Daily market update: Bitcoin dips to $17,000, can bulls summon another run to $20,000?

After a brief dip down into the $16,000s, the bitcoin price saw a recovery yesterday to $17,000. Another push to an all-time high will be a big challenge for bulls, but would you bet against them?

As always, here’s your daily market update to help you on your way. If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to help make sense of all these indicators, including in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 09.00am GMT.

Bitcoin price

We closed yesterday, 26 November, 2020, at a price of $17,150.62 – down from $18,732.12 the day before.

The daily high yesterday was $18,866.29. Meanwhile, the daily low was $16,351.03. This time last year, the price of bitcoin closed the day at $7,218.37 and in 2018 it was $3,779.13.

We’re 14.63% below bitcoin‘s all-time high of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.1% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $61,396,835,737, up from $43,710,357,371 the day before. That’s the highest daily volume since 8 October, 2020. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $318,231,964,319, down from $347,558,803,507 the day before.

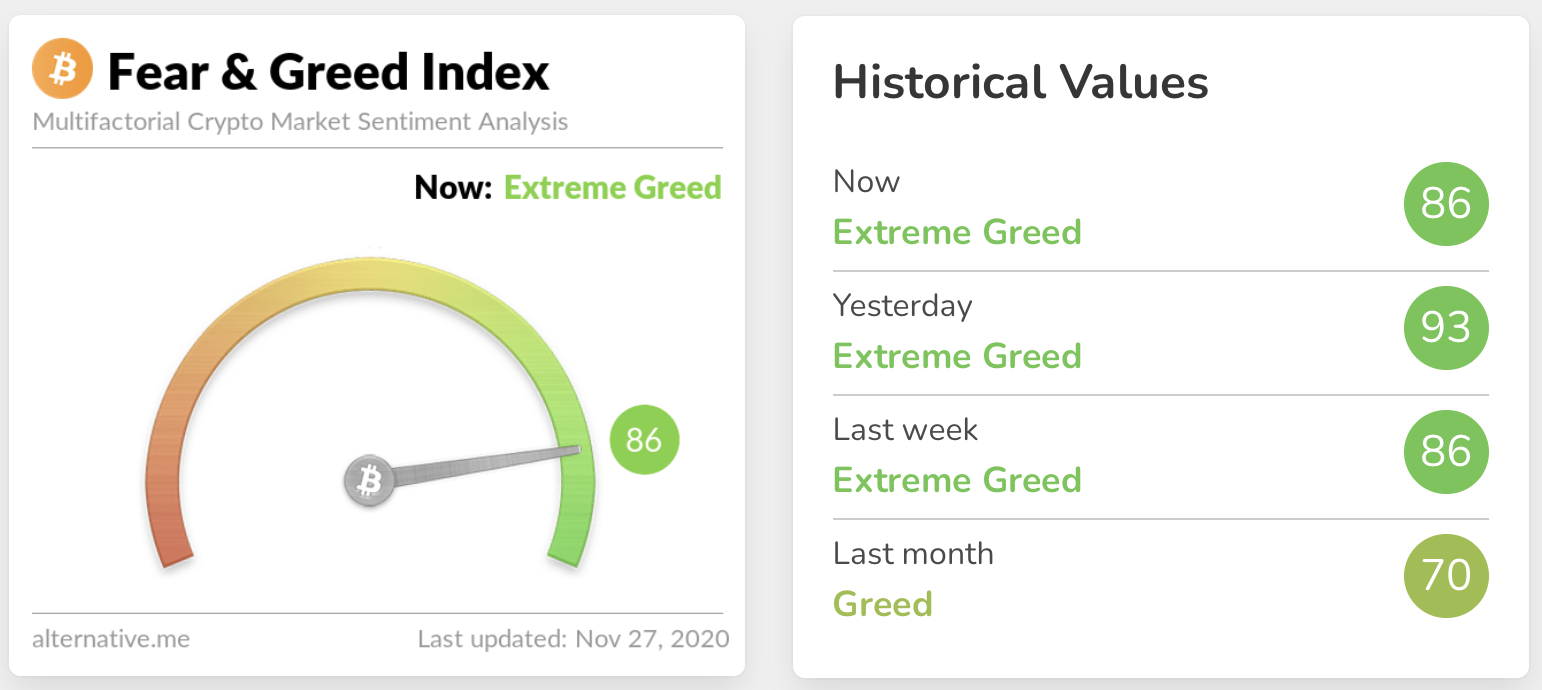

Fear and Greed Index

Despite yesterday’s price drop, sentiment remains in Extreme Greed at 86. The last time it was below 80 was 5 November. The index has now spent a record length of time in Extreme Greed and it’s important to note that the index doesn’t stay this high very often and a correction could be on the cards.

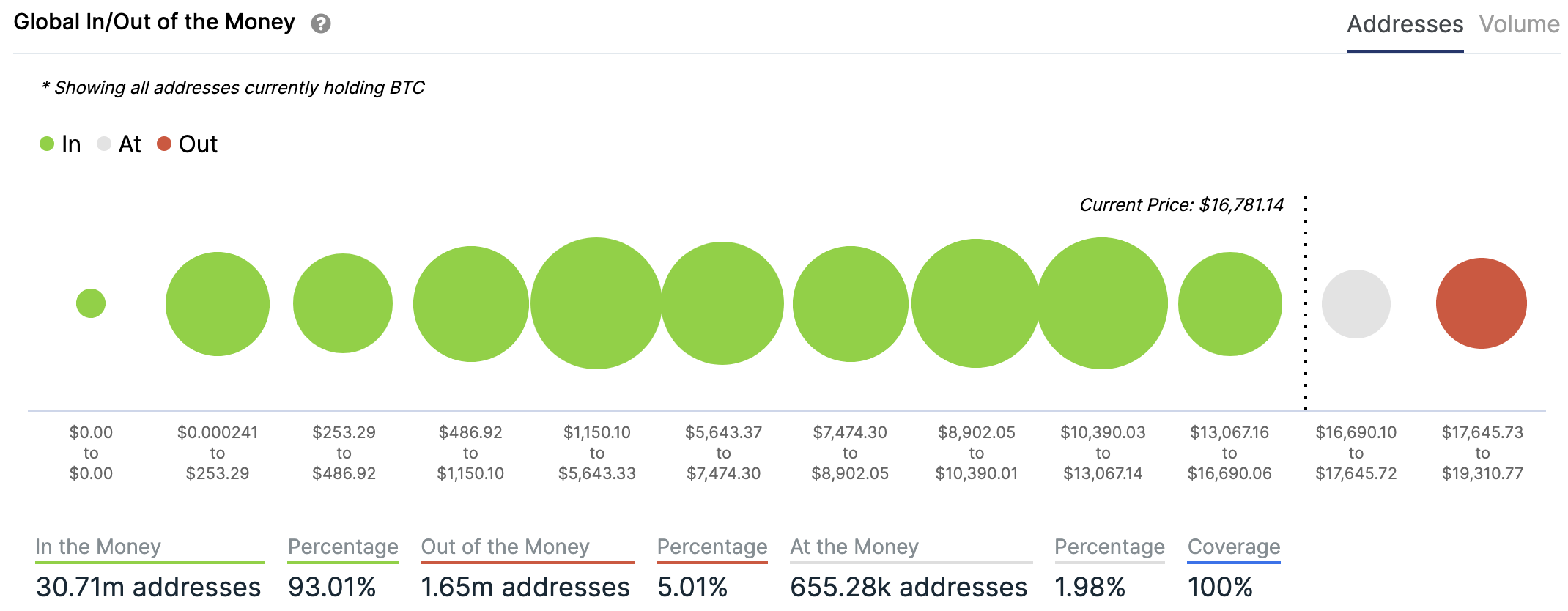

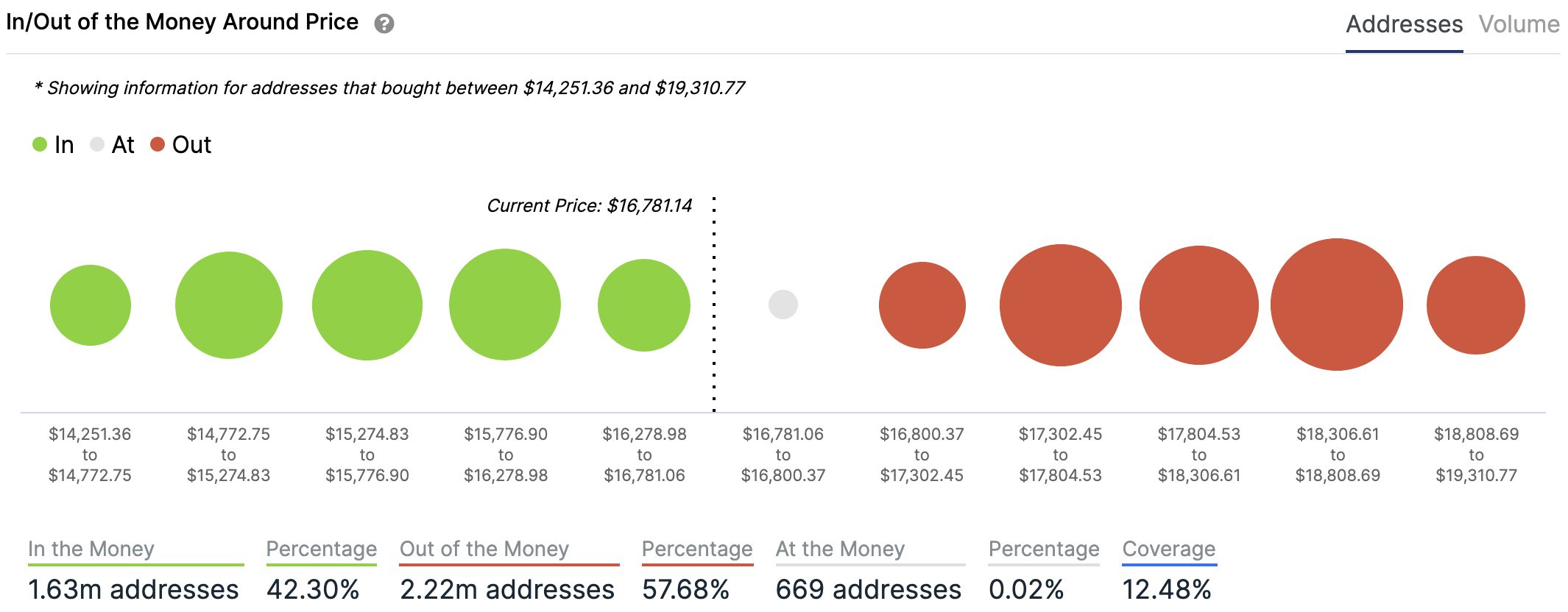

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Charts provided by IntoTheBlock.com

Volatility

Annualised price volatility using 365 days.

Charts provided by IntoTheBlock.com

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 63.25 Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 51.98. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

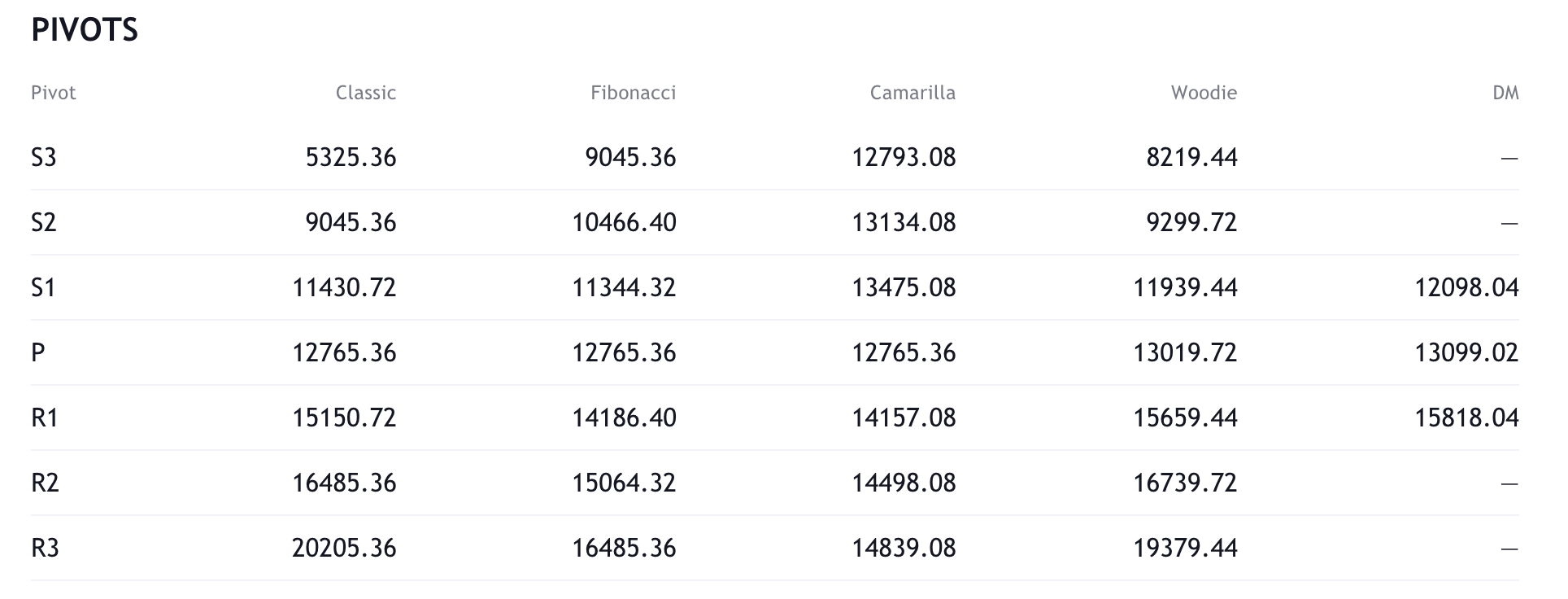

Resistance and support

What they said yesterday…

I sold the dip again last night ?#bitcoin pic.twitter.com/Ywz7tPx9eG

— lil bubble ? (@TheCryptoBubble) November 26, 2020

All my best investments were in networks that everyone needed, no one could stop, and few understood. #Bitcoin is the monetary network.

— Michael Saylor (@michael_saylor) November 26, 2020

#Bitcoin in the $16,000s and we call it a dip. Bullish.

— Lina Seiche (@LinaSeiche) November 26, 2020

Historical #Bitcoin prices on Thanksgiving:

2011 : $2.50

2012 : $12.48

2013 : $829

2014 : $376

2015 : $327

2016 : $740

2017 : $8,754

2018 : $4,004

2019 : $7,138

2020 : $17,176— Bloqport (@Bloqport) November 27, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press