Daily market update: Bitcoin enjoys highest weekly close in history

Good morning, cryptoverse. Bitcoin just made the highest weekly close in its history! The sentiment index has now spent more than a month in Extreme Greed, trading volumes are hitting yearly highs, and the birds are singing in the trees. Will it last or are we due a correction? Have we already had the correction? There’s still an important resistance level to overcome this week at $20,000. Will we do it?

If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 09.00am GMT.

Bitcoin price

We closed yesterday, 6 December, 2020, at a price of $19,345.12 – up from $19,154.23 the day before. It’s now been 20 days since the price was last below $17,000. The price has been above $19,000 for 5 out of the last 7 days.

The daily high yesterday was $19,390.50. The daily low, meanwhile, was $18,897.89. This time last year, the price of bitcoin closed the day at $7,547.00 and in 2018 it was $3,521.10.

We’re 3.71% below bitcoin‘s all-time high on CoinMarketCap of $20,089 (17 December 2017).

Bitcoin volume

The volume traded yesterday was $25,293,775,714, down from $27,242,455,064 the day before. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $359,123,541,247, up from $355,563,938,256 the day before.

Fear and Greed Index

Sentiment is at 94 again after another record high yesterday. We’ve now been in Extreme Greed for over a month so it’s important to note that the index doesn’t stay this high very often and a correction could be on the cards.

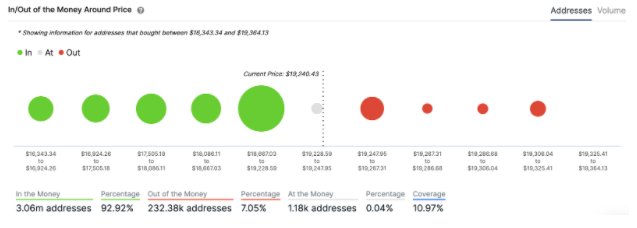

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Volatility

Annualised price volatility using 365 days.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 63.60. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 61.06. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

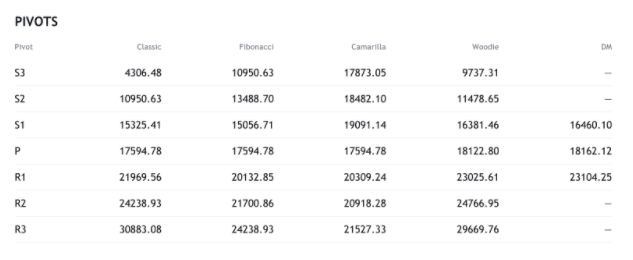

Resistance and support

What they said yesterday…

There are exactly 0 counterfeit Bitcoin in circulation.

— Dan Held (@danheld) December 6, 2020

At $25,000, #Bitcoin will flip Visa’s market capitalization.

— Blockfolio (@blockfolio) December 6, 2020

MicroStrategy CEO, Michael Saylor, took to Twitter to announce the company’s latest purchase of 2,574 Bitcoin for $50 million, bringing the business intelligence company’s stash to a whopping 40,824 BTC:https://t.co/Dwlicn09DR

— Global Crypto (@GlobalCryptoTV) December 7, 2020

1% of all ETH is now in the deposit contract!

Updated stats; the decentralization numbers are a bit worse than last time but only because they now properly treat Bitcoin Suisse with their multiple addresses as a single unit. Still doing far better than I expected! pic.twitter.com/B0ck5YGTUk

— vitalik.eth (@VitalikButerin) December 6, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press