Luno’s market analysis – Week 26

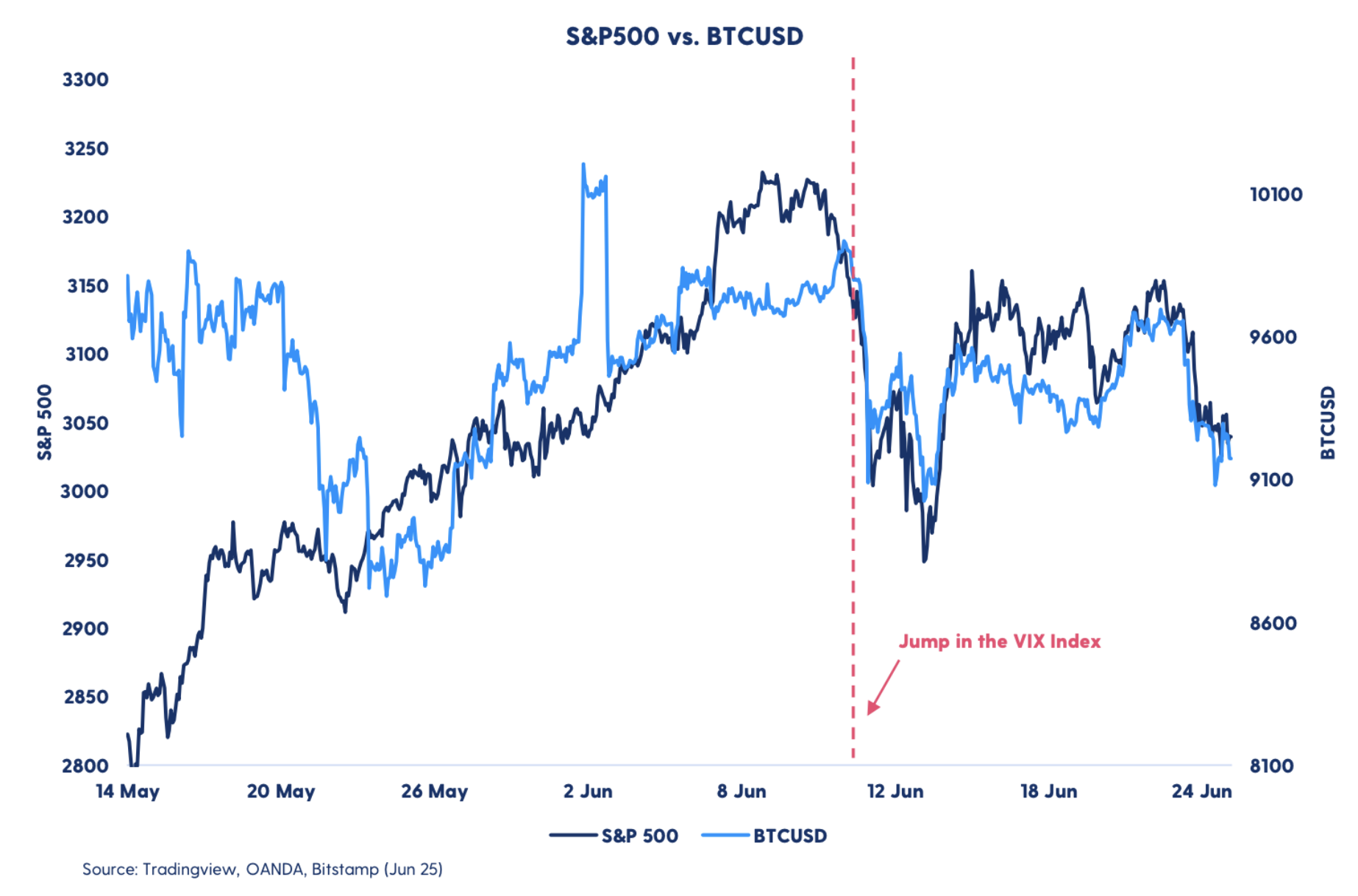

It’s been another week without any significant price action in the crypto market, although we did see a slight dip in the run-up to the weekend. This aligned with a build-up of uncertainty in the stock market, which saw its worst day for more than two weeks on Wednesday.

The US is still registering high numbers of daily Covid-19 cases, and it seems a reopening of the economy may be further down the road than many have expected. This means things could get worse again for the markets before they get better. Investors will need to keep an eye on the stock market over the coming weeks or hope for Bitcoin to decouple.

Price analysis

Short-term view

After a short-lived price rise on 22 June, BTC has seen a relatively sharp pullback, dropping below the previously mentioned support zone of $9,200 to as low as $8,800 on 27 June.

Over the last couple of days, we have seen the price stabilise somewhat, as BTC returned to the $9,200 zone. However, with low associated trading volumes and an RSI around the 50 point mark, it’s safe to say that the market is in a state of uncertainty at present, with neither bulls nor bears willing to take the lead.

Looking at price action on the daily, we can see the formation of a symmetrical triangle pattern. This is often associated with a break-out and continuation of a trend, but with so many macroeconomic factors at play when looking at the market fundamentals lately, one would be well advised to take these sorts of technical indicators with a grain of salt.

Levels to watch out for:

Should BTC not break above $9,200, the first level of support is likely to be found within the $9000 – $8800 zone, with the latter formed this Saturday and being the local 30-day minimum. Further below lies the $8,600 support region.

Should we see a breakout and continuation of the trend, BTC would need to overcome its $9,800 high of last week before pushing towards the $10,000 and $10,500 resistance zones.

Long-term view

With Bitcoin again seemingly tracking the stock market, all eyes now are on whether it continues to be treated as a risk asset by the marginal trader. Not for the first time this year, we are finding out how Bitcoin investors really perceive the asset. This could have long-term implications moving forward.

Reasons to be cheerful

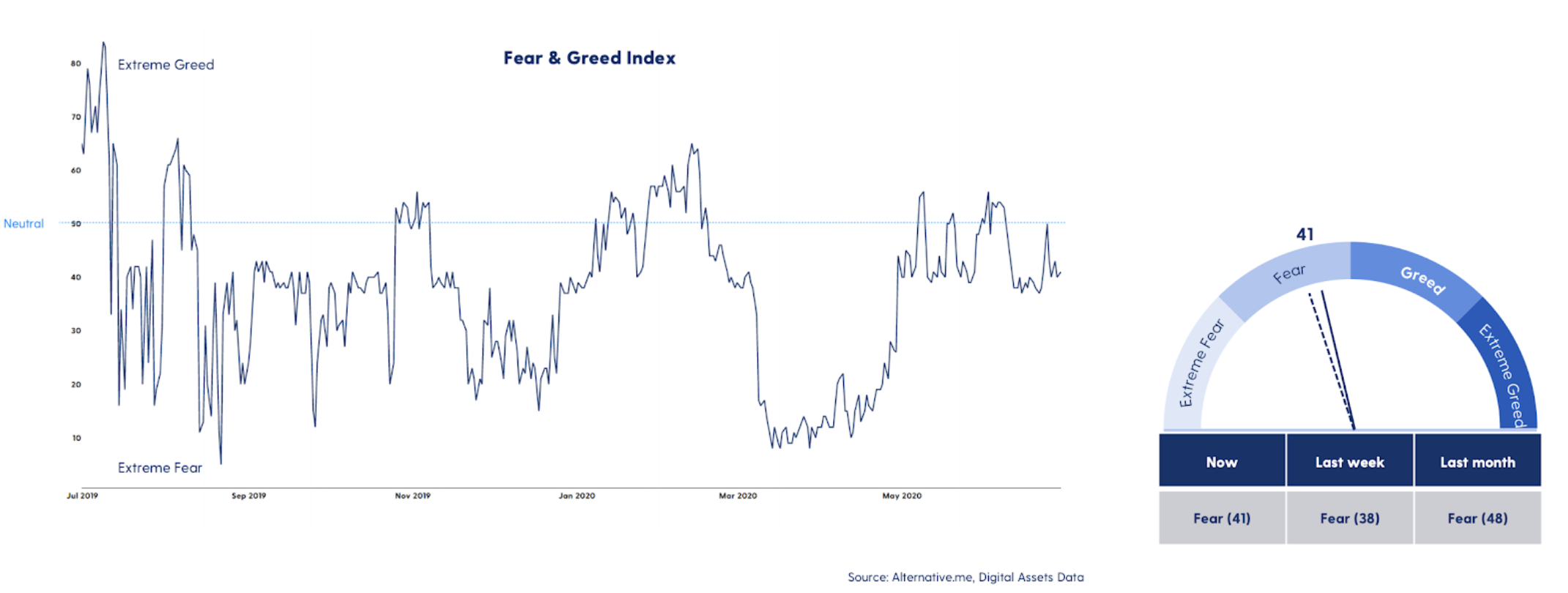

The Fear & Greed Index saw a small spike back to the neutral area again last week, but fell back sharply soon after. With uncertainty still present in the stock market, it seems like most market participants are patiently waiting for the next move as most assets are still ranging.

Minimal changes in Bitcoin volume

The 7-day average real trading volume has registered another week with sideways movement. Increased volume is often seen when Bitcoin moves fast, either up or down. With another insignificant week in terms of price changes, the volume is naturally following along.

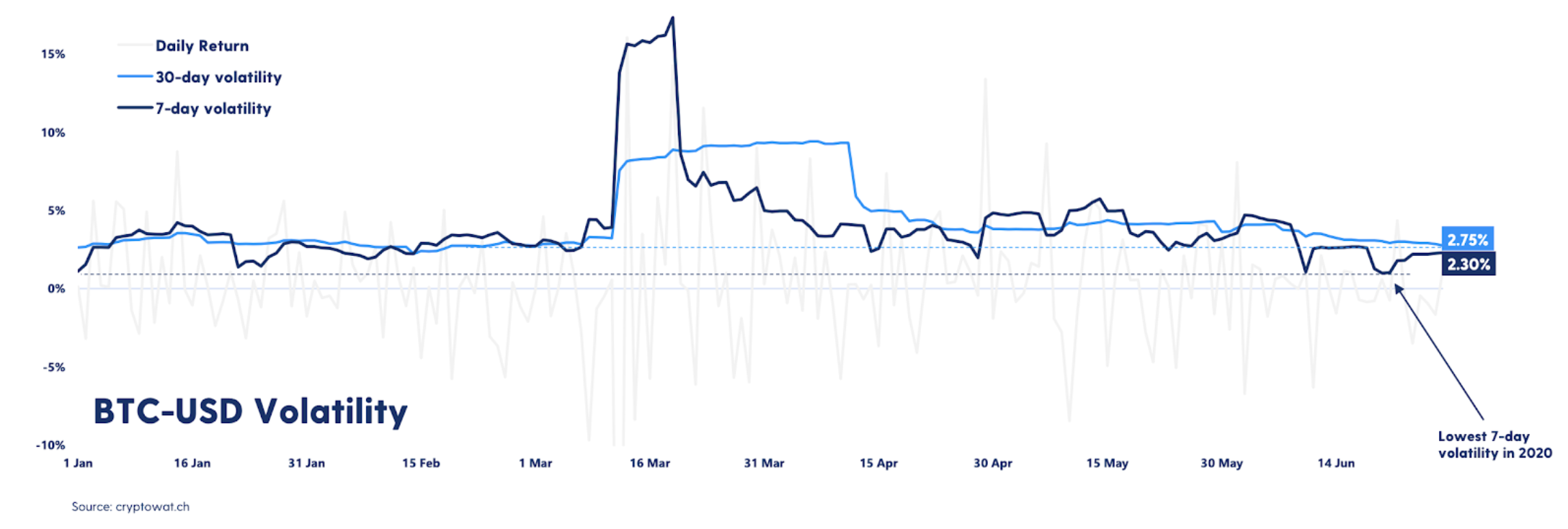

Volatility stays low

The 7-day increased again last week after touching yearly lows, but the 30-day volatility stays low. Both the monthly and quarterly contracts expired in the derivatives market on Friday, but we haven’t seen any big moves yet. Daily movements have been observed at the monthly close both in April and May, and it’s not unlikely we’ll see the volatility pick up this week.

Keep reading…

Crypto in 2020: The year so far

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press