Daily market update: Bitcoin closes record fourth day over $18,000

Ethereum 2.0 is just around the corner, XRP is soaring, and the birds are singing in the trees. Bitcoin, meanwhile, is entering its fifth straight day over $18,000 and the once-sceptical PayPal CEO, Dan Schulman is going on live TV to big up its value. It. Is. Happening.

Here’s your daily market update. If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 06:30am GMT.

Bitcoin price

We closed yesterday, 23 November, 2020, at a price of $18,364.12– down from $18,370.00 the day before. That’s a decrease of 0,.03%. It’s the first time in Bitcoin’s history that we’ve closed four consecutive days over $18,000.

The daily high yesterday was $18,711.43, while the daily low was $18,000.80. This time last year, the price of bitcoin closed the day at $7,397.80 and in 2018 it was $4,347.11.

We’re 8.59% below bitcoin‘s all-time high of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.7% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $42,741,112,308, up from $41,280,434,226 the day before. That’s the highest daily volume since 18 November 2020 and the second highest we’ve seen this month. High volume suggests that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $340,698,070,308, down from $340,790,183,317 the day before. To put that into context, Mastercard’s market cap is currently $331 billion.

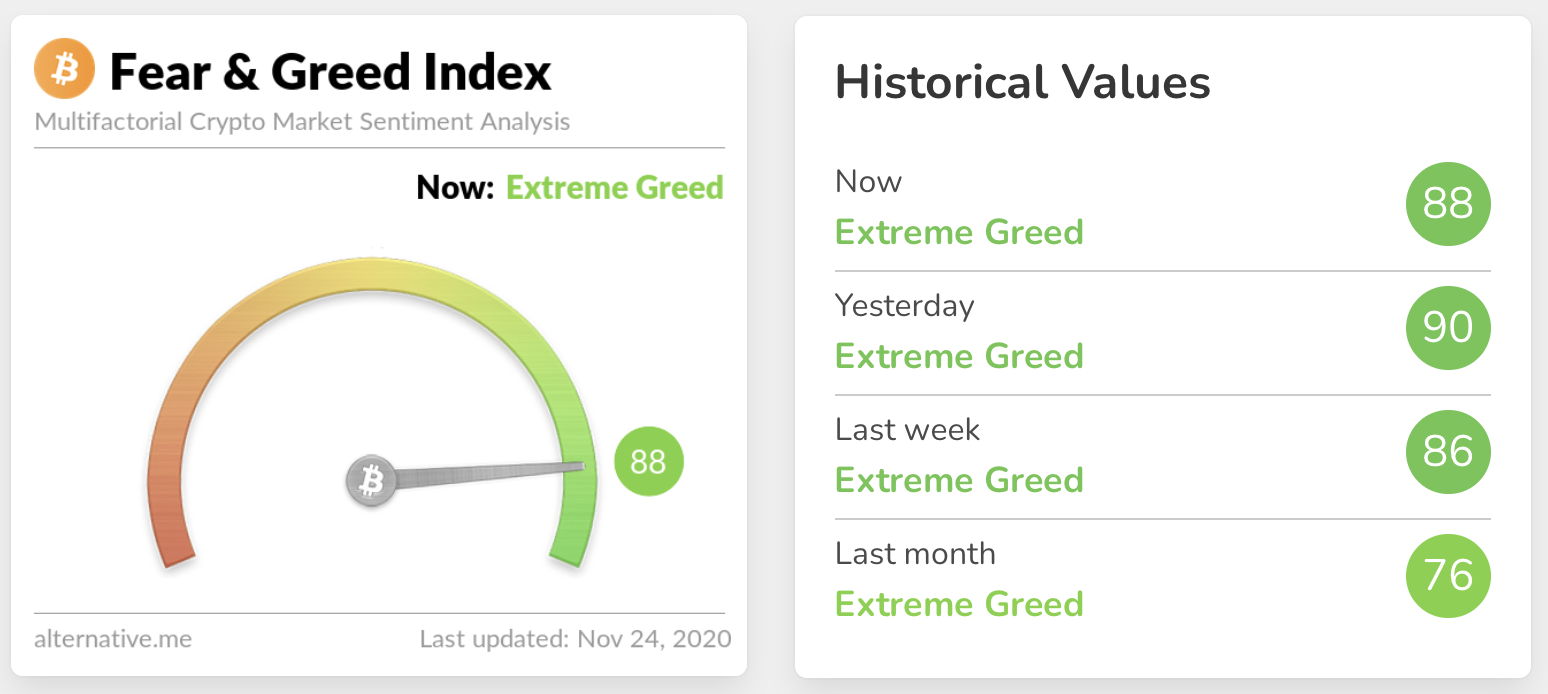

Fear and Greed Index

The sentiment is still in Extreme Greed at 88. The last time it was below 80 was 5 November. The index has now spent a record length of time in Extreme Greed and it’s important to note that the index doesn’t stay this high very often and a correction could be on the cards.

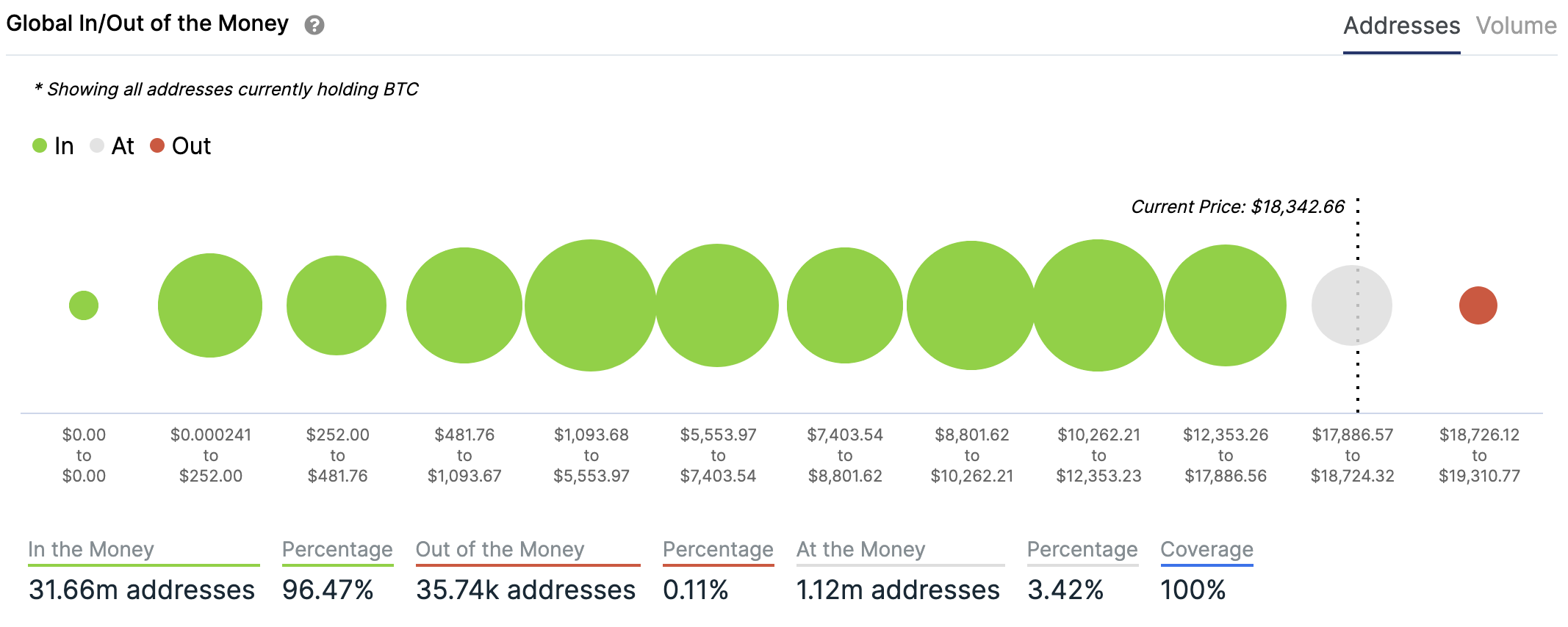

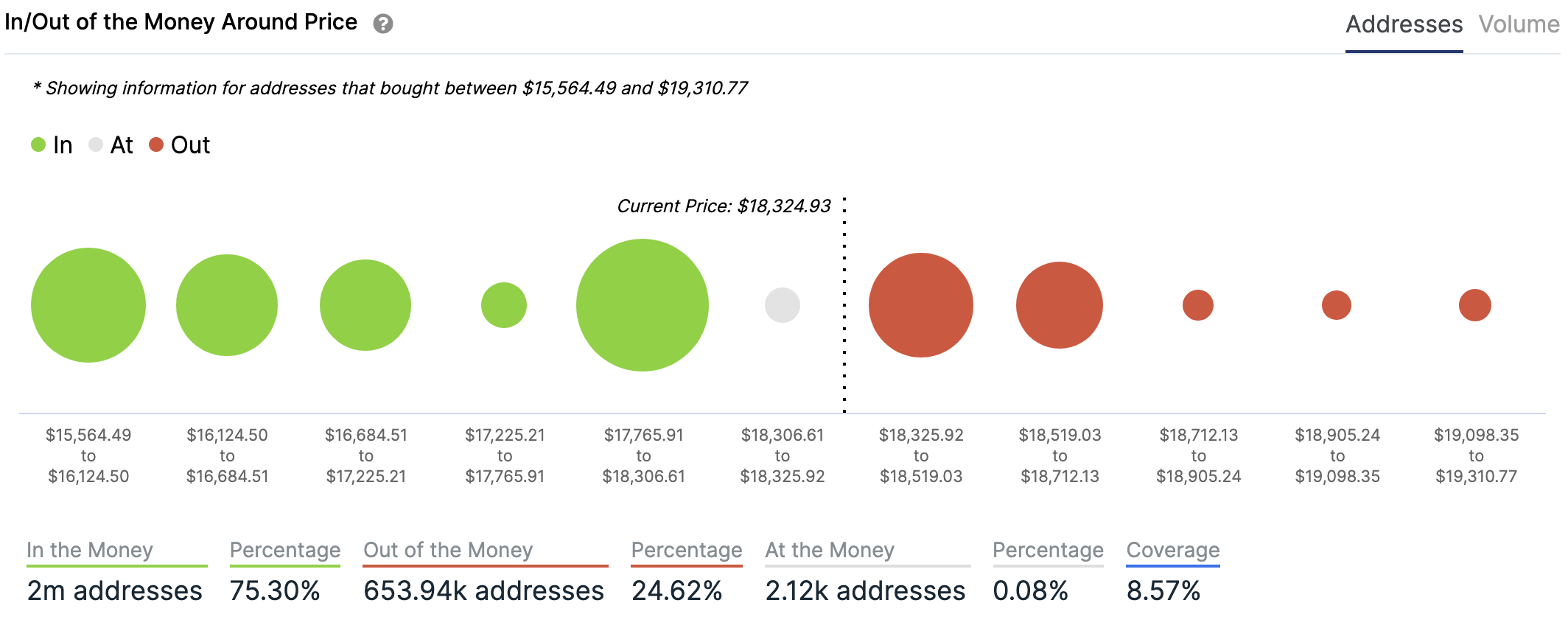

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Charts provided by IntoTheBlock.com

Volatility

Annualised price volatility using 365 days.

Charts provided by IntoTheBlock.com

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 61.73. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 76.47. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

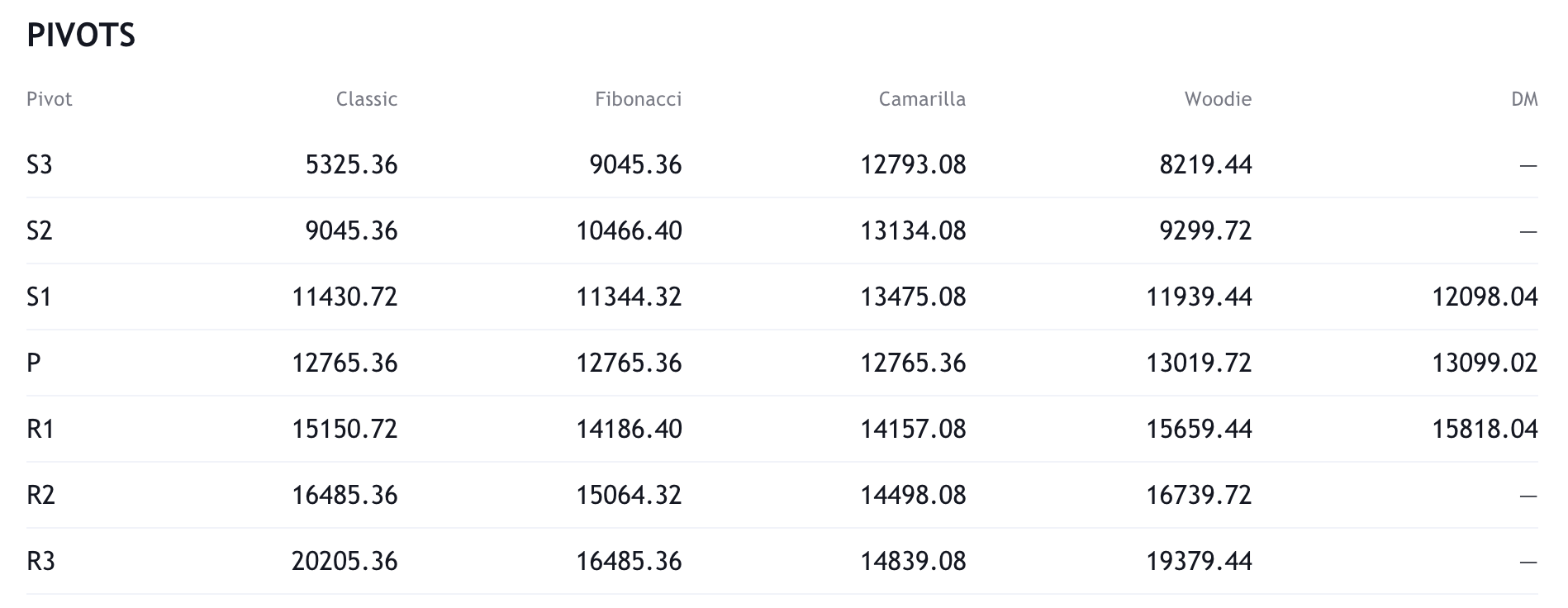

Resistance and support

What they said yesterday…

JUST IN: The smart contract required for triggering Ethereum 2.0 has enough funds to begin activation of its most ambitious upgrade yet on Dec. 1.@nikhileshde reports $ETH https://t.co/xu3datxZCt

— CoinDesk (@CoinDesk) November 24, 2020

Bitcoin at $100,000 in 2021? Outrageous to some, a no-brainer for backers https://t.co/zKwFZvrQqW pic.twitter.com/r2vlnsQKOL

— Reuters (@Reuters) November 24, 2020

If Bitcoin flippened Gold, each Bitcoin would be worth $450,000.

— Dan Held (@danheld) November 23, 2020

Once skeptical PayPal CEO is now pumping #bitcoin live on national television. They will all join us… #btc #paypal pic.twitter.com/MFGbBLdxX7

— Raider ₿ ? (@TruthRaiderHQ) November 23, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press