South African crypto regulatory framework coming, but timeline unclear

What

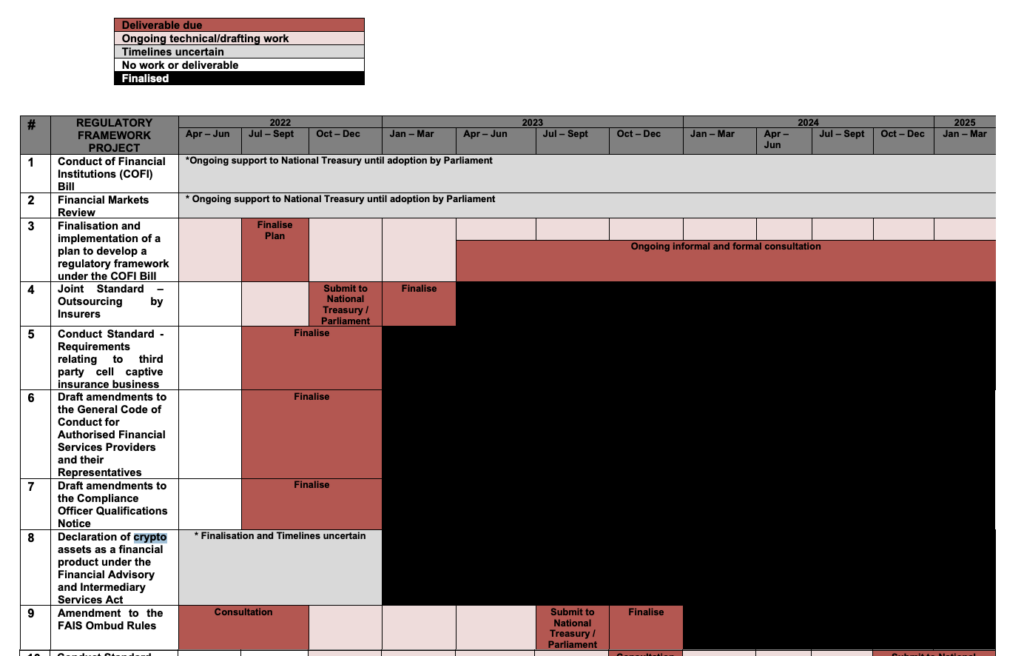

The financial regulator in South Africa, the Financial Sector Conduct Authority (FSCA), has listed among their priorities the finalisation of the draft licensing and regulatory framework for financial services providers and their services relating to crypto assets

Why

In what the regulator described as an “interim step towards protecting customers in the crypto assets environment,” they published a draft notice in November 2020, proposing that crypto assets be declared a financial product. In their regulatory outline for the next three years, the regulator noted the importance of finalising this framework, but said the timeline was unclear at this point

What next

The regulator’s next steps are dependent on the finalisation of other crypto policy proposals

The story

Due to broader developments in South African crypto regulation, legislation that will paint a clearer picture for financial advisers on how to approach crypto assets remains on hold, according to the FSCA.

If eventually cleared, the declaration of crypto assets as a financial product under the Financial Advisory and Intermediary Services Act will formally classify crypto assets a financial product.

“In the interim, the FSCA initiated further work in understanding the crypto asset landscape, and in particular in the advisor and intermediary environment,” the regulator said in the report. Input from financial services providers regarding their involvement in crypto assets has also been requested.

“The outcome of the survey will be considered in conjunction with the broader developments surrounding crypto assets, and will ultimately inform a decision regarding whether the FSCA will proceed to make the Declaration,” the regulator explained. “The regulation of crypto assets remains a high priority for the FSCA and the FSCA will continue to monitor the environment and formulate policy responses as deemed appropriate.”

Speaking on the PSG Think Big Webinar, Kuben Naidoo, deputy governor of the South African Reserve Bank (SARB) said, “Our view has changed and we now regard it [crypto-currency] as a financial asset and we hope to regulate it as a financial asset. There has been a lot of money that has flowed in and there is a need to regulate it and bring it into the mainstream.”

In closing, Naidoo explained, “Most central banks are focused on two things: regulating the broad crypto environment, and secondly, learning from it to see how it can take on board some of those lessons.”

For more on cryptocurrencies and digital assets, visit the Luno learning portal.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press