto? YES ???

“The last quarter of 2019 was all about Asia. We saw Malaysia welcome crypto companies back into the region (including Luno), while South Korea and Thailand also began to implement new regulation that should pave the way for the advancement of crypto. Another giant market that has been even more cautious than China so far is India. However, they too seem to be coming round to its benefits.”

This was definitely right! We got one!

India is arguably the most intriguing crypto story to come out of 2020 so far. In April 2018, the Reserve Bank of India (RBI), the country’s central bank, initiated a major crackdown on the trade and purchase of cryptocurrencies such as Bitcoin within its borders. However, in March, the Supreme Court of India overturned the RBI’s controversial ban after justices ruled that the action was “disproportionate”.

Speaking to News18, Dr. Garrick Hileman, Head of Research for Blockchain.com, said, “Opening the doors wider for cryptocurrencies won’t only expand their daily use in India, but also bring in new talent and innovation that would otherwise choose a more crypto-friendly country. In the long-term that’s a clear benefit for the Indian economy and its competitiveness globally.”

India has since seen a surge in Bitcoin trading following the Supreme Court’s decision. Trading volume on Mumbai-based WazirX, one of India’s leading crypto exchanges, for one, rose 400% and 270% month-on-month in March and April, respectively. The exchange is now facilitating around 60 million trades per day, up from 20 million before March.

With a population in excess of 1.3 billion people – more than half of whom have internet access – the potential for growth is huge and it is likely that the country is just getting started on its crypto journey.

Has there been an acceleration of regulatory efforts? IN A SENSE

“Regulators around the world are already accelerating their efforts. This escalation in pace was evident throughout 2019, likely motivated by Facebook entering the space with its Libra project. In 2020, we expect to see this continue.”

This has also come to pass already, with a number of countries introducing major new regimes. In South Africa, for example, the Intergovernmental Fintech Working Group (IFWG) introduced its long-awaited rules in April. Admittedly we were among the companies they consulted with on this, so we did have a bit of inside knowledge with this particular prediction, but let’s not nitpick.

The EU’s Fifth Money Laundering Directive also came into force in January, with the sixth directive will follow swiftly on its heels in December. For firms buying and selling crypto-assets, the 5AMLD requires them to register with national financial regulators. It also states minimum requirements for Anti-Money Laundering (AML) processes, similar to those we see with traditional asset classes.

The specifics of how these regulations will impact the space in the long term are still unknown. There will, however, certainly be lessons to learn for best regulatory practices that other regions can emulate if successful.

Will emerging markets lead the way? ON COURSE

“The need to innovate and differentiate from more established financial players drives the need for a more progressive mindset. The relative youth of their [emerging markets] financial system also provides them with an advantage, in that they are not so heavily tied to established ideas and ways of working.”

We have always believed that emerging markets have a great deal to gain through the widespread adoption of cryptocurrency. Take Africa as an example – a region former Monero lead, Riccardo Spagni recently noted has a class of problems where “we can just leapfrog, and use cryptocurrencies to our advantage.”

This potential appears closer to being realised than ever before. In our report on the adoption of crypto in Africa, released in May, we noted that Uganda, Nigeria, South Africa, Ghana, and Kenya are frequently among the top 10 countries by Google searches for the word “Bitcoin.” Worldwide, South Africa ranks fifth for crypto adoption among connected citizens.

In terms of adoption in emerging markets, though, it’s difficult to look past India as the region likely to see highest growth this year. Their return to the crypto world stage could bode very positively for crypto and it will be fascinating to see how the situation develops over the rest of 2020.

For other emerging economies – whether in Africa, Asia, Latin America or anywhere in the world, the financial havoc wreaked by COVID-19 is likely to be acutely pronounced. This is already changing how many view the financial system, and the impact of the huge stimulus programs necessary will only become truly known later in the year. That crypto adoption in these countries is still gathering at pace is hugely encouraging at a time when a new, inclusive financial system is needed more than ever.

Was it the making of privacy coins, or their demise? TOO SOON TO TELL

“Where stable coins were the main bugbear for regulators in 2019, their gaze is likely to shift towards privacy coins in 2020.”

Privacy coins certainly seem to be attracting more attention from governments. A new listing posted on the government’s official contracting website on 30 June, shows that the Criminal Investigation Division (CID) of the IRS is hiring private contractors to get more visibility into privacy coins transactions used in illicit activities. Per the document, the institution has a special interest in the privacy-centered cryptos Monero (XMR), Zcash (ZEC), Dash (DASH), Grin (GRIN), Komodo (KMD), Verge (XVG) and Horizon (ZEN).

Even their main proponents would admit that privacy coins were always going to be given a rough ride from the authorities, though. If they can navigate pressure from the likes of the IRS, it remains to be seen how far they can eventually go.

Is Libra going to launch (successfully)? ON COURSE

“With Libra planning to sign up to 80 more members to the project, its potential impact is tremendous. It’s really a question of ‘when’ rather than ‘if’. We will be watching eagerly.”

Libra was the big story of last year in crypto and 2020 has certainly been another eventful year, with big changes to the project.

For a start, Libra’s wallet ‘Calibra’ is now called Novi. The Libra blockchain is supposed to operate independently from Facebook, while Novi is a pure Facebook project headed by David Marcus. This rebrand appears to be Facebook’s attempt to put more air between itself and the Libra project – and a sensible one at that. If you don’t want to be overly associated with a project, it’s probably best the names don’t share so many letters.

Facebook has long been at pains to make it clear that Facebook is just another member of the Libra Association, alongside dozens of other members, such as Andreessen Horowitz, Coinbase, Iliad, Lyft, Shopify, Spotify, Uber, etc. It’s been suggested that this name change has been done to placate regulators who fear what Facebook-controlled money would look like – a move which if true should bring greater certainty to the project’s successful launch.

In another even significant attempt to quell regulators’ concerns though, Libra has also changed their offering. David Marcus, co-creator and a board member of Libra and head of Facebook digital wallet subsidiary Calibra, tweeted in April that Libra now plans to offer stable coins backed by just one nation’s currency, in addition to its coins backed by multiple currencies.

This change means that some coins offered by the group will serve as the equivalent value of a US dollar or a Euro, for example. Libra will also implement measures to combat money laundering, to avoid financing terrorism, and to enforce national financial sanctions.

It’s still unclear if Libra’s changes will be enough to entirely convince regulators and policymakers of their good intentions, but the signs are positive that they will manage to launch on schedule.

Boom or bust for ICO projects? FOR SOME

Although we’re not yet halfway through the year, it’s already become evident that this has been a boom or bust year for ICO projects. Of particular note in the Bust column is Telegram, which smashed records in 2018 with its $1.7 billion ICO. In June, the Securities Exchange Commission (SEC) finally got the better of the messaging platform, which announced after years of drama , they were calling it quits on its crypto-focused subsidiary, Telegram Open Network (TON).

Pavel Durov, founder and CEO wrote in a May blog post that “Telegram’s active involvement with TON is over. You may see – or may have already seen – sites using my name or the Telegram brand or the ‘TON’ abbreviation to promote their projects. Don’t trust them with your money or data.”

It’s better news for the other companies we mentioned, though. Filecoin launched its testnet in May and completed feature development work on the Lotus Filecoin client, described as an upgraded “Proof-of-Replication” consensus (PoRep). Hdac, meanwhile, which supports communication among the Internet of Things devices, is also still going. They recently teamed up with auditing firm CertiK and to bring Internet of Things (IoT) devices onto a blockchain. So it’s not all doom and gloom. There’s still 6 months left of the year though. Blockchain is still a nascent technology, and life as a startup is hard enough anyway, with the odds stacked against survival. We’ll be keeping an eye out.

Did Ethereum 2.0 provide a boost to decentralised finance? SORT OF

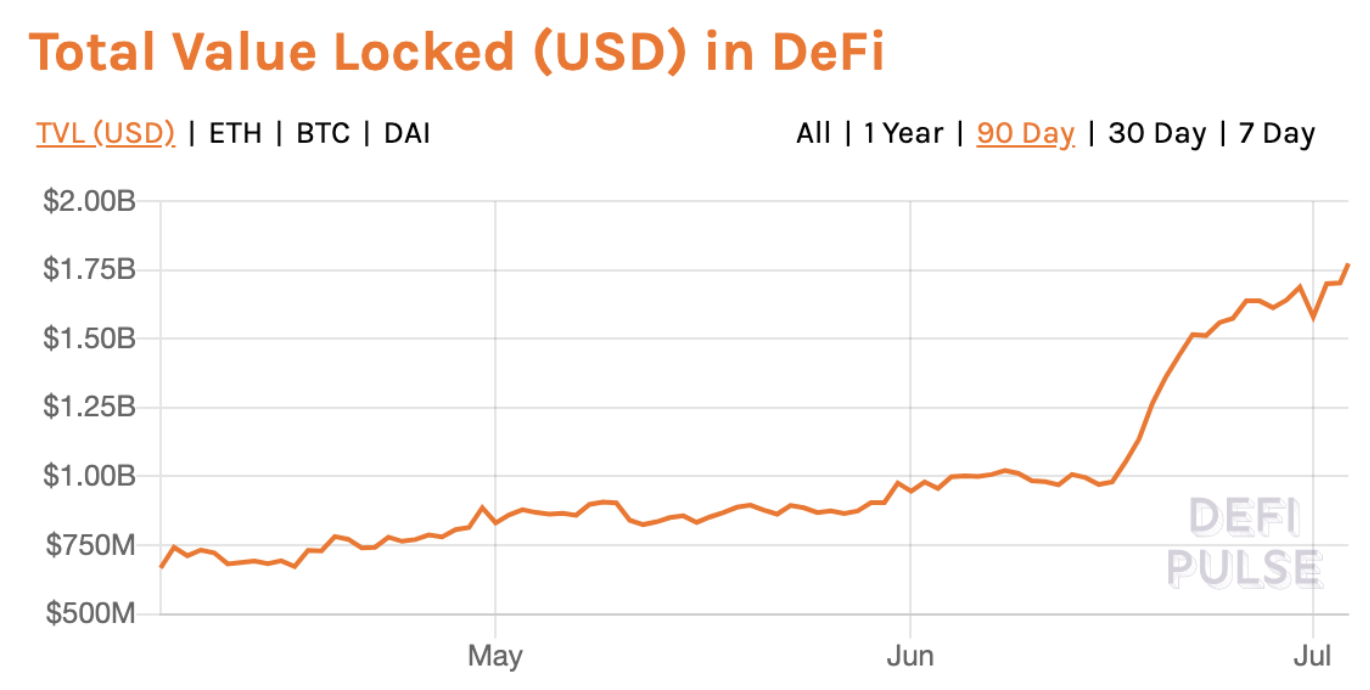

“Decentralised Finance (DeFi), in particular, could be in for a windfall. This sub-sector has already experienced gains in 2019, growing into a $600 million ecosystem. Ethereum 2.0 could spark new and interesting financial models for borrowing and lending, new staking mechanisms and incentives that could see new DeFi projects form, and see existing projects take off. The upgrade is much-hyped and has been long-awaited by the community. But will it have the impact many believe?”

The long-awaited Ethereum 2.0, codenamed Berlin, has been delayed again until later in the year, so we can’t appraise this quite yet. It’s been better news for DeFi, though, which seems to be going from strength-to-strength. The total value locked in DeFi has more than doubled so far this year, and is still rising. When Ethereum 2.0 does finally launch, we could see this explode even more. If it does ever actually launch.

Have institutional investors entered the space? YES

“In 2020, we should see institutional investors – banks, hedge funds, pension funds, endowments, etc. – show more interest in cryptocurrencies themselves, or at least in Bitcoin. They are increasingly looking to diversify their portfolios and finally have the professional machinery to do so.”

The pandemic seems to have caused fund managers to re-evaluate many of their attitude towards cryptocurrency.

This was shown in May when veteran hedge fund manager Paul Tudor Jones showed his appreciation for Bitcoin and revealed that he had a stake in the digital asset. He noted that: “The best profit-maximizing strategy is to own the fastest horse. If I am forced to forecast, my bet is it will be Bitcoin.”

Jones is largely considered one of the best macroeconomic traders ever, famous for his prescient bets against the U.S. stock market in 1987. He is incredibly influential and his endorsement is a massive boost for the space.

Elsewhere, the world’s largest digital assets manager, Grayscale Investments, has purchased more Bitcoin on behalf of its institutional clients since the third halving than has been mined. According to data supplied by independent researcher Kevin Rooke, Grayscale added 18,910 coins to its Bitcoin Trust in little over two weeks since the halving. Only 12,337 coins were mined in that time period, meaning Grayscale has acquired the equivalent of 153% of all Bitcoin produced since the block reward halving.

According to its Q1 2020 Digital Asset Investment Report, the vast majority (88%) of Grayscale’s customers are now institutional investors. “88% of inflows this quarter came from institutional investors, the overwhelming majority of which were hedge funds,” stated the report. It’s been said before, but it does look like institutional demand may finally be here.

Has Brave browser changed the advertising model for web giants? NOT YET

“In 2019, Brave reached 8 million users. With its popularity growing so rapidly, will we see the features that have made it so popular adopted by larger, established search engines such as Google and Yahoo?”

It’s been a mixed year for Brave, the open-source browser designed to prioritise privacy by blocking third-party ads and trackers.

In terms of users, it’s been somewhat successful. They reached 15 millions users in June – almost doubling their user base in just 6 months. These numbers are still not likely to trouble search engine giants such as Google, or even Bing, but they do suggest they’re going in the right direction.

They did see some controversy though, coming under fire from users for redirecting URLs from cryptocurrency companies to affiliate links that Brave profits from. Advertisers have also complained that they’re unable to see metrics, making it difficult to justify spend on the platform.

So we’ll say that they’re not that close to dragging the likes of Google over to their way of thinking just yet, but the signs are still there.

Have traditional financial players added crypto as an investment option? NOT YET

“The rise of FinTechs and challenger banks has been rapid over the last few years. They move fast, operate with a digital-first mindset, and know what consumers want. This has seen them lead the way in offering crypto as an asset class, with the likes of Revolut having integrated it into their platform since 2017. But could 2020 be the year that more traditional players catch up?”

This hasn’t entirely happened yet, but there are definite signs that major players are moving towards this position. JPMorgan’s turbulent relationship with Bitcoin, for one, appears to be softening faster than an ice cream in a shot putter’s armpit. In May, the bank added Gemini and Coinbase as its first crypto exchange customers. It was also reported that CEO Jamie Dimon hosted secret meetings with the boss of major Bitcoin and crypto exchange, Coinbase – and has been since 2018.

If PayPal enters the crypto space, this could also have significant ramifications. You can’t exactly call them a traditional financial player – although it might feel like it sometimes – but if they’re successful, it could only be a matter of time before others enter the space.

Finally… how many times will Bitcoin die this year? WAY OFF

According to 99bitcoins’ Bitcoin Obituary, which documents every time a major press publication say Bitcoin or crypto is ‘dead’, Bitcoin has now ‘died’ 381 times since 2010! That’s up just three from last year.

In our predictions, we went with what we thought was a conservative 15. So it looks like people might finally have come round to the idea that Bitcoin isn’t going anywhere! We’ll see whether the next six months adds another 12 to the total, though. There are still a few skeptics out there who need to be convinced.

Keep reading…

A beginner’s guide to crypto trading strategies

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press