Daily market update: Ethereum hits 3-year high

It was a turbulent day in the markets yesterday, with Bitcoin seeing a sharp retrace from $33,000 to $28,000 after Sunday’s new all-time high. The leading cryptocurrency by market cap managed to bounce back relatively quickly to over $31,000, where it has somewhat stabilised, but it could be a volatile few days ahead as the market figures out what it wants to do next. Such corrections are to be expected in a bull market, but traders should move carefully and also be aware of opportunities that could arise. Do your own research, only invest what you can afford, and make good decisions.

Elsewhere, it was a big day for Ethereum as it hit a 35-month high of over $1,150 and briefly did higher volumes than Bitcoin on a number of exchanges. With Ethereum 2.0 round the corner, will this be the year?

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 09:30am GMT.

Crypto markets at a glance

| Price | Market cap | Volume | Circulating Supply | |

| Bitcoin | $31,689.16 | $591,151,508,572 | $76,556,284,340 | 18,591,225 BTC |

| Ethereum | $1,045.81 | $116,887,864,778 | $50,367,634,316 | 114,123,758 ETH |

| XRP | $0.237725 | $10,603,343,964 | $4,993,664,687 | 45,404,028,640 XRP |

| Litecoin | $156.05 | $10,315,951,174 | $4,993,664,687 | 66,245,043 LTC |

| Bitcoin Cash | $418.42 | $7,644,964,399 | $6,962,729,858 | 18,600,863 BCH |

What bitcoin did yesterday

We closed yesterday, 4 January, 2020, at a price of $31,971.91 – down from $32,782.02 the day before.

The daily high yesterday was $33,440.22 and the daily low was $28,722.76. That’s Bitcoin’s lowest daily low in 2021. Which is absolutely fine, as it’s only been a few days.

This time last year, the price of bitcoin closed the day at $7,410.66 and in 2019 it was $3,857.72.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Market capitalisation

Bitcoin’s market capitalisation is currently $577,566,819,840 – down from $594,043,027,893. To put that into context, Berkshire Hathaway’s market cap is currently $536.97 billion. Jeff Bezos is worth $190 billion. That means he could only buy roughly a third of all bitcoin. Better get out on your bike and deliver some more books, Jeffrey.

Bitcoin volume

The volume traded over the last 24 hours was $82,030,775,649 – down slightly from $86,784,562,842 yesterday. These are among the highest volumes on record. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 69.34%.

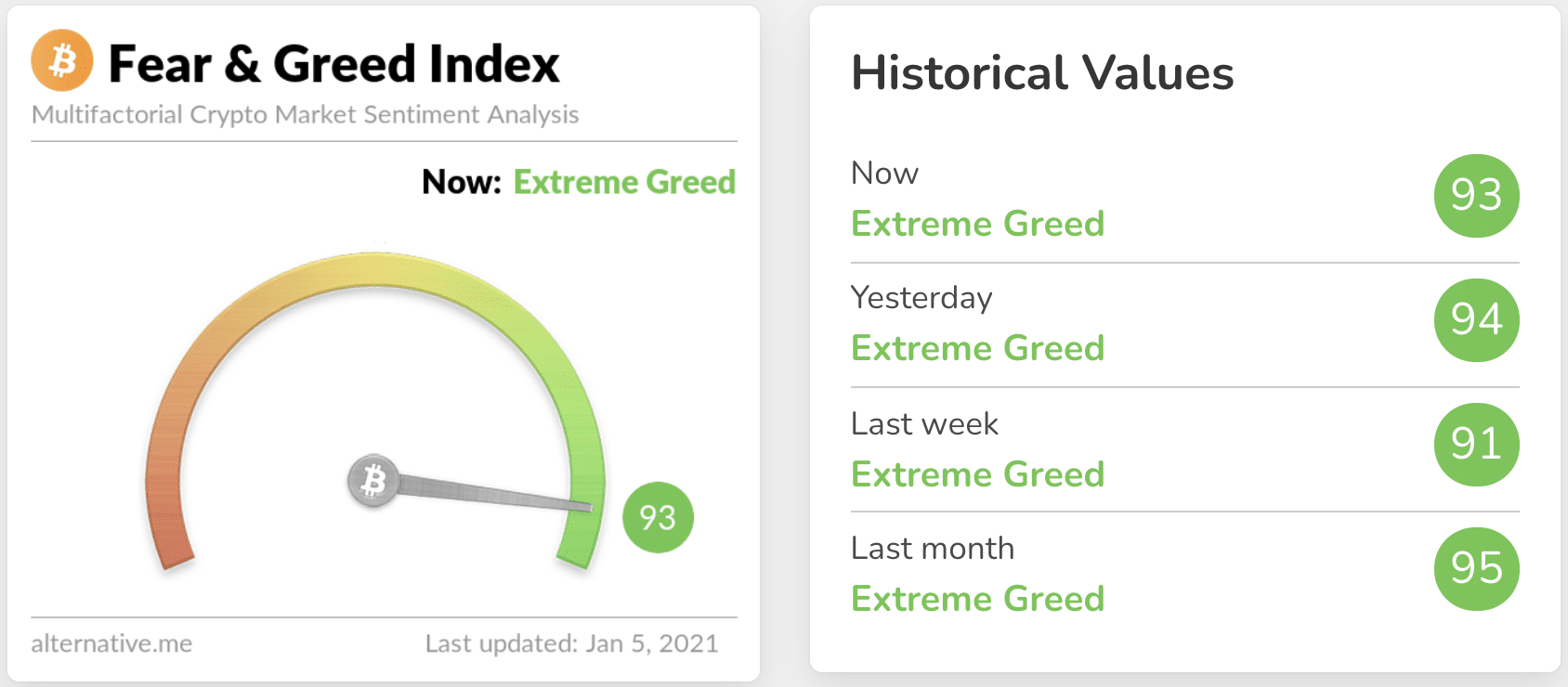

Fear and Greed Index

Despite yesterday’s dip, the sentiment remains in Extreme Greed territory at 93, albeit down from 94 yesterday. The last time the sentiment was not in Extreme Greed was 5 November, 2020.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 68.60. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 74.42. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

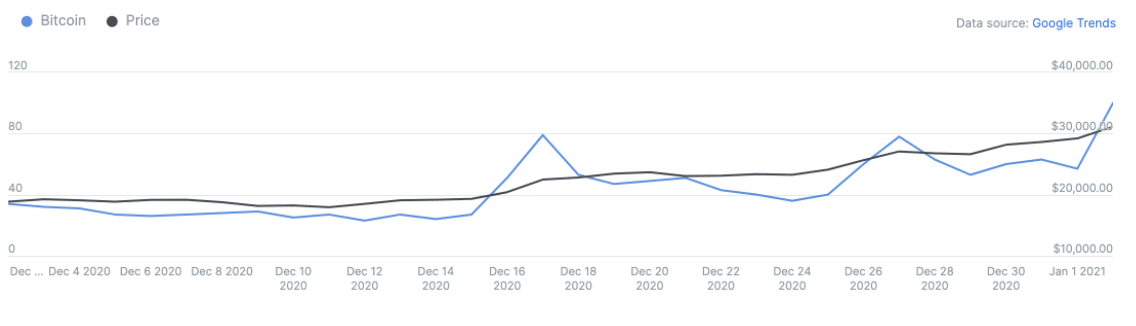

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 100 – taken from 2 January.

Convince your Nan: soundbite of the day

Bitcoin’s annual supply growth, which asymptotically approaches zero over time, is now down to about 1%, on par with the historical annual growth in the supply of gold. While far from perfect, gold is Bitcoin’s closest real-world analogy. However, the ultimate supply of Bitcoin is fundamentally limited by the design of the protocol itself and cannot be increased regardless of its value or the level of demand. Bitcoin is the first store of value in history for which its supply is entirely unaffected by increased demand. From this perspective, Bitcoin is better at being gold than gold – it’s even more salable across time.

– Ross L. Stevens, Founder and CEO of Stone Ridge Holdings

What they said yesterday…

Dip, what dip? JP Morgan sees the latest rise as just the beginning for Bitcoin

JPMorgan sees Bitcoin at $146,000 as long-term price target https://t.co/pwwb9FCiGR

— Bloomberg (@business) January 5, 2021

Big Jack Dorsey is taking FinCen to task about their latest crypto regulation attempts

Our comments on FinCen’s rule proposal on #bitcoin and “cryptocurrency.”

We believe this rule will do the opposite of what it intends, will leave people out of participating fully in the economy, and that it being rushed prevents better solutions.https://t.co/VRXYpLg8Mw

— jack (@jack) January 4, 2021

Remember Anthony Scaramucci? Apparently he’s into Bitcoin now. Good for Anthony

#Bitcoin is better at being #Gold than Gold

Gold is popular alt store of value because of hard money properties. #Bitcoin is harder money w/ fixed supply. Gold = $10 trillion mkt cap. Bitcoin = $500 billion mkt cap. We expect Bitcoin to take >50% of mkt share. You do the math.

— Anthony Scaramucci (@Scaramucci) January 4, 2021

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press