Daily market update: Bitcoin hits a new 2020 high at $16.7K

Bitcoin has hit a new 2020 high of $16,7K. The only question we’ve got now is: when $17K?

Here’s your daily market update. If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 10:00am SAST.

Bitcoin price

We closed yesterday, 16 November, 2020, at a price of $16,716.11 – up from $15,955.59 the day before. That’s an increase of 4.76%. This time last year, the price of bitcoin was $8,549.47 and in 2018 it was $5,578.58.

The daily high was $16,816.18, while the daily low was $15,880.71.

We’re 16.76% below bitcoin‘s all-time high of $20,089 (17 December 2017).

Bitcoin volume

The volume traded yesterday was $31,526,766,675, up from $23,653,867,583 the day before. High volume indicates that a significant price movement has stronger support and is more likely to be sustained.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $309,889,423,249, up from $295,790,551,598 the day before.

Fear and Greed Index

The sentiment is still in Extreme Greed, slightly down from yesterday’s 90, currently sitting at 86. Extreme fear can indicate that investors are getting too worried and there’s an opportunity for buyers, while extreme greed could mean the market is due for a correction.

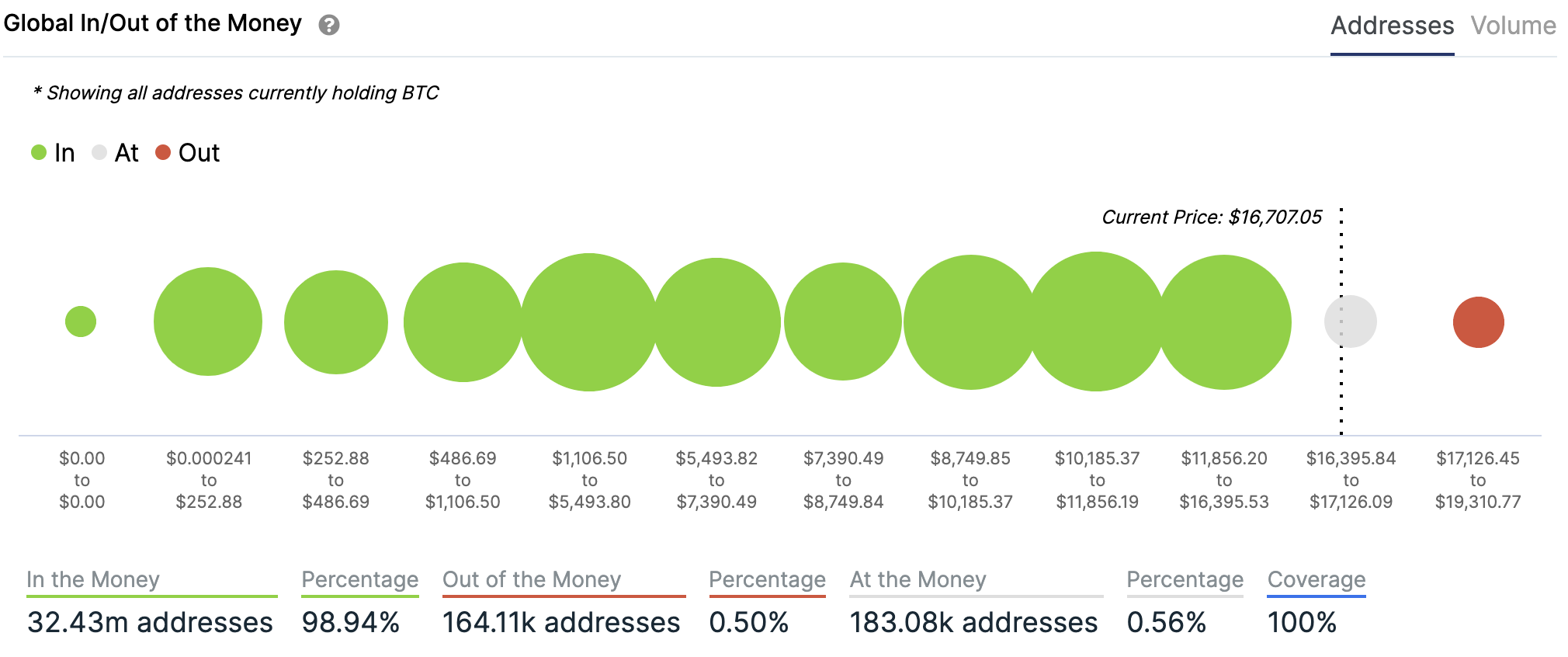

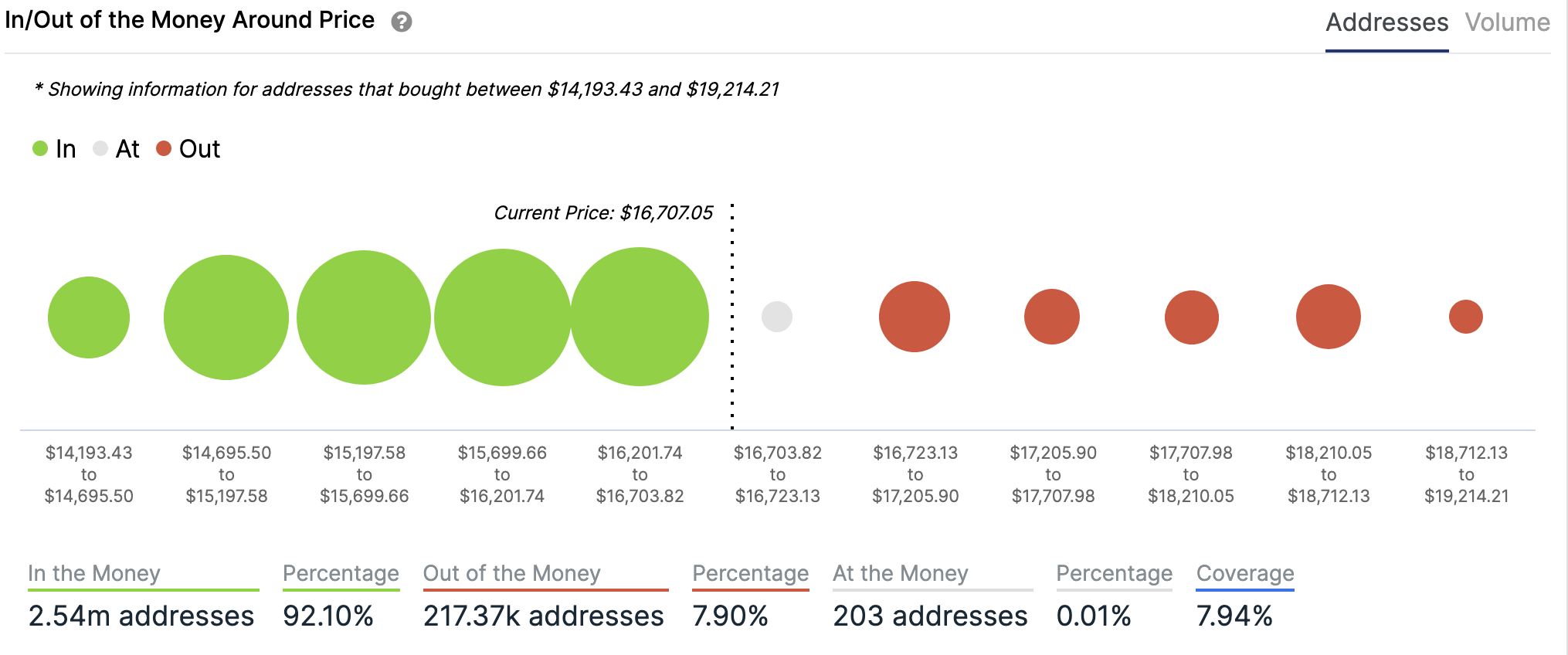

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

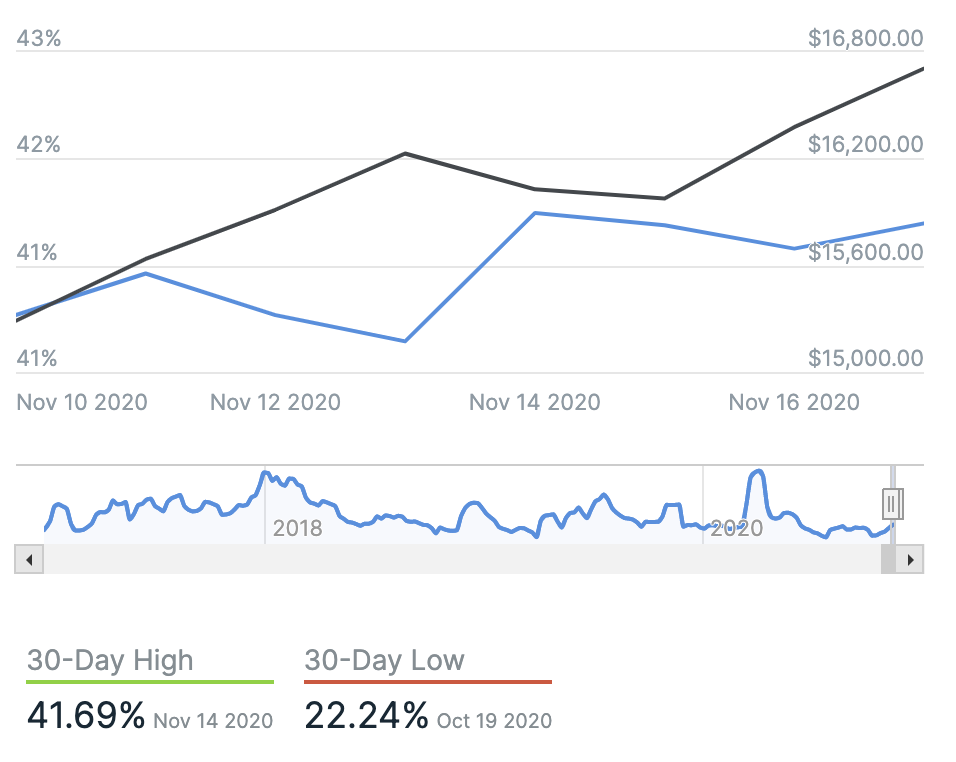

Volatility

Annualised price volatility using 365 days.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 65.63. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 75.46. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

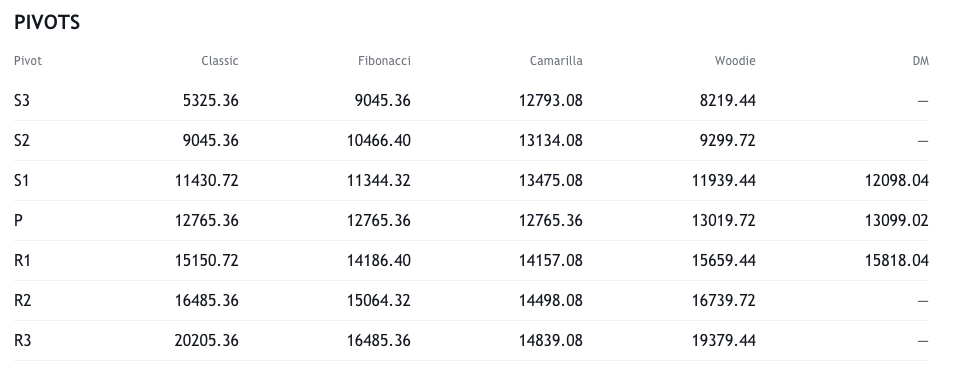

Resistance and support

What they said yesterday…

should i go long on bitcoin ?

— Maisie Williams (@Maisie_Williams) November 16, 2020

CitiBank report predicts #Bitcoin price of 318K by December 2021. Buckle up!

— Tyler Winklevoss (@tyler) November 16, 2020

#Bitcoin just had its 8th highest daily close ever. pic.twitter.com/0GkpGnsINq

— Jimmy Song (송재준) (@jimmysong) November 17, 2020

Since #Bitcoin was at $11.4k a month ago, miners have been selling an average 11 BTC per hr at exchanges.

In comparison 214 BTC per hr has been scooped off exchanges. This is net flows of buyers over sellers.

This week’s average is 328 BTC per hr.

(@glassnode data)

— Willy Woo (@woonomic) November 17, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press