Daily market update: BTC sees correction, where to next?

Bitcoin surged to a 2020-high this week at $19,390.97, but has since cooled down to $16,828.82. Market corrections are healthy and are to be expected in crypto markets – looking back at 2019 and 2018’s prices, we’re still seeing consistent growth year-on-year. But for now, let’s take a look at what happened in the past 24 hours.

If you’re new to the world of crypto, take a look through our beginner’s guide to crypto trading series to get a better idea of all these indicators, starring in-depth explorations of common strategies, market analysis techniques, and more.

The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 10.00am SAST.

Bitcoin price

We closed yesterday, 25 November, 2020, at a price of $18,732.12 – down from $19,107.46 the day before.

The daily high yesterday was $19,390.97, marking a high for 2020. Meanwhile, the daily low was $18,581.15. This time last year, the price of bitcoin closed the day at $7,146.13 and in 2018 it was $4,009.97.

We’re 14.11% below bitcoin‘s all-time high of $20,089 (17 December 2017).

As of today, buying bitcoin has been profitable for…

99.7% of all days since 2013-04-28.

Bitcoin volume

The volume traded yesterday was $43,710,357,371, down from $51,469,565,009 the day before. High volumes indicate that a significant price movement has stronger support and is more likely to be sustained. In the bull run of December-January 2018, the highest daily volume was $23,840,899,072.

Market capitalisation

Bitcoin’s market capitalisation as of yesterday was $347,558,803,507, down from $354,504,361,032 the day before.

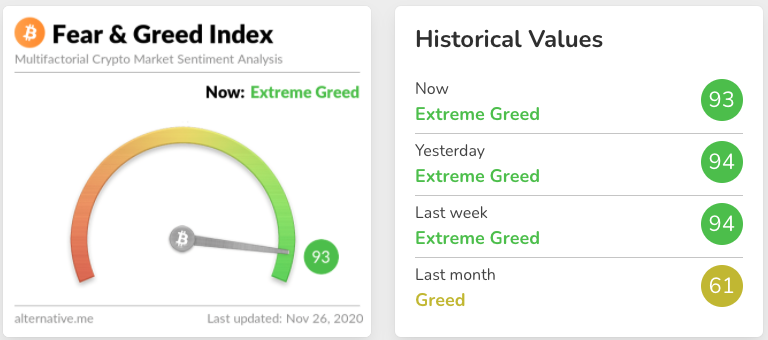

Fear and Greed Index

The sentiment is still in Extreme Greed at 93. The last time it was below 80 was 5 November. The index has only been higher once, when it touched 95 last summer. The index has now spent a record length of time in Extreme Greed and it’s important to note that the index doesn’t stay this high very often.

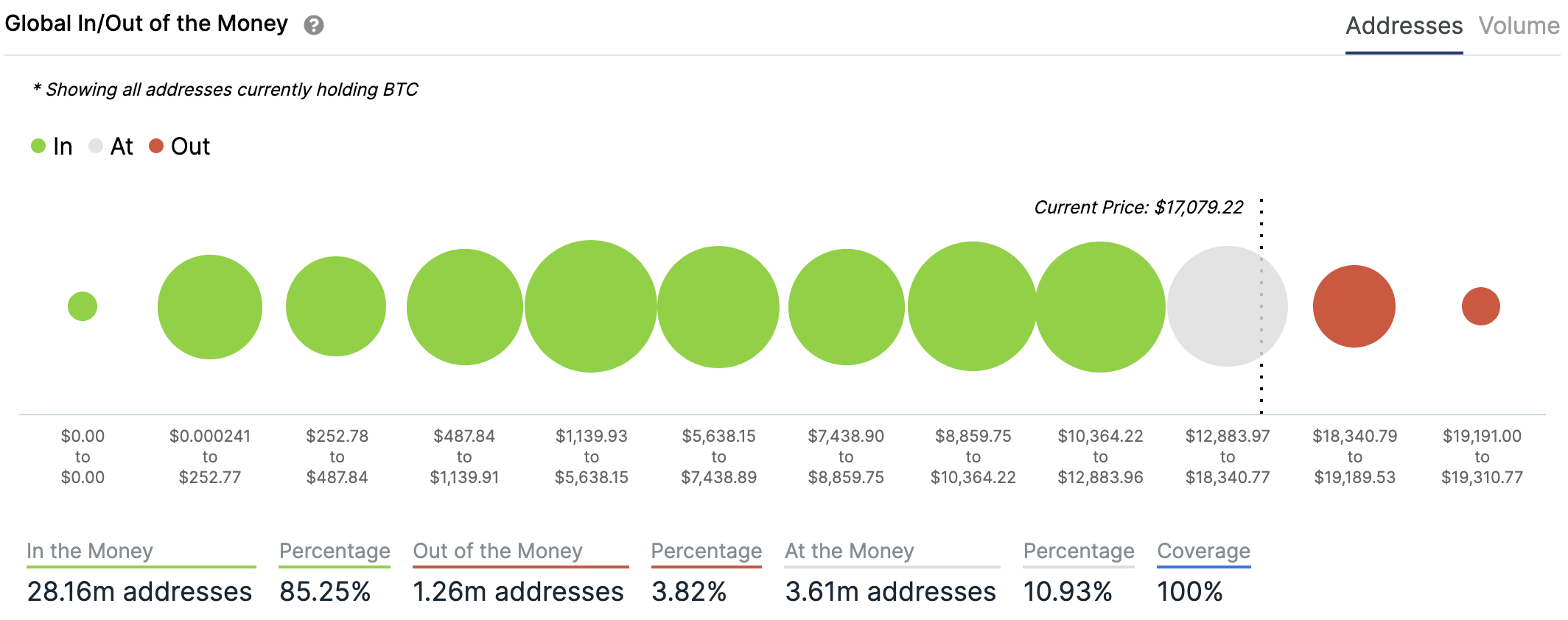

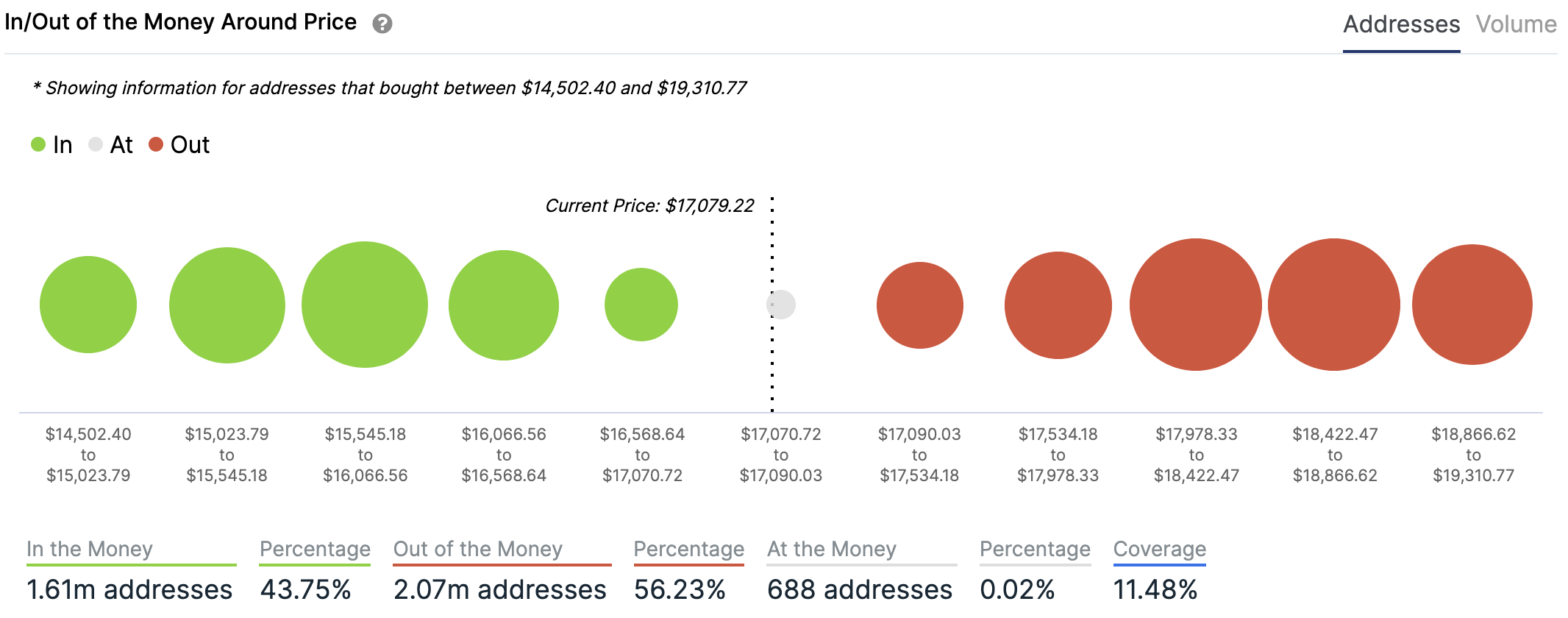

In/Out of the money

For any address with a balance of tokens, ITB identifies the average price (cost) at which those tokens were purchased and compares it with the current price. If the current price is higher than average cost, address is ‘In the Money’. If the current price is lower than the average cost, the address is ‘Out of the Money’.

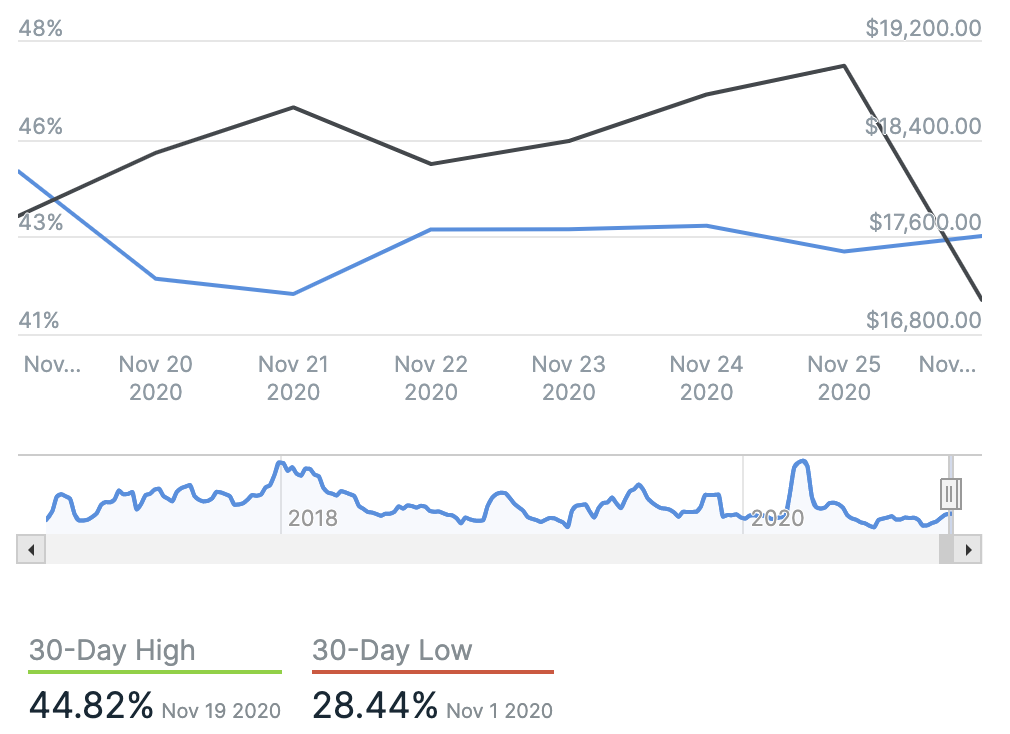

Volatility

Annualised price volatility using 365 days.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 64.08 Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 53.56 Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

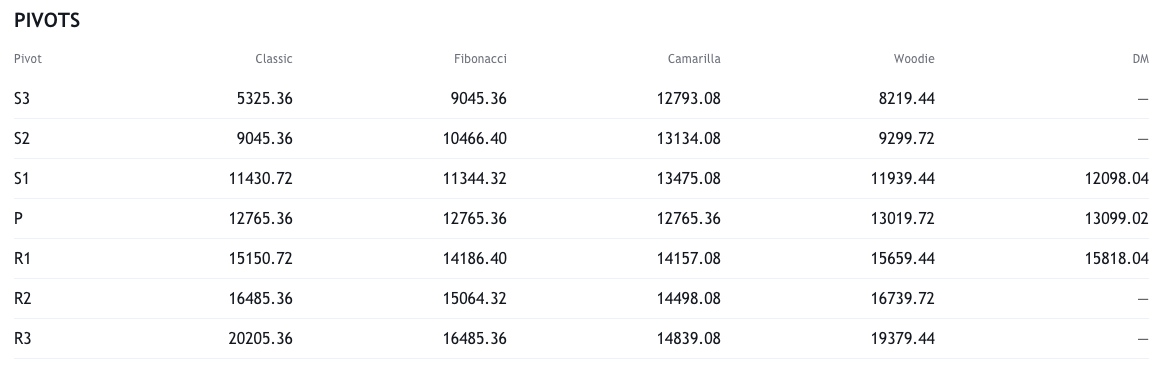

Resistance and support

What they said yesterday…

#Bitcoin is the world’s best treasury reserve asset, the emerging dominant monetary network, and the solution to the store of value problem faced by 7.5 billion people & $300 trillion in capital. At this point, it is all but unstoppable. https://t.co/43hkVS9kXc

— Michael Saylor (@michael_saylor) November 25, 2020

You’re a smart guy Peter, just too stubborn. Come join us, you won’t regret it. https://t.co/WGitMab1ws

— Cameron Winklevoss (@cameron) November 26, 2020

Don’t worry about the dip.

HODL✊ https://t.co/jHwsnhMyAh

— Dan Held (@danheld) November 26, 2020

Most people on the financial news are suggesting #Bitcoin is rallying because of emotions and crowd chasing. But if they understood how the protocol systematically sucks supply out of the market during strategic intervals, they would realize this current move is mathematical.

— Preston Pysh (@PrestonPysh) November 25, 2020

What other data points would you like to see covered in our Daily Report? Let us know on Twitter.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press