The year in crypto headlines: 2020 edition

It’s been one heck of a ride this year. We kicked things off on the brink of World War 3 and finished with UFOs – not to mention a global pandemic in-between. If 2020 was a TV series, critics would have said the narrative was a ‘cluttered’ mess and given it 2 stars.

The crypto world has had a particularly exciting year, and December’s new all-time high has certainly given us a happy ending. Let’s take a trip down memory lane and look at this year’s biggest crypto stories.

January

Akon’s crypto city

Many moons ago, Senegalese-American rapper Akon revealed his plan to build a city of the future in Senegal. It’s set to be the first city to run on 100% renewable energy and, presumably, to be powered by the rap star’s own digital currency, Akoin.

Just finalized the agreement for AKON CITY in Senegal. Looking forward to hosting you there in the future pic.twitter.com/dsoYpmjnpf

— AKON (@Akon) January 13, 2020

The rapper waxed lyrical about the potential for blockchain and crypto in Africa: “I think that blockchain and crypto could be the saviour for Africa in many ways because it brings the power back to the people. Cryptocurrency and blockchain technology offer a more secure currency that enables people in Africa to advance themselves independent of the government.”

Six central banks join forces to explore CBDCs

2020 was a defining year for central bank digital currencies, with a number of countries making giant leaps forward in research and development.

In January, the central banks of Sweden, Canada, Switzerland, the UK and Japan, along with the European Central Bank (ECB) and the Bank of International Settlements (BIS), announced that they were joining forces to assess the “economic, functional and technical design choices, including cross-border interoperability” of CBDCs.

Also in January, the National Bank of Cambodia announced it was in the final stages of deployment for its CBDC. In November, it officially launched its blockchain-powered payment system, becoming the first Asian bank to go live.

And…

Vodafone left the Libra Association, now known as Diem, Square won a patent for a fiat-to-crypto payments network, and the Swiss municipality of Zermatt announced it would start accepting tax payments in bitcoin.

Price check

BTC month-open price: $7,194.89

BTC month-close price: $9,350.53

ETH month-open price: $129.63

ETH month-close price: $180.16

February

Football ❤️ blockchain

FC Barcelona joined a growing list of football clubs to create their own token, essentially giving voting power to their “over 300 million” global fans. As of June, supporters were able to acquire the first ‘Barça Fan Tokens’ ($BAR).

Ethereum-based virtual game world, Decentraland launched

The highly-anticipated Decentraland, a virtual reality game built on the Ethereum blockchain, was unveiled to the public. The game allows users to connect their Ethereum wallets and purchase virtual real estate in the form of a non-fungible token (NTF) called LAND.

And…

The crypto community bid farewell to their crypto faithful candidate, Andrew Yang, who announced his departure from the 2020 presidential race. Elsewhere, Ripple confirmed rumours that it would be partnering with the National Bank of Egypt, marking the first time an Egyptian bank has joined forces with a crypto payments company. And Steven Seagal came under fire for promoting an initial coin offering (ICO) without disclosing he was paid for it.

Price check

BTC month-open price: $9,346.36

BTC month-close price: $8,599.51

ETH month-open price: $180.11

ETH month-close price: $219.85

March

India reverses its ban on crypto trading

The Supreme Court of India overturned the Reserve Bank of India’s (RBI) controversial ban on Indian banks’ dealings with crypto-related firms, after justices ruled that the RBI’s action was “disproportionate”.

Another Libra (Diem) pivot

Deviating from earlier plans, Libra (now Diem) announced it would support a set of fiat-backed digital currencies for different regions, such as the dollar, pound and euro. Mastercard, Visa and PayPal also left the association. You can be sure that wasn’t the last of the pivots – keep reading.

China’s CBDC takes a big step forward

According to a report, the People’s Bank of China (PBoC) completed the basic development of a digital yuan. Citing “industry insiders,” the report claimed that the central bank worked alongside private companies including Alipay, and had begun drafting relevant laws to circulate the new currency.

And…

The Bank of England released a report on CBDCs, outlining an “illustrative model” for a CBDC designed to store value and enable payments by households and businesses. Gaming company Zynga, best known for games such as Farmville, announced it was building a blockchain-based infrastructure. And EY, Microsoft, and ConsenSys launched an enterprise platform on Ethereum mainnet, designed to empower enterprises to adopt the public Ethereum blockchain.

Price check

BTC month-open price: $8,599.76

BTC month-close price: $6,438.64

ETH month-open price: $219.75

ETH month-close price: $133.59

April

Starbucks and McDonald’s rumoured to join China’s digital Yuan pilot

Information about a “pilot promotion meeting” for the digital currency revealed some heavy hitters could be involved in the testing phase. On the guest list were 19 merchants, including Starbucks, McDonald’s, and Subway. A Bank of China official was also quoted as saying that by the 2022 Winter Olympics, the token will be in widespread use.

Shortly after this news, screenshots of mobile wallets enabled to work with the digital Yuan were leaked.

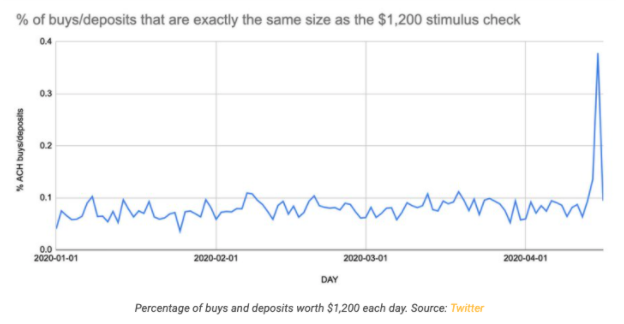

Americans use their stimulus checks to buy BTC

In an effort to support its citizens from the enormous economic hardship caused by the pandemic-induced lockdown, the US government gave Americans a $1,200 stimulus check. Shortly after the first payout, Coinbase CEO Brian Armstrong shared a graph of user activity of its exchange that indicated a fair few transactions of exactly $1,200 were made. A representative from Binance US told a similar story.

It appears the gamble paid off for those who opted to buy Bitcoin – ditching inflationary government money saw some buyers rake in up to 54% in profit by July.

At the time the first cheques were issued, each Bitcoin traded for around $7,000. In mid-July, each $1,200 cheque used to invest in BTC was worth around $1,829 – amounting to a gain of more than $600.

And…

The Banque de France announced its launch of an experimental program to test the integration of a digital euro in settlement procedures, and CoinMarketCap was acquired by Binance for a reported $400 million.

Price check

BTC month-open price: $6,437.32

BTC month-close price: $8,658.55

ETH month-open price: $133.61

ETH month-close price: $207.60

May

Bitcoin’s third halving goes off without a hitch

After much anticipation, the most hyped cryptocurrency event of 2020, Bitcoin’s third halving, finally took place on 11 May.

The 630,000th block was mined by Antpool, although they were somewhat overshadowed by the miner of the final Bitcoin block with a reward of 12.5 BTC, f2pool. The mining giant encoded the block with the message “?NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue”, in a homage to Satoshi’s Genesis block, which contained a similar message about the financial crisis of the day: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”.

The impact was immediately felt as Bitcoin’s hash rate fell by 30% over the three subsequent days, however, the price remained relatively stable.

Billionaire Paul Tudor Jones declares himself bullish on bitcoin

Paul Tudor Jones, billionaire hedge fund manager told investors he sees bitcoin as a hedge against the inflation caused by central bank quantitative easing strategies.

“The best profit-maximising strategy is to own the fastest horse,” Jones wrote in a market outlook paper titled ‘The Great Monetary Inflation’. He continued, “If I am forced to forecast, my bet is it will be Bitcoin.”

The news came just as bitcoin breached $10,000 for the first time since February.

And…

April was a good month for bitcoin ATM deployment as hundreds were installed across the globe throughout the month. Ukraine’s energy minister announced it was looking to use excess electricity to mine bitcoin. And Reddit introduced a new system to reward “quality posts and comments” with ERC-20 tokens based on the Ethereum blockchain.

Price check

BTC month-open price: $8,672.78

BTC month-close price: $9,461.06

ETH month-open price: $207.90

ETH month-close price: $230.98

June

Ethereum fee transaction blunder

A standout moment for the community this year came in the form of a rather embarrassing and unfortunate error made by one unknown Ethereum user. The user accidentally sent not one but TWO transactions with excessively large transaction fees in a single day.

The user kicked off their big giveaway by paying $2.6 million in fees to send just $133 of Ethereum. If this wasn’t enough, they made a second, similar mistake just hours later. This time, the user was sending $86,000, but still managed to send the same transaction fee of $2.6 million. Ouch.

Reports released that Trump told the treasury to “go after bitcoin”

It was reported in June that the now former-president of the United States, Donald Trump, allegedly told US Treasury Secretary, Steven Mnuchin “Don’t be a trade negotiator,” and to instead “Go after Bitcoin [for fraud]!”

It appears the conversation took place in May 2018, around the same time the crypto community celebrated Bitcoin’s 33% rise against the dollar. Is anyone going to tell him?

And…

PayPal started adding crypto and blockchain-expert job ads to their website, foreshadowing the platform’s move to facilitate bitcoin purchases. Elsewhere, Bitcoin.com.au struck a deal with Australia Post to allow Australian residents to purchase Bitcoin at its 3,500 national post offices.

Price check

BTC month-open price: $9,463.61

BTC month-close price: $9,137.99

ETH month-open price: $230.86

ETH month-close price: $226.31

July

Twitter comes under attack

An easy reference point for the middle of year could be Twitter suffering its most wide-reaching attack. Hackers hijacked around 30 high-profile figures’ accounts, including former presidents and tech giants. Fortunately, they didn’t bother starting World War 3 and instead decided to carry out a pretty rudimentary crypto giveaway scam.

Ethereum becomes the most-used blockchain

Ethereum surpassed Bitcoin as the network that settles the most value per day. In other words, the dollar value of the transactions of both Ether (ETH) and the tokens built on it is now higher than that of Bitcoin.

This was primarily down to the rise of Decentralised Finance (DeFi) – specifically stablecoins.

And…

The total sales of blockchain-based non-fungible tokens (NFTs) exceeded $100 million for the first time since their inception in 2017. The Bank of England governor formally announced they were contemplating a digital currency.

Price check

BTC month-open price: $9,145.99

BTC month-close price: $11,323.47

ETH month-open price: $226.13

ETH month-close price: $345.55

August

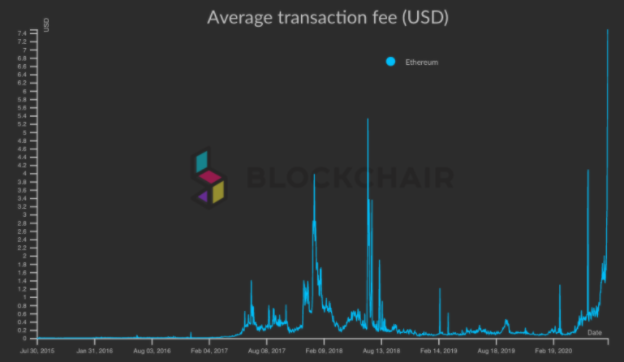

Ethereum transaction fees hit an ATH of $6.87m

Thanks once again to the DeFi boom, Ethereum gas fees (transaction fees) hit an all-time high of $6.87 million. It seems folks are willing to do whatever it takes to get their transactions completed amidst the frenzy.

MicroStrategy announce purchase of $250m in bitcoin

MicroStrategy’s CEO Michael Saylor is now a familiar name in the bitcoin space, and it all began in August when he took $250 million from the company’s cash reserves to buy 21,454 BTC.

On the decision, he commented: “Bitcoin is digital gold — harder, stronger, faster, and smarter than any money that has preceded it. We expect its value to accrete with advances in technology, expanding adoption, and the network effect that has fueled the rise of so many category killers in the modern era.”

And…

Authorities arrested the 17-year-old mastermind behind the Twitter hack. Despite pleading not guilty, he remains in jail with bail set at $725,000. JP Morgan told us what we already know: younger investors are more interested in bitcoin while their older counterparts prefer buying gold.

Price check

BTC month-open price: $11,322.57

BTC month-close price: $11,680.82

ETH month-open price: $345.80

ETH month-close price: $435.08

September

Luno joins Digital Currency Group (DCG)

In early September, we announced our acquisition by New York-based Digital Currency Group (DCG). As the company’s earliest investor, DCG has been with Luno in some form or other for nearly seven years now. Luno’s mission to upgrade one billion people to a new and better financial system by 2030 is about to be turbo-charged with DCG on board.

Kraken takes first steps to becoming the first US crypto bank

In mid-September, Kraken announced the state of Wyoming had granted the exchange a license to create a crypto bank in the state, dubbed Kraken Financial.

???*BREAKING*???@Krakenfx just won approval to create America’s first crypto bank.

World, please meet Kraken Financial. Kraken Financial, world.

Wait, a what? Kraken is a BANK?! How did this even happen?!

Allow me to threadeth. ?

— Marco Santori (@msantoriESQ) September 16, 2020

Kraken would be the first US crypto exchange to create a bank, more specifically referred to as a “Special Purpose Depository Institution”. This means Kraken can hold custody over digital assets, operate payment systems, and allow customers to switch between fiat and crypto with ease.

Ethereum miners generate ATH fees

Ethereum miners recorded their highest-ever earnings in September with a grand total of $166 million.

#Ethereum miners made a total of $166 million from transaction fees in September – a new ATH.

That’s an increase of 47% compared to the previous record high in August.

In comparison: #Bitcoin miners made $26M from fees – a difference of more than 6x!https://t.co/OkbOGhN4TT pic.twitter.com/f0NB94F9nd

— glassnode (@glassnode) October 1, 2020

That figure was 3.7 times higher than the previous record amount, set during December 2017 and January 2018 when crypto prices skyrocketed.

And…

Michigan made history as one of the first virtual conventions in the US to successfully utilise blockchain voting. Payments giant Mastercard announced it had launched a platform enabling central banks to test how proposed central bank digital currencies (CBDCs) would work in real life.

Price check

BTC month-open price: $11,679.32

BTC month-close price: $10,784.49

ETH month-open price: $434.87

ETH month-close price: $359.94

October

Square places big bitcoin bet

Financial services giant Square announced that it has acquired 4,709 BTC at the price of $50 million – representing around 1% of the company’s total assets.

Square’s Chief Financial Officer, Amrita Ahuja, said in a statement: “We believe that bitcoin has the potential to be a more ubiquitous currency in the future. As it grows in adoption, we intend to learn and participate in a disciplined way.”

PayPal launches bitcoin offering

After months of rumours, PayPal officially announced it would start allowing users to buy bitcoin via its app and website. Many called it a decisive moment for bitcoin adoption.

Grayscale reveals record-breaking quarter

In mid-October, all eyes were on institutional investors as they continued to demonstrate bullish bitcoin attitudes. Grayscale announced it had raised $1.05 billion for investment projects during Q3 – marking the largest inflow of funds from investors during a single quarter in Grayscale’s history. Up until mid-October, Grayscale’s total investments sat at $2.4 billion – double the total of $1.2 billion invested in Grayscale products between 2013 and 2019.

And…

Bitcoin set a record for 67 days closing above $10,000. The World Economic Forum named XRP as the “most relevant asset in the CBDC space.” And crypto’s favourite crazy uncle, John McAfee was arrested in Spain on allegations of tax evasion.

Price check

BTC month-open price: $10,795.25

BTC month-close price: $13,780.99

ETH month-open price: $360.31

ETH month-close price: $386.59

November

Bitcoin, Ethereum and XRP prices soar

November was a breakout month for all three cryptocurrencies, with bitcoin surpassing its all-time high. The month kicked off with one BTC setting you back $13,780.99, soaring to its high of $19,749.26 at the end of the month.

BTC wasn’t alone in the spotlight as Ethereum started the month off with a tentative $386.59 per ETH, finishing strong at $614.84. Many attributed its increase to the long-awaited ETH 2.0 upgrade, which promises to solve a fair few of the network’s current issues.

Ripple’s XRP also saw gains, having gone from one of the worst-performing assets in 2018 and 2019 to one of the best altcoin investments this year. At the beginning of the month, $0.23 would have gotten you one XRP, while at the end it would have been $0.66.

A bull has no name: Maisie Williams bets on bitcoin

It hasn’t been only institutional investors looking to get in on the crypto action – Game of Thrones actress Maisie Williams, best known for her role as Arya Stark, indicated her interest in bitcoin via a Twitter poll.

should i go long on bitcoin ?

— Maisie Williams (@Maisie_Williams) November 16, 2020

thank you for the advice. i bought some anyway. https://t.co/mhZiVoN6vy pic.twitter.com/XeU1KkfuXy

— Maisie Williams (@Maisie_Williams) November 17, 2020

Welcome to the community, Maisie!

And…

November saw bitcoin hitting a number of pretty monumental records. The number of active addresses on the Bitcoin blockchain reached 1.18 million – a similar high to what we saw during its legendary bull run. Bitcoin’s market capitalisation broke its previous all-time high with its market cap having exceeded the $328.89 billion seen on 16 December 2017, currently sitting at $355,563,938,256, with a price of $19,142 per BTC. And to top it off, the number of bitcoin whales also hit an all-time high.

The number of #Bitcoin whales (entities holding at least 1,000 $BTC) has reached a new ATH after more than 4 years.

An entity is a cluster of network addresses controlled by the same individual/institution.

Chart: https://t.co/rK7rYG55SY pic.twitter.com/kZbFEJR734

— glassnode (@glassnode) November 25, 2020

Price check

BTC month-open price: $13,780.99

BTC month-close price: $19,625.84

ETH month-open price: $386.59

ETH month-close price: $614.84

December

Bitcoin hits new all-time high

After threatening to break $20,000 for several weeks, the bitcoin price set a new all-time high on the 16 December. The price of 1 bitcoin is now over $23,000 at time of writing (17 December 2020). Incidentally, it comes almost exactly 3 years to the day that the last all-time high was set on 17 December 2017 of $20,089.

Facebook’s Libra seized the day with a new name

What was once Libra has now been rebranded to “Diem”, as the association attempts to gain regulatory approval by highlighting the project’s independence from Facebook.

Stuart Levey, CEO of the Diem Association said the project’s name switch is part of a move to showcase a simpler, revamped structure. “The original name was tied to an early iteration of the project that received a difficult reception from regulators. We have dramatically changed that proposition.”

And…

MicroStrategy bought another 2,754 BTC at $19,427 each – worth a total of $50m.

MicroStrategy has purchased approximately 2,574 bitcoins for $50.0 million in cash in accordance with its Treasury Reserve Policy, at an average price of approximately $19,427 per bitcoin. We now hold approximately 40,824 bitcoins.https://t.co/nwZcM9zAXZ

— Michael Saylor (@michael_saylor) December 4, 2020

Price check

BTC month-open price: $19,633.77

BTC month-close price: TBD

ETH month-open price: $

ETH month-close price: TBD

Phew, that’s a wrap! We’ve all been through a lot this year – what was your standout crypto moment? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press