Daily market update: Bitcoin bounces back over $12,000

Bitcoin’s back, baby! Not that it ever actually went anywhere, but it just tipped back over $12,000 again yesterday, which is pretty frigging exciting! We’re off to a flying start for September! ARE YOU EXCITED?! WE’RE EXCITED!!! WE’RE ALWAYS FRIGGING EXCITED!!!!!

Here’s your Wednesday market update. It’s like your normal daily update, but BIGGER and BETTER. Because Wednesdays are BIGGER and BETTER. We’re excited! Read it now.

If you’re new to the world of crypto trading, don’t forget to take a look through our beginner’s guide to crypto trading series, starring in-depth explorations of common strategies, market analysis techniques, and more. It will help you use the data in this update to make your crypto trading decisions.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am BST

Bitcoin price

We closed yesterday, 1 September 2020, at a price of $11,970.48 – with a daily high of $12,067.08 and a low of $11,601.13.

That’s up from $11,680.82 the day before. The daily high is the first time we’ve been over $12,000 since 19 August.

We’re 40.41% below bitcoin‘s all-time high of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

97.4% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $27,311,555,343 – up from $22,285,928,250 the day before.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $221,181,001,607, up from $215,817,677,822 the day before. To put that into context, Jeff Bezos’s net worth is $196,000,000,000, which means he could only buy 88.62% of all Bitcoin. You can’t have everything, Jeff!

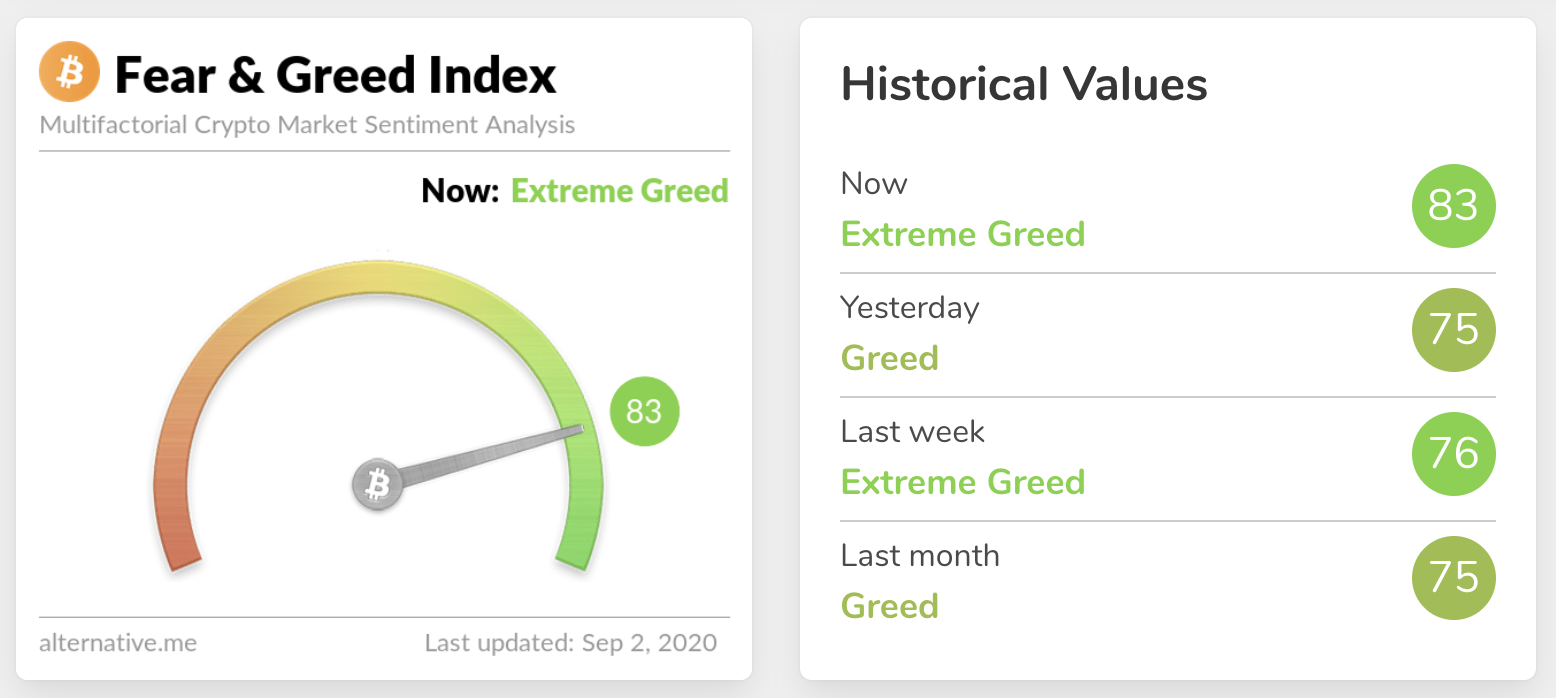

Fear and Greed Index

It feels like an age since we were last in ‘Extreme Greed’, having been in the mere Greed zone since Saturday. But we’re back, baby! And at 83 the Index is at the highest point since 17 August. August was characterised by greed, and we’ve never seen a whole month up in this area – will the run continue through September?

Extreme fear can be a sign that investors are too worried, which could be a buying opportunity. When Investors are getting too greedy, that means the market may be due for a correction.

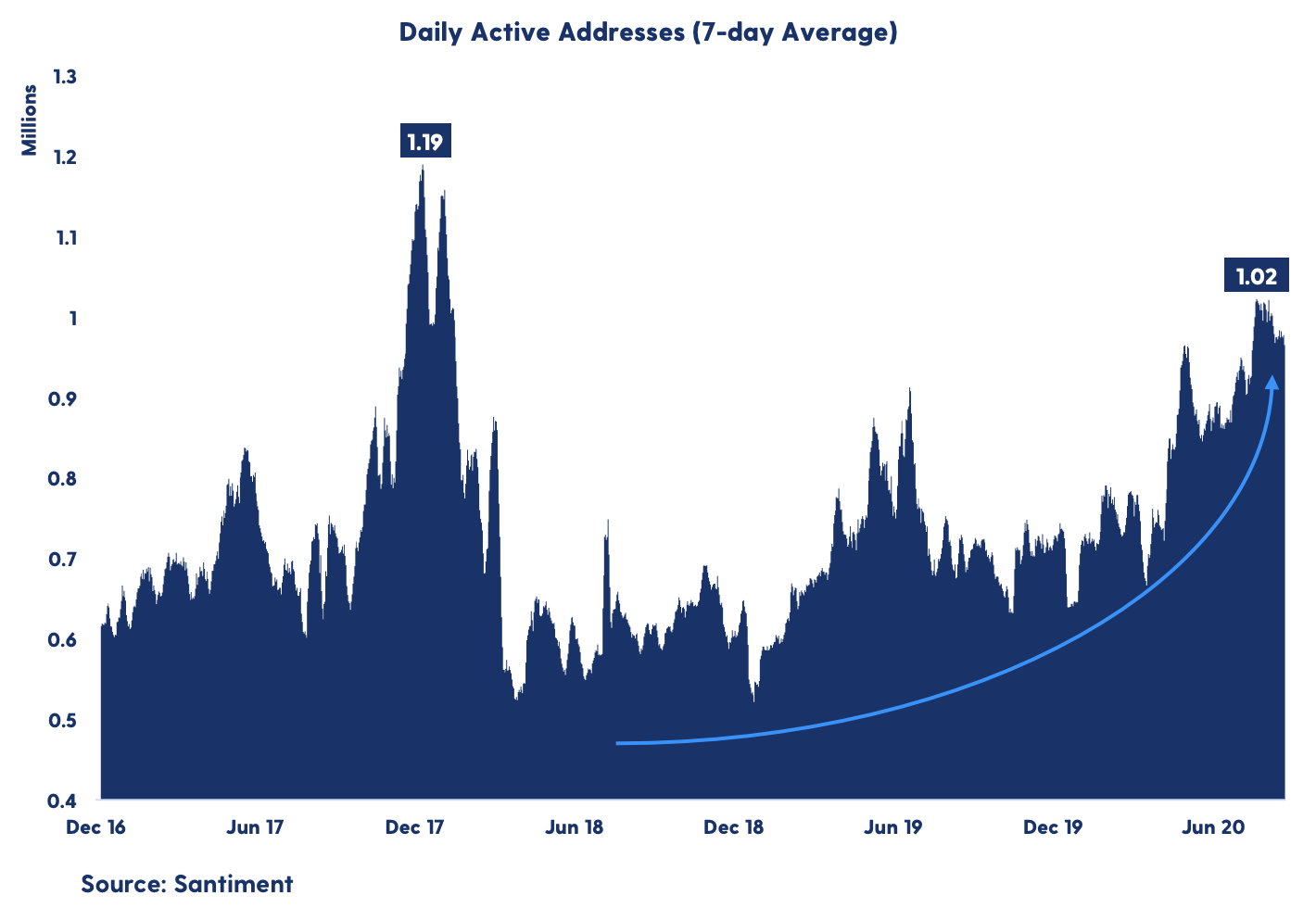

Activity on Bitcoin is approaching 2017 highs

Daily active addresses on the Bitcoin blockchain have increased steadily over the past two years, according to data from Santiment. This month, the activity on the Bitcoin network was back to levels not seen since January 2018. Over 1 million daily active addresses, based on a weekly average, were registered in the beginning of August.

We’re currently seeing more activity on Bitcoin than last summer, when the price touched $14,500. It’s always a healthy sign that the use of Bitcoin is increasing with the price, as we’ve seen over the past months.

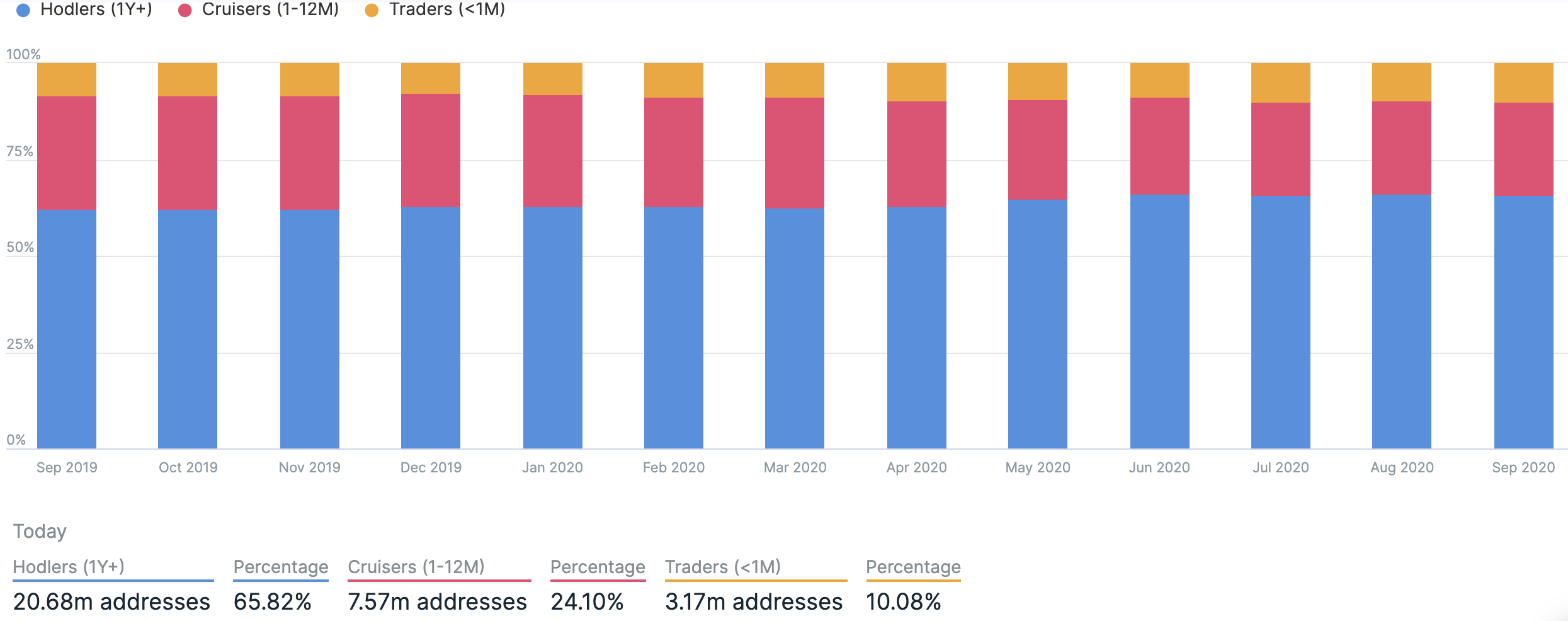

Ownership by time held

Hodlers are passive investors who have held Bitcoin for more than a year. Cruisers have held their crypto for 1-12 months, while traders have held theirs for less than 30 days. The stack bar shows the composition of holders by their holding period at the end of each calendar month.

Data courtesy of Into The Block

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.60. Its lowest recorded dominance was 37.09 on 8 January, 2018.

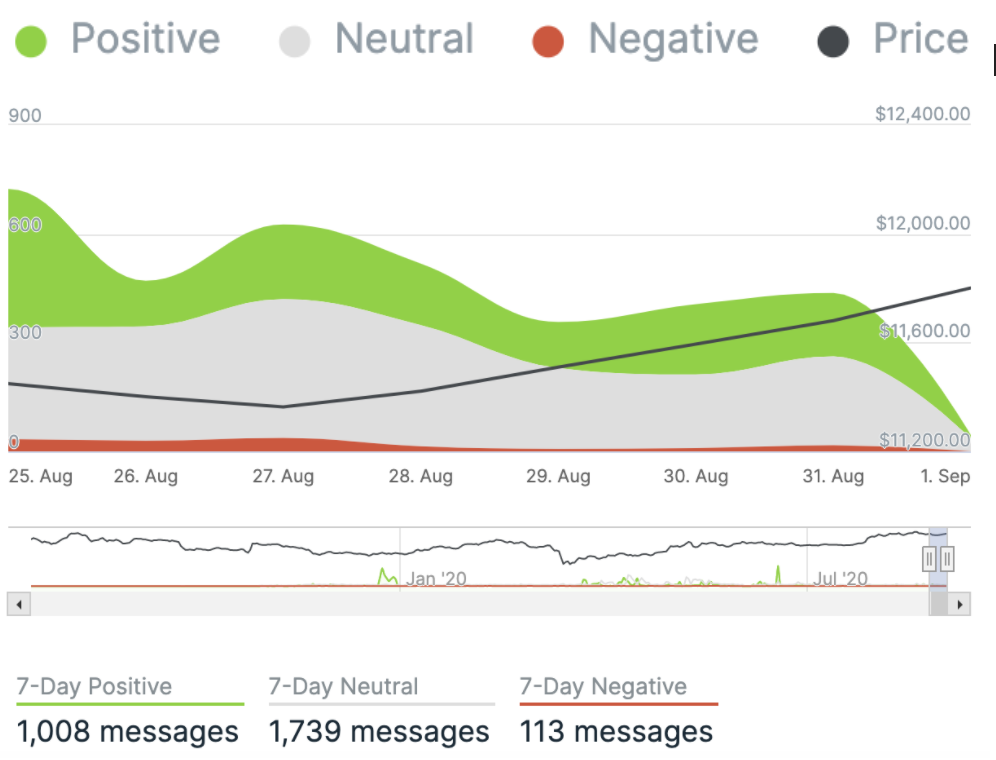

Telegram sentiment

This is a metric from intotheblock.com designed to show whether messages sent in Telegram have a positive, neutral or negative connotation.

Relative Strength Index (RSI)

The daily RSI is currently 56.04. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

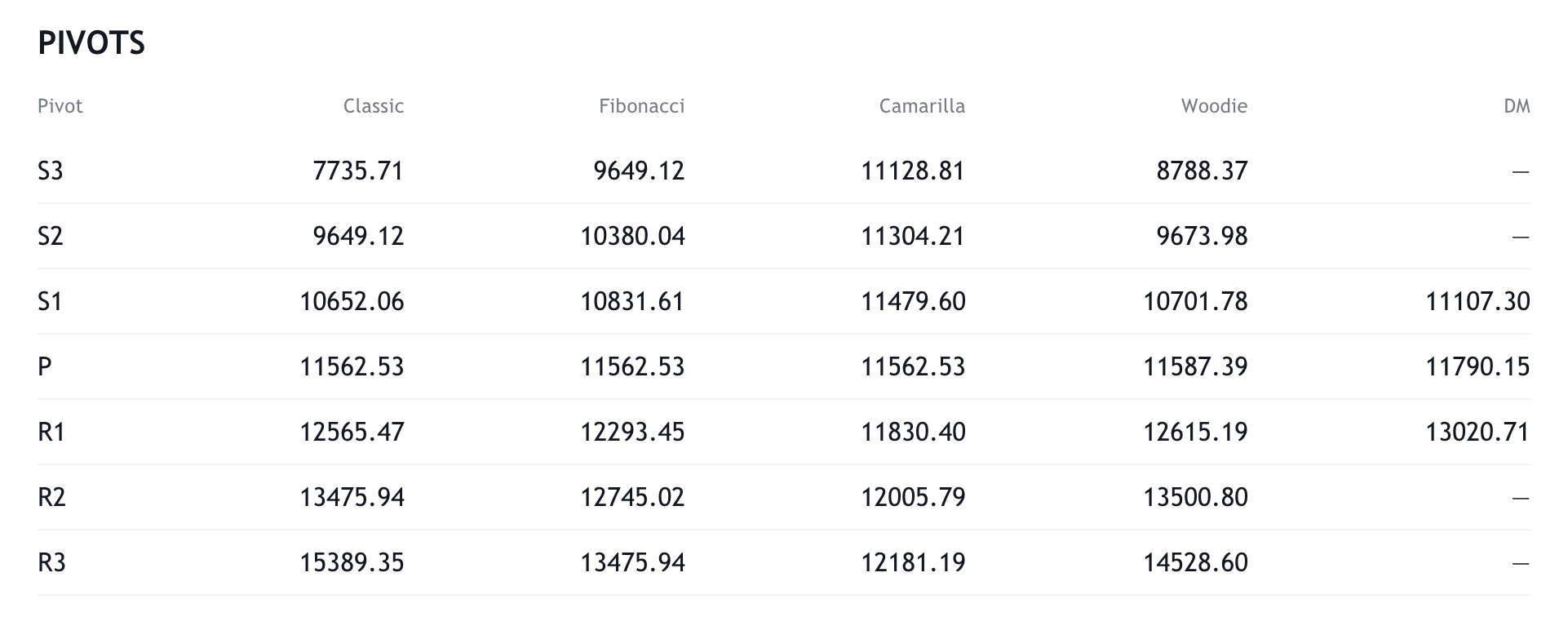

Resistance and support

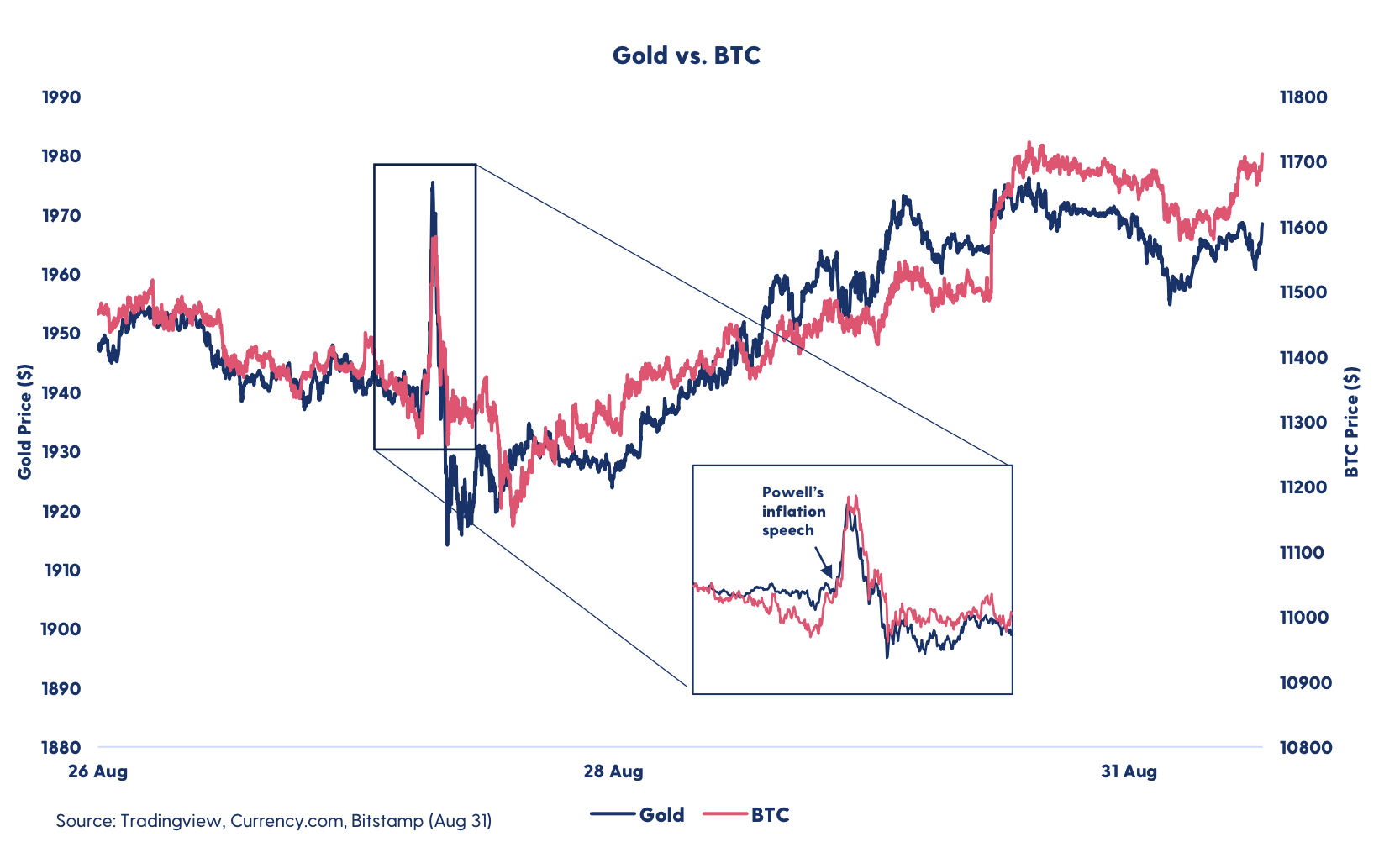

Powell’s inflation speech: Bitcoin and gold move in tandem

Last Thursday, the Federal Reserve announced that it’s willing to allow inflation to increase more than normal. These changes are a major policy shift. Gold, the traditional inflation hedge, spiked on the announcement, but retraced sharply after a few minutes. More notably, the bitcoin price followed the exact same pattern.

The two assets have traded in tandem since, giving investors confidence in the “digital gold” narrative for bitcoin. This may well be only a short-term price correlation, but it will be interesting to see whether more traders treat bitcoin as a digital gold.

What they said yesterday…

Bitcoin just broke $12,000!

— Dan Held (@danheld) September 1, 2020

Total value held on @Bitcoin‘s Lightning Network channels reached a record high of $12.4 million as August added the largest-ever number of new listening nodes.

Report by @zackvoellhttps://t.co/bSEpXP0oGv

— CoinDesk (@CoinDesk) September 1, 2020

“Bitcoin will never work.” ☠️⚡️ pic.twitter.com/XrVFwRXsNJ

— Brekkie vonbitcoinart.com (@BVBTC) September 1, 2020

The U.S. dollar is becoming a shitcoin faster than ever imagined. #Bitcoin is the key to salvation. https://t.co/fMMStO9zIg

— Tyler Winklevoss (@tylerwinklevoss) September 1, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press