Luno’s market analysis – Week 17

Welcome to this week’s retrospective of the latest goings-on in the crypto markets, featuring an overview of price movements, a look at the fundamentals, and the impact of other major events over the last week. The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

A strong week in the crypto market closed with a sixth green weekly candle. This hasn’t been seen since the start of the bull run at the beginning of 2019. Bitcoin is now up 15% in April and 7% so far in 2020, having started the year at around $7,100.

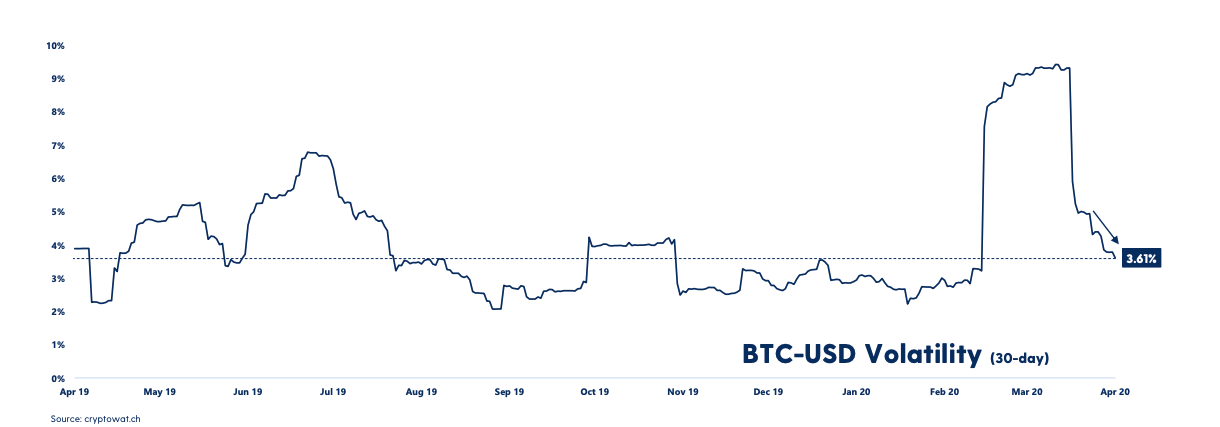

A big recovery going into the halving in three weeks could mean a perfect storm for Bitcoin. Confidence may still be low in the market, but it is recovering, and both volatility and volume seem to be getting back to normal levels. Lower volatility, in particular, indicates that the market is stabilising, and we may be past the worst uncertainty in the crypto market for now. However, with the global financial climate still in turmoil, volatility could easily pick up again if the stock market starts to drop and market participants should continue to act carefully.

Ether (ETH) is still looking strong, too. It’s increasingly gaining market share, while other large caps struggle to follow the two leaders.

Price analysis

Short-term view

After a retrace down to $6,700, Bitcoin rebounded strongly to the $7,800 mark, comfortably breaking through the April high resistance of $7,500. This most recent move to the upside further consolidates the upward momentum that has been building since mid-March.

Bulls are now looking to surpass a strong resistance level around $7,700. The current level shows strong resistance, though – it acted as support both in June and September last year, and the BTC price struggled with this resistance level for almost seven weeks in November and December. Should we see another retrace, key resistance levels to look out for can be seen between the $7,500 and $7,300 zone, with further support at the local low of $6,500. Having said that, the bulls seem to be in control for now.

Long-term view:

Strong psychological resistance lies ahead for BTC at the $8,000- $8,200 zone, which would not only mark a complete recovery from the drop related to COVID-19, but might also intersect with the 100-day and 200-day moving averages as well.

There’s more good news to be found in the relative strength index (RSI), which is used to help identify when an asset’s price is too far from its “true” value. It currently sits at around the 60 point mark, which is usually suggestive of an upward trend. With the BTC halving event just around the corner, it’s difficult not to be excited about the future in store for Bitcoin.

Volume still trending downward, but slowing

The 7-day average real trading volume is still trending downwards. Decreasing volume has been the trend since the market crash in March, but it seems like it’s now slowing down and stabilising. Still, we’re now below 2020 average volume and a momentum change in volume would provide more confidence for investors.

Are Libra announcement’s affecting the Bitcoin price?

Last summer, Facebook’s announcement that they would be launching their own cryptocurrency with Libra gave a huge boost to the whole market, as many saw this as a step towards the mass adoption for cryptocurrencies. However, throughout 2019, Facebook and Libra went into a spiral of negative news and the sentiment changed. In 2020, it looks like negative Libra news stories are giving the Bitcoin price a boost. Bitcoin continues to stand strong, and no-coiners who first became interested in cryptocurrencies due to Libra, might now look towards Bitcoin as Libra is struggling.

Reasons to be cheerful

The Fear and Greed Index has finally escaped the “Extreme Fear” area, where it has lingered since 9 March – the longest period registered since the index launched in February 2018. We are now back in the “Fear” area, as investors are getting more confident.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press