April Economic Calendar: Rates, inflation and the Bitcoin Halving

It’s been an eventful month in the crypto market, with Bitcoin soaring to a new all-time high of $73,600. Many other cryptocurrencies rode the apparent wave of optimism, but it wasn’t all smooth sailing, with bouts of volatility throughout March. With the Bitcoin halving set to take place later in April, the upcoming month promises to deliver as much, if not more excitement. But where will the price go?

? March recap

*Past performance isn’t indicative of future performance.

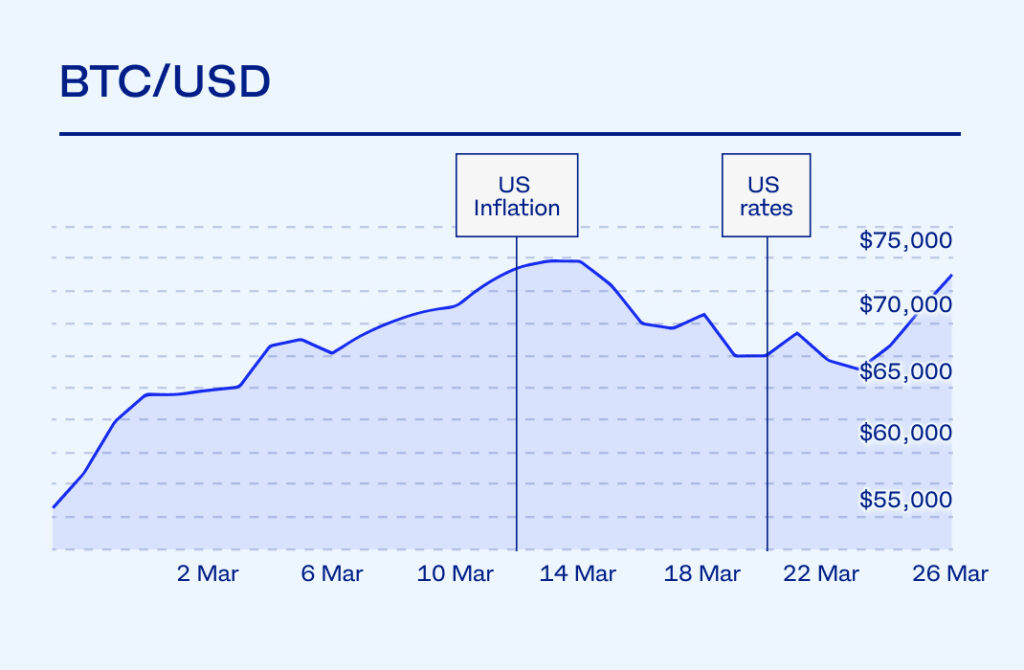

March started on a good note for crypto investors as the price of Bitcoin quickly surged from around $50,000 in the last week of February to $60,000 in the first week of March. The market leader tentatively tested the all-time high of $69,000 during this period but failed to gain support and quickly dipped to $61,000. It was pretty much upward from there for Bitcoin until it passed its previous all-time high on 10 March. The price continued to surge to post a new high of $73,600 on 14 March.

Volatility was the order of the day for the rest of the month, as much of the narrative was driven by dynamics in the spot Bitcoin ETF markets, and some notable large sales in crypto markets as investors took profits following the new Bitcoin high, according to market analysts.

A breakout rally later in the month was looking promising for Solana as its price rose above the $200 level for the first time since November 2021. Following a similar pattern to Bitcoin, the rally quickly turned south, sending the price back down to around $170, where it closed out the month. Despite the ups and downs, most cryptocurrencies finished March significantly higher compared to the start of the month. Solana was up more than 60% over 30 days, while others such as Avalanche, Uniswap, and Maker showed gains of more than 50%.

The Fed announced that rate cuts are scheduled for later in the year, despite inflation numbers again coming in higher than expected. Jerome Powell, Chair of the Fed, said the hot numbers “haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road towards 2%.” US stocks rallied to new all-time highs following the announcement. The question is whether crypto markets will be further buoyed when the Fed eventually starts trimming rates.

Investors will also be watching how the Bitcoin Halving, expected to happen around 21 April, impacts price. Historically, volatility usually followed these halving events with notable price rallies lagging the event by a few months. But with an unprecedented price high preceding the halving, it’s anyone’s guess how this one will play out.

What’s on in April?

What? US ISM Services Purchasing Managers’ Index (PMI)

? When? Wednesday, 3 April

Relevance? The US ISM Services PMI measures the health of the American services sector, which includes industries like healthcare, retail, and hospitality. Investors pay close attention to these numbers because the services sector makes up a significant portion of the US economy. Will the US economy continue to show strong numbers?

What? US unemployment rate and non-farm payrolls

? When? Friday, 5 April

Relevance? US unemployment numbers serve as a critical indicator of the overall health of the US economy. The US economy continues to post strong numbers despite high interest rates dampening consumer spending power.

What? US inflation rate numbers

? When? Wednesday, 10 April

Relevance? The inflation rate in the US will decide the Fed’s plans with interest rates. Inflation remains stubbornly high in the US and other economies around the world.

What? FOMC minutes

? When? Wednesday, 10 April

Relevance? The Federal Open Market Committee (FOMC) decides whether to raise or cut interest rates in the US. The FOMC minutes generally provide insight into the Fed’s thinking about interest rates in their previous meeting.

What? ECB inflation rate numbers

? When? Thursday, 11 April

Relevance? The European Central Bank (ECB) will make their interest rate decision, taking into account the current situation in the European Union as well as also considering what the FOMC discussed in their March meeting.

What? Bitcoin halving

? When? Sunday, 21 April

Relevance? The Bitcoin halving happens roughly every four years, with the next one expected around 21 April this year. The first halving was followed by price increases of more than 8,000% at the top of the cycle. Bitcoin’s value also increased roughly 3,000% at the peak of the second halving cycle in 2016, and the last halving in 2020 was followed by a bull run that topped out at an all-time high price of around $69,000. This year’s halving is already unprecedented by Bitcoin setting a new all-time high before the halving, so it’s anyone’s guess how this will play out.

Read more: What is the Bitcoin halving?

*This information is not intended to be nor does it constitute financial, tax, legal, investment or other advice; nor is it a call to trade. The information is intended as general market commentary for information purposes only. Before making any decision or taking any action regarding your finances, you should consult a qualified Financial Advisor.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press