Luno’s market analysis – Week 18

Welcome to this week’s retrospective of the latest goings-on in the crypto markets, featuring an overview of price movements, a look at the fundamentals, and the impact of other major events over the last week. The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

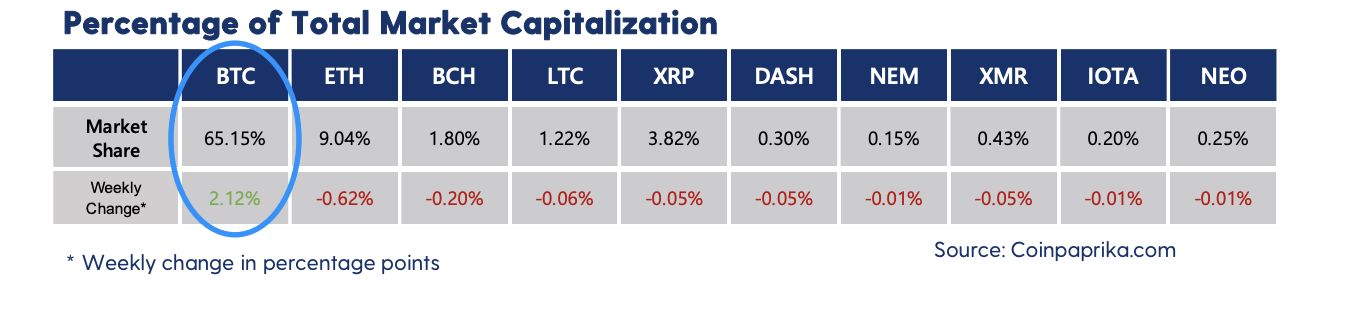

Is FOMO back in the crypto markets? Last week was a triumph for Bitcoin, with prices shooting up roughly 20% to almost $9,500. This meant Bitcoin ended April with a 29% gain, clawing back the losses that occurred following the market crashed in March .

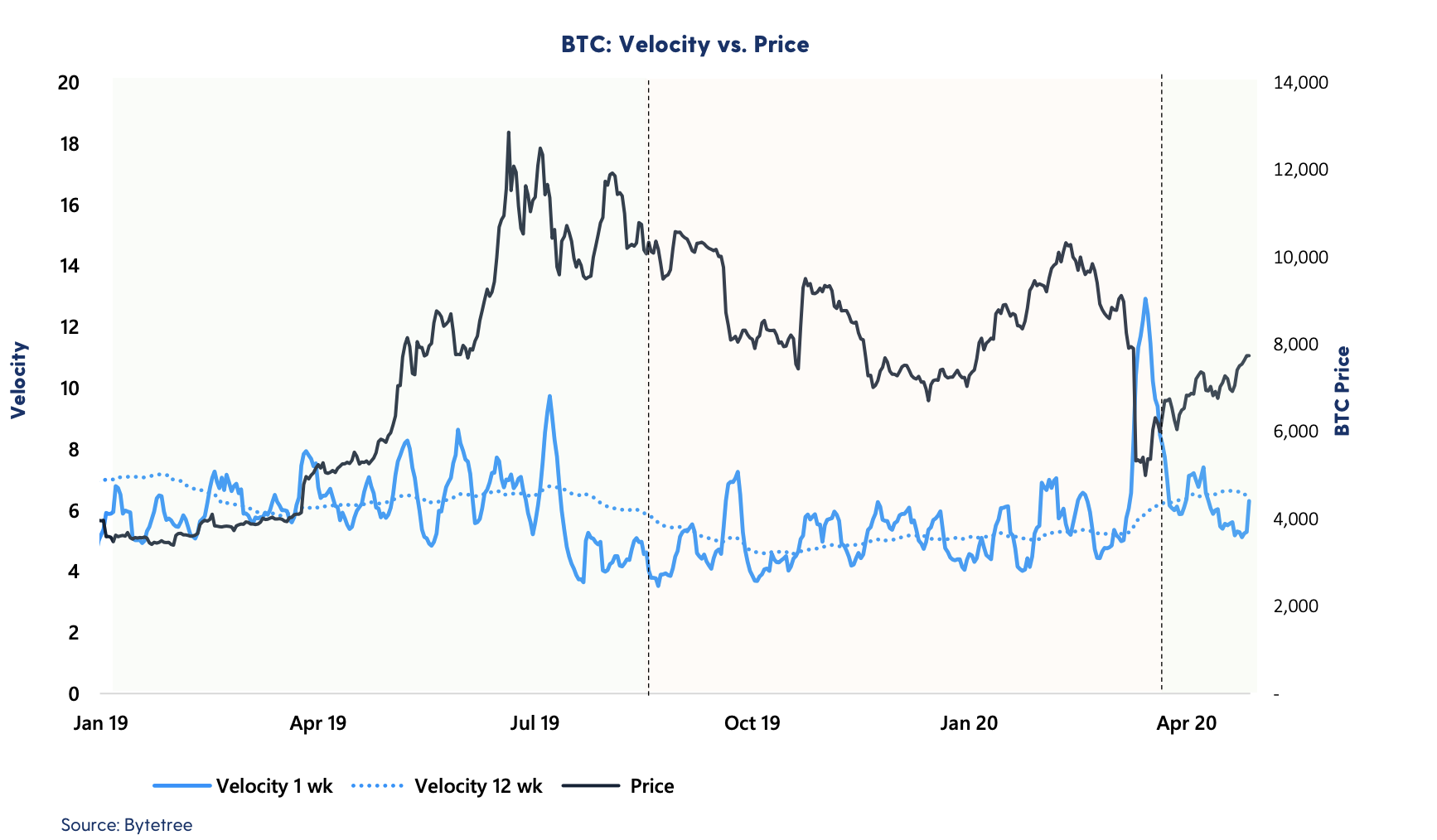

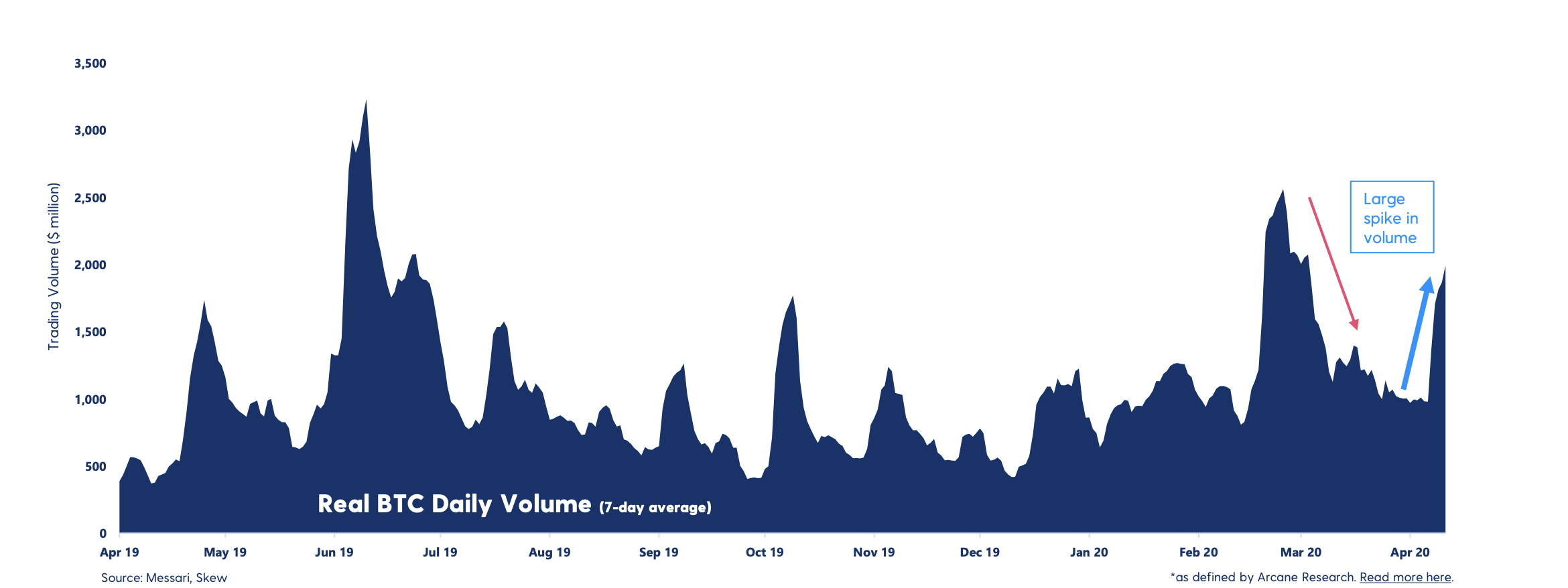

This wasn’t the only good news, though. Both Bitcoin velocity and volume surged again, having spent several weeks in a clear downwards trend. With the halving now less than a week away, the network remains strong and all eyes are on whether or not Bitcoin can maintain all of this momentum.

However, bullish signals will still be tempered by the fragile nature of the global economy. Bitcoin’s correlation with the S&P500 is still high and increased again last week. If the stock market takes another hit, there is still concern that Bitcoin could too.

Price analysis

Short-term view

Last week saw a mammoth rally for BTC, as the price ploughed through the $8,000 – $8,200 resistance zone to hit a weekly high of $9,400. The subsequent retrace corrected the BTC price down to the golden fibonacci level at $8,400, where it held. At time of writing, BTC sits at $9,235.

Currently trading in a volatile range-bound manner, the relative strength index (RSI) is now touching the overbought zone of around 75 points. The key resistance level to look out for now is the recently formed $9,200 – $9,400 zone, which BTC would need to overcome to continue on its upward trajectory. Support should be looked for at the recently tested $8,400 zone, with further support at the $8,000 and $7,500 marks.

Long-term view

Looking to the long term, we saw yet another green-candle weekly close, with a price increase of around $1,200. This makes it the seventh week in a row that BTC has closed higher than it started.

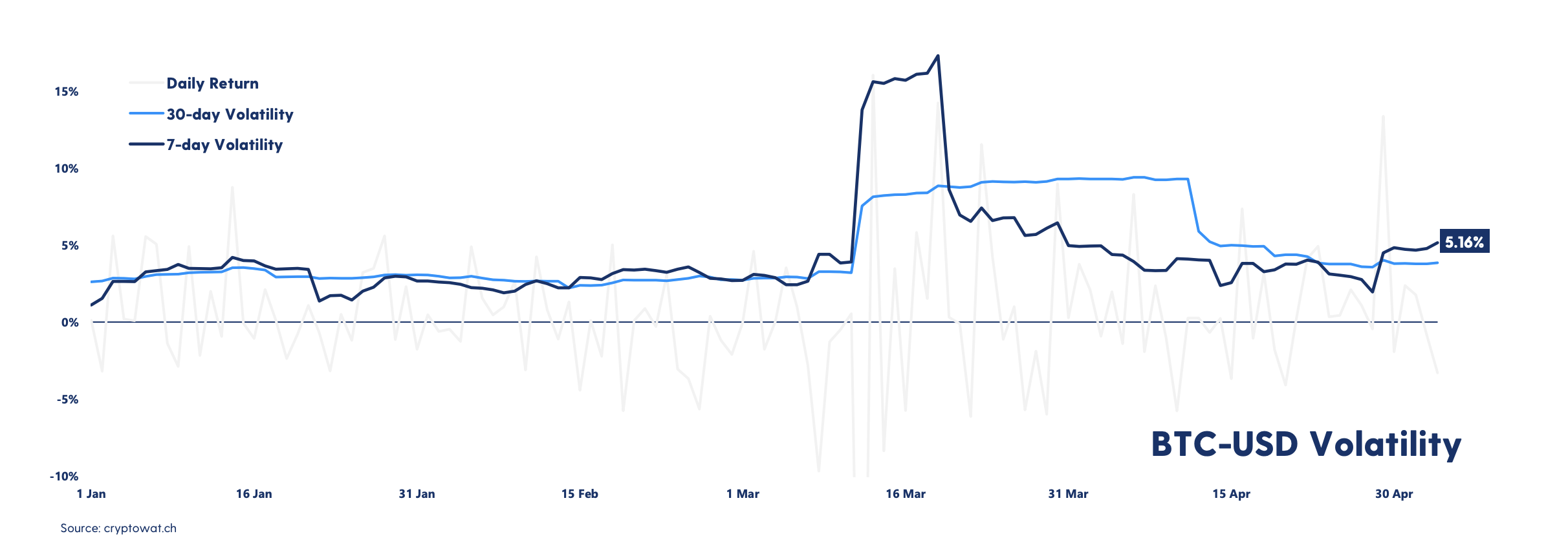

7-day bitcoin volatility is increasing

Volatility dropped sharply after the price crash in March. However, last week we saw a spike in the 7-day volatility again, after the price saw a massive run up to levels well above $9,000. The 30-day volatility remains unaffected, for now.

Reasons to be cheerful

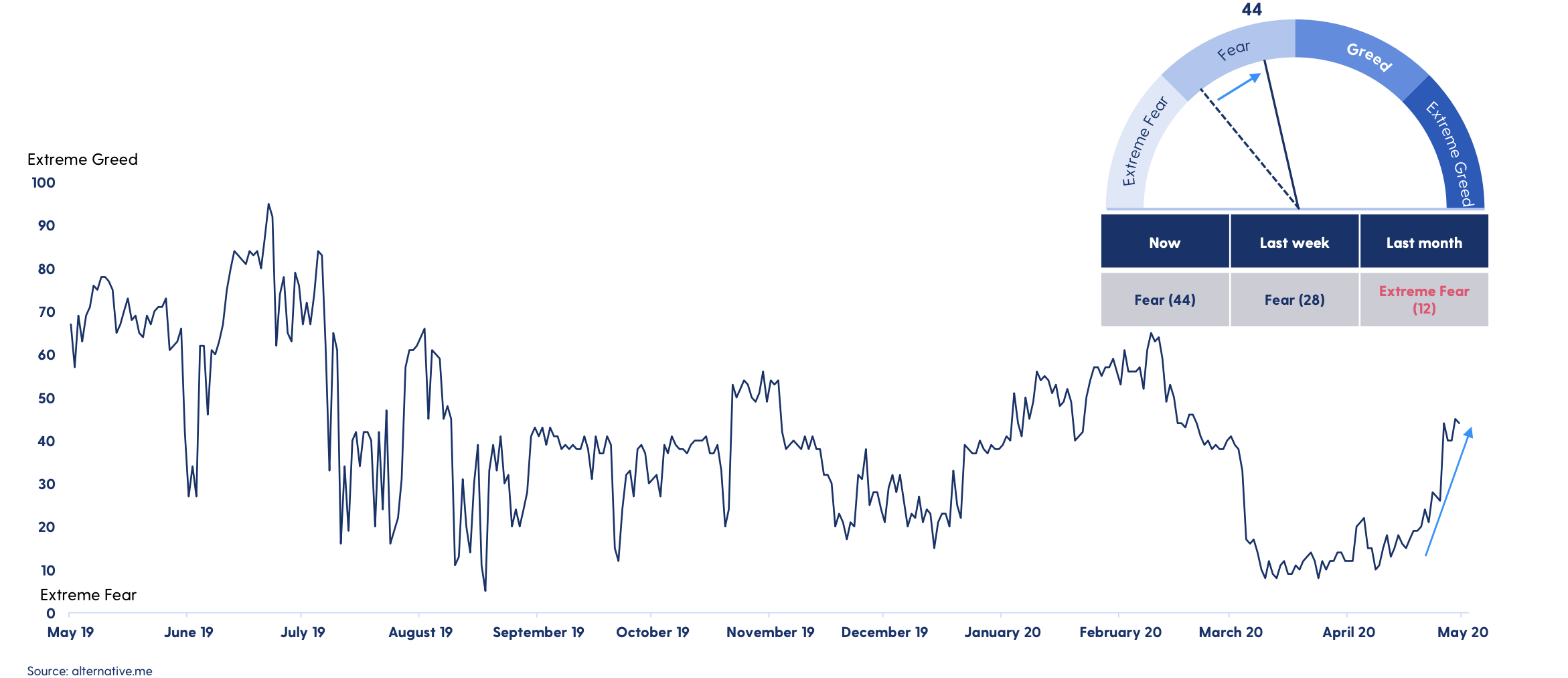

The crypto markets saw a massive confidence boost last week, as the Fear & Greed Index finally broke out of “Extreme Fear” after 7 weeks. It now sits at 44 and is approaching the “Greed” level, which has not seen since March.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press