November Crypto Calendar: US elections and interest rate decisions

November kicks off with the highly anticipated US elections, followed quickly by the Fed’s expected interest rate cuts just two days later. Will these developments spark sustained rallies to offset October’s lacklustre performance so far, or will investors have to wait for more price action?

What happened in October?

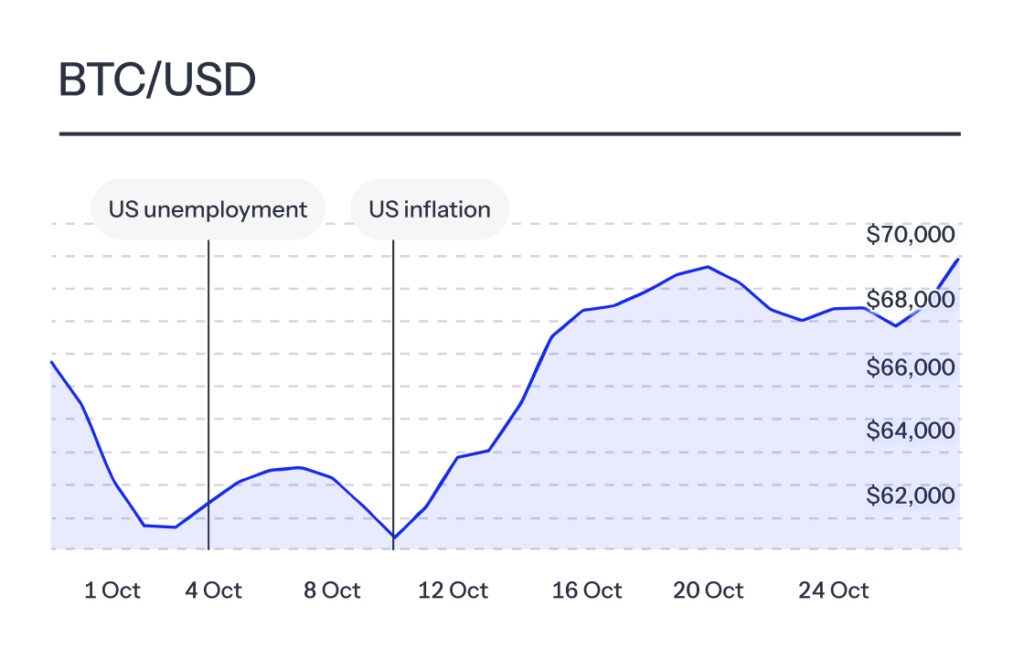

*Past performance is not indicative of future performance

“Uptober” perhaps didn’t hit the heights we’ve come to expect from October, which has historically seen an average price increase of +22%, though it still looks set to maintain its reputation for positive performance. At time of writing, Bitcoin is changing hands for more than $67,000, a 6% increase since the beginning of the month.

Still, there will be disappointment among crypto investors at a failure to sustain a breakout – with a dip below $60k on 10 October followed by a climb to a monthly-high of around $69,400 that failed to break the elusive $70,000 mark. This market leader saw a sharp retrace and has since failed to regain momentum. Will events next month set it back on course?

Ethereum followed a similar pattern, although its price fell 1.7% over the month. One standout in October was Dogecoin, which saw its price increase by more than 30%, thanks to a significant surge on October 17. Solana and Uniswap also experienced notable price rallies during the month.

Investors are now looking ahead to early November, with the analysts expecting the upcoming US elections to potentially impact the crypto markets in a big way.

What’s happening in November?

What? US unemployment rate

? When? 1 November

Why investors care: The US unemployment rate is an important measure of how healthy the economy is, as it affects how much people spend, how businesses perform, and what decisions are made about interest rates and money supply.

What happened last month?

The latest US unemployment rate for September 2024 was 4.1%, a slight decrease from 4.2% in August 2024.

What? US elections

? When? 5 November

Why investors care: Crypto has become increasingly politicised in the US, especially leading up to the elections. While Trump has openly endorsed crypto, Harris has been less vocal about her party’s support for the industry. Regardless of the outcome, analysts expect volatility around this event.

What? Fed interest rate decision

? When? 7 November

Why investors care: The Fed’s interest rate decision can impact crypto investors by influencing market liquidity and risk appetite. Lower rates make borrowing less expensive, potentially increasing investment in riskier assets like cryptocurrencies.

What happened last time? The Federal Reserve announced a 0.5% cut to the federal funds rate, lowering it to a target range of 4.75% to 5.00%, marking the first reduction since March 2020.

What’s expected? According to tracking tools like the CME FedWatch, investors expect the Fed to further lower interest rates by 0.25%.

What? China inflation numbers

? When? 9 November

Why investors care: Chinese inflation numbers help investors gauge economic trends, anticipate central bank actions, and understand the broader implications for global financial markets.

What happened last month? China’s annual inflation rate decreased to 0.4% in September 2024, down from 0.6% in August, marking the lowest inflation rate since June.

What? US inflation numbers

? When? 13 November

Why investors care: These numbers can affect interest rates, as the Federal Reserve may take a more conservative approach when cutting rates to control inflation, which can lead to reduced investment in riskier assets like cryptocurrencies.

What happened last month? The latest US inflation rate for September 2024 was 2.4%, down from 2.5% in August, marking the lowest annual increase since February 2021.

What? Avalanche (AVAX) token unlock

? When? 18 November

Why investors care: The coin release will see 1.67 million AVAX tokens become accessible. Further supply could put pressure on the price but, on the other hand, could create interest in the crypto.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press