What is cryptocurrency?

Cryptocurrency may often seem like an entirely new phenomena, but the concept of digital cash has actually now been around for almost four decades. It was first introduced in a 1982 paper written by David Chaum. Digital cash took many forms over the next 27 years, with a number of failed ‘ecash’ projects making at least some waves before burning out, including the likes of Flooz, Beenz and Chaum’s own DigiCash.

Original DigiCash tech team in 1994

The list of reasons given for these companies’ failures are long and varied – from fraud, to friction between companies’ employees and their bosses. A key factor underpinning their failures, though, was their centralised nature. They adopted a Trusted Third Party approach, meaning that the companies behind them verified and facilitated the transactions.

When DigiCash went bust in 1998, many believed that the idea of digital cash was a lost cause. There was, however, a person or group of people who didn’t – Satoshi Nakamoto. Nakamoto recognised that decentralisation was key to the dream of digital cash – a medium of exchange built for the internet, one that was optimised to exploit all of its potential to enable faster and cheaper transactions, and to solve historic issues in the financial system. Cryptocurrency was born.

Enter Satoshi…the Bitcoin founder

‘Satoshi Nakamoto’ is a moniker used by a person or group of people. There have been many investigations to unmask the person(s), but there is still no conclusive evidence of who they are. All that’s known for sure is that in 2008, Satoshi Nakamoto released ‘Bitcoin: A Peer-to-Peer Electronic Cash System’, today known by most simply as the Bitcoin whitepaper. The paper proposed a new form of digital cash, a cryptocurrency to be called Bitcoin.

The header of the Bitcoin whitepaper

Satoshi managed to pull all of the work done by corporates, academics, researchers and more together into one coherent plan and helped to implement it. Satoshi also designed the entire Bitcoin system in an ‘open source’ manner – this means the code is available for everyone to inspect and see. Nothing is hidden. Over time, many others have also worked on this code so it’s already very different from the initial outline Satoshi proposed. This is one of the central planks of cryptocurrency – it is for the people and no central party has control.

How Bitcoin works

Nakamoto’s innovation that made Bitcoin possible was blockchain, which is the underlying technology on which the majority of cryptocurrencies are based.

The blockchain is a distributed ledger. It is similar to the ledger that banks hold to monitor all the digital transactions we make using fiat currency. However, unlike the bank’s ledger, there is no central authority controlling it. It’s peer-to-peer, which means anyone in the network can see that a transaction has taken place. This provides the security, transparency, and trust that has got so many excited about cryptocurrency. Think of it more like a Google doc to which everyone has access. Everyone can see every change that has been made and have a say whether the edit should remain. To do this, blockchain uses a consensus algorithm that ensures the correct changes are made and no one can hijack the process for their own ends. It also uses cryptography to ensure that once a change has been verified, it cannot be undone.

People aren’t just using blockchain for cryptocurrency, either. You can theoretically store any data on a blockchain and companies across a variety of industries are using it for different tasks, such as keeping track of goods through the supply chain. However, cryptocurrency is certainly its most prominent application.

The Bitcoin blockchain

The Bitcoin blockchain ledger is distributed across the entire network of Bitcoin users. Everyone in the network can see it and trust that what is on it is correct. Any transaction made using Bitcoin is therefore recorded on the Bitcoin ledger and sent across the whole Bitcoin network for everyone to see.

The updated ledger is copied hundreds of thousands of times, every single hour, across multiple computers to make sure that everyone has the exact same version. They will then verify that the transaction has really taken place and there is nothing amiss. If at least 51% confirm that it has taken place, it will be added permanently to the blockchain.

The blockchain has to be double and triple and quadruple checked by computers all around the world. You can actually set your own computer to become part of the network and help both verify transactions and also ‘mine’ Bitcoin.

What is the network in the Bitcoin blockchain?

A Bitcoin node is essentially just a storage device, like a laptop or a PC, with internet access, that has the capacity to store the Bitcoin blockchain. These nodes relay information from users to miners. They also store the Bitcoin blockchain. Nodes are synchronised with each other. Even if a node is offline for some time, it will download the latest data from the other nodes once it connects to the internet again.

If we return to the Google doc example, imagine you’ve got View-only access. If you have access, you can see the sheet at any time that you’re online. When you’re offline, any changes made by people with edit access will then update to the sheet next time you’re online. If we ended the analogy here, this would be what is known as a lightweight client. A lightweight client, however, cannot be referred to as a node. To be a node, you have to be a “full” client. A full client is a client that owns the blockchain and is also sharing blocks and transactions across the network.

Anyone with a storage device that has enough space and is connected to the internet can run a node. A node doesn’t necessarily mine Bitcoin, though. All miners are nodes, but not all nodes are miners. They are still vital to the ecosystem, though, as they contribute to decentralisation, and therefore, the security of the blockchain. However, miners are even more important. They ‘find’ the Bitcoin (in a manner of speaking).

How is Bitcoin issued?

Where fiat currencies are issued by central banks, new Bitcoins are “issued” to miners via a block reward for solving a block. They do this by using special hardware to solve a complex computational problem, which produces a seemingly-random 64 character output. This output is known as a ‘hash‘.

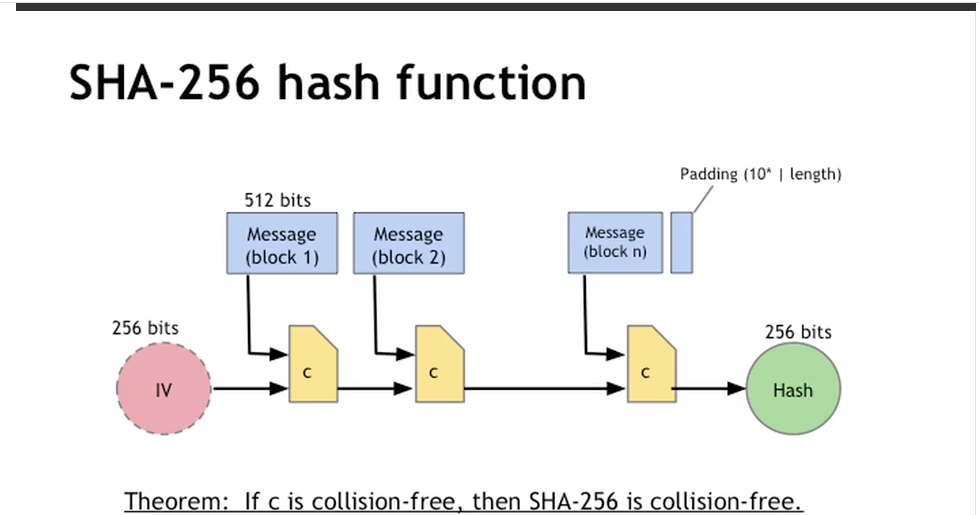

A hash function is a mathematical process in which data of any size is ingested and put through a series of operations in order to turn it into a ‘hash’. That data is a fixed size is critical when dealing with large volumes of transactions and data. Instead of having to remember all that data, the hash function condenses it into a fixed length to keep track of it more easily.

In Bitcoin, miners use the SHA-256 Cryptographic Hash Algorithm. The data that a miner inputs into the SHA-256 hash function include all the current transactions which fit into the block’s size limit, the previous block’s hash result, and the nonce. The nonce is a random value the miner changes with each hash attempt to get a new output. Even a tiny change in input produces a completely different output.

Bitcoin miners are looking for an output with a certain number of zeroes. Today, Bitcoin miners have to find a hash which starts with nineteen zeroes. To get this number requires many, many attempts. Once the hash is found, the block is closed and it is added to the blockchain. After successfully mining a block, miners are rewarded with newly-created Bitcoins and transaction fees.

But wait… the supply of Bitcoin is controlled?

To ensure that the way Bitcoin is issued is sustainable, Bitcoin creator Satoshi Nakamoto included a rule in the Bitcoin protocol that the rewards miners earn would decrease by 50% every 210,000 blocks (approximately every 4 years). This is an event known as the ‘Bitcoin halving‘, or the ‘Halvening’. Since Bitcoin’s inception in 2009, there have been two halving events. The initial reward for miners was 50 Bitcoin for each block mined. It was then halved to 25 Bitcoin in 2012, 12.5 Bitcoin in 2016 (the current reward), and the next halving is set to take place in May 2020, when the reward will be reduced to 6.25 Bitcoin.

One of the key characteristics of Bitcoin is that there is a cap on the number of Bitcoins that will ever be in circulation. The upper limit for Bitcoin’s supply is 21 million. Once the network reaches that limit, no more Bitcoin can be released. However, if these 21 million Bitcoin were released in the wrong way, it would create a host of problems.

What about other cryptocurrencies?

Bitcoin may have been the first cryptocurrency, but many others have been developed in its wake. More than 2,200 different cryptocurrencies are traded publicly, according to CoinMarketCap.com, a market research website. These have either been created as a ‘fork’ of the Bitcoin blockchain or on an entirely new blockchain. They have been built by people who believe that Bitcoin is not able to fulfil certain functions of money or to fulfil a different purpose entirely.

Take for example, Bitcoin Cash, which was launched in August 2017 as a result of a hard fork of the original Bitcoin blockchain. The main motive of the fork was to increase the block size in the blockchain from 1MB to 8MB (then to 32MB) to facilitate faster transactions.

An example of an entirely new cryptocurrency is Ether, which is the cryptocurrency issued on the Ethereum blockchain. Where Bitcoin stores a list of balances and transactions on its blockchain, the Ethereum blockchain is designed to store different types of data. This data can be accessed and used by computer programs running on the Ethereum blockchain. These programs are called decentralised apps, or dApps. Developers around the world can build and run decentralised applications on the Ethereum blockchain. The purpose of these is to improve the industries of finance, personal information storage, governance and more by using the transparent nature of a blockchain.

How do I get cryptocurrency?

If you’re not a miner, you will likely need to buy cryptocurrency through a broker or exchange. You’ll first need a wallet – an online app that can hold your currency. This wallet will require both a private and a public key that define your identity on the blockchain.

Your private key is the “ticket” that allows you to spend your bitcoins. They are almost never handled by the user, instead the user will typically be given a seed phrase that encodes the same information as private keys. They also allow anyone who has your private key to sign transactions on your behalf, meaning that they can send all of your cryptocurrency from your wallet to theirs. This is irreversible. It is vital that your private keys be kept private. Do not share them with anyone.

Your public key, on the other hand, can be made public. It is your identity on the blockchain, similar to your email address. This is the address you give people in order to send you money. A wallet program, like Luno’s, will secure your private key for you, let you easily perform transactions, and make it easy for you to share your public key with others so that they can send you money.

Once you have your wallet, you would generally create an account on an exchange, and transfer real money to your account to buy cryptocurrencies. Both a wallet and an exchange can often be found in one place, for example, the Luno platform.

What can I do with cryptocurrency?

People use cryptocurrency for a number of reasons. Like any currency, cryptocurrencies can be used to buy goods and services. There are many merchants – both online and offline – that accept Bitcoin as the form of payment – from massive online retailers to small local restaurants. Other digital currencies such as XRP and Ethereum aren’t accepted as widely just yet, but they are beginning to be.

People all over the world use Bitcoin to send money to friends and families or buy things online. They do this because it is cheaper and faster than using local currency. This is because it is decentralised, meaning when you send money overseas, you don’t have to wait for it to be approved by the many middlemen who usually deal with remittance.

Cryptocurrency is also seen as an investment opportunity. It is notoriously volatile, and by either buying and holding crypto or trading it, people have made large sums of money – or lost large sums.

What is Luno?

Luno makes it safe and simple to buy, store and learn about cryptocurrencies. The Luno wallet and payment app make it easy to send, receive and spend a variety of different cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, XRP, and Litecoin. You can also convert your crypto into your local currency at any time and spend it. The Luno Exchange, meanwhile, provides an intuitive platform where more experienced traders can buy and sell a variety of trading pairs for minimal fees.

What sets Luno apart, however, is the focus on security and education. Luno does everything possible to ensure that your crypto is safe, innovating with best-in-class processes and technology. Education is also paramount, helping those new to the space become comfortable with this new and transformative technology, and those more experienced to keep abreast of developments and everything they need to know. This is all provided through the Luno Learning Portal and blog.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press