Ugandan gold discovery could strengthen Bitcoin’s fundamentals

Although always seen as a safe place to keep money, the future of Bitcoin could be impacted by newly discovered gold and an increasing supply.

News from Uganda has revealed surveyors estimate they have discovered 31 million metric tonnes of gold ore in its northeastern Karamoja region. According to a government spokesman, this will equate to around 320,000 tonnes of refined gold, worth around $12.8 trillion. To put this figure into perspective, the US, which has the largest gold reserves in the world, holds around 8,134 metric tonnes ($523 billion). If Uganda’s claims are true, this could cause serious disruption to the price of gold by significantly inflating the world’s total supply and triggering a supply shock.

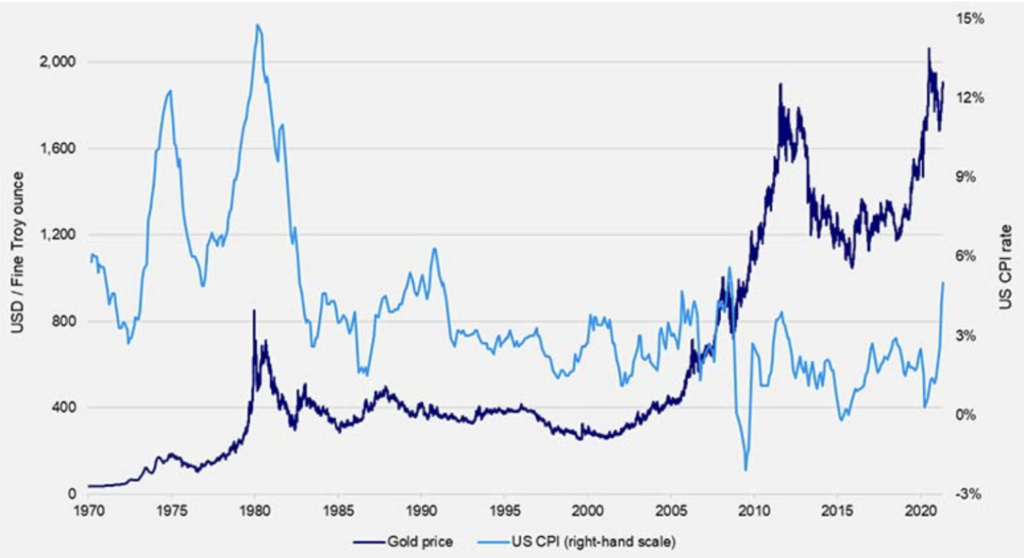

Gold’s primary use as an investment asset has long been to act as a hedge against inflation due to its scarcity. The idea is that over time, the price of gold follows the rate of inflation, so by the time one retires, their investment does not lose its spending power. With inflation rates currently at their highest levels since the 1990s, an influx of new gold could potentially disrupt this mainstay commodity and make investors look elsewhere for assets to guard against inflation.

Micheal Saylor, CEO of MicroStratgey, said more gold proves Bitcoin is the only asset that offers “legitimate scarcity” in an interview with Market Insider: “The biggest idea here is Bitcoin is the first and the only legitimate scarcity in the universe. Gold is not scarce. They just found 320,000 tonnes of gold in Uganda… so Bitcoin is the ideal commodity because you can’t make any more of it,”. Bitcoin, often dubbed “digital gold” due to its limited supply, is also considered by some as a hedge against inflation and could benefit from a gold supply shock, as pointed out by Saylor.

Striking gold

To make matters worse, other places have discovered large amounts of gold in the last few years. In October 2020, a surprise find of 1,371 tonnes of gold was found in Russia’s Siberian region. In August the same year, 5,000 tonnes of gold deposits were also found in Poland.

Looking to the distant future, gold may face further supply issues. NASA has enlisted the help of Elon Musk’s Space X to hunt down the so-called “golden asteroid”, and eventually bring the precious metal back to Earth. According to some scientists, the asteroid could contain enough gold to make “everyone on Earth a billionaire”.

After making the announcement, the Ugandan government said it will be seeking investment from mining companies to extract the gold. The Chinese mining company, Wagagai, has already invested in gold mining operations in Busia, an eastern region of Uganda. Wagagai is said to have invested $200 million so far, along with an on-site refining facility.

Coupled with this, the Ugandan government passed a new law earlier this year that will entitle a state-backed mining company to a 15% share of all mining operations in the country. This will ensure the Ugandan government and its mining partners can establish a mutually beneficial relationship.

Stock-to-flow disruption

A key indicator for tracking how the scarcity of an asset impacts the price of an asset is the stock-to-flow (S2F) ratio. The higher the ratio, the more scarce and valuable an asset is deemed to be. S2F ratios are calculated by looking at the amount of current stock and its flow, the amount mined each year.

For gold, the amount mined each year can fluctuate depending on how much gold is mined and refined in a given year. For Bitcoin, the flow remains constant due to its adjusted mining difficulty and halving events every four years to ensure there will only ever be a maximum of 21 million Bitcoins in circulation. As of 2019 gold had a stock-to-flow ratio of 62, compared with a ratio of 56 for Bitcoin (2022). A greater gold supply could therefore throw gold off its perch and give Bitcoin a higher S2F ratio.

For Bitcoin, the stock-to-flow model long remained a fairly accurate indicator for predicting future prices. Although this finally broke down last year, what we do know for certain is that miners are unlikely to find a deposit of missing Bitcoin addresses hidden in the Earth. This was an intentional design feature for Bitcoin to create a truly deflationary asset that could prove to be gold’s undoing one day.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press