Daily market update: Bitcoin back over $12,000, but will surge be sustained?

Good morning, crypto fans. And what a morning it is. It’s also now been more than 87 days since we last saw the bitcoin price in four digits. Have we really had our last opportunity to buy a whole bitcoin for less than $10,000? Where to from here?

Things were relatively flat last week for bitcoin, though the start of this week has seen a strong turnaround for the world’s leading cryptocurrency by market cap. Bitcoin is back over $12,000 this morning – the first time it’s reached that level since the beginning of September. The question now is whether the momentum can be sustained?

The fly in the ointment is the increasingly fraught and unpredictable US presidential race. Election day is now less than two weeks away and there are still no signs of either side playing nice. Bitcoin’s surge last night came off the back of the resumption of stimulus talks in the US, with House Speaker Nancy Pelosi making positive noises that an agreement can be reached. However, there will be concerns that bitcoin is still mirroring the stock market. Should a stimulus package not be agreed upon, we could see the price drop again rather quickly.

If you’re new to the world of crypto trading and want to make sense of all these indicators, check out our beginner’s guide to crypto trading series, featuring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am BST.

Bitcoin price

We closed yesterday, 20 October, 2020, at a price of $11,916.34, with a daily high of $11,999.92 and a low of $11,681.48. That’s the highest closing price since 1 September.

We’re 40.68% below bitcoin‘s all-time high of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

97.3% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $30,915,821,592 – up from $23,860,769,928 the day before. High volume indicates that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $220,721,282,865, up from $217,482,407,293 the day before.

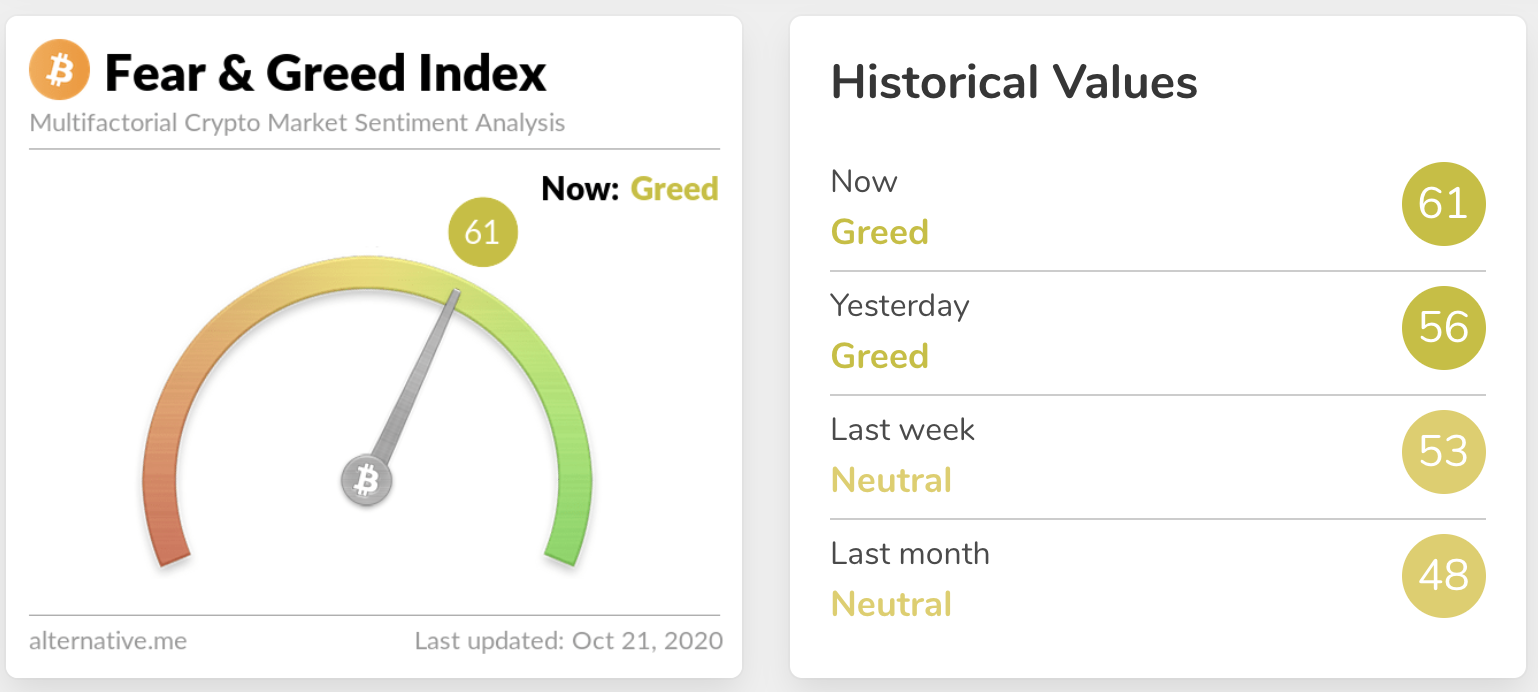

Fear and Greed Index

The Fear and Greed Index has been flat over the past week, but is now establishing itself in the “Greed” area and is back at 61. The uncertainty we saw in September seems to be fading, and investors are turning more positive after a month down in the “Fear” area.

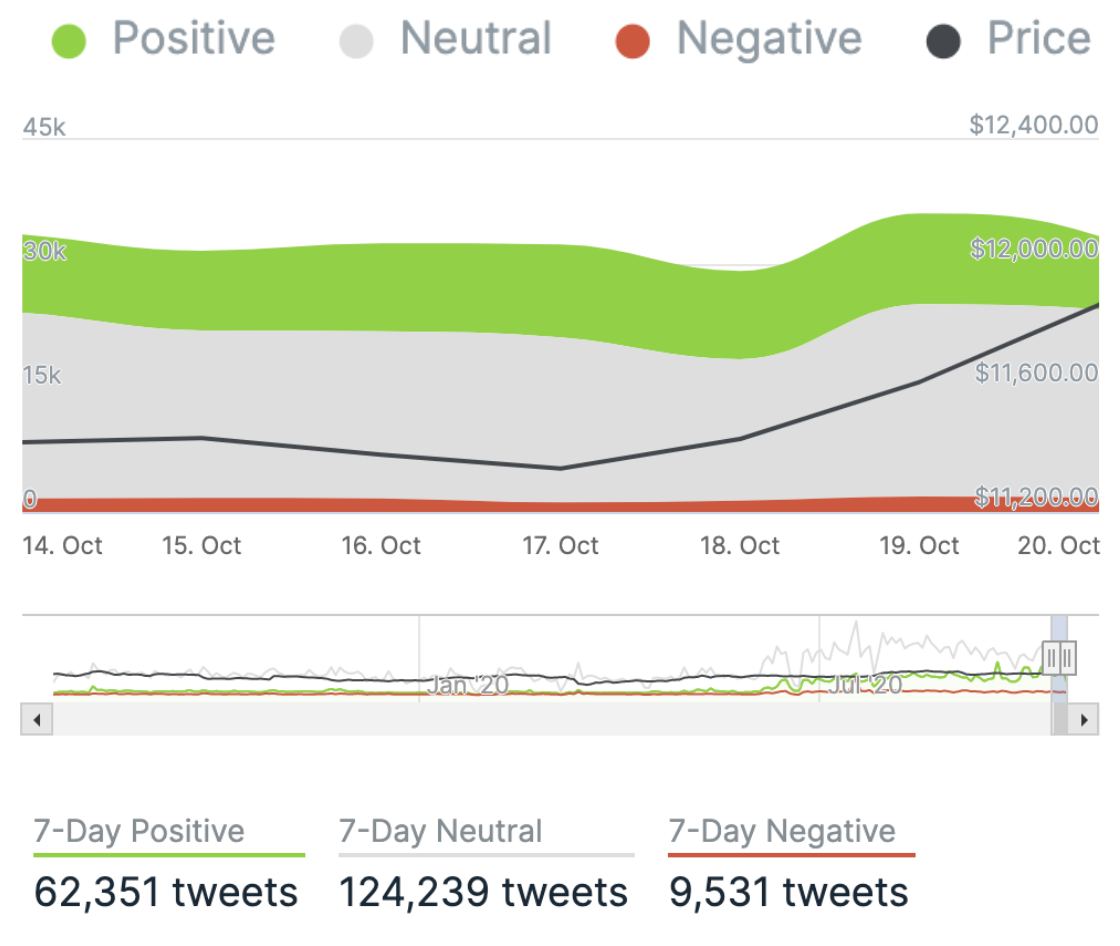

Twitter sentiment

Yesterday, there were 8,861 tweets sent with a positive connotation towards bitcoin, 22,773 with a neutral connotation, and 1,743 were negative.

Chart provided by IntoTheBlock.com

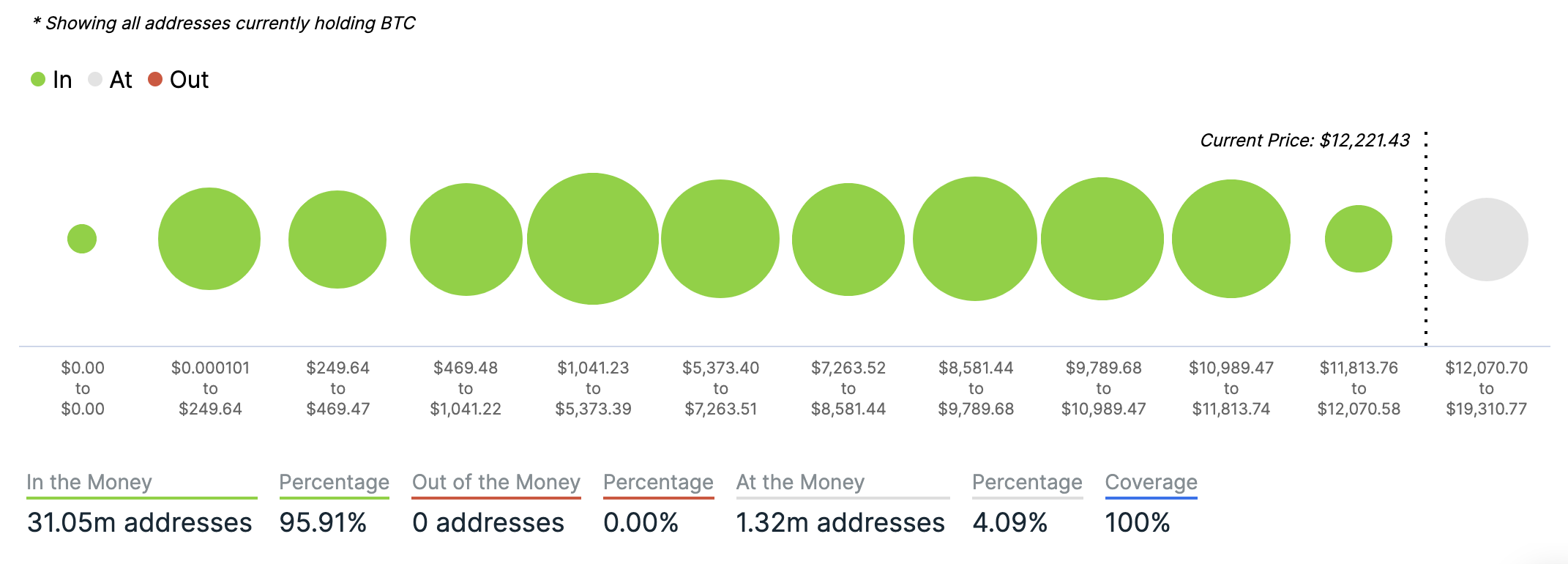

Global In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Chart provided by IntoTheBlock.com

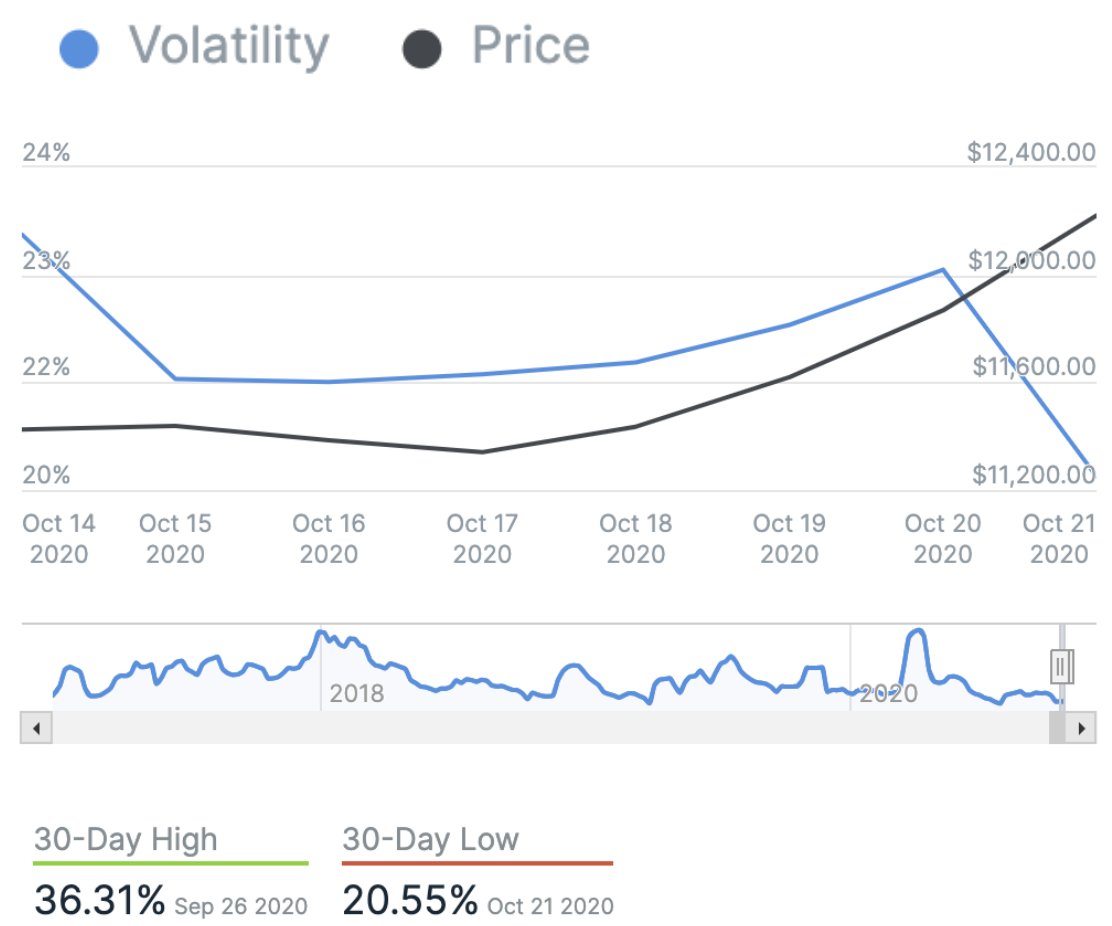

Volatility

Annualised price volatility using 365 days.

Chart provided by IntoTheBlock.com

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 61.69. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 73.77. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

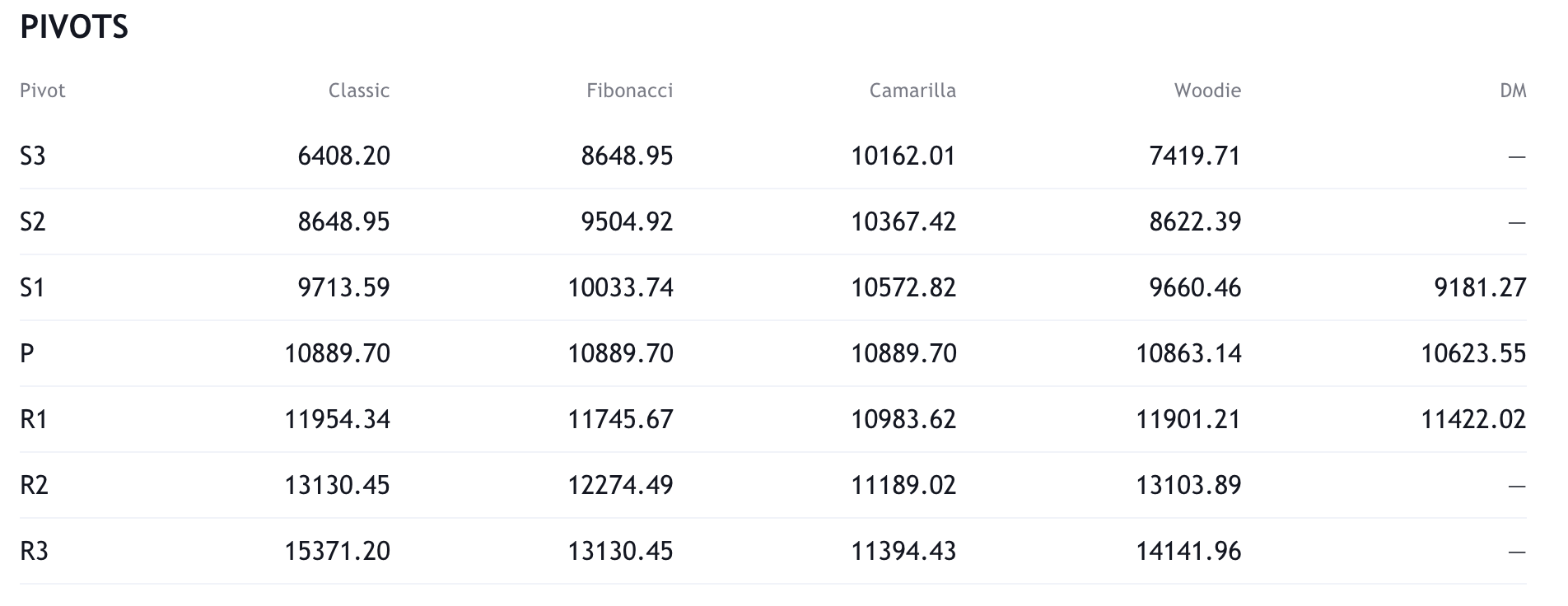

Resistance and support

What they said yesterday…

Morning #Bitcoin you beautiful beast

— Peter McCormack (@PeterMcCormack) October 21, 2020

We choose to go to the moon, not because it is easy, but because we need hard money. #Bitcoin

— Samson Mow (@Excellion) October 21, 2020

NEW: Mode Global Holdings PLC, a U.K-listed company, has announced it will place 10% of its cash reserves into bitcoin as part of its treasury investment strategy.

Via @Dan_Z_Palmer https://t.co/8Lf8Ufo69l

— CoinDesk (@CoinDesk) October 21, 2020

Despite Tuesday’s rally to $12,000, crypto traders lack the bullishness they showed when bitcoin reached the same price level two months ago, futures data indicates.

Report by @zackvoell https://t.co/oNWruhv1MJ

— CoinDesk (@CoinDesk) October 21, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press