Rates, inflation and other important events in May

April was a quieter month following Bitcoin’s new all-time high in March. Another round of hot inflation numbers and the Bitcoin Halving kept investors busy, though, with volatility largely the order of the day. But where to next? Here’s what you should be keeping an eye on in May.

But first, a recap

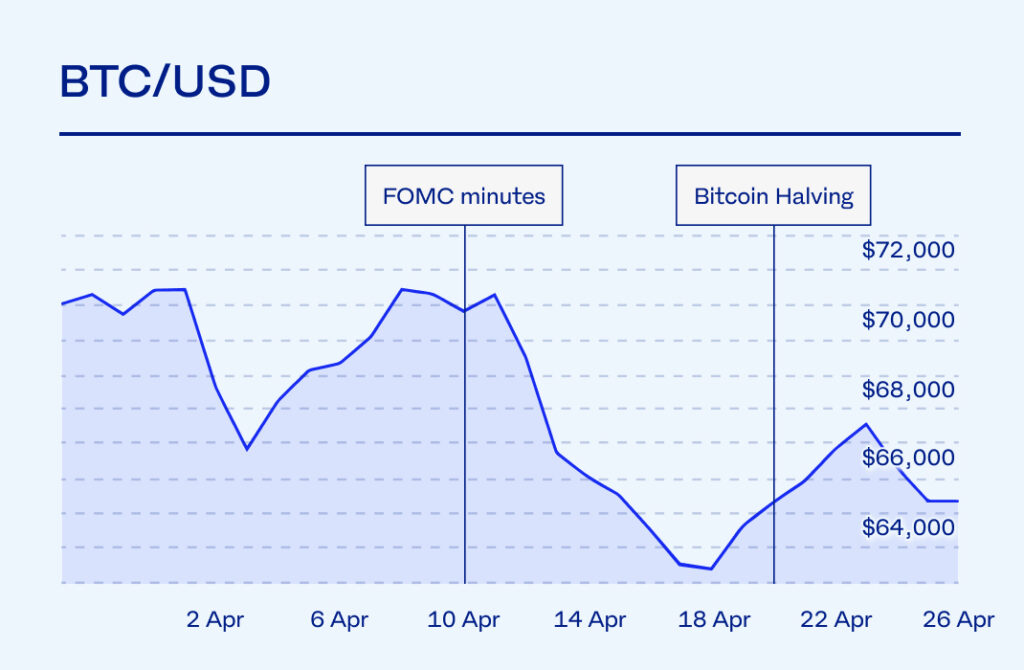

April started with a sharp drop in crypto prices. Bitcoin was trading above $70,000 at the beginning of the month but saw a sharp sell-off on 2 April, seeing the market leader drop all the way to $64,000. Markets regained some ground between 2 – 8 April, with Bitcoin climbing back to $72,000, only for it to sink to monthly lows on 17 April as renewed volatility gripped markets. The $60,000 level was tested a few times, but the market leader managed to find support and stay afloat above this key price level. Around the time of the Bitcoin Halving on 20 April, the crypto was trading for roughly $65,000.

The Fear and Greed Index, a sentiment indicator that measures the emotions of market participants by analysing various factors, spent most of April sitting between Neutral and Greed – a drop off from March’s long spell in Extreme Greed.

In the broader economy, the US labour market continued to add jobs in March, according to the unemployment numbers released on 5 April, while the Consumer Price Index (CPI) numbers on 10 April also showed a 3.5% rise in inflation, higher than the expected 3.4%. These strong numbers from the US economy have further pushed out investor expectations of a rate cut, now only expected to happen in September.

There’s some disconnect between predicted rate cuts, the economy, and the labour market, according to JP Morgan. “Historically, when the Fed cuts rates, it is usually because the economy is weakening,” Michael Feroli, JP Morgan’s Chief US Economist said. “The current situation is more complex as the economy and the labour market are standing strong, but inflation looks less worrisome… as things stand, we think the Fed will go ahead with a cut even while the labour market is still doing well.”

With the focus around Bitcoin Exchange Traded Funds (ETFs) slowly shifting back to what the Fed’s doing with interest rates, May will be a key month to see what Fed Chair Jerome Powell is thinking.

What’s on in May?

What? US unemployment rate and non-farm payrolls

? When? Friday, 3 May

Why investors care: US unemployment numbers serve as a critical indicator of the overall health of the US economy. The US added more jobs in March, possibly meaning that the full effect of heightened interest rates are yet to filter down to the economy.

What? Bank of England interest rate decision

? When? Thursday, 9 May

Why investors care: Similar to the Federal Reserve Bank, the Bank of England steers the monetary policy in Great Britain, deciding whether to raise or lower interest rates. Unlike the US, however, the BoE is in the tough position of fighting inflation against the backdrop of an economy showing signs of pressure.

What? US inflation rate numbers

? When? Wednesday, 15 May

Why investors care: The inflation rate in the US will decide the Fed’s plans with interest rates. The latest Consumer Price Index (CPI) numbers from the US were again higher than many economists expected, possibly pushing out rate cuts to later in the year.

What? FOMC minutes

? When? Wednesday, 22 May

Why investors care: The FOMC minutes generally provide insight into the Fed’s thinking about their decisions on monetary policy in their previous meeting, this one taking place at the beginning of May.

*This information is not intended to be nor does it constitute financial, tax, legal, investment or other advice; nor is it a call to trade. The information is intended as general market commentary for information purposes only. Before making any decision or taking any action regarding your finances, you should consult a qualified Financial Advisor.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press