Top crypto countries and their approach to cryptocurrency regulation

Mainstream media casts a small net, which is why we don’t often read about Vietnam or India being the biggest users of cryptocurrency globally. In fact, the most recent data by blockchain research firm Chainalysis showed developing nations beating out developed countries like the US and UK as the top users of cryptocurrency globally.

We cross-referenced the Chainalysis findings with that of another report by research firm Finder and singled out a few countries that have taken to cryptocurrency in a big way. But how are governments in these countries approaching the sticky issue of regulating crypto? For the most part, it continues to be a game of wait and see, but crypto regulatory preparations are moving along swiftly.

Global captains of crypto

Below are the countries leading the charge in cryptocurrency adoption. Let’s look at how these governments are dealing with regulating an industry that presents as many challenges to lawmakers as it does opportunities.

Vietnam

Vietnam sits at the top of both the Chainalysis and Finder lists as the population with the most active cryptocurrency users in the world, but the Vietnamese government is yet to take an official stance on cryptocurrency.

The Ministry of Finance did, however, put together a research group in March last year to start the process of legislative reform necessary to regulate cryptocurrency and bring it into the legal mainstream. While it’s legal to invest and trade in cryptocurrencies, Vietnam is yet to legalise transacting with a cryptocurrency like Bitcoin.

India

The country made headlines recently with its decision to regulate rather than ban cryptocurrency. Indian Finance Minister Nirmala Sitharaman said in her budget speech in February that Bitcoin and other similar cryptocurrencies will henceforth be recognised as virtual assets. The move was seen by many as an acknowledgement by the Indian government of cryptocurrency’s massive potential. But the regulation was bittersweet, as it came with a 30% income tax attached to these assets.

Australia

The land down under is no stranger to crypto, seeing that an estimated 22% of Ozzie internet users hold cryptocurrency in one form or another. The Australian government said late last year it will start work early in 2022 on drafting a licensing framework for cryptocurrency exchanges, along with a reform of its current payment laws to account for the new wave of payments options including services provided by Google and Apple.

Speaking to 7NEWS Australia in December last year, Australia’s Treasurer, Josh Frydenberg, said the new set of regulations will “broaden the definition of services and products that can be regulated,” taking cryptocurrencies and digital assets “out of the shadows” and into a “world-leading” regulatory framework.

Pakistan

The country consistently ranks among the top five most active crypto populations in the world, but the Pakistani government has in the past flopped between giving crypto the thumbs up, only to propose a China-style blanket ban a few months later. The official stance continues to be unclear, but in October last year, a minister told the national assembly that the government had no objection to citizens investing in cryptocurrencies, but admitted there was a lot of work ahead in setting in place a firm regulatory crypto framework. In July last year, the government set up a committee to look into cryptocurrency regulation.

Kenya

Kenya has long been seen as a key market in Africa for cryptocurrency adoption, in large part due to its position as a global leader in mobile money use. Despite this, the cryptocurrency industry continues to be largely unregulated but the Kenyan Central Bank has been mulling the development of a CBDC and coming to terms with crypto regulation.

Speaking to the media at the DC Fintech week in the US, Central Bank of Kenya Governor Dr Patrick Njoroge said the central bank is closely watching the cryptocurrency industry, adding that Bitcoin is an exciting technology, but that he sees it as more of an investment tool at this stage. “The space for cryptocurrencies needs to be well mapped out so as to address such concerns as money laundering and financing of illicit activities,” said Dr Njoroge.

Venezuela

Venezuela earns its place in the top 10 on the Chainalysis list due to the active peer-to-peer trading of Bitcoin. The country’s economic woes have intensified in recent years, leading to hyperinflation and a devaluation of the bolivar currency. It has led many Venezuelans, seeking to protect their investments, to Bitcoin. The leading cryptocurrency is also accepted by various merchants in Venezuela, especially in Caracas and Puerto La Cruz. For example, the Simón Bolívar international airport in Venezuela is reportedly in the early phases of implementing a cryptocurrency payment service at the airport, and other industries have followed suit. Burger King and Pizza Hut in Venezuela also accept Bitcoin.

Adding to crypto optimism in the country, the new president of the Bank of Venezuela, Román Maniglia, is also a die-hard supporter of cryptocurrencies.

Singapore

Singapore is often referred to as the crypto hub of Southeast Asia, a reputation cemented by the government’s approach in opting for clear regulation rather than clamping down on cryptocurrency.

“With crypto-based activities, it is an investment in a prospective future, the shape of which is not clear at this point,” Ravi Menon, managing director of the Monetary Authority of Singapore, told Bloomberg. Countries that ignore cryptocurrencies are at risk of being left behind, he said. “Getting early into that game means we can have a head start, and better understand its potential benefits as well as its risks.”

The country is regarded as an example to others in how to go about developing a clear regulatory framework that facilitates cryptocurrency operations.

United States

The US has been wary of making rash decisions regarding its cryptocurrency policy, but late last year President Joe Biden asked for input from various government agencies before signing an executive order on regulatory reform to accommodate cryptocurrencies. That order was finalised in early March 2022.

Cryptocurrency trading and investing, along with mining operations, have until now mainly been subjected to the same regulatory requirements as traditional financial institutions. Other than that, it’s been a relatively open environment for trade, investment and the mining of cryptocurrencies. Some states like Colorado have even given residents the option to pay their taxes using cryptocurrency.

United Kingdom

The UK government has followed the US in their slow and steady approach to regulation. The latest from the government was a consultation response, published in January 2022, which detailed plans to bring the crypto industry in line with standards set out for traditional financial service providers.

The Chancellor of the Exchequer, Rishi Sunak said, “Cryptoassets can provide exciting new opportunities, offering people new ways to transact and invest, but it’s important that consumers are not being sold products with misleading claims. We are ensuring consumers are protected, while also supporting innovation of the crypto asset market.”

While recognising the risks in the industry, the government said it was eager to support innovation in crypto assets and recognised the potential benefits of certain cryptocurrencies. The Cryptoasset Taskforce continues to head the UK’s regulatory response to cryptocurrencies.

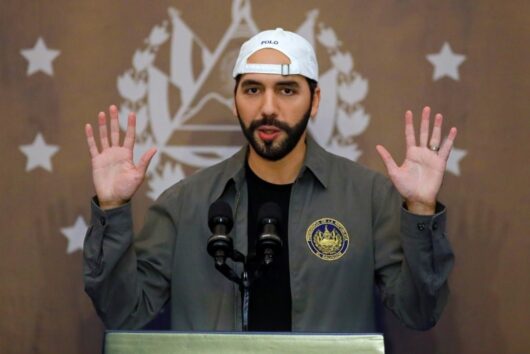

El Salvador

A list of crypto heavy hitters just wouldn’t be the same without featuring the original adopter. Even though the country doesn’t feature among the top crypto adoption countries, El Salvador continues to be the one and only torchbearer of using Bitcoin as legal tender, while it continues to fill its treasury with Bitcoin.

Most governments are in the process of finalising their regulatory frameworks for cryptocurrencies this year while marching ahead with central bank digital currency (CBDC) projects of their own. This year is shaping up to be a big one for cryptocurrency regulation, which means a big year for cryptocurrency adoption.

Visit our learning portal to learn more about cryptocurrencies like Bitcoin and Ethereum.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press