Daily market update: Bitcoin celebrates 12th birthday with push over $34,000

On 3 January, 2009, the pseudonymous creator of Bitcoin, Satoshi Nakamoto, launched the ‘Genesis Block’ and laid the foundations for a new financial order. Yesterday, the original, the undefeated, aaaand stiiiill the largest cryptocurrency by market cap, Bitcoin, celebrated by surging to yet-another record-high price of over $34,600. The move means the price of bitcoin has more than quadrupled over the past year. Will it do the same again in 2021?

Bitcoin wasn’t the only big story yesterday, though. Ethereum saw a return to over $1,000 and alts everywhere were on a pump. The news cycle lately has been dominated by talk of institutional investment and Bitcoin, but with CME set to launch Ether futures in February, could the major players be set to shine their lights elsewhere? Who’ll be the biggest beneficiary of a new alt season?

It’s definitely tempting to get swept up in all this excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 09:00am GMT.

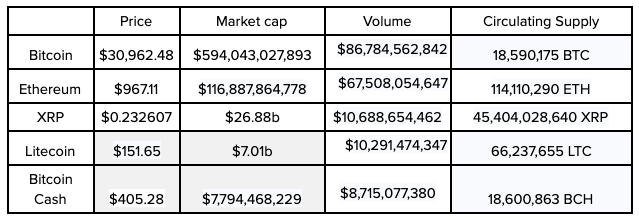

Crypto markets at a glance

What bitcoin did yesterday

We closed yesterday, 3 January, 2020, at a price of $32,782.02 – up from $32,127.27 the day before. That’s the highest closing price in Bitcoin’s history.

The daily high yesterday was $34,608.56 and the daily low was $32,052.32. That’s Bitcoin’s highest daily high and highest daily low ever. It’s also the first time we’ve ever closed out a day with a lowest price of over $30,000.

This time last year, the price of bitcoin closed the day at $7,344.88 and in 2019 it was $3,836.74.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Market capitalisation

Bitcoin’s market capitalisation is currently $594,043,027,893. To put that into context, Berkshire Hathaway’s market cap is currently $543 billion and VISA’s is $511 billion. Tesla’s is $668 billion. We’re coming for you, Elon.

Bitcoin volume

The volume traded over the last 24 hours was $86,784,562,842. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 62.60%.

Fear and Greed Index

The sentiment remains in Extreme Greed territory at 94, up from 93 yesterday. The last time the sentiment was outside Extreme Greed was 5 November, 2020. It’s important to remember that the index doesn’t stay this high very often and a correction could be on the cards. Equally, it’s now been almost 2 months that we’ve been saying that, so it might be time to re-evaluate some of our ingrained ideas around this particular metric.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.40. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 77.93. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

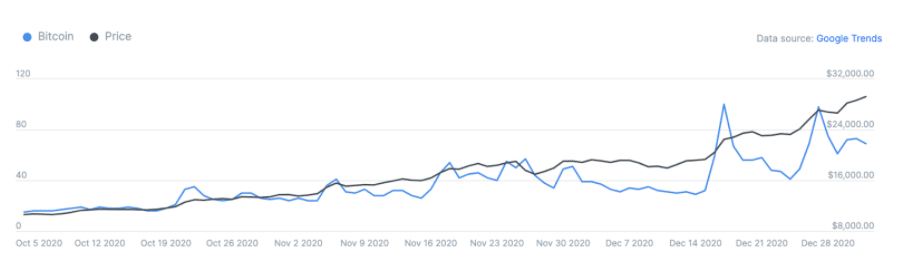

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 69 – taken from 1 January.

Convince your Nan cutout of the day

All investors hope for financial freedom. Few achieve it. Because few Investments actually offer it. And those that do often require access (accredited investors only) or have low liquidity (startups). #Bitcoin is open to anyone, anywhere, and can be bought and sold anytime.

– Cameron Winklevoss, Gemini CEO

What they said yesterday…

Bitcoin climbed above $34,000 for the first time on Sunday, extending a record-breaking rally https://t.co/j7TnCYHaO2 pic.twitter.com/aQS6B7nsZ7

— Financial Times (@FinancialTimes) January 4, 2021

After a dearth of mainstream media attention last year, $34,000 seems to have finally tickled their fancy.

2009 – Inception

2010 – no bid

2011 – $0.31 – $1.6m

2012 – $5 – $39m

2013 – $13 – $102m

2014 – $784 – $10B

2015 – $315 – $3B

2016 – $433 – $6B

2017 – $1k – $10B

2018 – $14.6k – $250B

2019 – $3.9k – $67B

2020 – $6.9k – $135B

2021 – $34k – $625BThanks for the wild ride #Bitcoin! pic.twitter.com/ZDEUWAXAl7

— Bitcoin (@Bitcoin) January 3, 2021

Where to next?

On the 1st business day of 2021, #Bitcoin takes its rightful place atop the Financial Times.

“No force on earth can stop an idea whose time has come”― Victor Hugo https://t.co/hUqsy0IRjq

— Michael Saylor (@michael_saylor) January 3, 2021

Michael Saylor kicking off the year as he finished the last – bullish.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press