Understanding market cycles

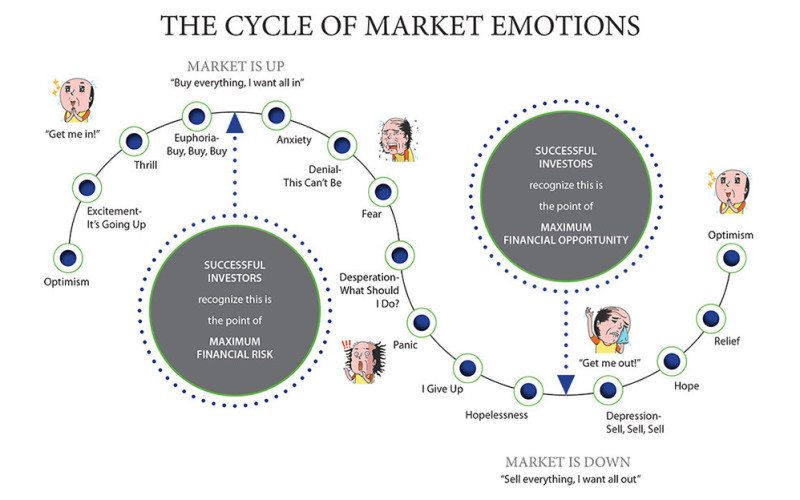

Investor emotions can play a significant role in driving market cycles, whether it’s in cryptocurrencies or traditional assets like stocks. Excitement and greed can lead to an increase in buying, often resulting in a surge in prices, whereas other emotions like fear and panic can result in selling pressure and declining prices. Being prepared for these ups and downs in the market can help you make better investment decisions.

In this article, we’ll explore market cycles and look at the unique cycle of the crypto market, the impact of the Bitcoin halving, and how this relates to investor emotions.

Different phases of market cycles

Stage 1: Acceleration and optimism

Most market cycles start with an acceleration phase. During this phase, early adopters recognise the potential of the investment and start accumulating at lower prices. Optimism grows as more people buy in, and positive sentiment starts to shape the market landscape.

Stage 2: Full throttle and euphoria

As the market gains momentum, it can lead to a bull run, causing a significant increase in prices. Euphoria takes over, and everyone wants to be part of the action, but it’s essential to stay level-headed and not let the hype cycle cloud your judgment.

Stage 3: Detours and anxiety

No market cycle is without its detours. Following the acceleration and bull run phases, the market typically enters a correction phase, where prices start to decline and uncertainty creeps in. Remember, corrections are a natural part of the investment journey and provide an opportunity to reassess your strategy.

Stage 4: Rough roads and the blues

During a bear market phase, negative sentiment takes over, and investors may experience feelings of despair. Avoid making hasty investment decisions based on fear. Remember, bear markets eventually pass.

The impact of the Bitcoin halving

The Bitcoin halving is a scheduled event that occurs roughly every four years. This event reduces the rate at which new bitcoins are created to counter the effects of limitless money printing, which erodes currency value down the line.

The halving can also lead to an increase in demand and so too the price of bitcoin, according to the laws of supply and demand. But market dynamics are complex, and while the halving has in the past been followed by periods of higher prices, it does not guarantee future price movements.

Navigating the market cycle: Your roadmap to investing

Just as a reliable roadmap guides us on a journey, certain principles can help us navigate the crypto market cycle:

- Gain a solid understanding of the underlying technology, fundamentals, and risks associated with bitcoin and cryptocurrencies.

- Diversify your investments across different asset classes to manage risk effectively.

- Define your investment strategy and stick to it. Avoid making impulsive decisions.

- Evaluate projects based on their long-term potential, real-world use cases, and adoption, rather than short-term price fluctuations.

- Keep up with market news, industry developments, and expert analysis to make informed investment decisions.

Embrace the cycle

Understanding market cycles is important for investors embarking on their crypto investment journey. By staying informed, managing your emotions, and keeping to a sensible investment approach, you can make the most of the evolving cryptocurrency market.

? Keep reading…

What kind of crypto investor are you?

Mapping your risk journey: A comprehensive guide

A simple guide to Bitcoin market indicators

Please note that the information in this article is not intended nor does it constitute financial or investment advice. Before making any decision or taking any action regarding your finances, you should consult a licensed Financial Adviser. The information and content provided is provided by Luno as general information. While every care and effort has been taken to ensure the accuracy of the information provided, Luno does not guarantee the suitability, accuracy or potential value of any information provided.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press