Daily market update: Investors increasingly choosing Bitcoin over gold according to Deutsche Bank

The bitcoin price continues to hit yearly-highs and now we’re seeing a glut of celebrities joining the party. Earlier this week it was Games of Thrones star Maisie Williams, now it’s rapper and international superstar, Logic. What a time to be alive. Who next?

Here’s your daily market update. If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Bitcoin price

We closed yesterday, 19 November, 2020, at a price of $17,817.09– up from $17,804.01 the day before. That’s an increase of 0.07%. It’s the highest closing price since 18 December, 2017. At time of writing, the price of one bitcoin is $18,156.90.

The daily high yesterday was $18,119.55, while the daily low was $17,382.55. This time last year, the price of bitcoin was $8,206.15 and in 2018 it was $4,871.49.

We’re 11.31% below bitcoin‘s all-time high of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.7% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $36,985,055,355, down from $49,064,800,278 the day before. High volume indicates that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $330,475,167,134, up from $330,218,014,062 the day before. That’s the highest it’s ever been.

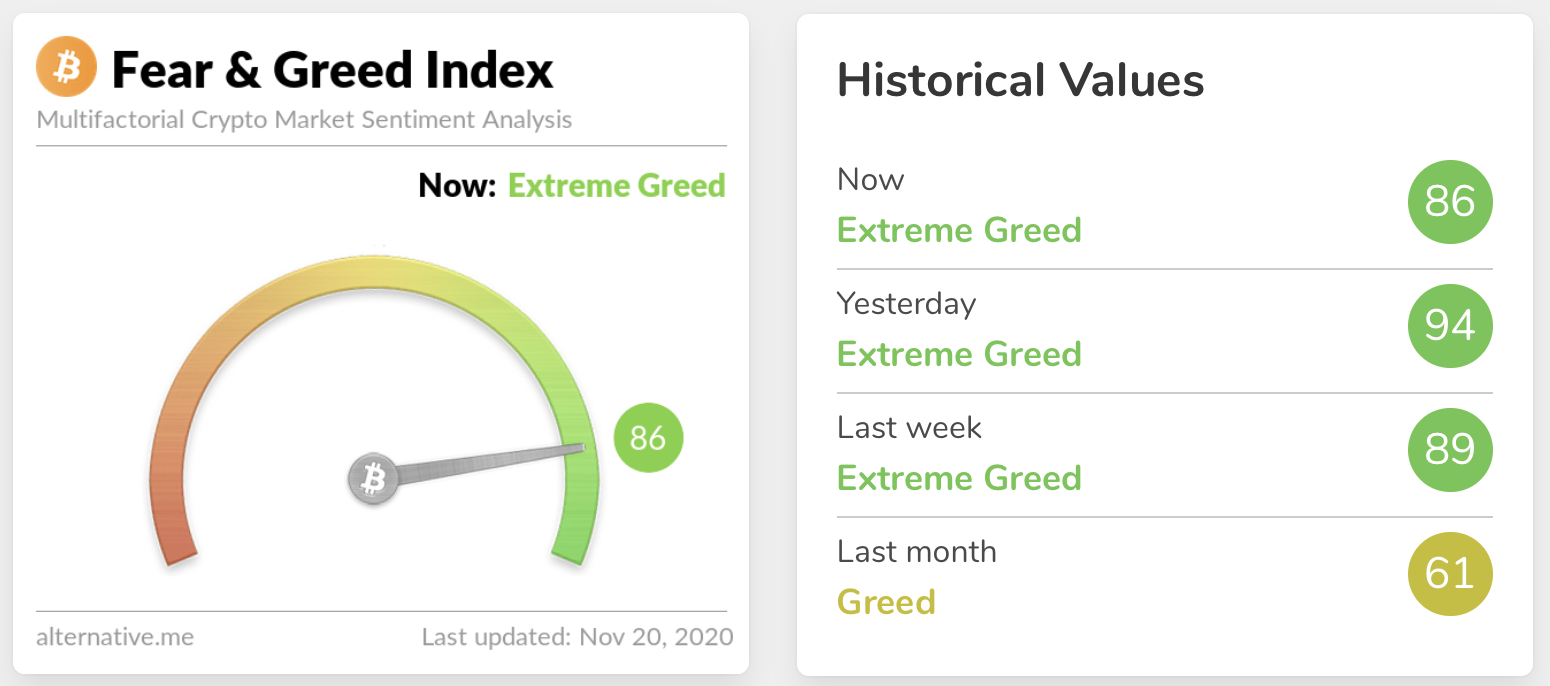

Fear and Greed Index

The sentiment is still in Extreme Greed again at 86 today. This is a record length of time that the index has spent in greed and it’s important to note that the index doesn’t stay this high very often, so a pullback would not be surprising. Equally, the index has only been around since 2018 and this bull run has already exhibited some curious behaviours in comparison with those in the past.

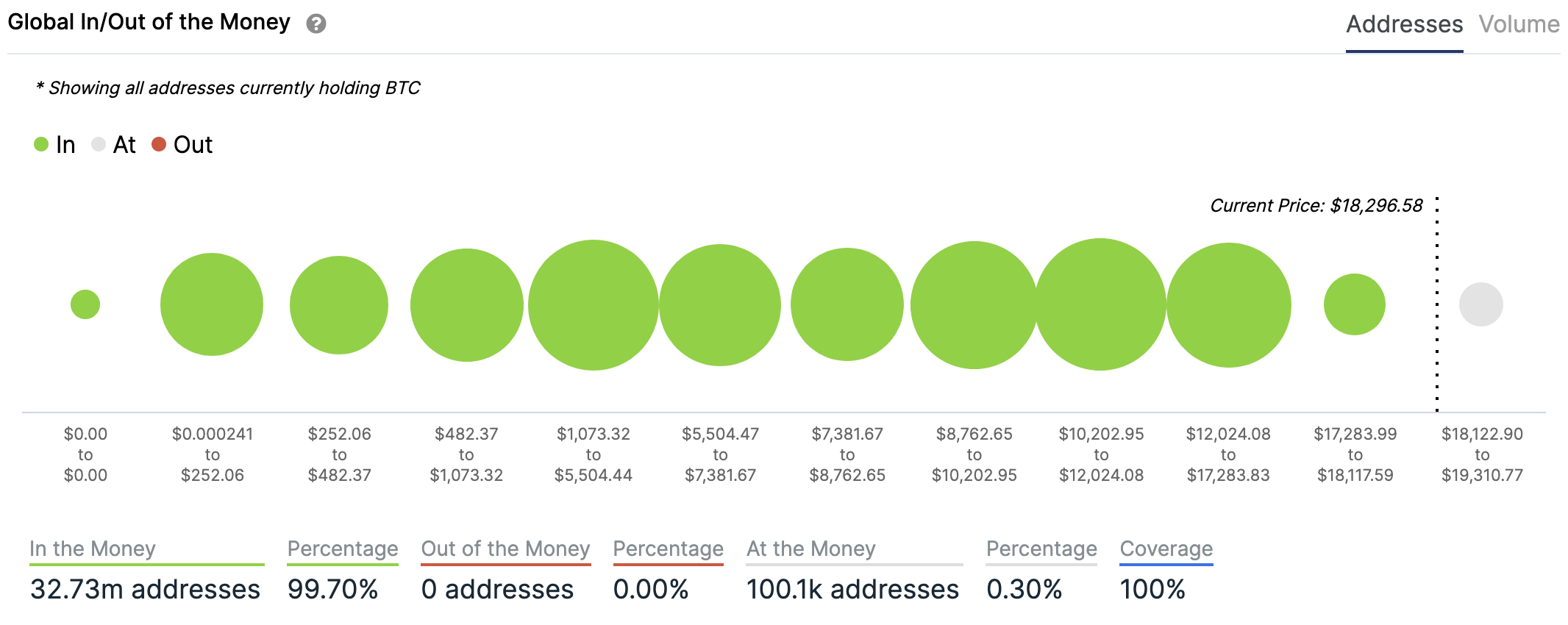

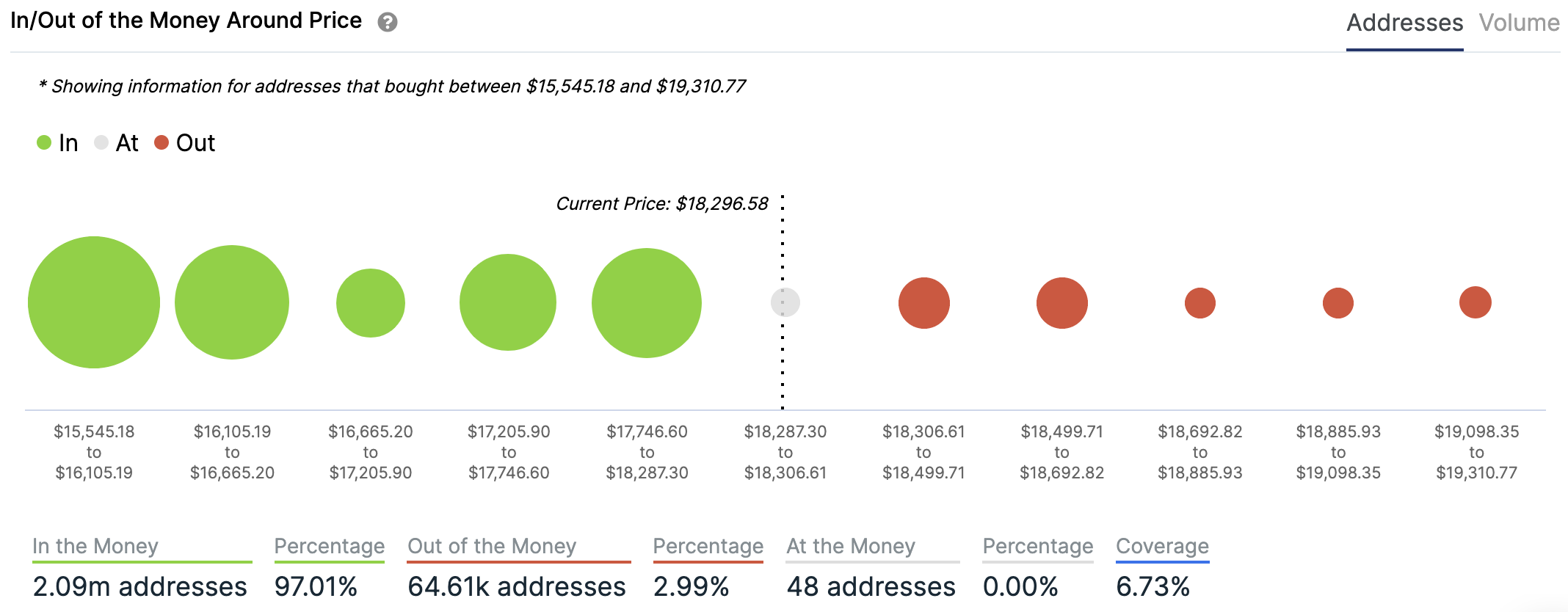

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Charts provided by IntoTheBlock.com

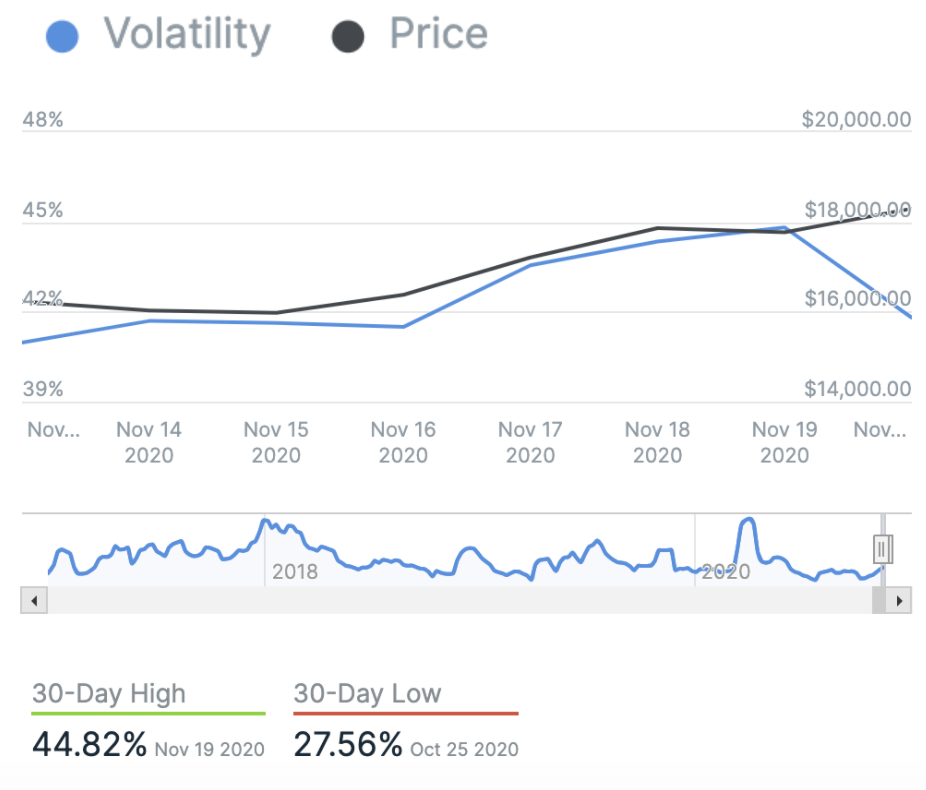

Volatility

Annualised price volatility using 365 days.

Charts provided by IntoTheBlock.com

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 67.04. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 82.65. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

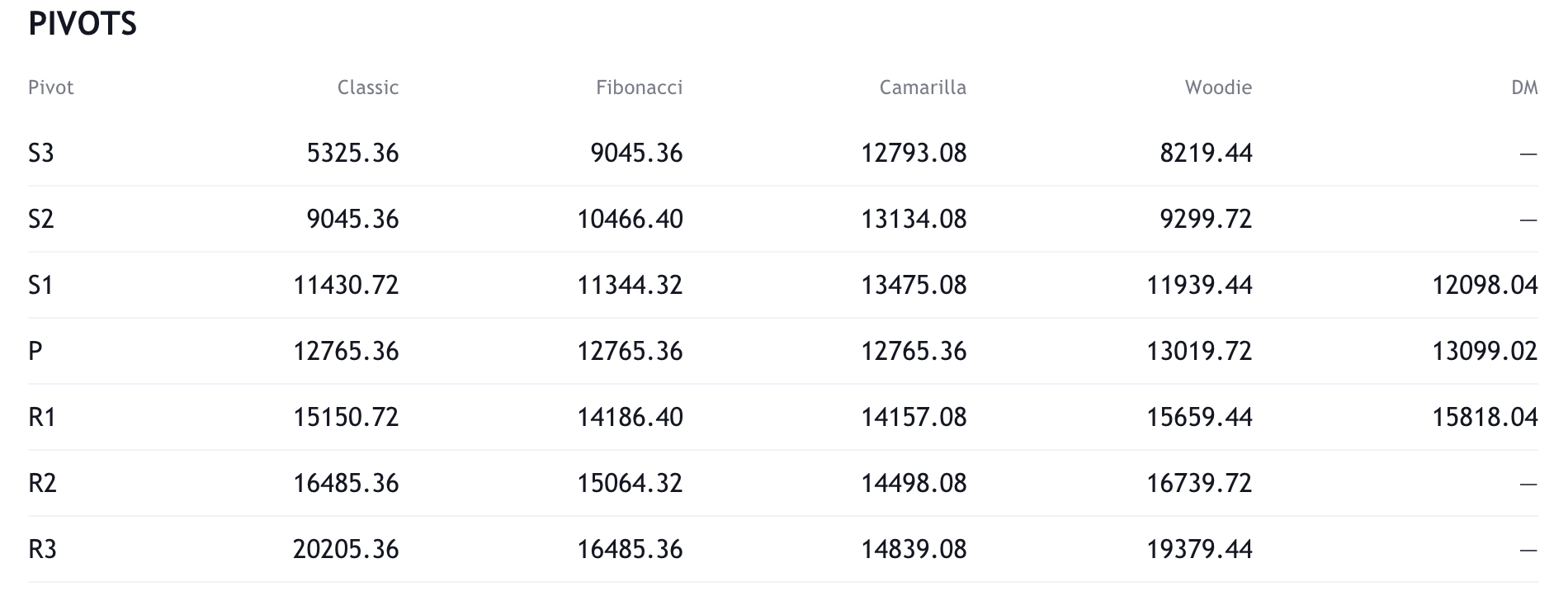

Resistance and support

What they said yesterday…

Deutsche Bank: Investors Increasingly Choose Bitcoin Over Gold to Hedge Dollar Risk, Inflation https://t.co/v4c4ew04Dn

— Bitcoin News (@BTCTN) November 20, 2020

#Logic says he bought $6M worth of Bitcoin last month! ?? @Logic301 pic.twitter.com/PYxm5qs2fo

— WORLDSTARHIPHOP (@WORLDSTAR) November 20, 2020

I’m starting to get 2016 Vibes #Bitcoin

— PierreRochard.com (@pierre_rochard) November 20, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press