Luno’s market analysis – Week 24

Welcome to this week’s retrospective of the latest goings-on in the crypto markets, featuring an overview of price movements, a look at the fundamentals, and the impact of other major events over the last week. The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

Monday was a painful day for both cryptocurrency and stock investors, as the prices took a tumble at almost exactly the same time. The good news is that both recovered quickly, likely buoyed by news of $1 trillion infrastructure investment boost in the US. The bad news is that it seems any rumours of a decoupling were unfounded, and we once again find ourselves avidly watching stock market movements.

The dip itself may have been fuelled by any number of factors, in particular a resurgence of COVID-19 across China and the US. However, it must also be seen in light of the recent “rally” across all markets, and many have highlighted that a pullback was long overdue.

Price movements

It was a relatively volatile week for Bitcoin – at least in comparison with recent weeks. Despite this, we find Bitcoin trading where we left off last Wednesday, right back in the $9400-$9.600 zone.

The Bitcoin price briefly fell below the support area we have been looking at lately, but has since returned. Bulls will now want BTC to hold the uptrend that has been forming throughout May, with higher lows. This is still not invalidated and could lead to a new push towards the yearly high. On the downside, there is strong support at $8,400 should the bears have their way.

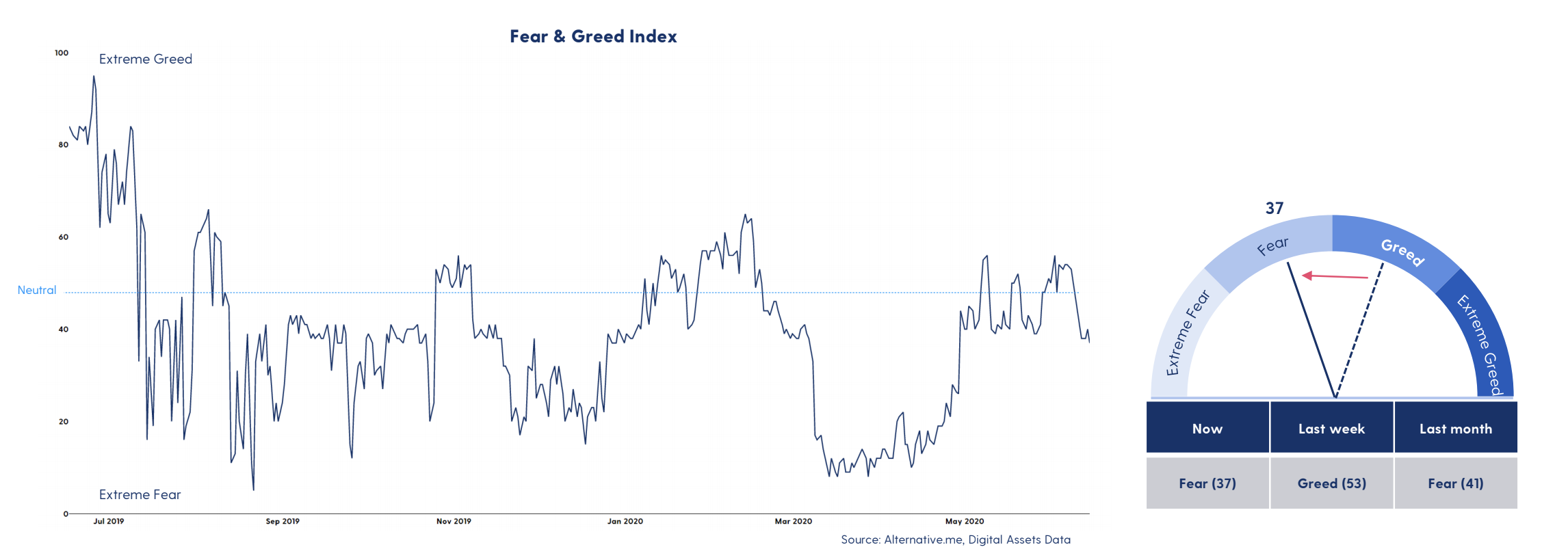

Fear and Greed back

The Fear & Greed Index dropped back down in the “fear” zone last week, as the BTC price took a solid hit. The Index is now at 37, the lowest we’ve seen since 30 April.

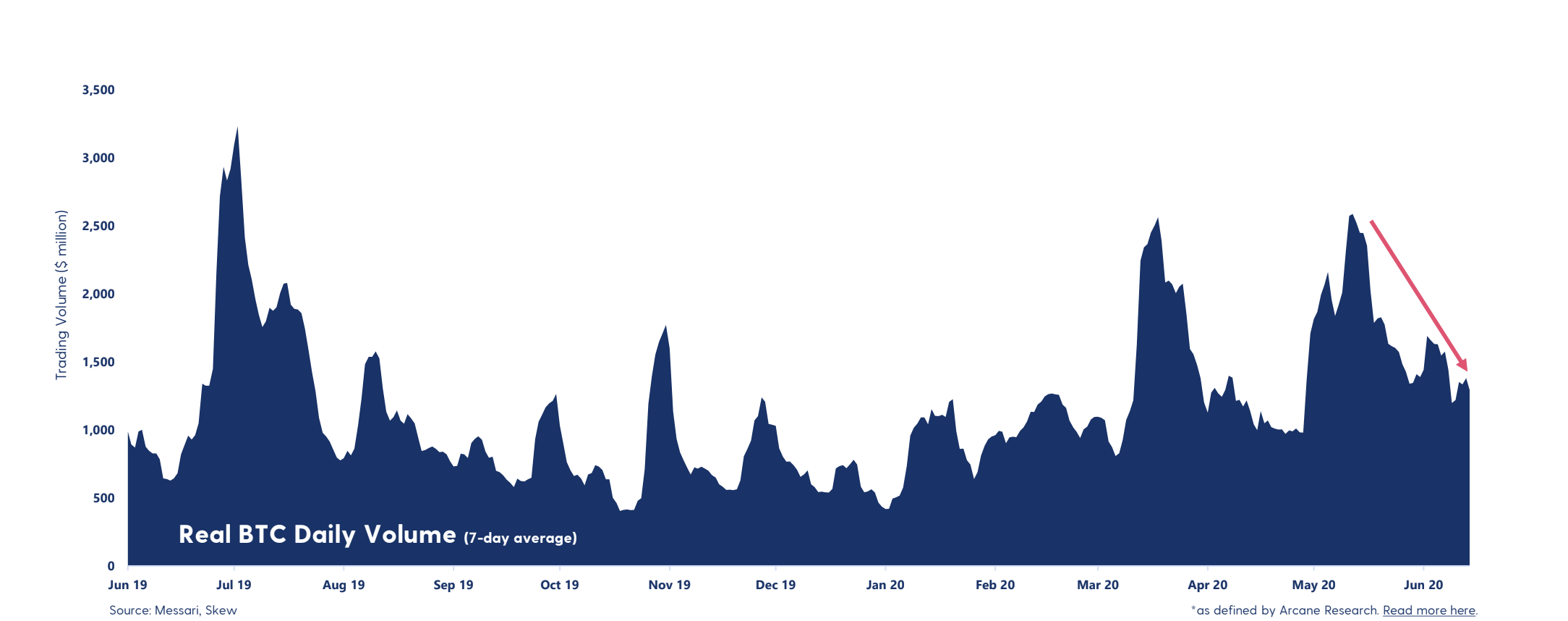

Volumes continue to fall

The 7-day average real trading volume has continued to decrease lately. We have seen some spikes in volume, but these have been related to the BTC price falling. A falling price that gets supported by strong volume is normally a bearish signal.

Reasons to be cheerful

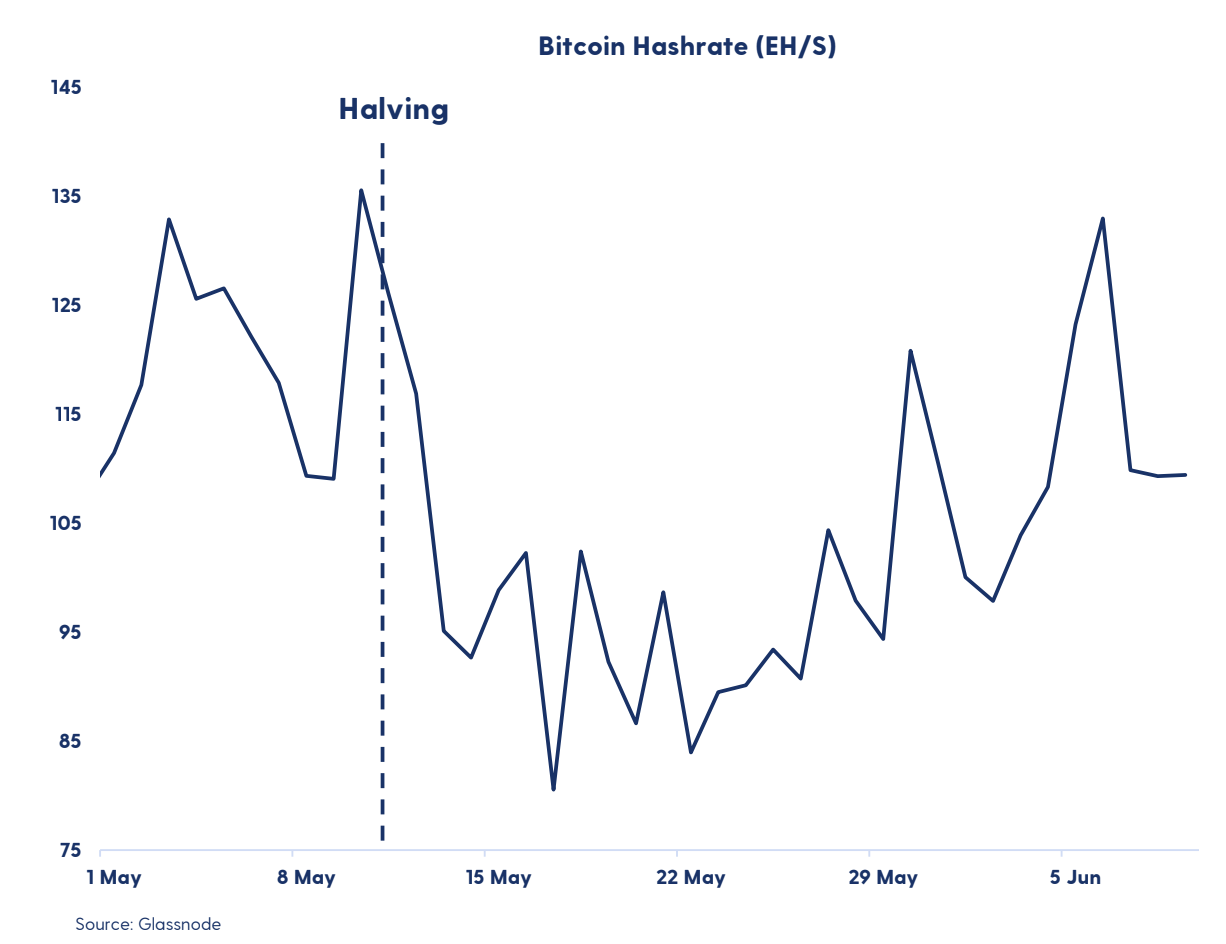

The halving of the block subsidy on 11 May led to a sharp decline in the hashrate on the Bitcoin Network. But the tide is turning, and the hashrate has now returned to the pre-halving levels seen in the first two weeks of June.

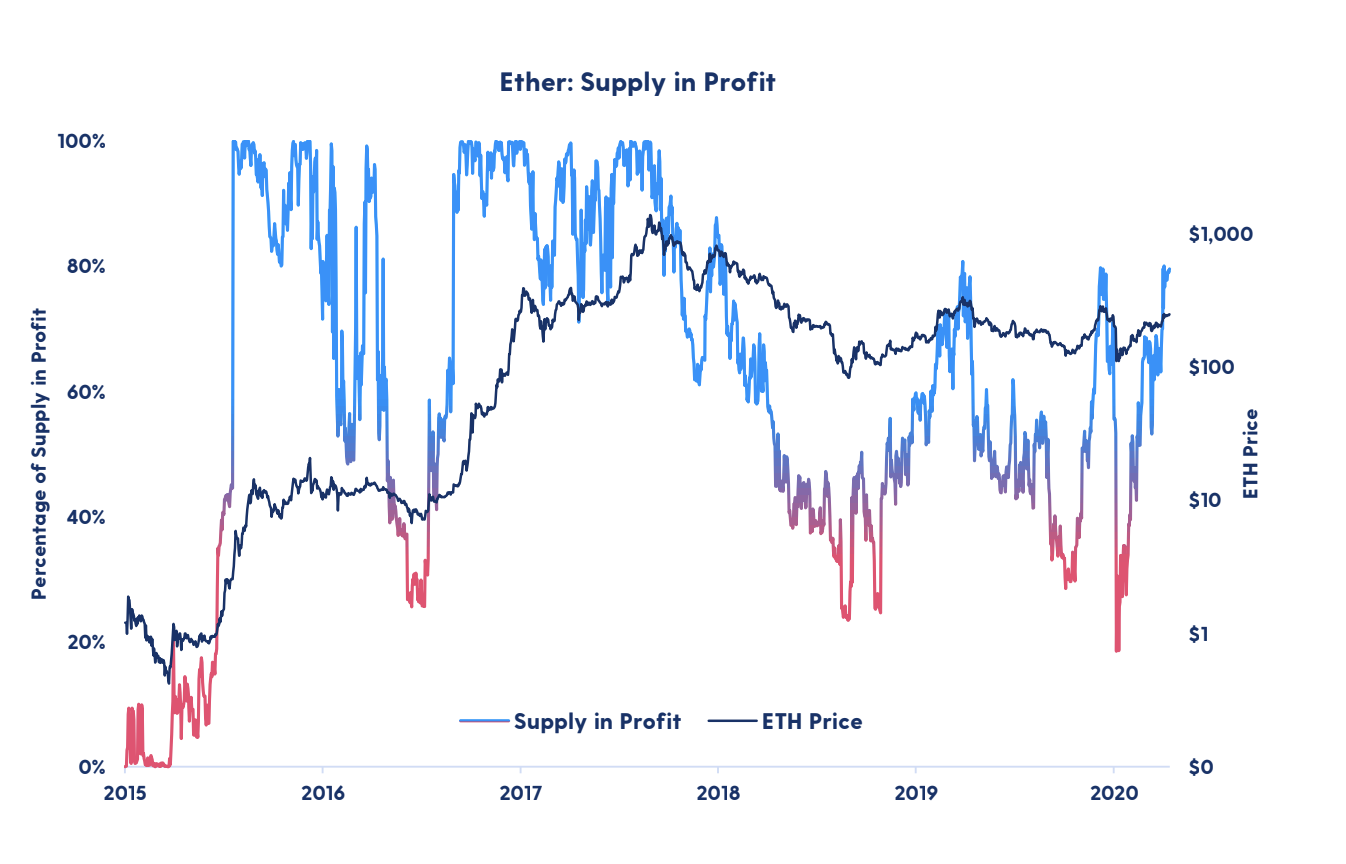

Most ether (ETH) investors are in profit

Ether (ETH) has looked strong recently, and outperformed bitcoin over the past month (approx. 15%). Data shows that investors holding ETH are enjoying the performance lately, as 80% of the ETH supply is in profit. This metric shows the percentage of circulating supply in profit, i.e. the percentage of existing coins whose price at the time they last moved was lower than the current price. This is the third time at this level over the past year, and we can see that the ETH price is lower for each of these 80% profit tops. Hence, more investors have been “buying the dip” over the past year.

Keep reading…

Luno’s view on the regulation of cryptocurrency

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press