Daily market update: Rejection at $12,000 for Bitcoin – where to next?

After yesterday morning’s excitement, bitcoin hit a hard rejection at $12,000 and dropping almost $800. All eyes now are on whether the bulls can summon the energy for another rally to $12,000, and what happens if they manage to force their way through.

Here’s today’s stat attack for your eyeballs. If you’re new to the world of crypto trading, don’t forget to take a look through our beginner’s guide to crypto trading series, starring in-depth explorations of common strategies, market analysis techniques, and more. It will help you use the data in this update to make your crypto trading decisions.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 10:00am BST

Bitcoin price

We closed yesterday, 2 September 2020, at a price of $11,414.03 – with a daily high of $11,964.82 and a low of $11,290.79.

That’s down from $11,970.48 the day before. The closing price on the same day last year was 10,346.76.

We’re 43.19% below bitcoin‘s all-time high of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

95.5% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $28,037,405,299 – up from $27,311,555,343 the day before.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $210,909,793,681, up from $221,181,001,607 the day before. To put that into context, Jeff Bezos’s net worth is $196,000,000,000, which means he could only buy 92.93% of all Bitcoin. You can’t have everything, Jeff!

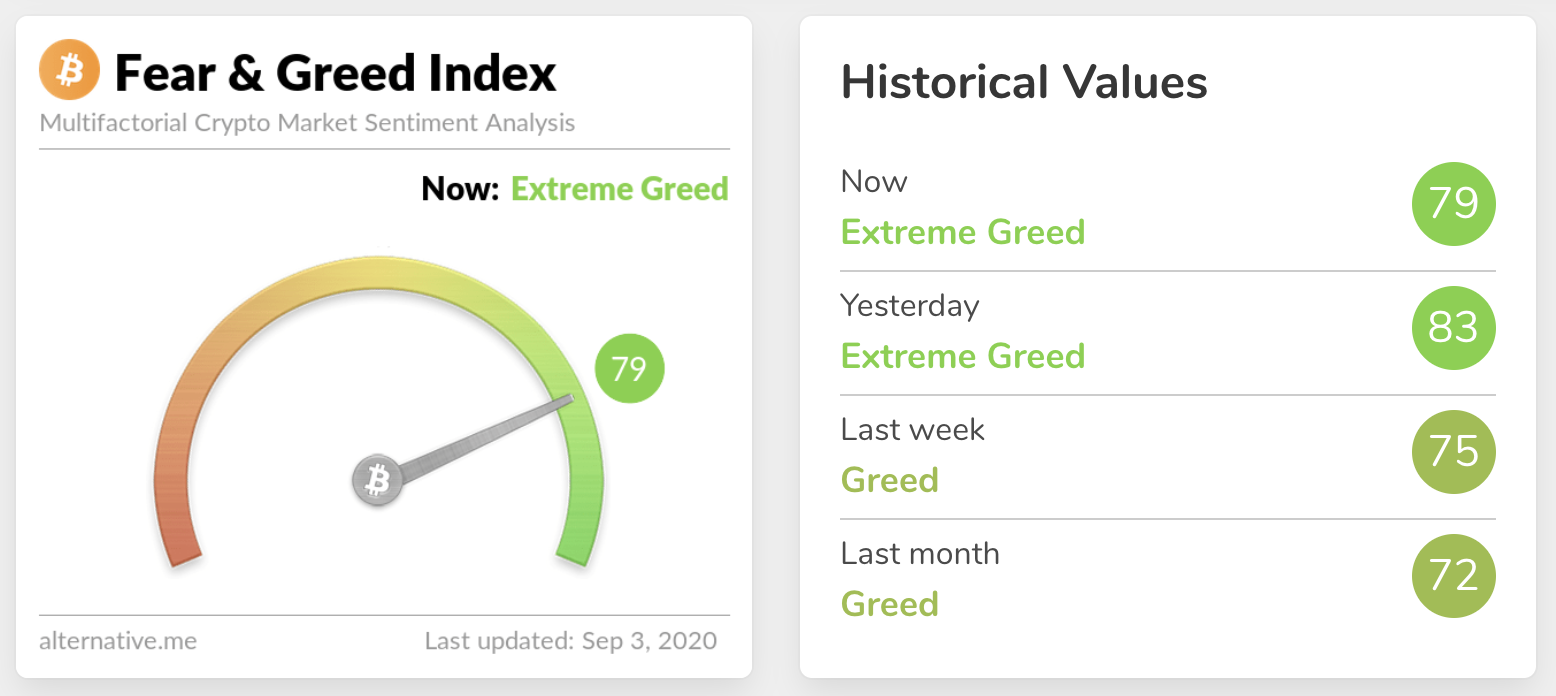

Fear and Greed Index

We’re still up there in Extreme Greed, down 4 points from 83 yesterday to 79. August was characterised by greed, and we’ve never seen a whole month up in this area – will the run continue through September?

Extreme fear can be a sign that investors are too worried, which could be a buying opportunity. When Investors are getting too greedy, that means the market may be due for a correction.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 59.85. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 47.75. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Resistance and support

What they said yesterday…

Ethereum names will be the new Facebook accounts.

There’s an initial killer app to get people to sign up. For FB, it was collegiate social networking. For Ethereum, it’s defi.

Then you get decentralized single sign on for the crypto ecosystem. Log in with Ethereum.

— balajis.com (@balajis) September 2, 2020

We need to get past the myth that it’s *fatal* if one entity gets enough to 51% attack PoS. The reality is they could attack *once*, and then they either get slashed or (if censorship attack) soft-forked away and inactivity-leaked, and they lose their coins so can’t attack again. https://t.co/utash1hUDU

— vitalik.eth (@VitalikButerin) September 2, 2020

#Bitcoin is “pristine collateral,” says @RaoulGMI

Brilliant macro perspective on true essence of btc value.

Shortage of safe haven assets accentuates extreme demand for an impossibly perfect asset.

Permanently upward sloping yield curve will fully cement high forward value. pic.twitter.com/m2ae3AyTQq

— Dan Tapiero (@DTAPCAP) September 3, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press