March Economic Calendar

The crypto market continued its upward march in February, with both Bitcoin and Ethereum hitting highs not seen for years. This is despite inflation again coming in higher than expected. Investors will be glued to the Fed’s press conference on 20 March where it will announce its latest decision on interest rates, though do they still have the impact they once did?

Let’s look at this and other economic events happening in March, but first, a recap.

? February recap

*Past performance isn’t indicative of future performance.

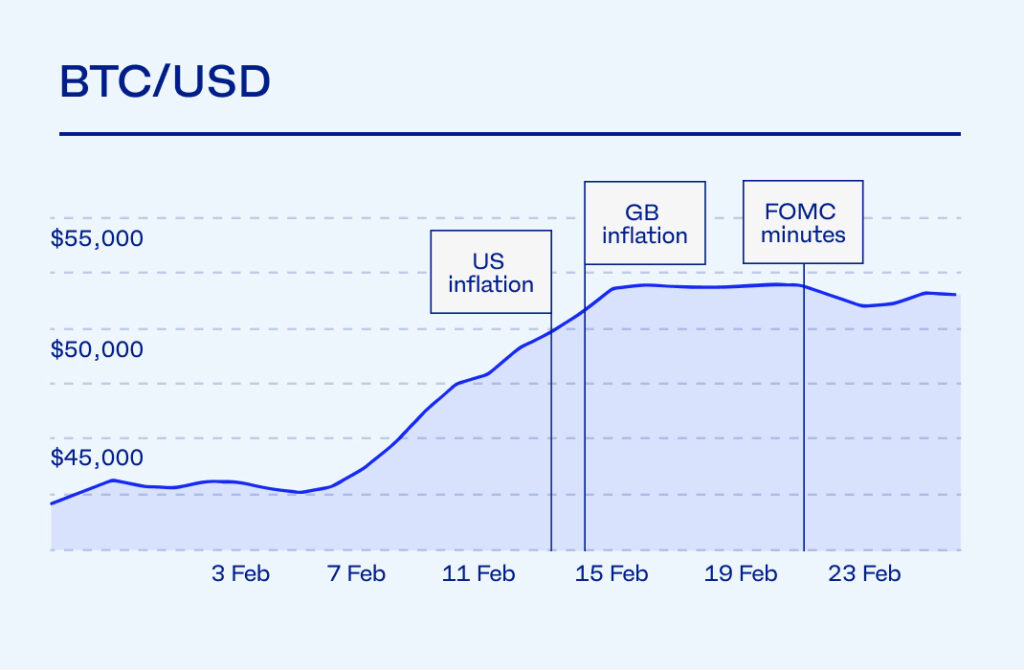

Bitcoin started the month priced around $44,000. It pushed past the $50,000-level around mid-February and $52,000+ towards the end of the month – its highest level since November 2021. The market leader also set all-time highs against a few currency trading pairs.

However, It’s easy to get sidetracked by Bitcoin’s price action and the related spot ETF headlines while other cryptocurrencies also had a remarkable month. Ethereum was trading just shy of the $3,000 level towards the end of February, returning more than 17% over the month. Its younger peers – Solana, Polygon, Cardano and others – were also up in the double digits over 30 days, many of them showing returns of more than 20% over this timeframe.

During all of this, inflation numbers remained hot. On 13 February, the January Consumer Price Index numbers from the US showed a 0.3% monthly increase in the prices of consumer goods, and a 3.1% increase over the year. As JP Morgan explained, while markets were hopeful the Fed was done hiking rates, possibly even cutting rates up to seven times in 2024, “the current report does not support the narrative that inflation will moderate on its own to the Fed’s 2% target.” Stocks were down following the CPI release, while many crypto markets also saw a slight temporary downturn before picking back up again. The CME FedWatch Tool shows that investors have tempered expectations down to four or five rate cuts for 2024.

February’s US jobs report showed strength in the US labour market, a signal that the US economy continues to grow despite high interest rates, something Fed Chair Jerome Powell called a “historically unusual” situation. The UK economy, on the other hand, is showing signs of pressure, with February numbers from the Office of National Statistics showing the UK economy entered a recession at the end of last year.

The Federal Reserve Bank announces its interest rate decision on 20 March, which will be watched closely by central banks and investors around the world.

What’s on in March?

What? US ISM Services Purchasing Managers’ Index (PMI)

? When? Tuesday, 5 March

Relevance? The US ISM Services PMI measures the health of the American services sector, which includes industries like healthcare, retail, and hospitality. Investors pay close attention to these numbers because the services sector makes up a significant portion of the US economy. Will the US economy continue to show strong numbers?

What? European Central Bank interest rate decision

? When? Thursday, 7 March

Relevance? The European Central Bank’s (ECB) decided last month to keep its interest rates unchanged, and few analysts expect a rate cut from the central bank in its next few meetings.

What? US unemployment rate and non-farm payrolls

? When? Friday, 8 March

Relevance? US unemployment numbers serve as a critical indicator of the overall health of the US economy. January jobs numbers came in strong, showing little sign of the US economy cooling down anytime soon.

What? US inflation rate numbers

? When? Tuesday, 12 March

Relevance? The inflation rate in the US will decide the Fed’s plans with interest rates. While the highs of last year seem to be a thing of the past, the current 3.1% remains a way off the Fed’s long-term target of 2%.

What? GB inflation rate numbers

? When? Wednesday, 20 March

Relevance? Inflation in the UK has remained stubbornly resistant to high interest rates, while the UK economy has shown signs of pressure. The Bank of England will be watching these numbers closely to make a call on future interest rate decisions.

What? Federal Reserve Bank interest rate decision

? When? Wednesday, 20 March

Relevance? The Fed’s interest rate decision is followed closely by central banks around the world, given the size and global impact of the US economy. While investors are anticipating rate cuts this year, the US central bank says it remains “prudent” before they start to trim.

*This information should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary for information purposes only and is not investment advice or recommendation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press