April in Review

With most of the world in some form of lockdown, it’s been a tumultuous time for the financial world. As April draws to a close, we take a look back at what made headlines this past month.

Seven crypto firms targeted by 11 lawsuits

The beginning of April saw 11 class-action lawsuits being dished out to a number of cryptocurrency exchanges including Binance, KuCoin, BiBox, BitMEX and parent company HDR Global Trading Limited, as well as Block.one, Quantstamp, KayDex, Civic, BProtocol, Status, and the Tron Foundation.

The lawsuit alleges numerous exchanges have sold unlicensed securities without broker-dealer licensing and engaged in market manipulation. The plaintiffs have also argued many token issuers selectively withheld information from investors to ensure it would not be apparent the tokens comprised securities until well after the token sale.

BIS’ bulletins and an update on CBDCs

The Bank of International Settlements (BIS) reported unprecedented concerns about viral transmission via cash as a result of the COVID-19 pandemic, despite the fact “scientists note that the probability of transmission via banknotes is low when compared with other frequently-touched objects.” They found that central banks are increasingly feeling the pressure to work on CBDC developments as the public’s relationship with cash, among other things, is ramping up.

- Read more about the status of China, Sweden, and France’s CBDC projects.

- Starbucks and McDonalds set to test digital Yuan

Satoshi, is that you?

Charles Hoskinson, CEO of IOHK and co-founder of Ethereum, suggested a new method that could be used to work out who an author is based on their writing style. He claims the method, “stylometry”, could be applied to unveil the true identity of Bitcoin’s alleged creator, Satoshi Nakamoto.

As long as the code was written entirely by Nakamoto, Hoskins elaborates, “you can apply stylometric techniques to that code and apply it to all the open-source projects that have ever been written and there’s a very high probability that you’re going to find a match between that code and other code.”

More importantly, he raised the age-old question of whether or not it even matters who Satoshi is.

China announces Baidu and Tencent executives to join its national blockchain committee

The committee is being set up to work on setting industrial standards for blockchain technology. It’s chaired by Ministry of Industry and Information Technology (MIIT) deputy minister Chen Zhaoxiong, and includes five vice presidents – all government staff. In total, the committee has 71 members, drawn from across 15 notable companies and universities, including Baidu, Tencent, Huawei, Peking University, Tsinghua University, Fudan University, and more.

The announcement follows a recent report by New York-based research firm, CB Insights, which shows that Chinese startups are starting to substantially increase their blockchain-related investments. In 2019, the percentage of deals enacted by US startups fell to 31%, while China’s market share grew to 22%.

EU Parliament says Europe should move to cover regulatory ‘blind spots’ for crypto assets

The European Parliament Research Service has published a new study in which they have highlighted a number of areas for concern when it comes to crypto.

In the report, researchers argue that the Fifth Anti-Money Laundering Directive (AMLD5) framework the EU adopted in May 2018 is now outdated when compared to higher international standards such as that of the Financial Action Task Force (FATF). They note that there were now some legislative “blind spots” concerning the supervision of crypto assets in the European Union, and recommended the creation of a new regulatory body.

“Newly mined coins are by definition ‘clean’, so if someone (e.g. a bank) is willing to convert them into fiat currency or other crypto-assets, the resulting funds are also clean. A first regulatory step could be to try to map the use of this technique and subsequently, if it effectively proves an important blind spot, to consider appropriate countermeasures.”

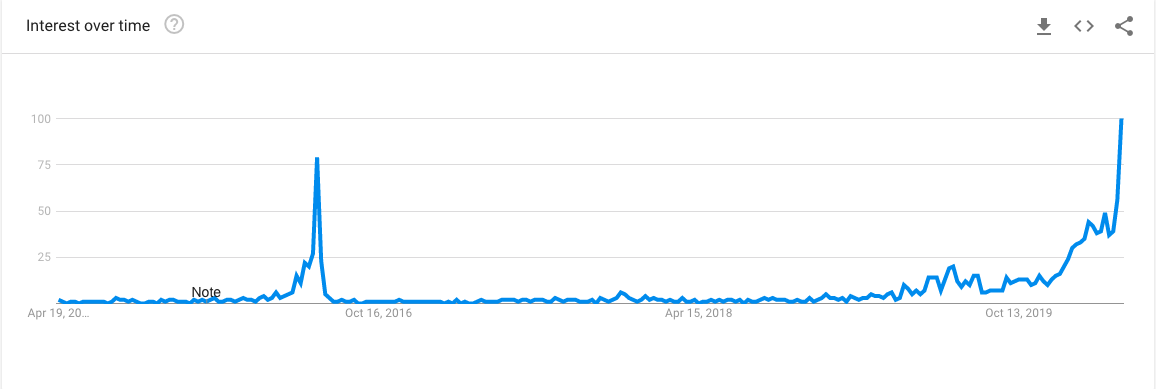

Halving interest sees record increase

The buzz around the forthcoming Bitcoin “halving” next month seems to be hitting peak levels. Data from Google Trends as of April 14 indicates that this year’s peak of interest in the event is 16% higher than back in 2016, the last time that halving occurred on the network.

Libra’s new cryptocurrency gets watered down as it attempts to woo regulators

The Facebook-founded Libra Association has revised its planned digital currency after hitting regulatory hurdles.

In a series of tweets on Thursday morning, David Marcus, co-creator and a board member of Libra and head of Facebook digital wallet subsidiary Calibra, said that Libra now plans to offer stable coins backed by just one nation’s currency, in addition to its coins backed by multiple currencies. That means some coins offered by the group would serve as the equivalent value of a US dollar or a Euro, for example.

Excited with the progress of @Libra_ in the last 9 months. I keep on thinking about all the people and small businesses that could benefit from the Libra Network already being operational — especially now during these times of unprecedented hardship. 1/8

— David Marcus (@davidmarcus) April 16, 2020

Could blockchain ‘Immunity Passports’ get the world back to work?

Oracle has joined the slew of tech companies working on a so-called immunity passport built on the blockchain.

They have partnered with Vottun, a company specialising in the certification and traceability of data on the blockchain, to release a digital credentials system that could enable employees currently in lockdown to go back to work.

Rohan Hall, Chief Executive Officer (CEO) at Vottun, told Cointelegraph the passport “can be verified at any time using cryptography by any mobile phone that can read a QR code”. Credentials “are securely stored” and “immutable” and the system is as simple as using a mobile boarding pass for a flight.

South Africa looks to introduce crypto regulatory framework

South Africa’s financial regulators have recommended that cryptocurrency “remain without legal tender status”, in a roadmap outlining what could become the nation’s first comprehensive crypto laws.

“Crypto assets and the various activities associated with this innovation can no longer remain outside of the regulatory perimeter,” said the IFWG, whose members include the South African Reserve Bank, the Financial Sector Conduct Authority and the National Treasury, among others. “Clear policy stances” must be formed.

Crypto asset manager Grayscale reports record inflows despite economic slump

Multi-billion dollar crypto-focused investment firm, Grayscale reported the largest quarterly influx of inflows in its history on Thursday.

In the first quarter of 2020, Grayscale raised $503.7 million across its family of products, according to its quarterly report. The numbers have been taken as a potential sign that at least some corners of the investment community have looked to crypto during a tumultuous market period.

The $2.2 billion asset manager also reported inflows surpassed $1 billion over a 12-month period, the company’s first billion-dollar year. The majority of demand came from institutional investors, who made up 88% of total investments in the quarter.

Akoin’s kingdom

Akon, the rapper-turned-crypto entrepreneur who’s building an entire ‘sustainable eco-tourism smart city’ in Senegal, has announced that yet another African city will run on his cryptocurrency, Akoin.

Akoin has secured a deal to become the main currency of the Mwale Medical and Technology City (MMTC) – a $2 billion technology city in Western Kenya that’s home to over 35,000 people and thousands of businesses, all of which will be using Akoin.

Akoin, which is based on the Stellar blockchain, is currently in beta and will launch later this year.

MicroBT launches three new Bitcoin miners ahead of halving

MicroBT, a Chinese Bitcoin miner manufacturer has launched three new machines, positioning themselves as worthy rivals to industry leader, Bitmain.

MicroBT COO Jianbing Chen announced the launch of WhatsMiner M30S+, M30S++ and the M31S+ in an online conference on Friday. Chen asserted the Bitcoin mining hardware market has now entered the “3X era”, in reference to three new features of the new WhatsMiners: “low power consumption ratio, high stability, and one-year long warranty service.”

MicroBT reported that the power consumption ratio of WhatsMiner M30 series would be lower than 50W/T (watts per terahash), emphasising that a lower W/T ratio helps Bitcoin miners with a higher gross margin.

BSN’s ‘ChinaChain’ launches globally

China’s long-awaited Blockchain Services Network (BSN), aka ChinaChain, was finally opened for global commercial use yesterday. Six months after its beta test, Chinese government officials and various heads of organisations gathered in Beijing to announce the public launch.

The BSN is a global infrastructure to help blockchain projects create and run new blockchain applications for a lower cost. The BSN also aims to accelerate the development of smart cities and the digital economy. The network is financed and built by a consortium of China’s biggest telcos and banks, including China Mobile, UnionPay and State Information Center.

The nodes connect 128 cities across China, with 7 in place internationally, including Paris, Sydney, San Paulo, Singapore, Tokyo, Johannesburg and California (no city was specified.) It’s got promise, but will it fulfil it?

Litecoin to join the Luno family

Litecoin is joining the Lunoverse on 11 May, bringing its lite features to our Exchange and Instant Buy/Sell. We’re working hard to make sure everything is ready for you to be able to trade, buy and sell Litecoin the safe and easy way. That means making sure our multi-signature hot wallet and storage are ready, as well as doing our security checks and coordinating multiple layers of encryption.

*Litecoin will not be available in Malaysia at this time, we are currently working with local regulators.

Got a few minutes? Take a trip down memory lane and reminisce on previous Bitcoin Halvings’ hype

The Bitcoin halving/halvening – whatever you call it, there’s no doubting it’s one of the most anticipated events in the crypto calendar this year. Here’s everything you need to know.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press