Singapore’s Monetary Authority partners with JPMorgan Chase to explore DeFi’s effectiveness

What

The Monetary Authority of Singapore (MAS) is partnering with JPMorgan Chase to explore DeFi’s potential

Why

The partnership is part of MAS’ Project Guardian initiative that aims to understand the effectiveness of DeFi in improving the borrowing and lending process

What next

JPMorgan Chase will lead a blockchain pilot as part of the project, with Singapore’s central bank poised to leverage the pilot’s results to inform its crypto policymaking

The story

The Monetary Authority of Singapore (MAS) has partnered with the US investment bank JPMorgan Chase to launch a pilot program exploring the potential of Decentralised finance (DeFi).

Alongside JPMorgan, MAS has recruited Singaporean multinational bank DBS alongside local digital asset issuance startup Marketnode to lead the pilot.

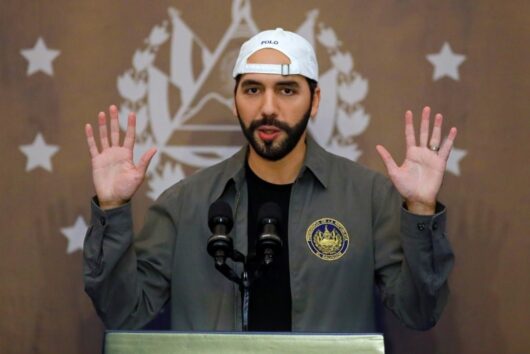

Speaking at the opening of the second Asia Tech x Singapore Summit, Singapore’s Deputy Prime Minister Heng Swee Keat said the nation must “pierce through both the hubris and the veil of suspicion” surrounding digital assets to fully grasp the “potentially transformative underlying technologies.”

The project, which comes in the wake of the mass exodus of crypto firms to Dubai, intends to focus on digital securities backed by traditional finance.

Singapore’s central bank will be watching the results of the pilot closely, with the intent to build the results into its crypto policymaking.

To learn more about DeFi and Bitcoin, visit our learning portal here.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press