Daily market update: Bitcoin back over $19,000 again

An unpredictable and chaotic year is coming to an end. With the price of bitcoin closing its fifteenth straight day above $18,000 yesterday, it’s a positive sea of tranquility. Will it stay that way this week? Will we hit $20,000?

Here’s today’s market report. If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 09.30am GMT.

Bitcoin price

We closed yesterday, 13 December, 2020, at a price of $19,142.38 – up from $18,803.66 the day before. The price has now closed over $18,000 for 15 consecutive days.

The daily high yesterday was $19,381.54. The daily low was $18,734.33. This time last year, the price of bitcoin closed the day at $7,269.68 and in 2018 it was $3,313.68.

We’re 4.71% below bitcoin‘s all-time high on CoinMarketCap of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.4% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $25,450,468,637, up from $21,752,580,802 the day before. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $355,479,173,806, up from $349,170,613,899 the day before.

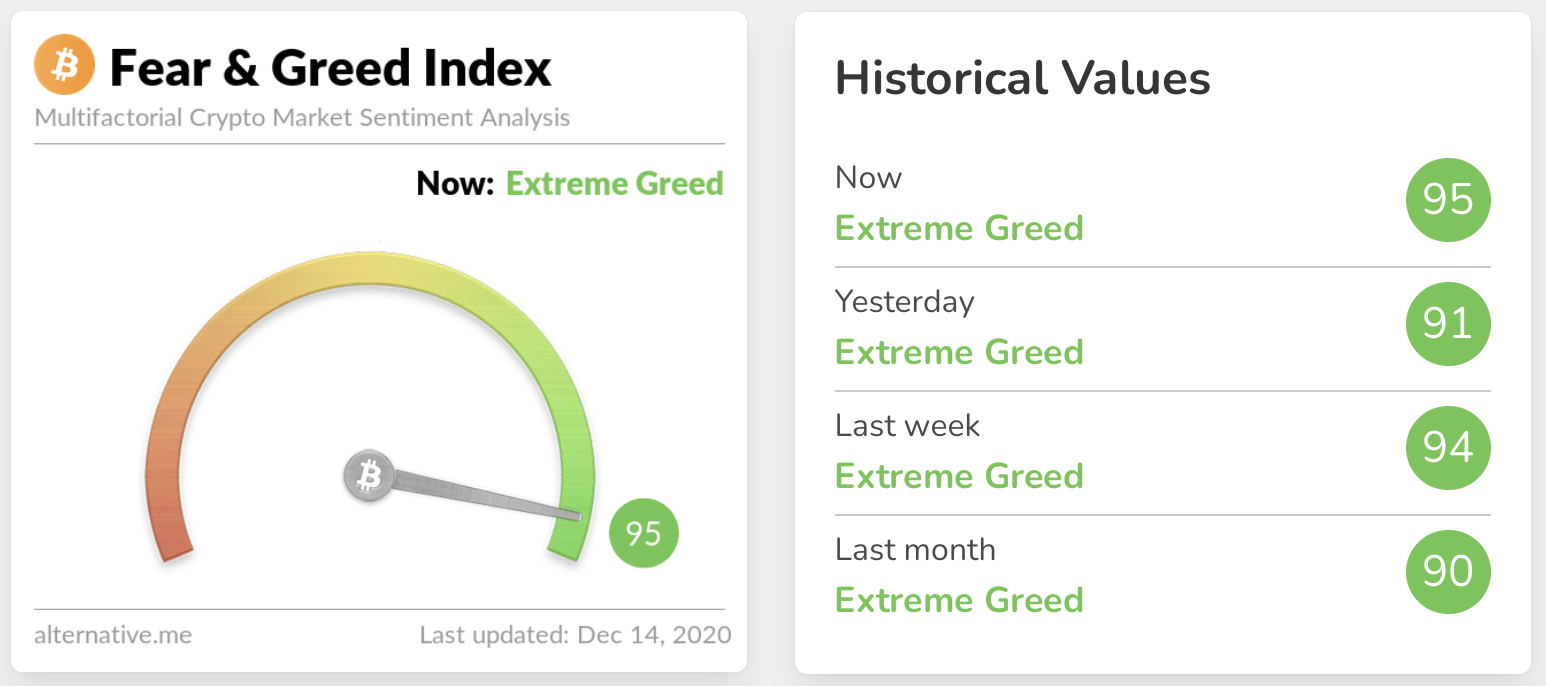

Fear and Greed Index

The sentiment remains in Extreme Greed territory at 95. It’s important to remember that the index doesn’t stay this high very often and a correction could be on the cards.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 64.41. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 58.60. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

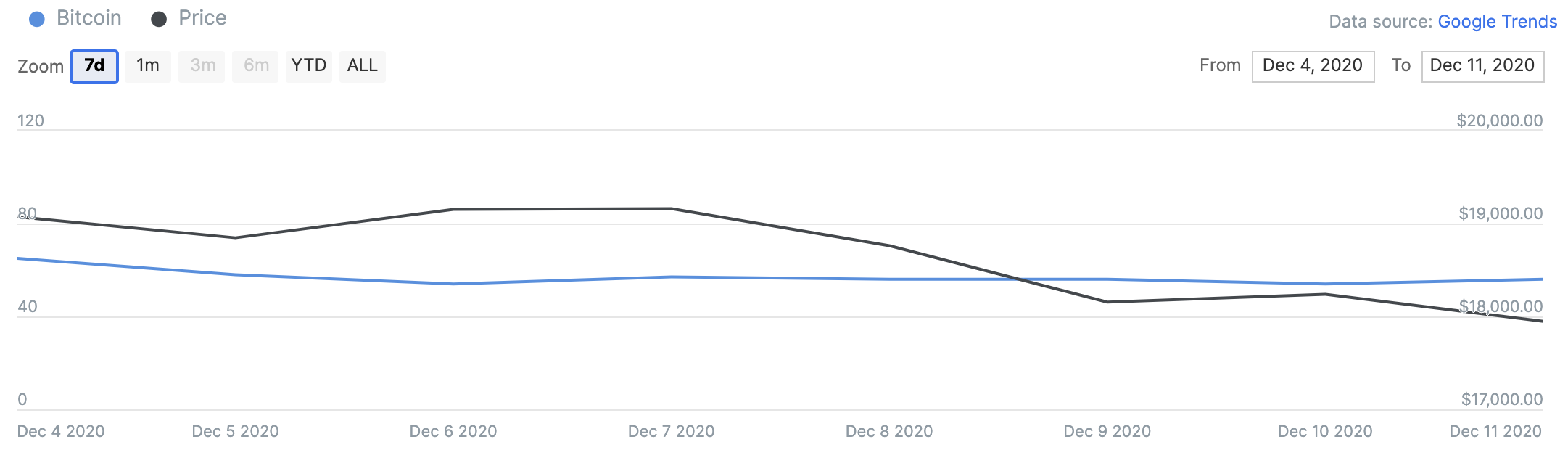

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. Today’s score is 56.

Charts provided by IntoTheBlock.com

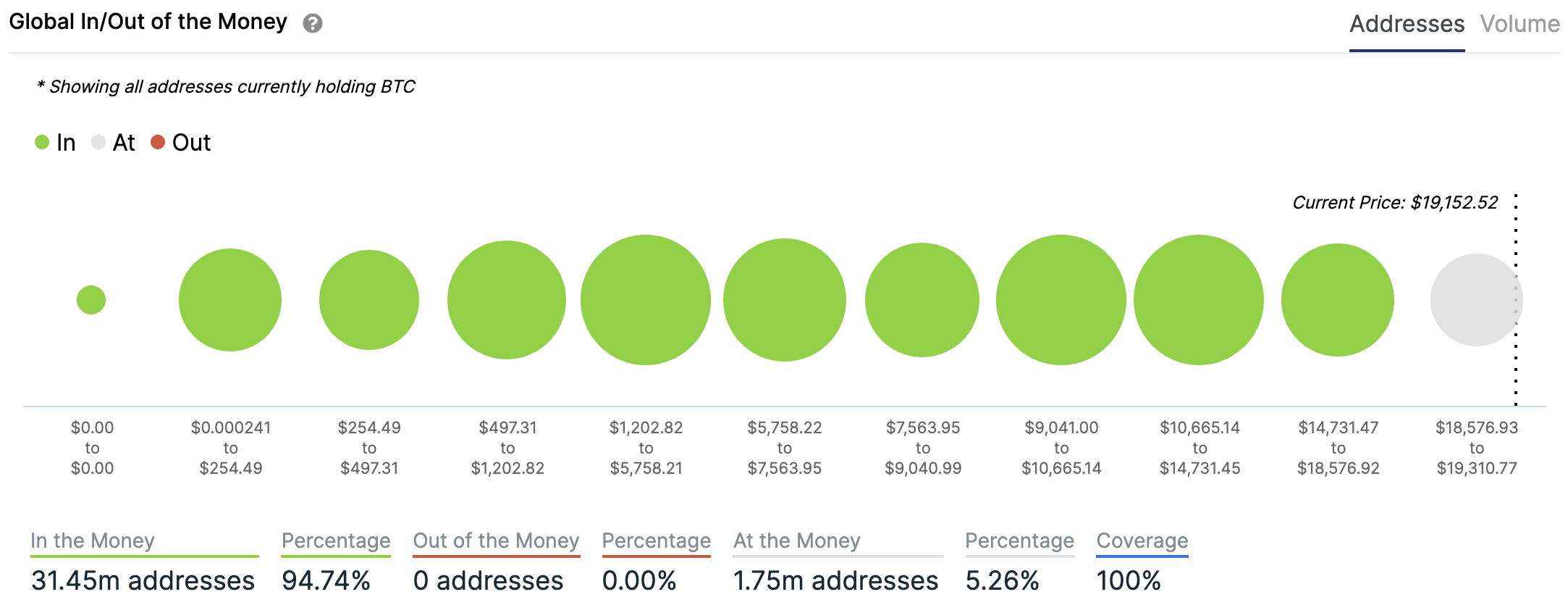

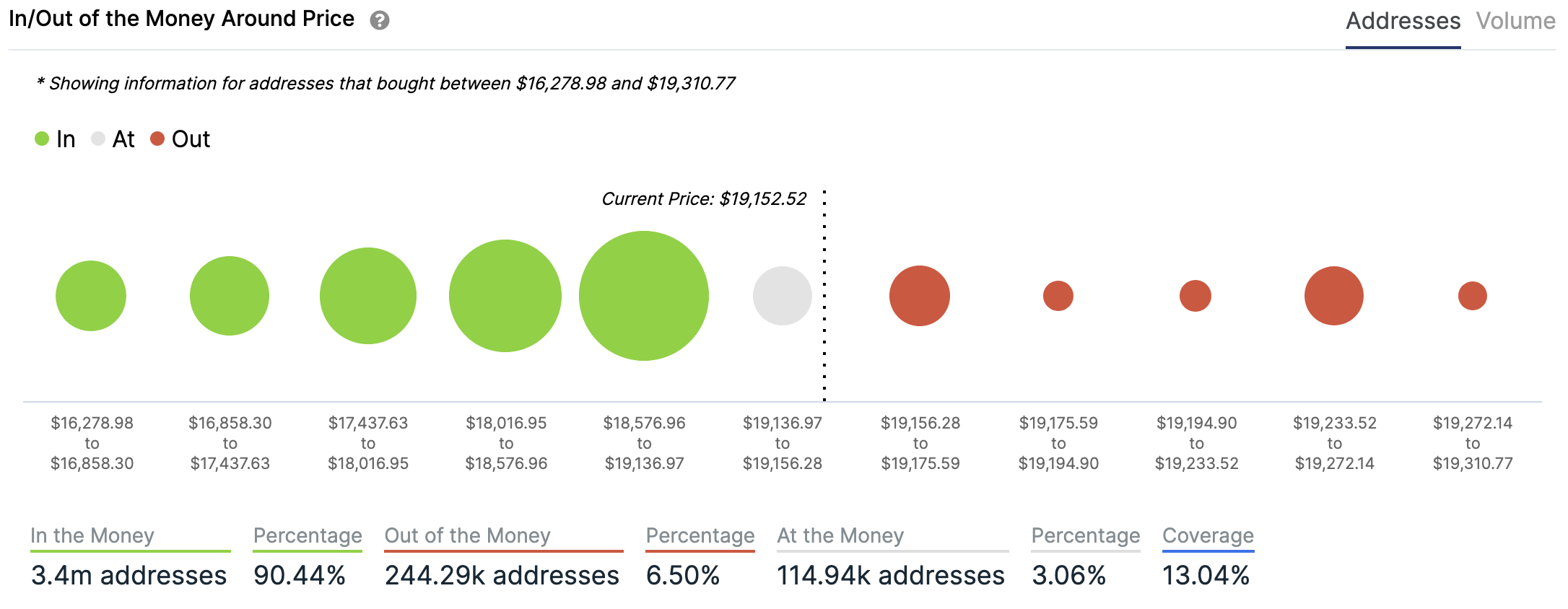

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Charts provided by IntoTheBlock.com

Volatility

Annualised price volatility using 365 days.

Charts provided by IntoTheBlock.com

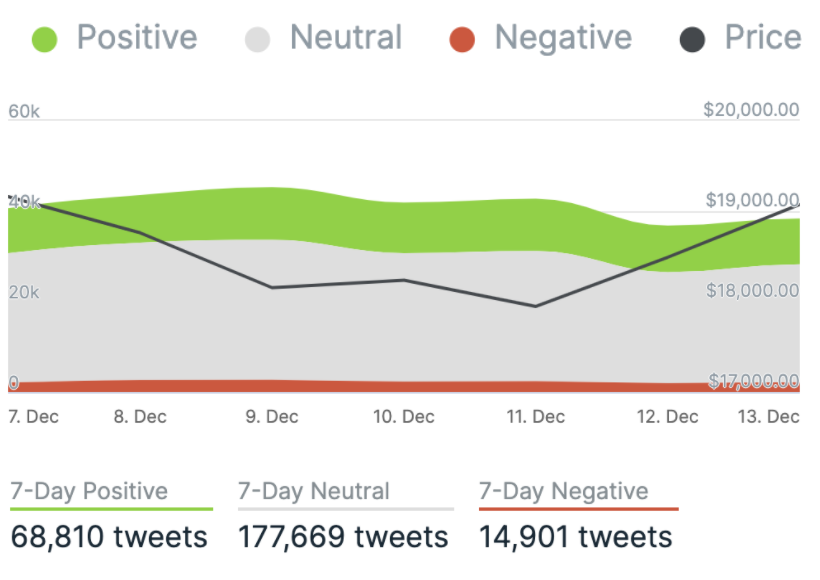

Twitter sentiment

Yesterday, there were 10,138 tweets sent with a positive connotation towards bitcoin, 26,092 with a neutral connotation, and 2,185 were negative.

Charts provided by IntoTheBlock.com

What they said yesterday…

#Bitcoin market cap: $353 bn

Employees: 0

CEO: none

Marketing budget: $0

Hours of operation: always running

Location(s): everywhere

Incorporated under the laws of: nobody – its code is its law

Conclusion: it’s not like anything you’ve ever seen before

— Tomerrrrrrrrr Strolight (@TomerStrolight) December 14, 2020

? ? ? ? ? ? ? ? ? ? 32,353 #BTC (628,484,540 USD) transferred from unknown wallet to unknown wallet

— Whale Alert (@whale_alert) December 13, 2020

#Bitcoin will become world-famous in 2021! Prepare!

— The Moon ? (@TheMoonCarl) December 13, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press