Daily market update: Bitcoin surges past $35,000 to new all-time high ?

If you thought the dip at the beginning of this week spelled the end of the bull market, you, my friends, were very much mistaken. This morning saw Bitcoin storm back to another new all-time high of over $35,000, charging through resistance like tanks through milk. This puts Bitcoin among the top 10 assets by market capitalization, above the likes of Alibaba and Samsung. Tesla – you’re next.

Bitcoin wasn’t the only one tearing it up, though. Ether is still going strong, coasting just above the $1,100 mark. It might be ‘lockdown’ in society, but crypto is very much open for business. Enjoy the ride. Enjoy it carefully, that is – still make good decisions, don’t go too crazy.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 09:30am GMT.

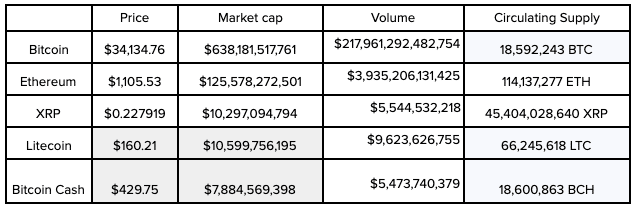

Crypto markets at a glance

What bitcoin did yesterday

We closed yesterday, 5 January, 2020, at a price of $33,992.43 – up from $31,971.91 the day before. That’s the highest daily closing price in Bitcoin’s young but magnificent history. It’s the fourth day in a row that bitcoin has closed over $30,000.

The daily high yesterday was $34,437.59 and the daily low was $30,221.19.

This time last year, the price of bitcoin closed the day at $7,411.32 and in 2019 it was $3,845.19.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Market capitalisation

Bitcoin’s market capitalisation is currently $643,541,344,617 – up from $577,566,819,840 yesterday. This is good enough to make BTC the ninth-most-valuable asset in the world, according to Asset Dash. It puts it above the likes of Samsung, Berkshire Hathaway, and even Alibaba, which currently has a market cap of $622.54 billion.

Bitcoin is also considerably outshining other global financial networks, with VISA’s market cap sitting at a lowly $472.86 billion and Mastercard’s at $346.35 billion.

Bitcoin volume

The volume traded over the last 24 hours was $217,961,292,482,754 – up from $82,030,775,649 yesterday. This is up there with the highest 24-hour trading volumes on record for bitcoin. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 69.66%.

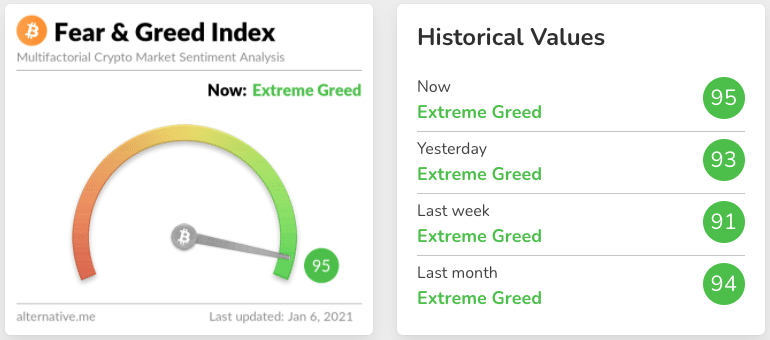

Fear and Greed Index

Unsurprisingly, the sentiment remains in Extreme Greed territory and is back up to 95 from 93 yesterday. The last time the sentiment was not in Extreme Greed was 5 November, 2020. The price of one bitcoin on that day was $15,706.40.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.39. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 83.70. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

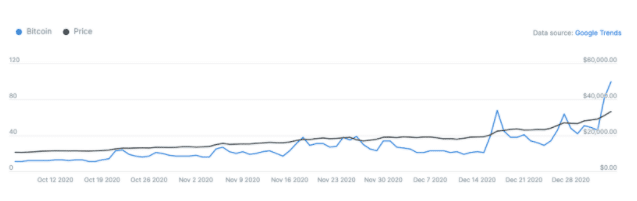

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 100 – taken from 3 January.

Convince your Nan: Soundbite of the day

Today, there is significantly more demand for bitcoin than there is supply. About 900 new bitcoin are mined daily, and three market participants alone — PayPal, Square, and Grayscale Bitcoin Trust — purchase considerably more than 900 bitcoin a day because of high investor demand. If this dynamic continues, and we believe it will, much higher prices lie ahead for the dominant cryptocurrency.

– Anthony Scaramucci and Brett Messing

What they said yesterday…

Mark Cuban’s run for president on a Bitcoin platform is… bullish news?

I’ll run if BTC gets to $1m AND we can get commitments to donate 350 BTC to the Treasury each of the 4 yrs so that we can give 1 satoshi to every citizen each yr, that they must hold for 10 years. How’s that sound 🙂 https://t.co/dW0e7FJ91m

— Mark Cuban (@mcuban) January 5, 2021

“First they ignore you, then they laugh at you, then they fight you, then you win”

JP Morgan now wants to sell you bitcoin

….

you can’t make this stuff up pic.twitter.com/tp6rFng1jM

— Meltem Demirors (@Melt_Dem) January 5, 2021

The bulls have Tesla in their sights…

With #Bitcoin at $35k, soon 1 $BTC = 1 Tesla. Few understand this. @elonmusk pic.twitter.com/n8iOrOwXb0

— Samson Mow (@Excellion) January 6, 2021

The celebrities are coming…

Bitcoin?

— DT (@DTranquill) January 5, 2021

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press