Introducing Repeat Buy

We’re excited to introduce Repeat Buy – a new way of investing in cryptocurrency with Luno.

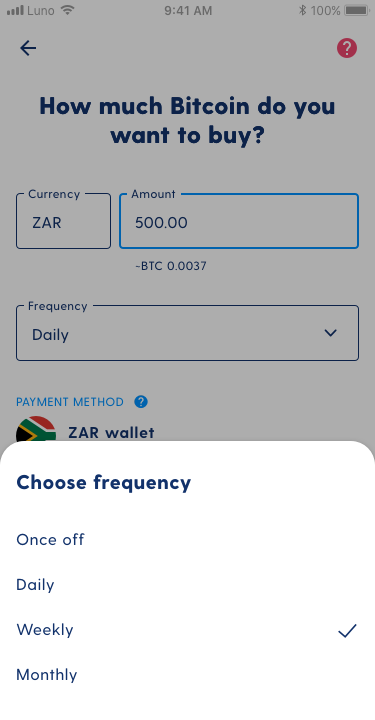

With Repeat Buy, you can set up a schedule where cryptocurrency is automatically purchased for you at regular intervals. For instance, you may want to buy ZAR 1,000 or EUR 100 worth of Bitcoin on the first day of every month. All you need to do is go to your Luno App, select how often you want to buy and the amount, make sure there’s enough local currency in your wallet, and we’ll do the rest. It’s as easy as that!

This is automating an investment strategy more commonly known as ‘dollar-cost averaging’. Dollar-cost averaging (the word dollar is used here, but it can be any currency from around the world) is not just an easy way to invest in crypto, though. It’s attracted many fans in recent years because it has a number of benefits.

SET UP REPEAT BUY

Trading crypto

The cryptocurrency market is still in its early stages and therefore price volatility remains commonplace. If you’re holding crypto because you believe it will one day be the world’s main medium of exchange, this volatility probably isn’t all that important – you’re simply ready for when the time comes. For others though, the volatility makes it a very attractive asset to trade.

Trading crypto is by no means a perfect science. You can invest huge amounts of time and research trying to predict the best time to buy and sell to make a profit and still get it wrong. It can be extremely stressful. If you’re not willing to develop a strategy that works for you and research market movements, or you just generally have a low tolerance for risk, then there are easier ways to make a living.

An easier life

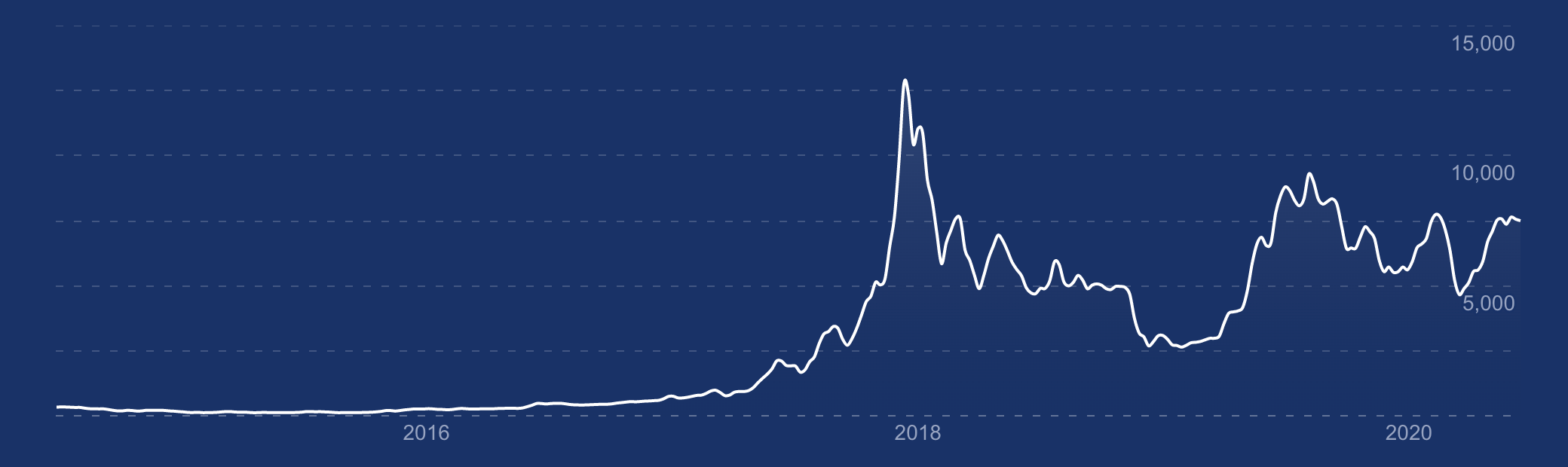

An interesting thing about crypto is that it may be volatile in the short term, but in the long-term, you could argue that it hasn’t really been that volatile at all. It has only actually gone one way – up. For example, on 11 March 2016, you could have bought 1 Bitcoin for $410. This same Bitcoin would have been worth $9,565 on 13 June 2020 – a return of almost 23X.

This long-term upward trend has given rise to the idea of hodling (another piece of crypto slang that has given rise to a swarm of memes).

Hodling comes from a misspelling of “hold”, made by a poster on the Bitcoin Talks online forum. Simply put, hodling is when you buy a lump sum of cryptocurrency and store it securely for potential long-term, long-range, and long-odds growth.

Hodling requires less of your time than trading strategies which take a more short-term approach. It’s also proven effective for many when you consider Bitcoin’s meteoric rise in value since its inception. However, It’s also telling that it’s sometimes used as an acronym for ‘Hold On for Dear Life’ – if you don’t time your purchase for when Bitcoin is at its lowest price and it keeps falling, you can only really wait and watch or cut your losses, which can be nerve-racking.

Enter dollar-cost averaging

Dollar-cost averaging is a variation on hodling that mitigates against some of these risks and removes the stress of watching and waiting.

The goal of dollar-cost averaging is to make regular investments of the same amount at repeated intervals, regardless of the day-to-day price of your favorite crypto. The thinking is that by investing small amounts in regular installments over a longer period of time, this will hedge against major price movements up or down and help you avoid mistiming the market. Timing the market with 100% accuracy all the time is impossible. Dollar-cost averaging reduces your losses when the market drops, and when it goes up again, maximizes your returns. It has the added advantage of removing some of the biases from your decision-making. Once you set up dollar-cost averaging, the strategy will make the decisions for you.

You can talk a look at what dollar-cost averaging might have earned you if you’d already been doing it at Dcabtc.com. For example, if you’d started investing $10 a week three years ago, and continued to do this every week for those three years, would have more than doubled their investment by the end, with a 119.49% gain. This means that in 2.5 years, someone could have seen $1,500 turn into more than $3,000.

Sounds perfect, right? Not quite. There are those that believe dollar-cost averaging doesn’t give you the profits that can be gained from day trading or hodling. When the price is going up, those who invest earlier will get better results. This means dollar-cost averaging would have a dampening effect on gains in an uptrend. In this case, lump-sum investing may outperform dollar-cost averaging. Dollar-cost averaging also doesn’t entirely mitigate against all the risks and absolutely won’t guarantee a successful investment – other factors must be taken into account too. Rather, it’s simply the safest option. If you’re after the full crypto rollercoaster experience or if you’ve got aspirations to be the next great trader, it’s probably not for you. If you’re after a more level-headed, measured approach to cryptocurrency speculation, it’s a great place to start.

I’m in. How do I get started?

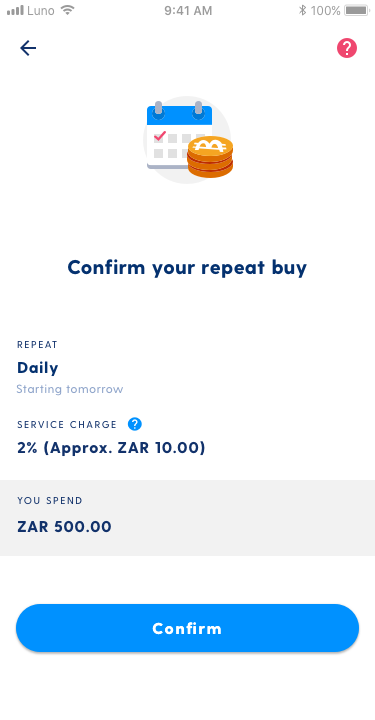

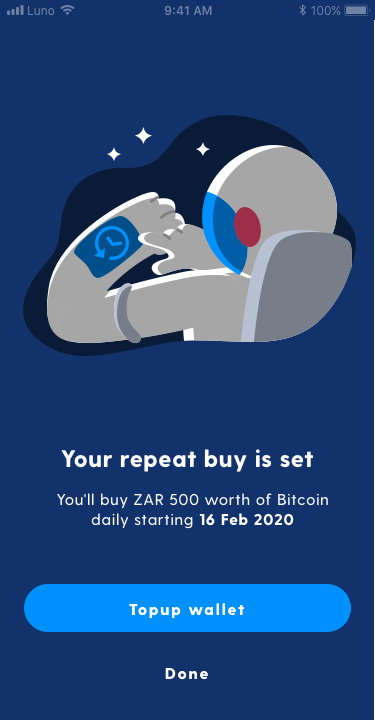

Our new Repeat Buy feature makes dollar-cost averaging even easier. Just go to the Luno App and when you buy crypto, you’ll be asked whether you want to set it up. That’s it.

Once you’ve set it up, you’re not locked in – you can change the amount and frequency of your investment or cancel it at any time. You’ll need to make sure there’s enough in your local currency wallet to cover your purchase. You can either set up a repeating bank transfer to put this amount in automatically or we will send you an alert to remind you to top up. Give it a try today!

Step 1: Choose how much local currency you wish to buy of Bitcoin and often you want to buy

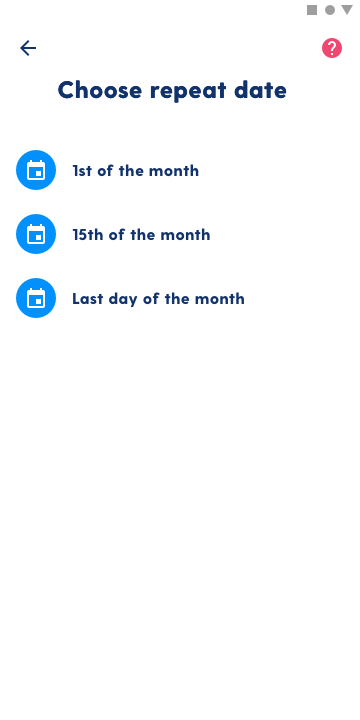

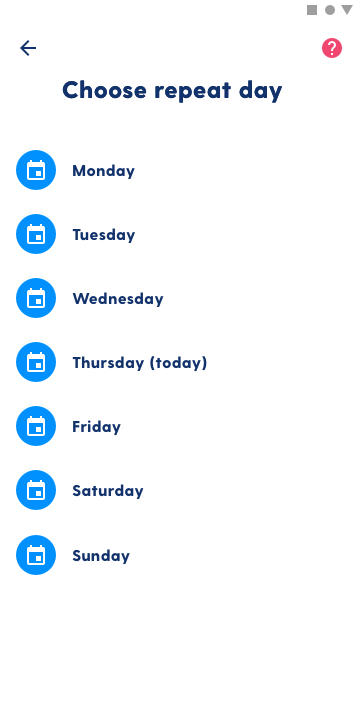

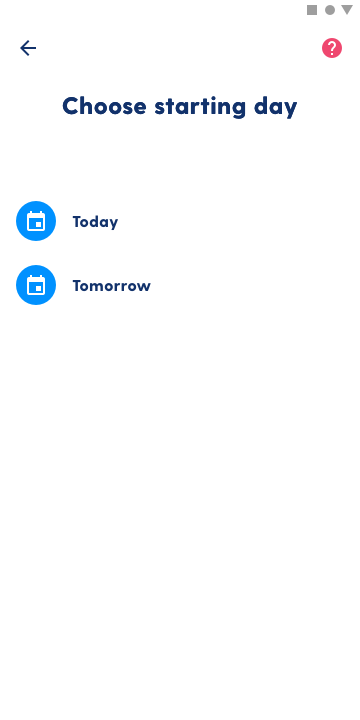

Step 2: Choose the day of the week or month you’d like to deposit. If you choose daily, you’ll simply be given a choice of when to start

Monthly

Weekly

Daily

Step 3: Confirm. And you’re ready to go!

GET STARTED

Keep reading…

Crypto in 2020: The year so far

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press