Luno’s market analysis – Week 20

Welcome to this week’s retrospective of the latest goings-on in the crypto markets, featuring an overview of price movements, a look at the fundamentals, and the impact of other major events over the last week. The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

With the third Bitcoin halving out of the way, all eyes last week were on how the markets would react – although J.K. Rowling asking Twitter to explain Bitcoin provided at least a brief distraction.

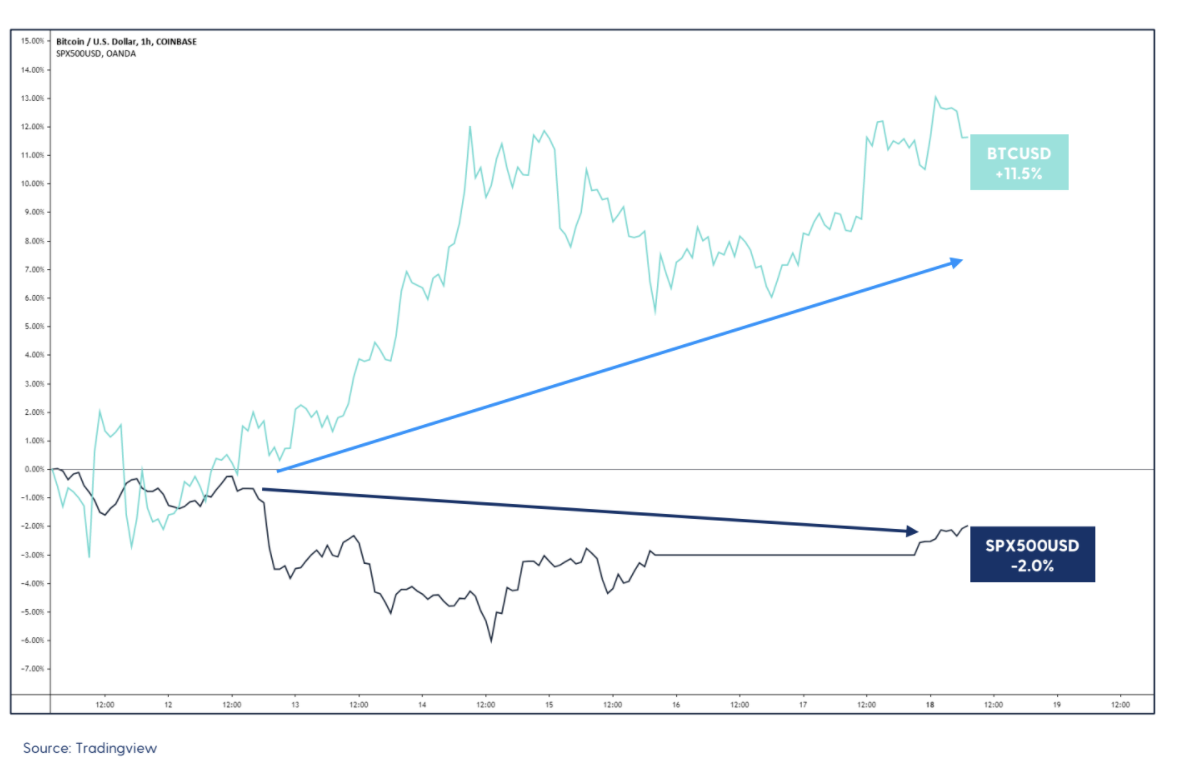

It may not have precipitated the epic bull run to $100,000 that some were predicting, but the price held strong nonetheless and again tested $10,000. With Bitcoin’s decoupling from the stock market still on track, the halving complete, and a backdrop of unprecedented monetary stimulus, the future looks bright for Bitcoin hodlers.

However, there could be threats on the horizon. Concerns are mounting of a potential trade war between the US and China, with tension rising as to the cause of the COVID-19 outbreak. When tariffs were imposed on Chinese goods in July 2018, the price of Bitcoin (BTC) plunged 31% from $8,487 to $6,000. Would a repeat halt Bitcoin’s recent momentum?

Price Analysis

Short-term view

The much-anticipated halving kick-started a volatile week for Bitcoin. The day of the event saw the price fluctuate between $9,100 and $8,100 in just a 24 hour period last Monday, before a sharp turnaround that saw it burst through the resistance zones to again test the psychologically-important $10,000 barrier.

Having again failed to push up to a yearly high, BTC has been trading range-bound in the $9,100-$9,800 zone with bulls looking to overcome resistance at the $9,800 and $10,000 levels. If these can’t be overcome and BTC breaks below these levels, look for strong support at the $8,100 zone.

Long-term view

There are several strong bullish indicators emerging. The 50-day moving average (MA) looks set to cross above the 200-day MA, forming a “golden crossover” within the next couple of days – a long-term bull market indicator not seen since 18 February. The Relative Strength Index (RSI), meanwhile, is neutral, hovering just below the 50 level.

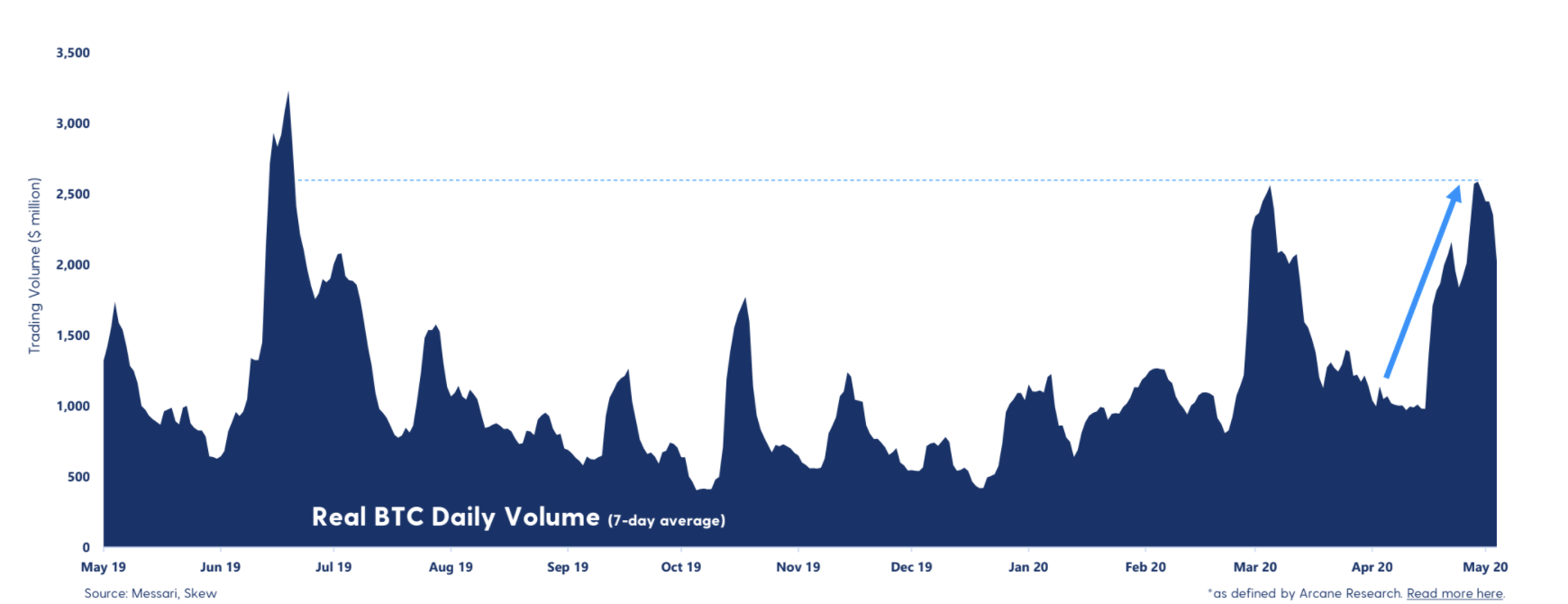

Trading volume has also been solid. Last week saw several trading days with volume between $2-3 billion. This level has not been seen since July 2019, when the Bitcoin price last peaked. Overall, the momentum still looks strong for the Bitcoin price and a push up to the yearly highs is not unlikely.

Reasons to be cheerful

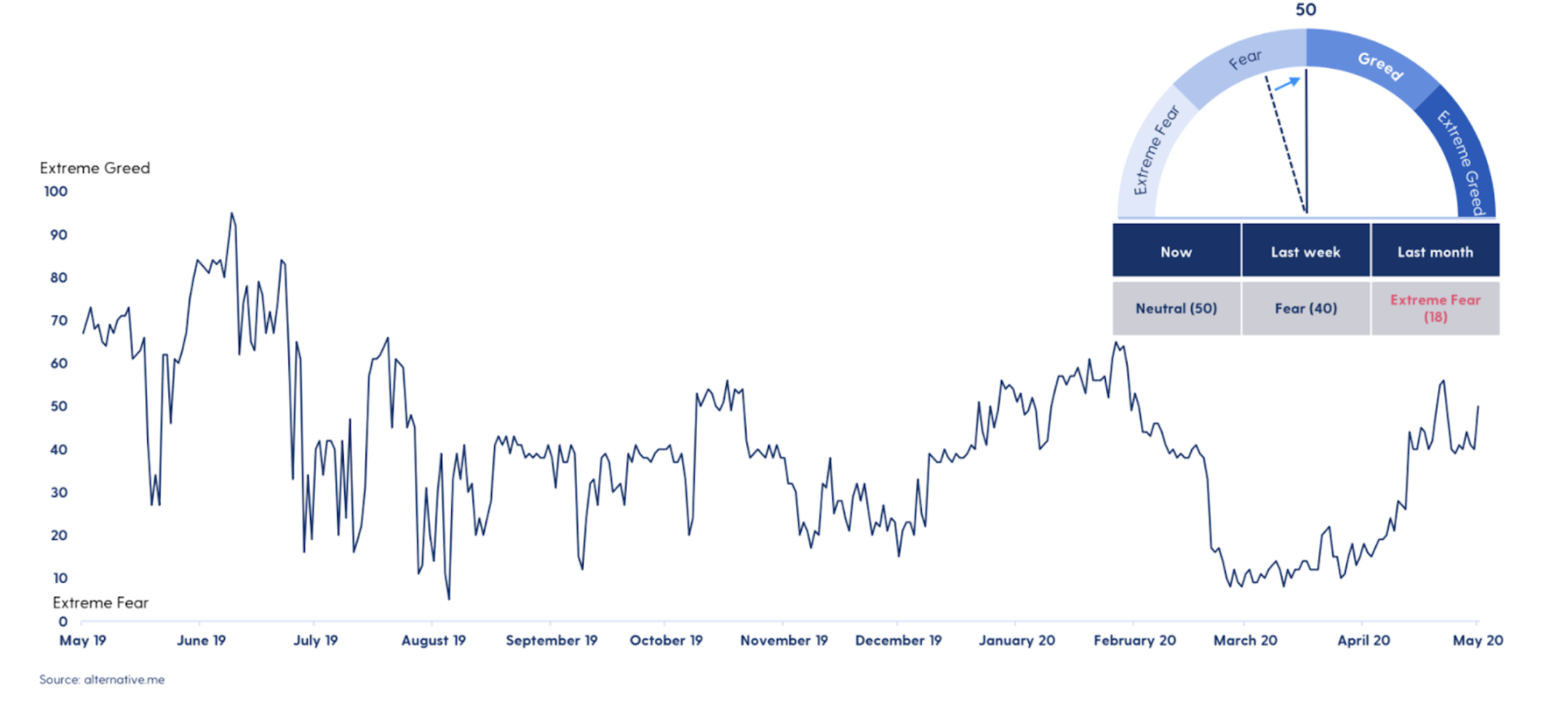

The Fear & Greed Index is now at 50, which is a neutral area. Last time we pushed up towards the greed zone, the Bitcoin price quickly dropped down and put the market back in a fearful state. With the positive price action during the weekend, it will be interesting to see how the market behaves if we once again enter a greedy state.

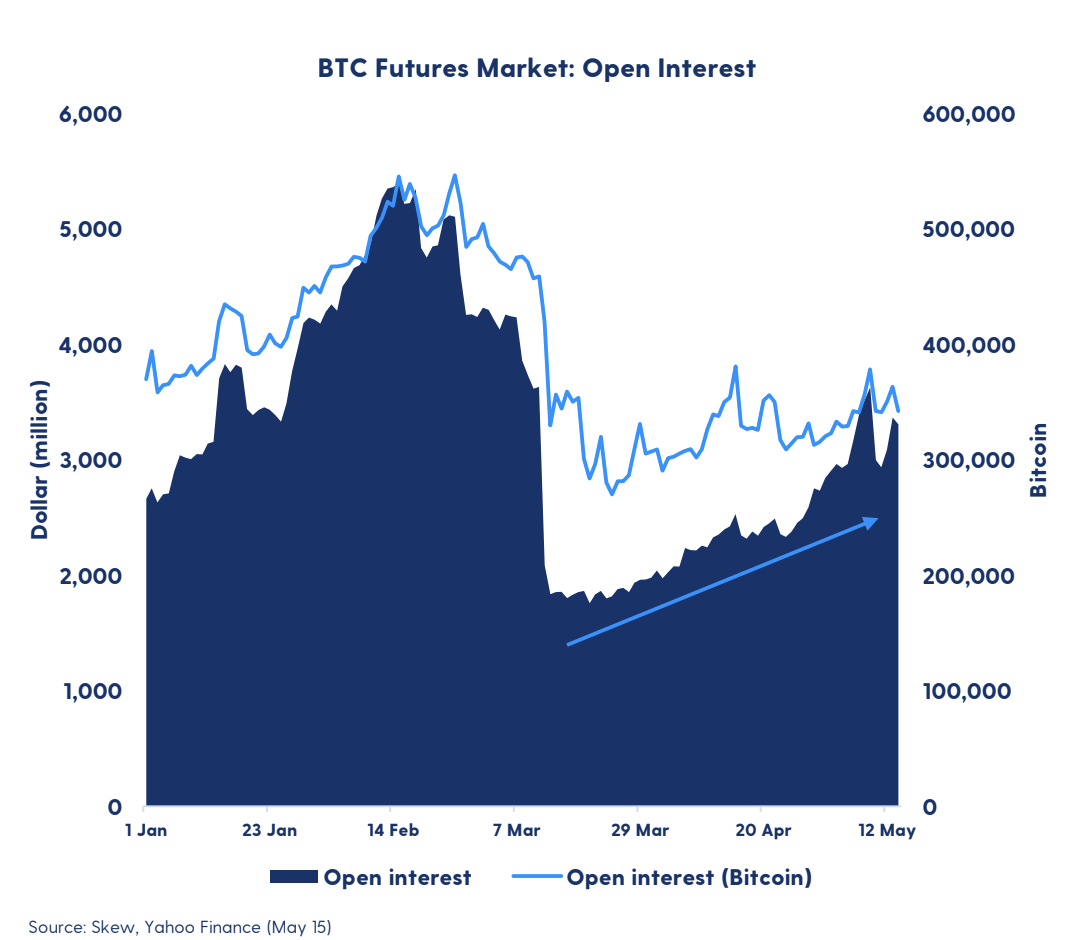

The futures market: A healthy change in open interest

The futures market has recently seen a steady growth in open interest. In May, the outstanding open interest exceeded $3 billion for the first time since the market crashed in March. However, measuring the open interest in bitcoin terms paints a different picture. The open interest in terms of bitcoin has remained fairly constant at around 350,000 BTC since March. The months building up to the 12 March sell-off saw a sharp growth in open interest, rising to as much as 550,000 BTC at its peak.

The trailer for Banking on Africa: The Bitcoin Revolution has landed!

Follow Bitcoin pioneers from across Africa as they fight to bring this revolutionary new technology to the masses and transform the continent’s financial systems. Supported by Luno and produced by award-winning production studio, Documinute, Banking on Africa: The Bitcoin Revolution arrives on Amazon Prime on 22 May. In the meantime, check out the trailer below.

Keep reading…

Luno’s market analysis – Week 19

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press