How runaway markets work

Investment decisions don’t start with purchases. They start with education.

As Bitcoin and Ethereum continue breaking records, we want to take a moment during this euphoria to explain an important concept: runaway markets.

To ensure you don’t make purchases you’ll later regret, it’s useful to understand how and why markets get out of control — and how to protect yourself.

Price = supply & demand

Supply and demand determine the price ofcryptocurrencies (and just about everything else too.) At any time, some people want to buy Bitcoin or Ethereum, while others want to sell it. Exchanges like Luno connect those people to each other. (Luno is purely a platform for buying and selling, and does not have any control over prices.)

At times, demand can be much higher than supply.

This has happened over the last few weeks. More and more people want to buy cryptocurrencies, which is pushing the price up and up.

Recent price increase on Luno

When you buy Bitcoin or Ethereum on Luno, you purchase it from someone else, called ‘the counterparty.’ This could be one person, or it could be multiple people and groups in different countries. However, the same rule of supply and demand still applies.

Supply and demand on Luno

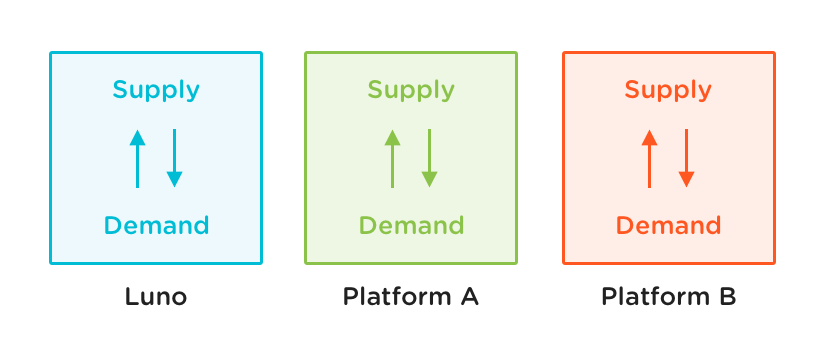

Cryptocurrency platforms, like Luno operate independently of each other:

You can see here that the price of Bitcoin is a bit different for each exchange. That’s because the levels of supply and demand vary on each platform.

Once again: exchanges don’t determine prices. They just match buyers and sellers.

Arbitrage

If the price is slightly higher on one platform, traders (i.e. external parties, not Luno) will sell on that platform and buy on another lower-priced platform. This is called arbitrage. It happens in almost all markets.

In theory, arbitrage should make prices equal across platforms. In practice, it doesn’t always work that way due to constraints like:

- Capital controls

- The difficulty of moving of local currencies

- Market timing

- Fees

- Liquidity and so on.

Why runaway prices happen

Downswings

Sometimes an event triggers a big reaction on a certain platform.

If, say, Platform B is experiencing technical issues, their customers might panic and immediately sell all their Bitcoin. So, supply will be higher than demand. This will push the price down on that platform, whereas it might stay unchanged on others.

Upswings

The opposite also holds true: customers on one platform might be very enthusiastic about the price of cryptocurrency. This increase in demand will push up the price. But it might stay unchanged on other platforms or in particular countries.

The differences between platforms vary: sometimes it’s a small amount, sometimes it can be more. Eventually, the price again reaches an equilibrium with a smaller difference.

Markets are efficient, but they aren’t always rational.

It could be argued that the faster the surge or plunge in price, the less rational the market becomes, with many people taking the same action at the same time.

Understanding supply and slippage

When you buy cryptocurrency on Luno (or on other platforms) it’s important to realise that:

- You are buying from another person or multiple people (the counterparty)

- There amount of cryptocurrency available at the current price is limited.

If you put a hundred people, each with one Bitcoin (1 BTC) that they want to sell (the supply side) in a room and you bring in a buyer with unlimited money who wants to buy 100 BTC (the demand side) the 100 sellers will quickly start arranging, each seller setting their price.

Some sellers might set their price close to the market rate of $10,000, some might set it at $11,000 and so on. Some might even say, “No, I think this thing I have is worth more, I’m only selling at $100,000 or even $1m”.

If the single buyer just says “I agree to buy 100 BTC at the current market rate” they will automatically buy all the bitcoin from all the sellers, some of it at $10,000, some of it at $1m.

This might seem like an extreme example, but cryptocurrencies are much, much smaller than other financial markets. Even relatively modest buy or sell transactions using cryptocurrency could see the effect of slippage.

It is therefore crucial that you closely review the final price you are quoted when buying Bitcoin or Ethereum. We will always show you the price you will pay and the amount you will receive in return before you confirm the transaction — it is shown right at the top of the Luno app or screen.

Exchange rates are just a guideline. This is why we show you a confirmation screen before you complete a transaction.

How to avoid buyer’s remorse

Occasionally during runaway prices — up or down — we find that some customers are upset about the price they paid or received.

Luno doesn’t benefit from individual transactions that are higher or lower than the expected market price. Luno only charges a small fee for each transaction to cover the costs of providing this service. Higher or lower prices are the result of supply and demand.

This is the case with other investments such as stocks, bonds, real estate and so on. People who trade these are familiar with market dynamics. If you are not an experienced trader or investor, it’s important to familiarise yourself with this.

Easy does it

Some people say that when the market is moving up you should sell and when it is moving down you should buy. We can’t and won’t give trading advice. But it’s important to highlight a few things:

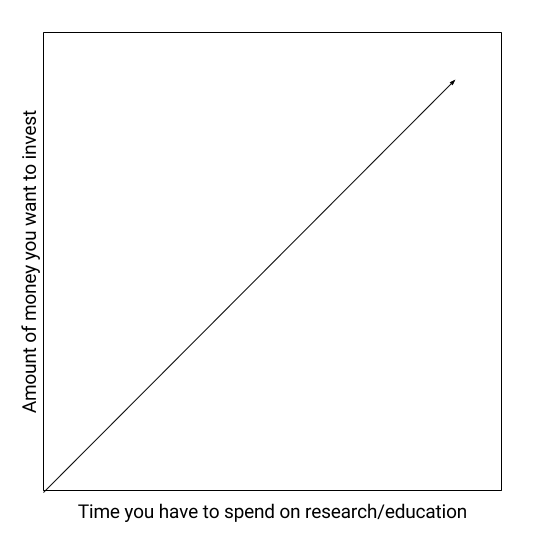

1. Learn as much as you can

Don’t invest in anything you don’t understand.

The more you want to invest, the more you should know about the subject matter. If you’re only spending the equivalent of a meal, you can probably go ahead and buy some without overthinking. If you lost that amount, it wouldn’t be the end of the world.

But, if you’re investing a substantial amount, you must arm yourself with plenty of information.

2. Take it easy

When things move fast, irrational decisions are more likely. Consider slowing down and setting a few rules, such as:

- I will only allocate x% of my investment portfolio to cryptocurrency each month

- I will only buy cryptocurrency with money I can afford to lose

- I will never buy cryptocurrency at an all-time high, only sell 😉

- I will only buy or sell after closely reviewing the final price.

If you investing without a strategy, you’re just gambling.

3. Expect delays

The price of Bitcoin has increased by over 1200% in the past year, Ethereum even more so. Platforms like Luno can’t scale that fast and trying too hard only worsens things. For example, it’s impossible to hire customer support staff at the same rate as new people are signing up.

We only employ the best and brightest for Team Luno because it’s a highly complex industry that requires a lot of training and checks to make sure you are given the right advice, the right help and that your money is safe with us.

We can’t simply employ anyone and everyone. We are hiring as fast as we can to clear the bottlenecks that come with an influx of customer signups, community and social engagements, resolution of queries and improving the performance of our platform to our customers across the world.

We’re really sorry about the delays you experience during these times of runaway prices. We’re working as hard as we can to solve everything.

We’ll send more communication about our scaling roadmap for 2018 later this year.

Summary

We’d like to say thanks to all our customers, all over the world, for your continued support. We’re witnessing a time of unprecedented interest in cryptocurrencies and we’re proud to have so many people form part of this wave; something we ultimately see as the future of finance.

We’re planning on increasing the number of educational resources for our customers in the coming months to always be the easiest way to buy, sell (and yes) learn aboutcryptocurrencies

To the moon!

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press