UK sets out plan to become a global cryptoasset hub

What

The UK has set out a detailed plan to become a global cryptoasset hub

Why

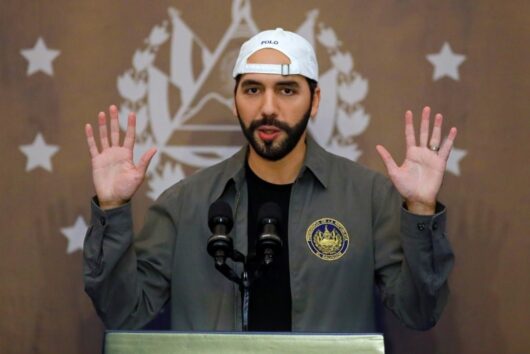

As part of this plan, financial services minister John Glen stated that the UK will legislate to bring some stablecoins under its regulatory framework

What next

Later this year the UK government will consult on creating regulations for a wider set of cryptoassets like Bitcoin, taking the sector’s energy consumption into account

The story

The UK has set out a detailed plan to exploit the potential of cryptoassets.

As part of creating a global cryptoasset hub, financial services minister John Glen said that Britain plans to bring certain stablecoins under the government’s regulatory framework to comply with existing payment rules.

While a stablecoin is also a cryptocurrency, it aims to minimise the volatility and offer price stability by pegging itself to a fiat currency, like the US dollar, or a commodity such as gold. The USD Coin (USDC) is such a stablecoin.

“The approach will ensure convertibility into fiat currency, at par and on-demand,” the finance ministry said, adding that the Bank of England would regulate ‘systemic’ stablecoins.

Later this year, the UK will consult on creating regulations for a wider set of cryptoassets such as Bitcoin, taking the sector’s energy consumption into account.

The plan will also develop the potential of blockchain, including whether it can be used for issuing British government bonds or gilts.

To learn more about stablecoins, visit our learning resource here.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press