Stop-Limit Orders explained

We’ve added stop-limit orders to the Luno Exchange and mobile App ?

This is an important feature for crypto traders, one that helps greatly in mitigating against some of the risks associated with price volatility. It’s a feature we know our community will be excited about and we’ve worked hard to bring it to you.

Here’s a quick explainer of what stop-limit orders are, their purpose, and how to implement them on our Exchange.

What is a stop-limit order?

A stop-limit order is similar to a limit order – a type of order where you buy or sell an asset at a given price or better. In the case of stop-limit orders, they only become active in the order book once the stop price has been triggered.

How does a stop-limit order work?

A stop-limit order requires two price points: the stop price and the limit price.

- A stop price refers to the condition of the specified target price for the trade.

- A limit price refers to the instruction for a trader to exit their position

Once the stop price is reached, a limit order is automatically placed in the order book to buy or sell at the limit price or better.

It’s important to remember stop-limit orders will guarantee a price limit, but not a fill. In a fast-moving market, the stop price may trigger but the market might move beyond the specified limit order price.

Let’s look at an example: A Trader has 1 BTC purchased at $200. They place a sell stop-limit order with a stop price of $205 and a limit price of $215. If a rapid decline takes the price below the stop price of $205, then a limit order is created at $215. Your order will now be active in the order book and will wait until the price to return to this level or above before being sold.

The benefits of stop-limit orders

The most significant benefit of a stop-limit order is that the traders can protect themselves from large price movements that could render a trade unprofitable. In order to protect your trades from volatility in the market, stop-limit orders offer an extra layer of risk mitigation by allowing you to specify an exit price.

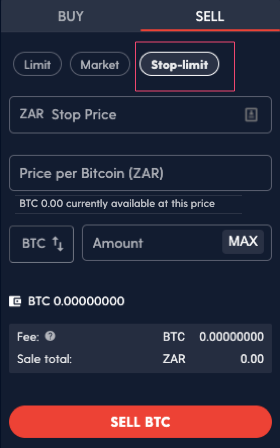

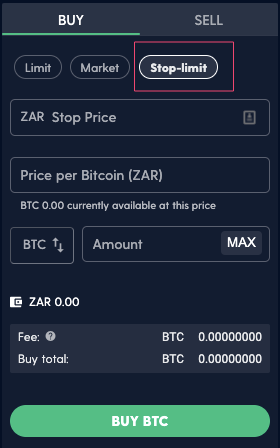

How to use stop-limit orders on the Luno Exchange

- Login to the Luno Exchange

- From the Place Order ticket, select Stop-Limit Order

- Select Buy or Sell and fill in a Stop Price, Limit Price and an amount

- Press (Buy/Sell) to place an order

5. Confirm your stop-limit order

Keep reading…

Crypto in 2020: The year so far

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press