What will the banks of the future look like?

Much like other aspects of our lives, from communication to media, the way we use money is evolving. Cryptocurrencies offer the opportunity to improve the inefficient aspects of traditional institutions. There’s a need for infrastructure to support the advancing shift so that it is safe and easy to transition.

At Luno we believe we play a major role in the next step of this evolution in financial services to upgrade the world to a better system.

In this way, we can provide more efficient financial services with equal and open access.

Companies like Luno are not ‘against’ banks or are out to get rid of them. In reality, the opposite is true. We believe in working directly with banks so we can better leverage this new technology to make a powerful long-term impact on the world.

There are plenty of situations where using decentralised cryptocurrencies through Luno might make more sense than using a traditional bank.

For example, if you’re sending money to family abroad, making a transfer through a bank is likely to mean going through several intermediary institutions, which makes the process slow and expensive. Meanwhile, with Luno, the money goes straight to the recipient in very little time and at a much lower cost, or even for free.

Having access to financial services is a vital part of being an empowered person in today’s world, enabling economic opportunities and the freedom to control your money. Hence the importance of grasping this new technology to bring it to more people, especially those who can’t be served by the old systems, or where they don’t make sense. Banking has always changed throughout history to meet new needs and adopt new technology, and this is simply the next step.

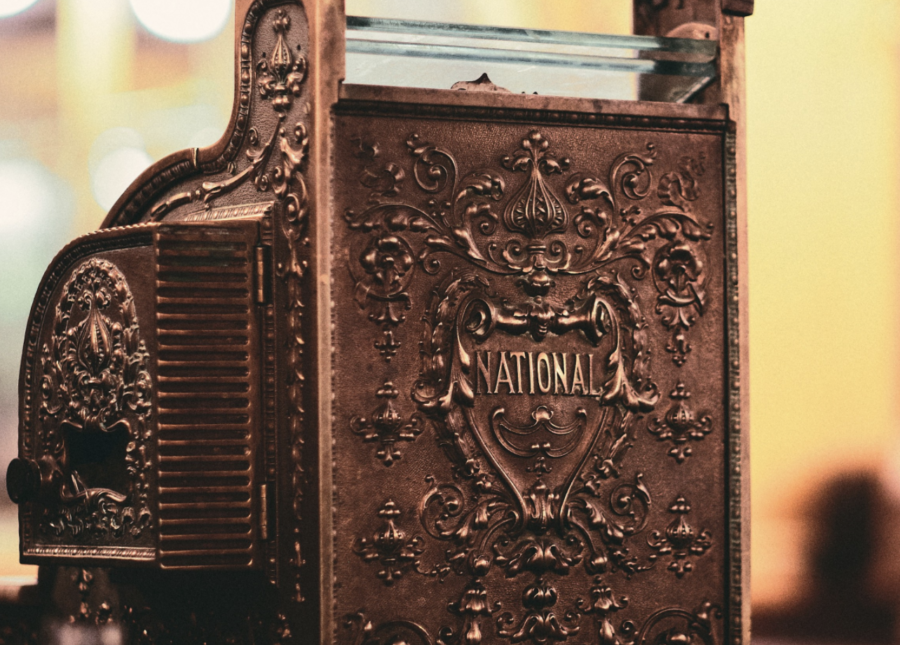

With that in mind, we often think about the history of banking and how looking at the way financial services change over time can highlight the path forward.

Banking is one of humanity’s oldest professions

For thousands of years, people have needed a way to accrue value for the future (in the form of money or commodities like gold) without it getting stolen and without putting themselves and their families at risk by keeping it at home.

This began with ‘grain banks’, where farmers deposited agricultural products and were given receipts they could use to collect it again.

After precious metals like gold and silver gained favour as a medium of exchange, people began storing money in temples. Places of worship traditionally held great wealth, so they were built to withstand attacks and staffed by people regarded as trustworthy and honest.

The system of credits and debits that remains at the heart of the banking industry was put in place, in a rudimentary form, thousands of years ago.

This system of lending and storing began to take off in the 12th century as banks popped up to provide credit for monarchs fighting ceaseless wars throughout Europe. When you see the opulent wealth monarchs displayed in the art from the time, you’re actually seeing the results of unrestricted credit — who could say no to a king asking to borrow money?

With safe places to store money, people could develop more complex financial systems as civilisations grew and individuals accumulated more wealth.

The word ‘bank’ was first used in the 17th century, originating from the Italian word ‘banca’ meaning ‘bench.’ At the time, bankers sat on long benches as they made loans and took deposits.

In the 17th century, the Bank of England was set up by William Paterson, a goldsmith experienced with the system of taking precious metal deposits and issuing receipts.

The key difference was that the new Bank issued bank notes that were legal tender and considered adequate payment for debts in themselves. While similar systems were in use thousands of years prior, they didn’t survive cultural revolutions.

The Bank of England set the tone for the subsequent evolution of banking.

In many ways, the focus shifted from taking deposits to issuing loans, which is arguably now the main role of banks. Yet this created new systematic risks and made the system more fragile.

A turning point came with the 2008 financial crisis, which revealed that banks could not be left to do as they wished and run rampant, or they could bring everything around them down. Increased complexity merely weakened the system.

Today, banks are striving to meet the demand for flexibility and easy access.

Today, many people do most of their banking online without visiting a physical branch. Yet, in many ways, they’re restricted by tight regulation and legacy technology that makes it difficult to offer reduced costs and increased speeds we now expect across many areas of our lives. It’s time to look at other options to offer people what they need.

Trust is still at the core of banking

The first ‘bankers’ were priests — people everyone felt they could trust.

Fast forward to today, merchant banks that have been around a long time retain enormous influence and political clout on account of having survived that long, despite any disasters along the way.

People living in countries experiencing economic unrest are starting to lose trust in financial institutions. This is creating a demand for new types of services and allowing upstarts to gain a foothold. Needless to say, the industry is set to change a lot more in the coming years. The old need for trustworthy deposits and fair credit hasn’t changed, it’s just time to meet them in a better way.

We believe that way is through secure, verifiable transactions made on a completely transparent record, like the Bitcoin and Ethereum blockchains. We work towards this every day by staying open to questions and debate.

What do you see as the next step in the evolution of banking? How will the next generation of banks provide more value and greater efficiency?

Keep reading…

Crypto in 2020: The year so far

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press