Daily market update: Bitcoin closes with first daily low over $19,000

If you thought bitcoin bulls were ready to start putting their feet up and winding down for the year, we’ve got news for you.

With record daily lows and sentiment in Extreme Greed, things certainly still seem to be on the ups. Will it last, though? Take a look at all the latest metrics below and make your mind up for yourself.

If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08.00am GMT.

Bitcoin price

We closed yesterday, 14 December, 2020, at a price of $19,246.64 – up from $19,142.38 the day before. The price has now closed over $18,000 for 16 consecutive days.

The daily high yesterday was $19,305.10. The daily low was $19,012.71. That’s the highest daily low in Bitcoin’s history. This time last year, the price of bitcoin closed the day at $7,124.67 and in 2018 it was $3,242.48.

We’re 4.2% below bitcoin‘s all-time high on CoinMarketCap of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.5% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $22,473,997,681, down from $25,450,468,637 the day before. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $357,432,550,020, up from $355,479,173,806 the day before. To put that into context, JP Morgan’s market cap is $360 billion.

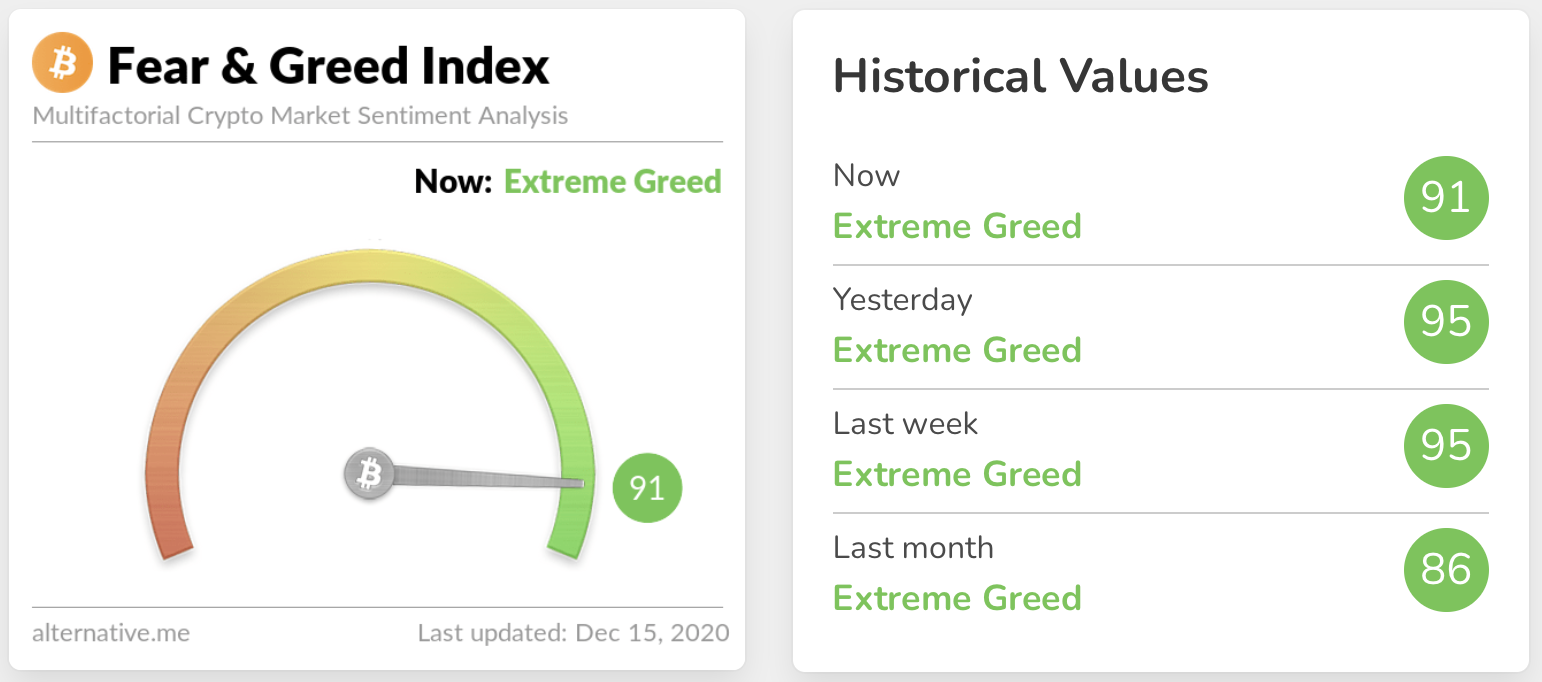

Fear and Greed Index

The sentiment remains in Extreme Greed territory at 91, down from 95 yesterday. The last time we weren’t in Extreme Greed was 6 November, 2020. It’s important to remember that the index doesn’t stay this high very often and a correction could be on the cards.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 64.44. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 58.71. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

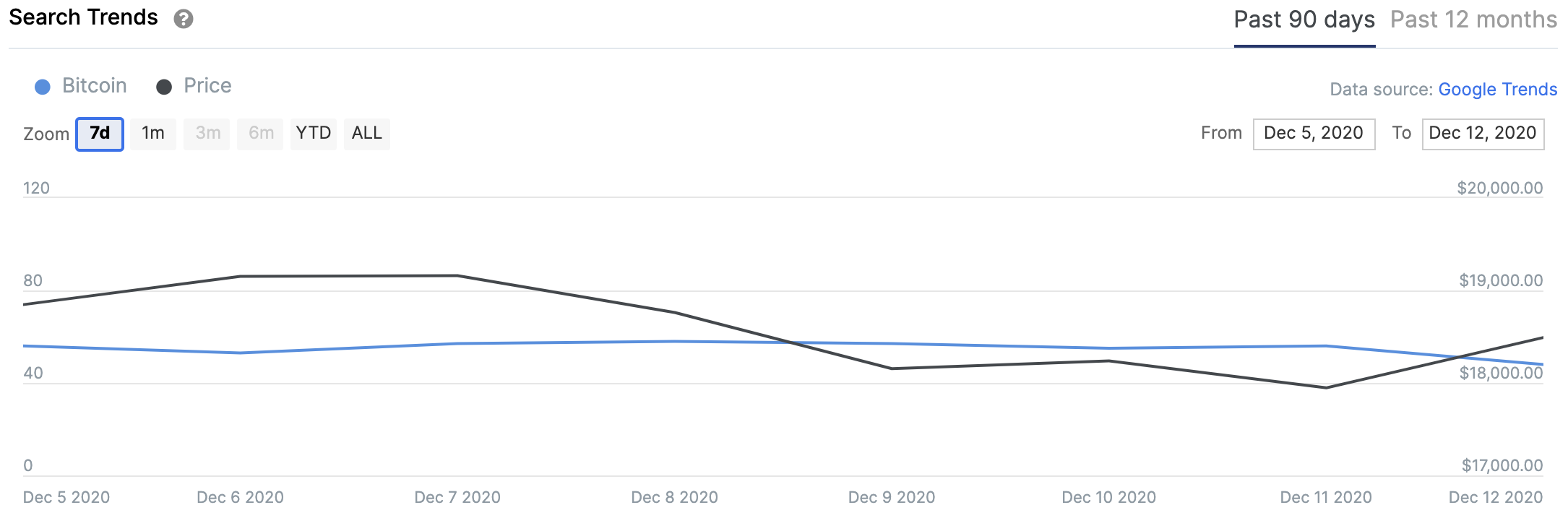

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. Today’s score is 48.

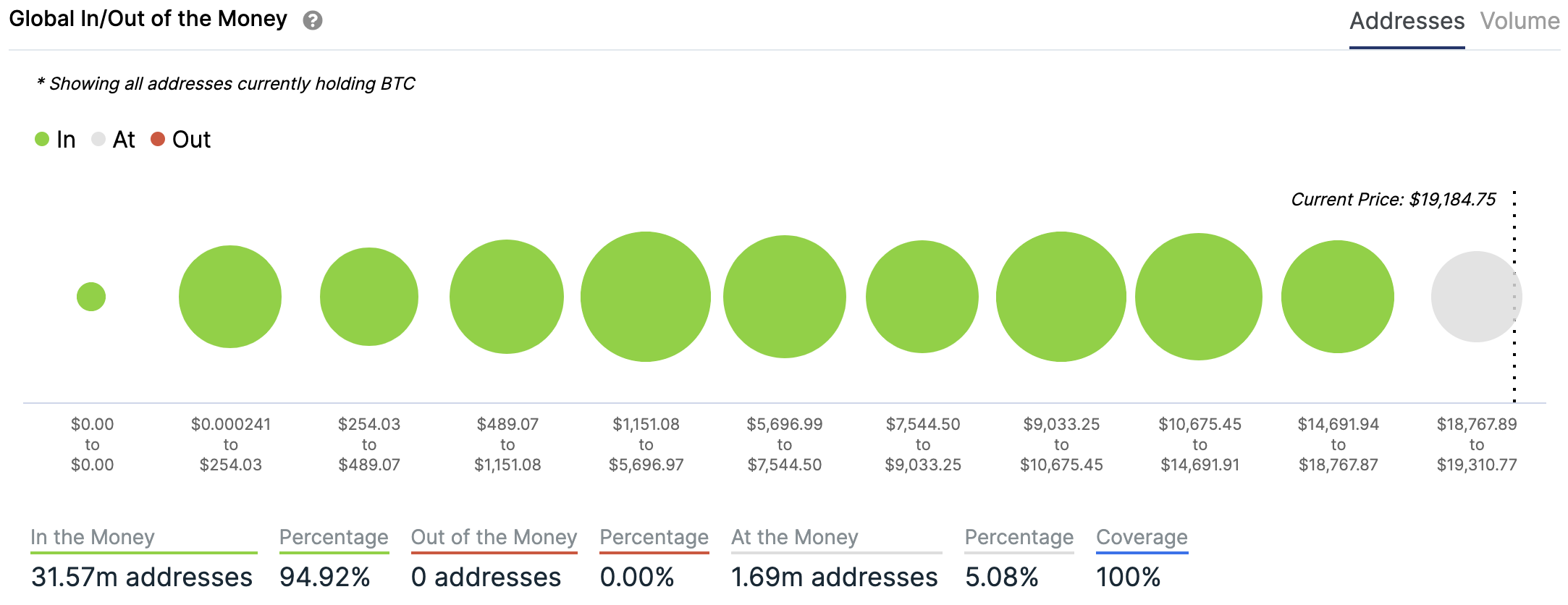

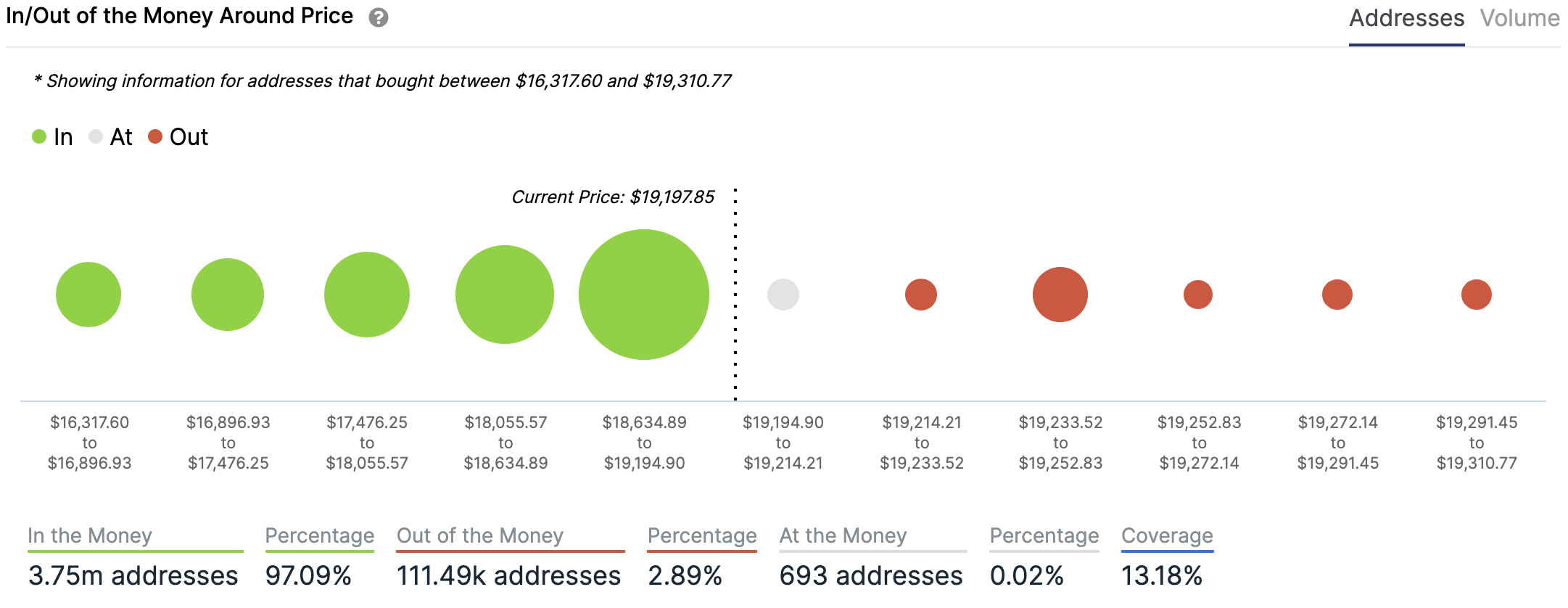

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

Volatility

Annualised price volatility using 365 days.

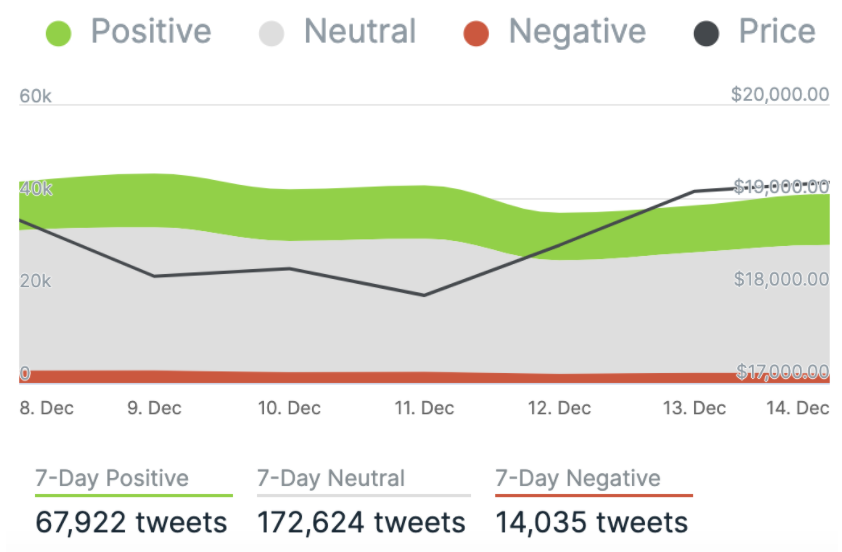

Twitter sentiment

Yesterday, there were 11,028 tweets sent with a positive connotation towards bitcoin, 27,833 with a neutral connotation, and 2,048 were negative.

What they said yesterday…

Record AUM for Grayscale…$13 billion https://t.co/bSFF7Jtimb

— Barry Silbert (@BarrySilbert) December 14, 2020

Billionaires are LITERALLY telling people publicly that they are buying #Bitcoin and there are people who are STILL bearish.

Corporations don’t buy treasury assets to dump $1000 higher.

This thing is likely going way higher. And they will still buy.

— The Wolf Of All Streets (@scottmelker) December 15, 2020

Anyone else find is weird that suddenly JP Morgan is such a big #bitcoin fan? https://t.co/IFrIkioqAV

— Lark Davis (@TheCryptoLark) December 14, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press