Daily market update: Gold will suffer for years because of bitcoin, says JPMorgan

JPMorgan Chase & Co. have said the rise of cryptocurrencies in conventional financial markets will have an adverse effect on gold. 2020 has seen institutional investment pour into bitcoin like never before – a trend they predict will not end anytime soon.

Strategists at the firm wrote: “If this medium to longer term thesis proves right, the price of gold would suffer from a structural flow headwind over the coming years.” But for now, let’s check out what’s happened in the BTC market yesterday.

If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 10.00am SAST.

Bitcoin price

We closed yesterday, 9 December, 2020, at a price of $18,553.92 – up from $18,321.14 the day before.

The daily high yesterday was $18,626.29. The daily low was $17,935.55. This time last year, the price of bitcoin closed the day at $7,400.90 and in 2018 it was $3,614.23.

We’re 7.64% below bitcoin‘s all-time high on CoinMarketCap of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.2% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $34,420,373,071, up from $31,692,288,756 the day before. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $344,486,483,494, down from $340,148,764,252 the day before.

Fear and Greed Index

We’re still in the Extreme Greed territory at 94. It’s important to remember that the index doesn’t stay this high very often and a correction could be on the cards.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 63.53. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 53.98. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

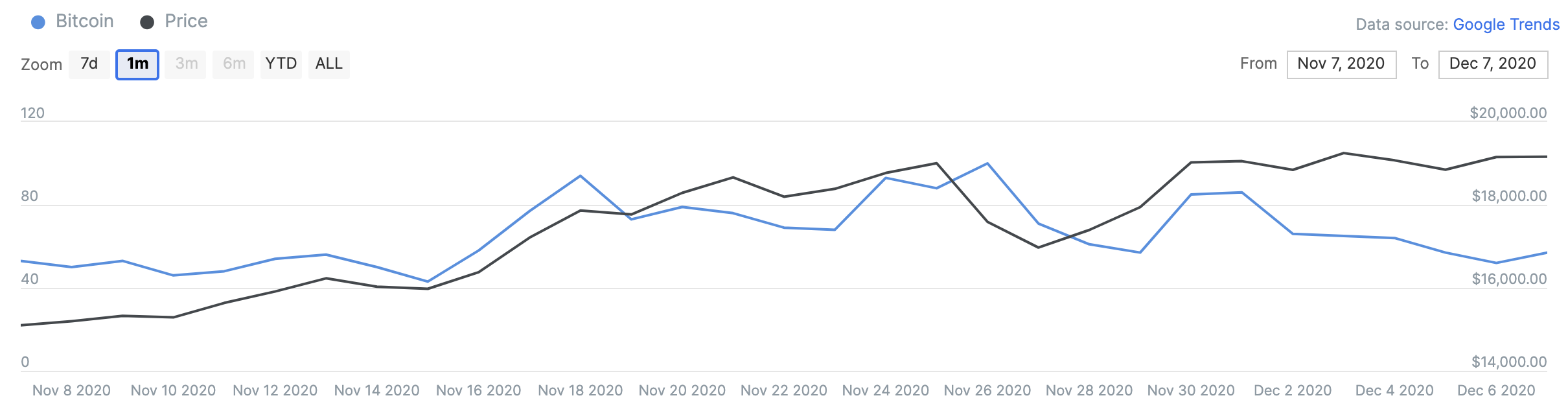

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword.

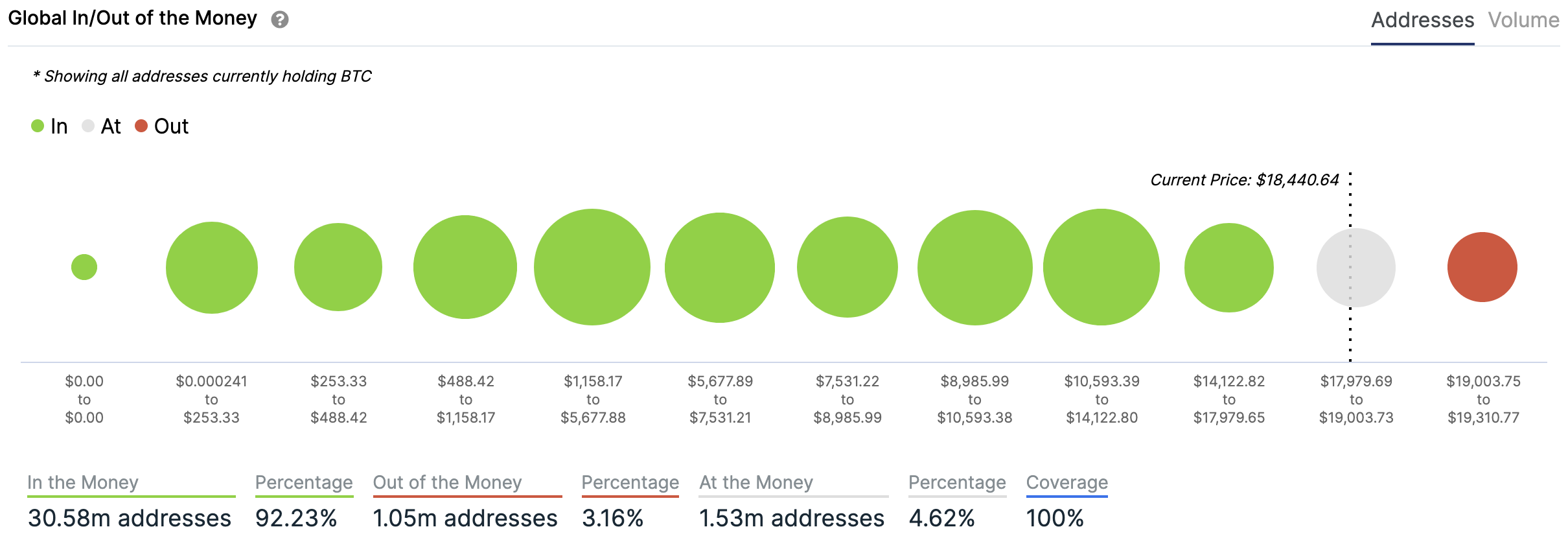

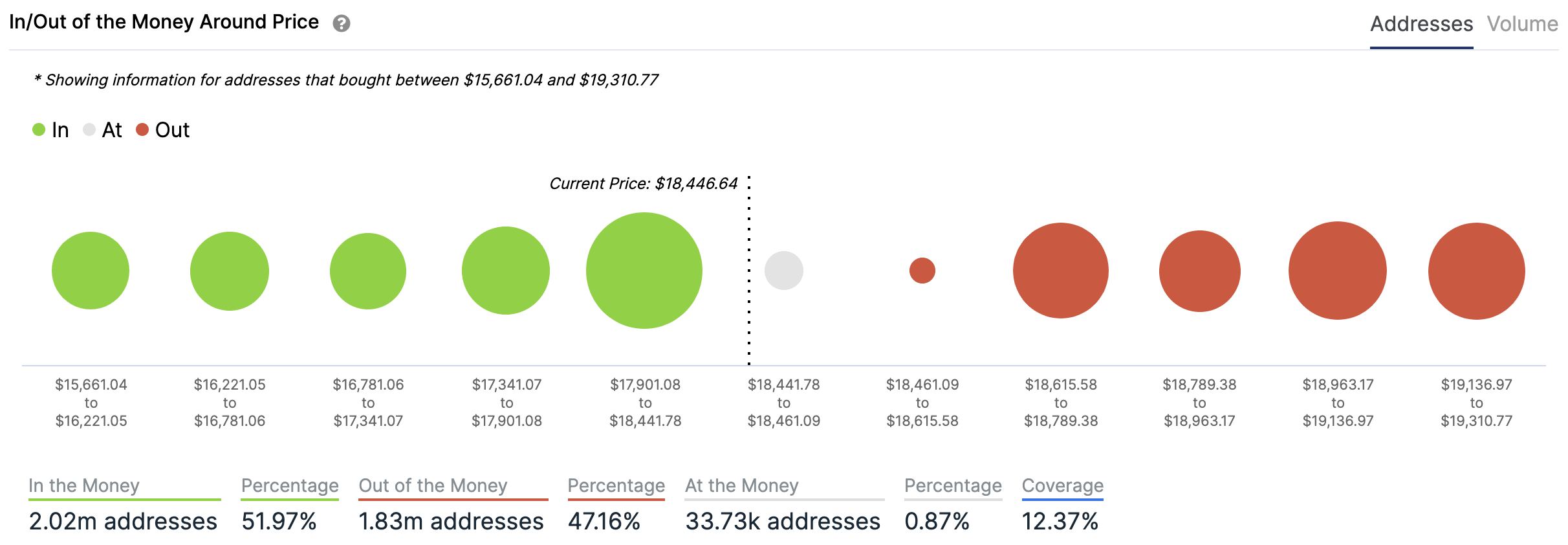

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

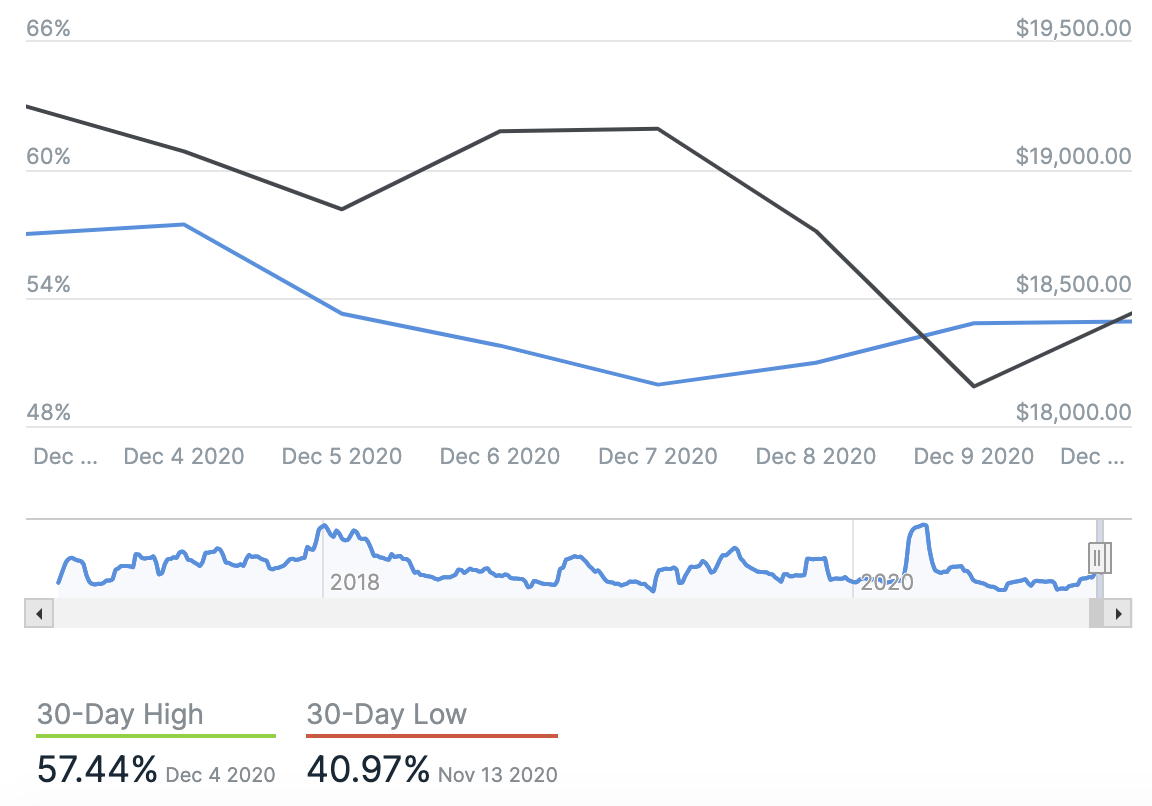

Volatility

Annualised price volatility using 365 days.

What they said yesterday…

BIG UPDATE: @RayDalio, Founder of Bridgewater (world’s largest hedge fund) just said in Reddit AMA: “I think that #Bitcoin (and some other digital currencies) have over the last ten years established themselves as interesting gold-like asset alternatives.”https://t.co/0yqia9frvy

— Cameron Winklevoss (@cameron) December 8, 2020

Gold won’t just suffer. Bitcoin will be the end of gold. pic.twitter.com/x2TqGsbNmq

— Dan Held (@danheld) December 9, 2020

#Bitcoin street art in the heart of Hong Kong. Spartans HODL! pic.twitter.com/9EK8XOvnw4

— Tyler Winklevoss (@tyler) December 9, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press